I recently read an interesting study on retirement from A.G. Edwards and AgeWave. It was published earlier this year. The study covered a lot of ground and was only partially focused on the financial aspects.

You may want to read the study in its entirety, but in this article, I’ll touch on its most significant (and interesting) findings and discuss them through the lens of biblical retirement stewardship.

Times they are a-changin

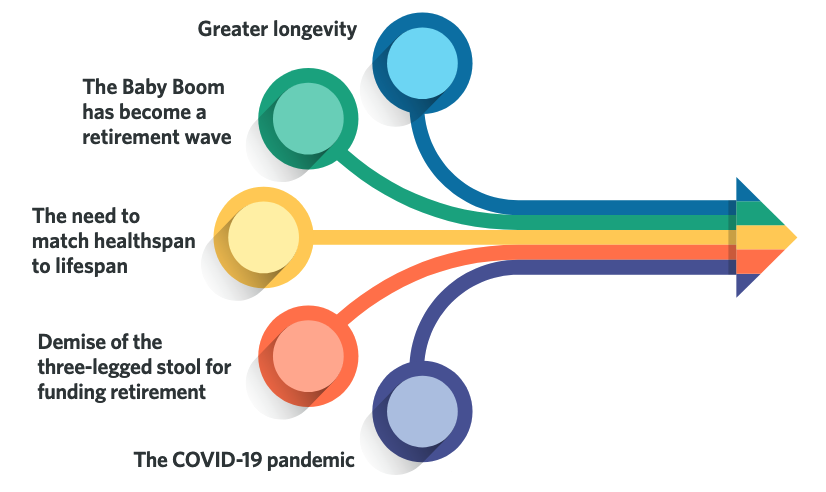

One key takeaway was that attitudes toward retirement are changing as Baby Boomers grasp certain realities about later life. These were highlighted in the study and depicted graphically:

Increasing longevity with the need for additional healthcare is undoubtedly a key consideration. The demise of the three-legged stool (Social Security, pensions, and savings) speaks to the virtual elimination of corporate pensions (only 8% said they would receive one) and the challenges with funding Social Security funding, which puts more focus on individual savings.

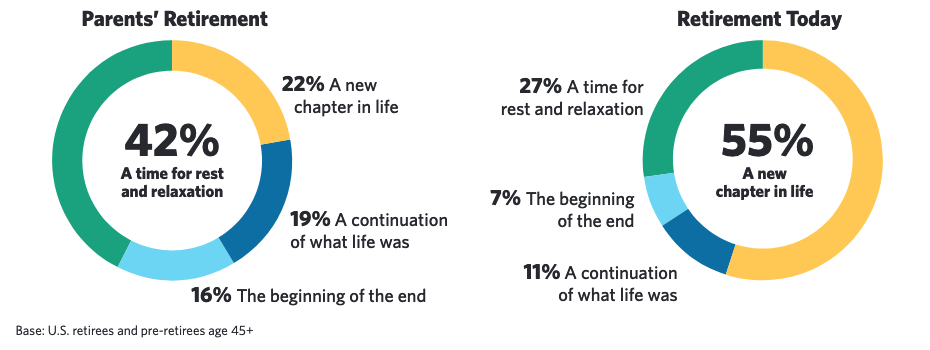

More significantly, perhaps, is the shift in retirees’ attitudes toward retirement versus previous generations:

More view retirement as a “new chapter in life” rather than primarily as a time for rest and relaxation.

As I have discussed many times on this blog, this has always been the goal of retirement stewardship—to view retirement as a new chapter and use our time, talents, treasure, and testimony to honor and glorify God and serve others.

Christians and non-Christians alike recognize that any stage of a life lived without purpose will be empty and unfulfilling. And if their purpose is exclusively pleasure, relaxation, and recreation it will ultimately be unsatisfying.

The centerpiece of the study was what it characterized as the ”four paths of retirement.”

The Four Paths of Retirement

The study suggests that each of us will likely follow one of four paths in retirement:

The study describes them this way:

We found that survey respondents in the heart of retirement divide into four distinct groups, characterized by their attitudes and ambitions, their circumstances and retirement preparations, and their level of enjoyment of life in retirement.

I want to discuss the four paths further—the study’s findings and my perspective on them in the context of retirement stewardship.

