Now that I’ve reached age 70, I’m looking forward to getting just a little older. Why? Because when I reach age 70½, I’ll be eligible to make Qualified Charitable Distributions (QCDs).

I first mentioned QCDs on this blog in an article published in December of last year titled ”My Year-End Retirement Stewardship Review and Planning Routine.” I discussed it briefly in the context of giving and planning in the future.

I was interested in it because I saw it as a way to reduce my overall tax liability. I wrote this:

With a QCD, almost all taxpayers with a Traditional IRA will reduce their overall tax liability by funding charitable gifts via the QCD rather than by other methods such as giving cash or appreciated securities.

Most Christians I know are generous, charitably inclined people. We know that the Bible is full of texts that stress the importance of generously giving our time, talents, and treasure for as long as we live. Because our hearts have been changed and we want to follow Jesus, we offer out of love and gratitude as an act of worship (Prov. 3:9, Luke 3:38, 2 Cor. 9:7).

One of the ways we maximize our financial resources for all the good purposes God has ordained for us is by lawfully minimizing what we pay in taxes. My attitude is to cheerfully (okay, not too begrudgingly) render Caesar his due, but not a penny more (Matt. 22:21).

Saving and investing in retirement savings accounts offer a tax-advantaged way to save and grow your money over the years. You can reduce your current tax liability if you wish, and you don’t have to pay taxes on the growth of your investments until later in life (never if you use Roth accounts).

Itemizing deductions has historically been the best way to minimize our taxes. And even though itemizing has become less common under current tax law, living in a country that generally incentivizes saving and generosity with its tax policies is a blessing.

In addition to mortgage interest tax deductions for many of us, charitable giving has been one of the larger of these itemized deductions.

Donations of goods and money have been, and in some circumstances still are, tax deductible up to certain limits. Under the current tax laws,

- cash contributions to a qualified charity in 2022, 2023, 2024, and 2025: up to 60% of your adjusted gross income (AGI) each year;

- cash contributions to a qualified charity after 2025: 50% of your AGI.

In other words, the IRS is not inhibiting you from giving away a lot of your income if you’re inclined to do so!

But there is a caveat to that: Under current tax laws, charitable donation deductions can’t be claimed as deductions if you don’t itemize. And since the Tax Cut and Jobs Act of 2017, the increased standard deduction made it less likely a taxpayer’s itemized deductions would exceed their standard deduction (which went from $12,000 in 2017 to $27,300 in 2022 for a 65 or over married couple filing jointly), fewer taxpayers benefit from itemizing.

In fact, according to a 2021 study, less than half as many taxpayers itemize as did under the old tax laws. Consequently, many who make charitable contributions will not receive a direct tax benefit as they did before.

That’s because most people don’t give enough that, when combined with other itemized deductions, exceed the standard deduction.

And now the good news: There’s a provision in current tax law that can provide some additional tax relief to retirees who give to charity. As we will see, a little knowledge may save you thousands of dollars in income taxes.

How QCDs work

A ”QCD” is simply a withdrawal from an IRA sent directly to a qualified charity (instead of being paid by the IRA account owner) that’s tax-free base on the current tax code.

Not only is the money not taxed, but you can still use it to help satisfy the required minimum distribution (RMD) requirements. In other words, if you need to withdraw $20,000 annually to satisfy your RMD and take a QCD of $10,000 plus $10,000 in ordinary income for retirement, you will have met the requirement. However, only $10,000 of your total RMD will be taxable.

The best way to describe how this could work for you is with a couple of examples.

First, let’s compare the tax liability of a retired couple, age 72, who are taking RMDs and making contributions by writing a check versus giving to the charity directly using a QCD. (Note: Since QCDs can begin at age 70½, you don’t have to take RMDs, which are required at age 72, to receive the tax benefit.) (Update: For some, the new RMD age is 73 due to the passage of SECURE Act 2.0.)

