Quite a while back, I published a series of four articles about care in later life. In articles three and four, I touched on various insurance products you can purchase to cover long-term care (LTC) expenses: traditional LTC insurance (LTCI), cash value life insurance (whole or universal life), and annuities.

I didn’t explore another category of product that is gaining traction in the marketplace: the ”hybrid” LTCI policy which combines life and long-term care insurance.

I recently had the opportunity to review a proposal for such a product for a friend of mine, so I thought it might be worthwhile to do an article about these increasingly popular yet complex and somewhat costly insurance products.

A real-life example

My friend and his wife are in their mid-60s, without LTCI, and were considering a new hybrid LTCI product, specifically, a single premium, indexed universal life (IUL) insurance policy with an LTCI rider (quite a mouthful, right?!).

He and his wife will receive Social Security benefits, and he also has some retirement savings, whole life insurance with built-up cash value, and a small pension. He wanted to better understand the hybrid LTCI product proposed by his financial advisor to help decide whether it makes sense for them.

Because he also owns two older permanent life insurance policies, he was also offered a different hybrid product by executing a Section 1035 Exchange. The IRS allows for the tax-free exchange of life insurance and non-qualified annuities for traditional and hybrid qualified long-term care products known as Qualified Longevity Annuity Contracts (QLACs).

The proposed exchange was for a product from a different insurer that was very similar to the new product he was considering. The main difference is the 1035 exchange rollover of the cash value of his older policies and continuing to pay a monthly premium instead of using a lump sum (from their retirement savings in this case) to purchase the new hybrid policy.

A closer look

The product I looked at for my friend is one type of hybrid LTCI policy. They’re called ”hybrids” because they combine a permanent life insurance or annuity policy with LTCI (via a ”rider,” which is simply a policy add-on—for an additional charge, of course).

Here’s an overview of the various components of a hybrid life-LTC policy purchased with a lump sum premium (typically from retirement savings, but it doesn’t have to be):

Premium payments

You pay monthly, quarterly, or annual premiums, or the total premium up-front with a lump sum. My friend was going to pay the lump sum from his retirement savings, which is allowed tax-free.

As mentioned above, the premium can also be satisfied via a Section 1035 Exchange of one qualified product for another. However, there may be additional fees that apply.

Hybrid LTC-life insurance policy

This is the actual hybrid insurance policy. It will come with both contractual (guaranteed) and non-contractual (not guaranteed) provisions.

Because it’s first and foremost a life insurance product, it offers a guaranteed death benefit. In my friend’s case, the life insurance component was a universal life product.

It also offers an LTC benefit, but it’s not totally both—it’s somewhat either/or since both the cash value and the death benefit can be reduced by the LTC benefits. (Because it’s also an LTCI policy, there are also medical underwriting requirements.)

Beyond the life insurance types, there are basically two kinds of hybrid policies. They differ mainly in the cost of the LTCI riders and how benefits are paid:

- You can use life insurance with an Accelerated Death Rider for specific long-term care needs, including cash advances in the event of a terminal illness.

- Life Insurance with an LTC Rider provides direct care coverage if the policyholder cannot provide for themselves.

Both types of products offer a long-term care policy that can provide you with long-term care benefits if needed, a death benefit if care isn’t required (or the benefit limit isn’t reached), and a cash surrender value if you change your mind.

So, unlike standalone traditional long-term care insurance policies that are “use-it-or-lose-it,” this hybrid policy will benefit you whether you live, die, or forfeit the policy (under certain circumstances).

My friend’s policy was like #1 above. The Acceleration of Death Benefit Rider (AODBR) will payout long-term care benefits for the initial two years of a claim. However, the death benefit would be reduced by this payout.

The policy also offered an Extension of Benefits Rider (EODBR) of two or four years, which would increase benefits to four and six years, respectively. Many advisors recommend insuring against a ‘worst-case scenario,’ but that may not make sense for some.

Long-term care benefit pool

The LTCI component of the policy will pay a monthly benefit out of a ‘pool’ of benefits, which is the maximum benefit under the policy’s contractual provisions. The benefit will have monthly, annual, and lifetime limits based on the chosen AODBR and EODBR options.

This ‘pool’ of benefits can increase with the growth of the life insurance cash value account (see next section); however, the benefits paid—and any cash withdrawals—reduce the amount of the life insurance.

Because this is an “indexed” universal life policy, the long-term care benefits will potentially increase with interest linked to a stock market index credited up to a non-guaranteed cap.

The cash/surrender value

The proposed hybrid IUL with an LTCI rider has an account that can grow based on the performance of whatever stock market index is chosen, such as the S&P 500.

For my friend’s proposed policy, the crediting rate for the cash value is determined by a formula instead of being at the insurance company’s discretion. The specific formula is tied to the performance of the chosen stock market index.