Here’s how the study’s subjects broke down based on the four paths:

- Purposeful Pathfinders (23%)

- Relaxed Traditionalists (26%)

- Challenged yet Hopefuls (20%)

- Regretful Strugglers. (31%)

I wasn’t surprised that there was a fairly even distribution across the first three or that over 50% felt “challenged’ financially to varying degrees. I was sad that the percentage of “Regretful Strugglers” percentage was higher than the rest.

Purposeful Pathfinders

I would put myself in the “purposeful pathfinder” category, but I am also sometimes a “relaxed traditionalist.”

My primary “purpose” is to serve God, my local church, and others in various ways while also enjoying times of rest and relaxation and the occasional “adventure.” That’s what I write about on this blog.

As I mentioned in my last article, my wife and I took an extended “vacation” in September to the national parks in Montana and Wyoming to celebrate our 50th wedding anniversary. There was plenty of relaxation, fun, and adventure, but it was our first big trip since we visited several national parks in Utah in the late Spring of 2019.

The key attributes of the ”purposeful pathfinders” in this study were as follows. (I’ve commented on each from a retirement stewardship perspective.)

- They have the highest sense of well-being in retirement. (As Christians, we have both a present and eternal hope based on our faith in Christ—his nearness in this life and the promise of eternity with him. There is no greater sense of well-being in this life.)

- They are leading “active, engaged, happy, purposeful, productive, and contributory lives.” (Our motivation for an active, productive life is to honor and glorify God and serve others, not just our pleasure and enjoyment.)

- They are focused on ongoing personal growth and self-improvement. (As Christians, we desire to grow in knowledge, wisdom, and the fruit of the spirit so we can best represent Christ in a fallen world.)

- They are doing very well “across the four pillars of family, heath, purpose, and finances.” (We love our families and community, and we do what we can to maintain our health and wisely manage our finances while putting our ultimate faith and trust in God.)

- They retired when they wanted and made the easiest transition into retirement. (We know from scripture that wisdom is paramount when making any major life decision, especially retirement. We pray and seek wise counsel.)

- They “rate themselves the happiest, most fulfilled, and most liberated among all retirees.” (”Whom the Son sets free is free indeed!”)

Relaxed Traditionalists

On the other hand, Relaxed Traditionalists place greater emphasis on relaxation and enjoying life. As stated, I think there is room for this in God’s plan for retirement, but I don’t see anything in scripture suggesting this should be a Christian’s primary focus.

In my book Reimagine Retirement, I note that the Bible often talks about what I call the “work/rest cycle,” which is patterned after what God himself did in creation—he worked, then rested. We are commanded to keep the sabbath, to rest.

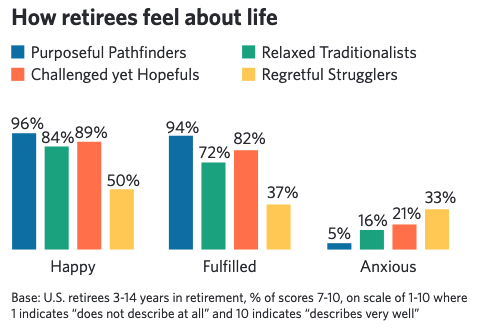

One thing I found interesting (but not surprising), and as shown in the chart below, was that this group rated themselves as happy and fulfilled, but somewhat less than the Pathfinders despite their focus on travel and simply having fun.

Also, note that all retirees felt at least a little anxious. I wasn’t surprised by that either given everything going on in the world, but as Believers, it’s important to remember what the Apostle Paul tells us in Phil. 4:6:

. . . do not be anxious about anything, but in everything by prayer and supplication with thanksgiving let your requests be made known to God (ESV).

Challenged Yet Hopeful

The smallest number of retirees identified as “Challenged Yet Hopeful.” They apparently have the “heart” and aspirations of the Purposeful Pathfinders, but their finances somewhat constrain them. Almost three-thirds said they have financial catching up to do, and there are worries about outliving their money.

The study found that while this group enjoys retirement, they may need to find ways to generate extra income or dramatically reduce spending to ensure they don’t outlive their savings.

Many in this group said they didn’t start saving for retirement until they were in their 40s. This is one of the main groups for whom I wrote Redeeming Retirement: A Practical Guide to Catch Up.