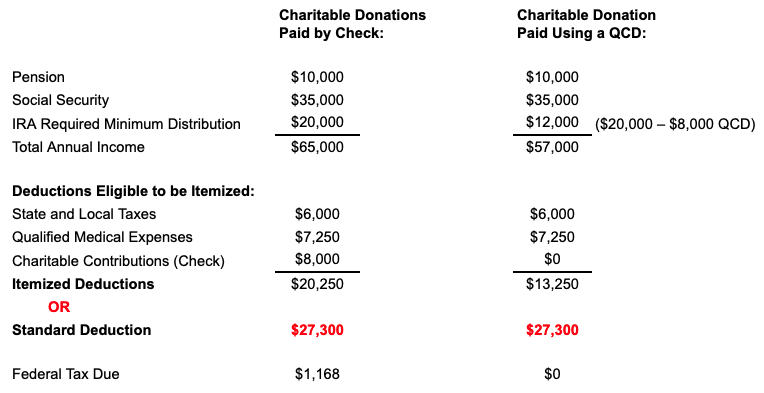

Our couple, whom we’ll call Alex and Alice, have fairly predictable living expenses. Their annual income consists of a $10,000 pension, $35,000 in social security, and, because they’re age 72, they’re taking RMDs of $20,000 (based on an IRA account balance of $547,945 with an RMD of 3.65%). They have a total annual income of $65,000.

Alex and Alice, age 72, Charitable Donations: $8,000 Annually

They are generous givers and contribute to their church and other mission organizations and charities in their community totaling $8,000 annually.

As you can see below, since their itemized deductions of $20,050 don’t add up to more than the standard deduction, they will take the standard deduction of $27,300. More importantly, note that they don’t get a tax benefit for making the $8,000 contribution to their charities. Their total federal tax bill is estimated at $1,168.

However, if instead, Alex and Alice use a QCD to make a tax-free transfer directly to their preferred charities instead of writing checks (illustrated in the column on the right), they’ll reduce their total tax liability to zero!

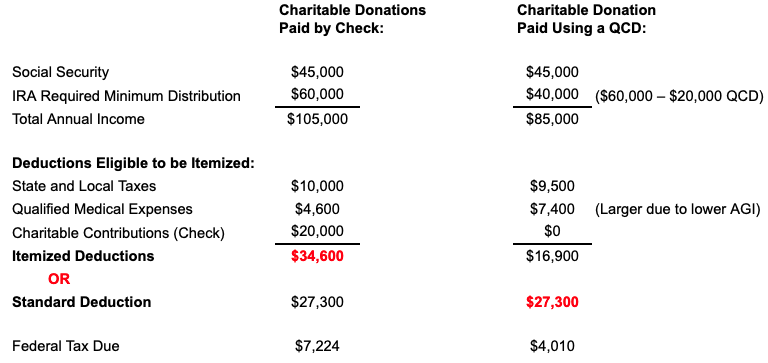

Here’s an example for another couple; we’ll call them Dan and Pam. They have no pension income, but they receive a higher social security benefit ($45,000) and are also withdrawing more from their IRA ($60,000) based on the RMD from an account balance of $1.6Mil. Their total yearly income is $105,000.

Dan and Pam are also generous and contribute $20,000 to their church and other charities annually. Their charitable contributions are deductible, as are allowed medical expenses and state and local taxes. The total of these deductions ($34,600) is more than the standard deduction of $27,300, so they itemize their deduction. That results in a total federal tax bill of $7,224.

Dan and Pam, age 72, Charitable Donations: $20,000 Annually

But what if they do QCDs instead of making cash contributions to their charities, just like Alex and Alice did? They will reduce their taxable income and itemized deductions accordingly. As you can see, their tax situation has changed significantly. They will have less taxable income and reduce their itemized deductions, but they can now take the standard deduction of $27,300. Consequently, their federal tax is reduced to $4,010, a savings of approx. $3,200!

Setting up QCDs

I haven’t done this yet, so I don’t know all the details, but the process looks straightforward. I will have to instruct my IRA custodian (which happens to be Fidelity in my case, but others provide this service) to direct IRA distributions from my traditional IRA (up to a limit of $100,000 per year) to a qualified 501(c)(3) charity.

My largest contributions are to my local church, so I plan to discuss this with the office staff to let them know of my plans and ensure the contributions are handled smoothly.