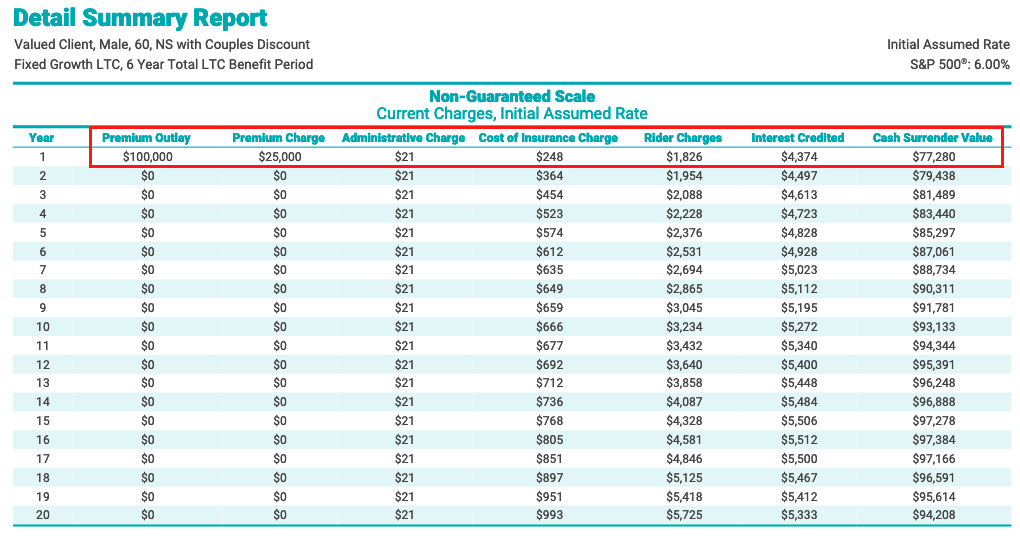

As illustrated below (an example ledger from my friend’s insurance company’s website—not his actual proposal) the cash value is based on an assumed interest rate of 6.0%, which is based on the historical performance of the S&P 500 with a 9.5% annual cap. (Keep in mind that assumes no “negative” crediting years, which tells you that the upside is very limited.)

6% is considerably less than the historical average return of over 10% for the S&P 500 plus dividends. If you owned an S&P 500 Index fund, you would receive those dividends, plus any share price appreciation. But, you would also take that hit when the market is down of course.

My friend shouldn’t assume that he’ll get stock market-like returns on his cash value or, worse, on his lump-sum premium, as not all of it goes to the cash value account due to insurance costs (more on that later).

The basic premise is that when the stock market goes down, he’s guaranteed a crediting rate of zero to 3% (it can’t be less than zero, which some certainly see as a positive).

When it goes up, he gets to ‘participate’ in that increased return (currently with a cap of 9.5%, which isn’t guaranteed for the life of the policy—it could go up or down, but no lower than 3%).

The indexed rate cap means that the most his account value can go up in a year is 9.5% (the ‘upside,’ even if the S&P 500 is up 10 or 20% or higher, which it has been in some years).

Conversely, the lowest he can receive is 0% (the ‘downside’), even if the S&P 500 is down 10 or 20% (which it is in some years).

Over the last several decades, the S&P 500 has averaged around 10%, so it’s been up many more years than it’s down. In any case, the insurance company is counting on it being less than that in the future (it lowers their risk).

As you can see from the above ledger, if you decide you no longer want the policy, you should be able to get some of your money back. Still, it will never be as much as you paid in depending on earnings and because you had to pay the insurance premiums and rider and administrative fees (see costs section below).

Things to consider

Hybrid IULs and annuities are relatively new products. They are (obviously) rather complex and high cost. Still, they pay benefits under different circumstances, which may be attractive to some retirees.

That said, here are a few things to consider before buying this type of policy:

It’s first and foremost a life insurance policy

The hybrid life insurance policy is life insurance with a LTCI rider.

Everyone will eventually die, but not everyone will need LTC; if they do, they may not need it for very long. Therefore, although hybrid policies offer both, you’re statistically more likely to receive a larger life insurance benefit than long-term care benefit.

Most retirees, at some point, no longer depend on their earnings from work to live (meaning they have enough from saving, pensions, and Social Security to live on for the rest of their life); they are financially independent and may no longer need life insurance.

As shown in the schedule above, the initial death benefit is considerably higher than the lump sum premium, as is the lifetime LTC benefit (if needed). Although the death benefit declines with age (but is still above the initial premium amount at age 80), the maximum LTC benefit increases substantially with age (though the likelihood of needing all of it decreases).

They come at a cost premium

Since everyone eventually dies, permanent life insurance must be priced so that there’s enough money to pay a death benefit to everyone in the insurance company’s benefit pool. The same is true for variable or indexed annuity payouts. Consequently, life insurance and annuity contracts tend to be expensive.