In that book, I acknowledge that “catching up” can be difficult, but the situation may be far from hopeless if you’re willing to make the hard decisions and life changes to get yourself on a better path and thus more hopeful. I wrote about this in an article about being retired but without enough income.

Plus, Christians can pray and seek God’s help and also his wisdom as we study the Bible and seek guidance in the practical areas I discuss in this blog.

Regretful Strugglers

It was concerning that almost a third put themselves in this category. Those in this category struggle with insufficient income and little hope of improvement.

Here are the main attributes as listed in the study:

- Only 35% view retirement as a new chapter in life, and 18% see it as the beginning of the end.

- Their struggles extend across multiple pillars of life, including an inability to find purpose.

- They engage in the fewest range of activities in retirement.

- Many appear to have struggled with unsatisfying lives before retirement.

- They rate themselves as the least happy among the groups and the most anxious.

- 59% say they have many regrets.

I feel bad for those who are on this path. A high percentage say they have regrets, which is understandable, but they can’t stay there.

To the Christian in this situation, your regrets mean you’re focused on the past. If you’re fearful or in despair, you’re overly focused on the present (or thinking wrongly about it).

The Bible seems to point us to the future, God and his Word, and his promises, which are our present help in a time of trouble (Ps. 46:1) and our hope for the future (Phil. 3:20).

Hope for the challenged and struggling

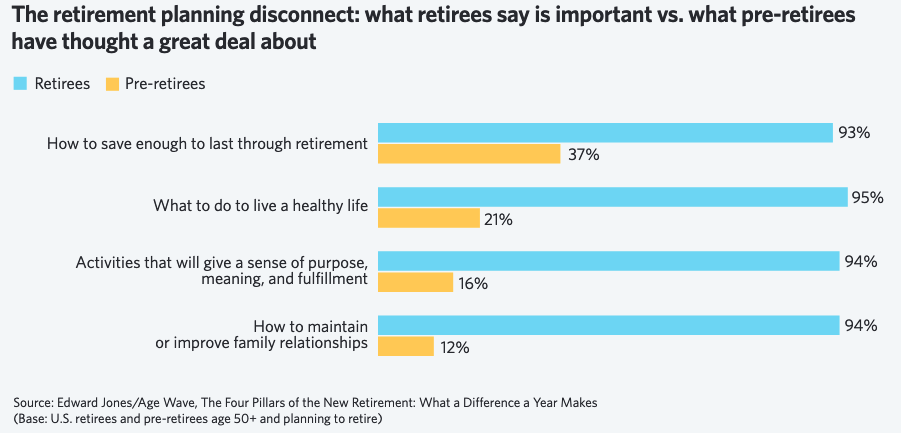

Retirement can be a major reality check. And not surprisingly, the study found that the perspective of those in retirement is different from pre-retirees. In fact, you might say there is a major disconnect.

As you can see, retirees in the study rated all the concerns in the above chart highly, whereas pre-retirees hardly gave some of them any thought. Saving enough was the major focus of pre-retirees, but the percentage who have given it a lot of thought was still relatively low.

This seems to correlate with the fact that about 50% of respondents were in the “Challenged Yet Hopeful” or “Regretfull Strugglers” categories.

If you have found yourself in either of those categories, I want you to know that there is hope. In fact, I would rather that the fourth category be renamed “Struggling But Hopeful.” In support of this, I want to remind you of a few things:

1—God calls us to plan, save, and prepare, but He does not say that we will be on our own if we don’t.

We have to face reality, no matter how difficult it may be. But while our circumstances may be challenging, our God is greater. The “head in the sand” approach won’t work. We must understand and assess our situation’s realities, whatever they are. But we must remember that we are finite creatures with virtually no control over the macroeconomic forces that can hugely impact our finances now and in the future.

Still, we do all we can, following the biblical wisdom we have been given—whether through specific scriptures or subject matter experts we can trust—to take whatever steps we can to plan for the future and position ourselves as best we can. Then we trust the rest to God.

We can trust God because he has promised to care for us. You can count on that. But does that mean we sit back passively and do nothing and expect God to take care of us? No, as that would be presumptuous. We must find a balance between trusting in God’s sovereignty and providential care for us and our responsibility to do all we can to take care of ourselves wisely.

2—Although many of us may never be “rich” during this life, at least in a material sense, we will be rich beyond our wildest dreams in the life to come.