I understand there’s a small wrinkle that has to do with tax reporting. There’s a problem “coding” an IRA distribution on tax form 1040 as a”QCD” so the IRS can give it tax-free status. The form currently codes them as normal taxable IRA distributions, but the IRS has provided special instructions on how to report them:

To report a qualified charitable distribution on your Form 1040 tax return, you generally report the full amount of the charitable distribution on the line for IRA distributions. Enter zero if the full amount was a qualified charitable distribution on the line for the taxable amount. Enter “QCD” next to this line. See the Form 1040 instructions for additional information.

I can see no reason not to do this. It’s not selfish or greedy to take advantage of a lawful tax benefit afforded to retirees aged 70½ and over. But I do have a dilemma: when to start?

Because I receive a monthly income in retirement from social security and my IRA, I give to my church twice a month. I’m not allowed to start QCDs until April 14, 2023, when I’m age 70½. Still, it would be best for me to withhold all my tithes and offerings for January 1 through April 14 and then make a lump sum QCD. However, it may not be good for my church and its cash flow planning.

That’s a conversation I plan to have with our church administrator, who also happens to be a good friend. Perhaps they have special provisions for how to budget and plan for income that comes on a one-time or irregular basis. (I know that many business owners and self-employed people contribute that way, sometimes at the end of the year.)

Most will benefit from QCDs

This is good stuff! Based on the two examples, most IRA owners taking distributions and charitably giving from them can benefit from QCDs. How much will depend on various factors, but the larger your charitable contributions, the more significant the positive tax impact (not to mention the effect on the charities themselves), especially if your other deductions are relatively small.

I ran the numbers for myself using a recent tax return representing a “typical” year for us in terms of income and giving. The result was a $5,000 reduction in our federal tax liability by making QCDs instead of making direct cash contributions to our church and other charities.

You can estimate the tax benefits of using QCDs in your situation by compiling your numbers for the categories I’ve listed above and running the two different scenarios with a simple federal income tax calculator.

It’s important to know that retirement savings held in other retirement accounts, such as 401(k), 403(b), SEP, and SIMPLE IRAs, are not eligible for IRAs. For these accounts, you can name a donor-advised fund or another charity as a beneficiary in your estate planning.

You could also roll over assets from a 401(k) or 403(b) into a traditional IRA and then donate using a QCD. (I would strongly caution pastors eligible to claim a housing allowance in retirement as an offset to distributions from their 403(b) to consult with their tax advisor before doing any rollover.)

It would be a good idea for all retirees who give to charities, regardless of what type of account they currently have, to run simulations with a trusted advisor’s help to see if QCDs make sense. You can make simple comparisons between making contributions with cash versus doing a tax-free transfer from an IRA. As shown in the examples above, the tax benefits may be significant.

Donor-advised funds (DAFs) are an option for some

Fidelity Investments defines a DAF this way:

A DAF is a dedicated charitable fund maintained by a public charity (a “sponsored organization”) exclusively dedicated to charitable giving. When you contribute to a donor-advised fund during your lifetime, you are eligible for an immediate income tax deduction. When your estate makes a contribution to a DAF at your death, there may be estate or inheritance tax benefits, in addition to income tax benefits.

DAFs are most beneficial to those with a sizeable taxable windfall or many appreciated assets outside of tax-advantaged accounts (i.e., 401Ks and IRAs) who would like to reduce taxes as much as possible in the current year while having the flexibility to make disbursements to charities according to some schedule in the future.

In a way, a DAF is a simple alternative to a private foundation. You might also consider it a “charitable checking account” or “charitable investment account” that triggers an immediate tax deduction when you deposit funds into them while allowing for grants to charities from those accounts later on. (If the DAF is an investment account, the gift money may continue to grow until you decide to give them away.)

I corresponded with a reader a year ago who said he had a good experience setting up a DAF with Schwab. Although QCDs are targeted at charitable distributions from IRAs, DAFs are for those with significant financial assets outside of retirement accounts who want to put a structured plan in place for generosity. If that applies to you, I strongly encourage you to consider this option.

QCDs make the most sense for me since I have no significant assets outside my retirement accounts. But whether we use a QCD, a DAF, or give generously with no regard for the tax consequences, may we “. . . do good, to be rich in good works, to be generous and ready to share, thus storing up treasure for themselves as a good foundation for the future, so that they may take hold of that which is truly life” (1 Tim. 6:18-19, ESV).