In the last two articles, I discussed how retirees (and others) use bonds as part of a diversified portfolio because of their stabilizing effect in times of stock market volatility.

Bonds can also be an excellent source of income and may provide capital gains under some economic scenarios (especially falling interest rates).

We’ve also seen that individual bonds are best used for “liability matching” to future spending needs. And many retirees may find that building a bond ladder with individual bonds of different maturities can offer benefits that bond funds and ETFs don’t.

In this, the third in a series, I’ll look at the benefits of building a bond ladder versus investing in bond funds, especially in certain situations.

Rolling versus Non-Rolling Bond Ladders

There are two types of bond ladders: rolling and non-rolling. Which one you choose will depend on why you are selecting a bond ladder over a bond fund in the first place because, as we’ll see, a bond fund behaves much like a rolling bond ladder.

In the last article, I described how a rolling bond ladder would work for a single bond. You purchase a one-year bond initially for $50,000 and then “roll it over” each year by buying a new bond at the prevailing interest rate, which may be higher or lower.

But in reality, very few people would build a bond ladder with a single bond (a ladder with a single rung is a step stool, I think).

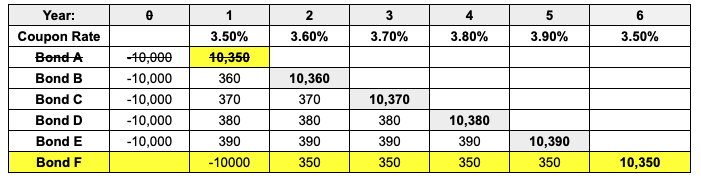

A better alternative, as shown below, might be to purchase five bonds (A thru E), each for $10,000 and with a different duration (from one to five years), and at the current coupon (interest rate) for that term (the second row in the table; interest rates are illustrative).

Then, after spending the coupons for income, you could roll over each bond when it matures by purchasing a new five-year bond that will start coupon payments in year two and mature in year six.

As shown in the table, the first bond (A) would mature in one year and would pay a coupon of 3.5%. You would receive your original $10,000 plus one year of coupon payments ($350) for a total of $10,350.

If you reinvest in another bond instead of spending the money you receive from the matured bond, you’ve created a rolling ladder because you roll over the money you receive from each maturing bond to a new five-year bond, extending the ladder to year six.

In the above example, you would roll bond (A) into a new five-year bond (F), which would start paying coupons of 3.5% in year two and will mature in year six. That process would continue for bonds B thru E as they mature, making the ladder non-depleting.

A rolling bond ladder is not necessarily designed to address a date-certain future liability, such as a year of college tuition or retirement income. A rolling ladder behaves more like a bond fund and will exhibit similar returns over long holding periods.

To fulfill a future spending liability, such as a year of retirement income, a non-rolling ladder of individual bonds is more suited to that purpose than a rolling ladder or bond fund.

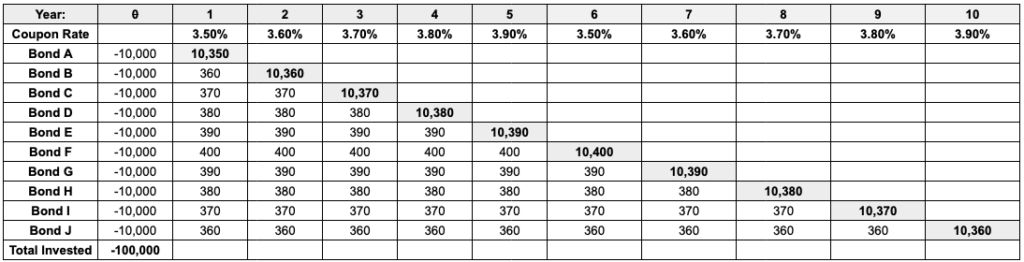

For example, if you need money each year for ten years and want to protect your principal from interest rate risk, you might set up a 10-year bond ladder as shown.

You could purchase ten bonds, each for $10,000 and with a different duration (from one to ten years), and at the current coupon (interest rate) for that term (shown below the year in the table; interest rates are illustrative).

The first bond (A) would mature a year from now and would earn interest of 3.5%. You would receive your original $10,000 plus interest of $350 in year one for a total of $10,350. The next bond (B) would mature in year two, and you’ll get back your original $10,000 plus $360 of interest, plus one year of each year for two years ($720) for a total of $10,720 ($720 + $10,000).