For a hybrid permanent life insurance policy, a significant portion of the premium that pays for the life insurance component and the LTCI rider fees cannot go into your cash-value account.

You may also pay an up-front sales commission to the advisor and/or the insurance broker. (You may not see that as a direct charge, but it will be reflected in a reduced cash account balance.)

The more the sales commission, insurance costs, rider, and administrative fees, the less you’ll have in the cash-value account.

Below is another illustrative schedule from the same insurance company’s website showing policy charges and values. Note the initial lump-sum premium of $100,000 and the declining cash surrender value over the first 20 years (it continues to decline beyond that to zero in year 32).

It’s not an ‘investment’

You are purchasing an insurance policy, not an investment product. It’s important to understand that you are not investing in the underlying securities of the S&P Index or an S&P Index fund (which would give you capital appreciation plus dividends).

Your interest crediting options are mathematical formulas the insurance company uses and are explained in the product literature. (As I noted earlier, the index amount doesn’t include dividends, which on a compound basis have been a significant part of S&P 500 total returns.)

These products are very complex

There are many moving parts–different benefits, fees, terms and conditions, etc. My friend’s product has two insurance components plus a cash component.

The problem with complexity is that generally, the more complex the policy, the less likely you are to understand how it will work in the future. The less you understand, the more likely you will be disappointed when you eventually compare the final results to the optimistic projections the salesperson showed you in the beginning.

Like any insurance/investing hybrid product, you need to hold an IUL for the rest of your life to achieve a reasonable return, and you are far less likely to do this when it turns out you bought something that isn’t what you thought it was. If you bail early, you will suffer loss.

It offers some growth along with downside protection

My friend’s product does what it says in that it provides a life insurance component, an LTC component, and though tied to a stock index with a cap, does offer some downside protection (though it does so by taking away some of the upside).

I think you can assume that, over the next ten years, a product like this will generate low to mid-single-digit returns (3 to 5%), which should keep up with inflation and then some.

You simply won’t get anywhere near the market returns due to the costs of the insurance, the additional fees, the loss of the dividends, and the cap rates. (But to be fair, you are getting a permanent life insurance policy and LTC insurance.)

Actually, the current 9.50% cap (which is guaranteed) is pretty reasonable. If you are comfortable with that, especially with little downside risk, then you may find it to be a somewhat attractive product.

It will pay a death benefit if you don’t need LTC and probably a reduced death benefit if you do

Should the insured need LTC, the policy will provide a significant benefit with a decent annual and lifetime maximum. Very few people need the maximum LTC benefit, though they may need some care for a time.

A significant advantage of a hybrid policy is having a guaranteed death benefit for beneficiaries if long-term care is never needed. If it is, a reduced death benefit may still be available, depending on the policy terms.

Hybrid policies provide fixed-premium LTCI coverage

Traditional LTCI policies do not have fixed premiums, so policyholders are not protected from future premium increases. LTCI premiums are increasing due to the higher cost of care and longer lifespans.

There are no single-premium LTCI products available. So, a policyholder has to do a series of 1035 exchanges to purchase one.

Should you buy one?

As a rule, I never tell anyone whether they should or should not purchase a particular financial product or investment. I just do my best to help them fully understand the product or investment, the pros and cons of buying it, and their other options, if any. Then they, with the help of their advisor, can make a wise, informed decision.

With that said, purchasing a hybrid policy that provides life insurance with long-term care benefits may be best for those with ample savings and can comfortably invest in a plan with high premiums or can afford to part with a big chunk of their savings to make a lump-sum purchase.

On the other hand, it may make sense to purchase traditional LTC if you think you can get a higher rate of return for the money in your retirement accounts or if you’ll need those funds to cover your living expenses down the road.

Looking back at my friend’s proposed product, overall, I think this is an okay (albeit complex and costly) product for someone who 1) doesn’t need access to any of the money except in the event of death or need for LTC; 2) doesn’t want to be concerned about market volatility; 4) will be happy with relatively low single-digit returns each year; and, 5) find both the permanent death benefit and LTC benefit attractive.

That being said, he may want to seriously consider the 1035 Exchange option instead as he could purchase a similar policy without having to take a lump sum from his retirement savings.

Unless he really wanted a hybrid policy, there are some other options: 1) Purchase a standalone LTC policy if he can afford the premiums; 2) Keep the money invested and reserved for LTC expenses only (a mental accounting exercise, not necessarily a separate account, but it could be). 3) Use his cash value life insurance as a source of funds for LTC if needed; 4) Consider a “longevity annuity” (deferred income annuity) as a lower cost, less complex option. (A “Qualified Longevity Annuity Contract” (QLAC) can be purchased using retirement savings without having to pay taxes on the distribution.)