We are not promised material riches in this life. The gift that God has promised is our inheritance in Him. We will have indescribable riches in eternity because of God’s loving kindness and mercy toward those whom He loves and who love Him. And most importantly, we will have HIM—the Father, Son, and Holy Spirit—forever!

3—Most people will intentionally and dramatically reduce their spending in retirement if they know they have to make their money last.

It would be best if you spent less—perhaps much less than you did before you retired. But you’re not spending less to save more; you’re spending less to make what you have saved go as far as possible. You will have to look at every single expense and see if you can reduce it.

Also, look for ways to reduce monthly debt payments, perhaps by refinancing the loans or consolidating balances into lower-cost, potentially tax-deductible forms of debt.

4—Those who have saved relatively little still have options, depending on their situation.

There are ways to make the money you have saved last longer or at least to try to make it last as long as you live. This, along with some part-time work, if you can manage it, in addition to the expense reductions discussed in #3 above, may be just enough for you to handle your retirement expenses. Let’s look at a few:

- You could accept a lower probability that your savings will last. Be careful—this is a bit of a gamble. The recommended withdrawal rate of 3 to 4% we have been using is based on a 90 to 95% confidence level that your savings will last through your lifetime. If you decide to take additional risk and withdraw more than that each year, perhaps 5 to 6% versus the 3 to 4% recommended, the probability that you will outlive your money will increase significantly, at least statistically speaking. I wouldn’t recommend this unless you have to and make sure you understand and are willing to accept that risk.

- With limited savings, you may want to take steps to yourself some protection from exposure to market volatility. This usually means putting money into fixed-income investments like bonds, CDs, and bank savings accounts. This may help dampen their portfolio volatility, but strictly speaking, they are not absolutely “safe.” Bonds, and to a lesser extent, CDs, have interest rate risk. (When rates rise, they are essentially worth less—we have seen that this year.) They also do not protect from longevity risk (outliving your money) or inflation (loss of purchasing power). Annuities and Social Security are safer options. They potentially protect against three risks — longevity, inflation, and market exposure.

- If possible, delay receiving Social Security benefits as long as possible. For most people, this means working longer, if you can, at least to your full retirement age. Consider working to age 70 if you can maximize savings and your Social Security benefit. If you have to retire and can no longer work, be sure to choose the Social Security option that is best for you. And remember – for couples with only one spouse who has earned enough credits to receive a Social Security benefit, the other spouse can receive 50% of that benefit. (More on Social Security and the various benefit options in future articles.)

- Consider annuitizing a part of your savings. An annuity is simply a pooled-risk arrangement with an insurance company where you give them a certain amount of money, and they agree to give you a certain amount back each month, every month, for as long as you (or your spouse, if you so choose) live. Some who are in the “pool” don’t live as long, which helps the companies make payments to those who do. You come out well if you live longer than the average life expectancy. (There’s that longevity risk thing again.) If you don’t, the insurance company wins.

- If you purchase an annuity, askew high complexity and fees. I have to be honest; I’ve never been crazy about annuities, mainly due to their high fees and having to give up control of your principal. However, I am becoming increasingly convinced that they have an important place in many retirement income plans. The main advantage of an annuity is receiving a benefit you can’t outlive instead of relying only on a saving/investment account that you could outlive for any number of reasons. There is also a good possibility that the annual income you receive will be more than you can generate through traditional investments without taking undue amounts of risk. Still, keep in mind that hat although certain types of annuities may be less risky than the stock market, they aren’t totally without risk. Because an annuity is essentially a contract with an insurance company, they are only as safe as the insurance company itself.

- Consider tapping into your home equity as an additional source of retirement income. You may scale down to a smaller home in retirement and pocket the difference to generate more income. That’s probably the best way. A Reverse Mortgage may also be an option for you, but I recommend that you consider that only as a last resort. If you are “mortgage poor” in retirement because your housing costs are now taking up too much of your income, you must consider downsizing.

It’s all in his hands

We know and worship and serve a God who controls all things, including the dynamics of global macroeconomics (and all other things outside our control).

So, whatever your situation, wise planning combined with decisive action, done in prayer and with full faith and trust in God as your ultimate provider, will help you to make the course corrections you need to be ready for retirement when the time comes.

We do this, even as we are, “Waiting for our blessed hope, the appearing of the glory of our great God and Savior Jesus Christ” (Titus 2:13, ESV).