With each passing year, each remaining bond (C thru J) has one less year to maturity. This scenario fully depletes the ladder after the last bond matures in ten years. Most retirees build ladders based on their life expectancy.

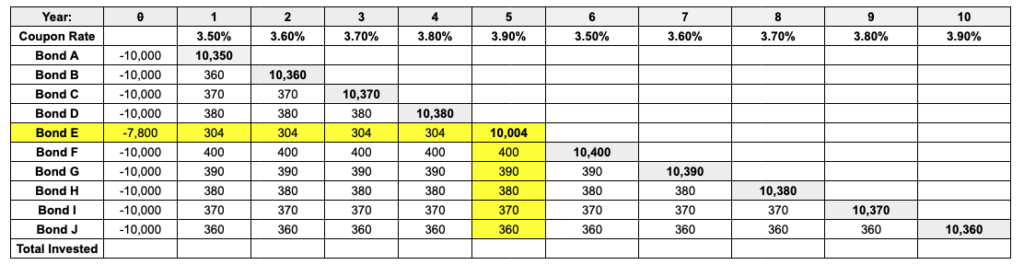

Because bonds make coupon payments monthly, semi-annually, or even annually, if you need $10,000 of income each year from your ladder, you might “discount” each bond purchase by the total income you expect to receive each year from the other bonds in the ladder.

For example, when bond E matures in year five, you’ll receive $1,900 in coupons (304+400+390+380+370+360). Therefore, you could have purchased a five-year bond with a face value of $7,800 to meet your spending requirement of $10,000 in year five ($7,800 + $2,204 = $10,004). (The math for this calculation is a little more complex than it appears; you’ll need a spreadsheet or an online bond ladder tool.)

Whether you do this would depend on what you expect your future spending needs to be (and inflation, since we’re talking about “nominal” non-inflation-adjusted bonds here).

Bond ladders versus bond funds

The primary reason for building a non-rolling bond ladder is to take advantage of the total return of the principal when they mature. Even though the “on paper” value may fluctuate, you’re assured of getting your principal back plus interest (unless you spend it for income before the bond matures).

Not only is each bond guaranteed not to lose value over its term, but the bond ladder won’t lose money over its term (which was ten years in the example above).

Some view this as a safer option for fixed-income investments than a bond mutual fund or ETF, which, as we have seen, works more like a rolling bond ladder.

For someone who needs to satisfy a date-specific future spending need, a non-rolling ladder may be superior to a bond fund. You could use it to match future cash flows from the return of principal and earn interest to future spending needs that protect the bond portion of your portfolio from interest rate changes.

It must be noted, however, that the value of individual bonds held in a personal bond ladder fluctuates just as the net asset value (NAV) of a bond fund does (since the fund’s NAV is an aggregate of the NAV of all its bond holdings). The daily fluctuation of the price of an individual bond will be very similar to a bond fund with the same duration.

You shouldn’t be too concerned if you plan to hold the individual bonds to maturity. Nor should you be overly worried by the fluctuation of a bond fund NAV if you are primarily interested in the income it’s generating and don’t need to liquidate shares to fund spending in the future.

Still, a bond ladder can provide some mental and emotional comfort. Bond funds and ETFs can seem opaque, and when you only see fluctuating prices (or significant losses as many did this year), it can be troubling since most retirees own bonds for relatively “safe” income. They (including me) don’t like to see their value decline as they did in 2022.

A bond ladder, on the other hand, feels more transparent. But if you build a rolling bond ladder and continuously reinvest your principal, your overall returns may not differ from investing in a bond fund or ETF.

A better ladder?

Another big issue with non-rolling bond ladders that match withdrawals with matured bonds is that you’ll get your principal and accrued interest back, but it won’t be adjusted for inflation. So, although you may receive your $10,000 investment back in full in five years, it’ll be worth less due to inflation—a lot less if inflation has been extraordinarily high over that period.

The remedy may be Treasury Inflation Protected Securities (TIPS). These are U.S. Treasury bonds that compensate for inflation. The U.S. Treasury is considered the safest bond issuer in the world. Many consider TIPS the safest of the safe because, unlike all other Treasuries, TIPs protect against inflation.

TIPS bonds pay their coupon rate of interest semi-annually. At maturity, the Treasury increases the amount of principal you are repaid to compensate for inflation over the bond’s life.

Should you build your bond ladder with TIPS? This may be one of the best times in a very long time to consider this strategy. I’ll discuss it in the next article, and even though I already invest in TIPS through a fund, I’ll explain why I’m considering a TIPS ladder as part of my retirement income strategy.