The last three articles discussed why retirees might want to own bonds and possibly individual bonds instead of investing in a bond fund.

Bonds come from many sources: governments, government agencies, blue chip corporations, and risky smaller companies (junk bonds). Municipalities also issue bonds (they’re called “munis”).

Something is common to them all: the more financially sound and creditworthy the issuer, the safer the bond and the lower the interest rate.

We’ve seen why bond prices come down when interest rates increase and vice versa. Short-term bonds are ‘safer’ than intermediate or long-term bonds because interest rate changes affect them less.

In the broader category of U.S. government bonds, there are Treasury notes, bonds, and Treasury Inflation-Protected Securities (TIPS). TIPS are unique because, unlike all other U.S. Treasury and corporate notes and bonds, TIPS can also protect against inflation.

But there’s a catch: the yield for TIPS is already discounted to account for expected inflation. When TIPS really shine is when we have unexpected inflation (especially over an extended period).

The difference between the yield of a TIPS and a treasury bond of comparable duration reflects that discount, which is the market’s expectation for inflation for that period. (This is called the “breakeven point” for nominal and inflation-indexed bonds.)

Thus, if inflation expectations become reality, TIPS and Treasuries will have almost identical returns. If inflation is higher, TIPS will do better. If actual inflation is less, then TIPS will pay less than regular treasury bonds.

In that way, TIPS work like ‘inflation insurance.’

This all makes TIPS almost totally risk-free. If that’s the investment you’re looking for, look no further. Short and intermediate-term TIPS are arguably the safest bonds available. Long-term TIPS, though safer than long-term Treasuries due to inflation protection, are not totally risk-free as both carry interest rate risk unless held to maturity.

An example

TIPS earn interest based on the coupon payment for an individual bond, just like any other bond. They pay interest semi-annually. Additionally—and this is the key difference from other bonds—the face value of the bond changes each year based on inflation as measured by the Consumer Price Index (CPI).

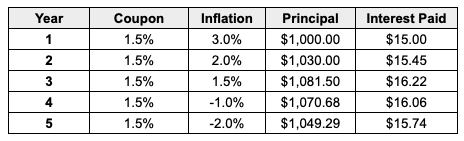

Let’s look at a simple example of a single five-year TIPS bond:

Here a five-year TIPS has a coupon rate of 1.50%. That means it will pay interest of 1.50% and make payments semi-annually.

If you invested $1,000 in this issue, you’d receive $7.50 in interest paid semi-annually, for a total of $15.00 per year. Not very exciting, but let’s say the CPI (inflation) increases that year by 3%. The face value of your TIPS would be adjusted upward by that percentage to $1,030.

This is where the unique properties of TIPS become most apparent.

Even though the coupon is fixed on a TIPS, the amount of interest it pays is variable because the principal adjusts for inflation. The interest payment in year two is the coupon (1.50%) multiplied by the inflation-adjusted principal ($1,030), which equals $15.45, or $7.73, paid semi-annually.

Let’s say that same TIPS is trading at $950 on the secondary market. We can calculate the “real yield” (inflation-adjusted yield) of the bond by dividing its market value ($950) by its adjusted coupon of $15.45, which equals 1.6%.

That increase may seem insignificant, and in the short-term, on a small amount of principal, it is. But for larger sums over longer periods, they can be significant due to compounding.

In the above example, I show the calculations for each year until the bond matures in five years. Inflation decreases in year four, and the TIPS accrued principal is reduced (in this case, by 1%). However, it can never fall below its original par value of $1,000, even if extreme deflation occurs.

The market value of the bonds will fall if interest rates rise, but if you hold the bond to maturity, you will receive at least the original face value.

Therein lies the real value of TIPS: You receive regular coupon payments, which are guaranteed for the term of the security, and you may receive a higher return of principal if inflation grows. But you will never receive less than the original face value of the bond.

Recent yields are higher

TIPS yields have not been as high as they have been for the last six months or so for many years. You’re guaranteed to beat inflation when yields are positive, and if inflation is higher than expected, then a TIPS inflation-adjusted yield will be higher too.

But that only happens if you hold the TIPS to maturity. If you sell early, you’ll get the current market value, which may be less than your original investment, including adjustments.

I don’t currently own any individual TIPS, but as I’ve mentioned before, I have a sizable investment in STIP, the iShares 0-5 Year TIPS Bond ETF. The fund invests 100% in TIPS with durations of less than five years (average duration is approx. 2.5 years). Its total return in 2022 was –2.41%, considerably higher (it lost less) than most bond funds. STIP has a current yield of about seven percent.

The negative return in 2022 shows that TIPS funds have interest rate risk just like a regular bond bund. However, the overall performance of TIPS may be better than regular bonds during periods of high inflation and rising interest rates.

The potential advantage of TIPS over non-TIPS bonds depends mainly on what inflation does in the future. But guess what—we can’t predict what it will be with a high degree of certainty. Sure, there are signs that higher-than-average inflation will be with us for some time, but we can’t say for sure.

TIPS are designed to protect against inflation over their lifetime, not deal with an unprecedented inflation surge in any given year that quickly subsides. Since inflation expectations are already baked in, some TIPS are sold with negative real yields when interest rates are low. According to data from the Wall Street Journal, all outstanding TIPS currently have positive yields, some as high as 4.6%.

Investing in TIPS

I imagine that I have piqued your interest in TIPS, especially since their coupon payments are higher now, and rising inflation has been in the forefront of the news for a while now.

TIPS coupons are lower than corporate bonds, and other treasuries of the same duration for the same reason: the markets’ expectations about inflation are already priced in. You’ll be better off buying TIPS if they have underestimated future inflation.

My current fixed income allocation of 65% of my retirement portfolio breaks down like this:

| Short-Term TIPS ETF | 14.5% |

| Short-Term Bond Index ETF | 18.5% |

| Total Bond Index ETF | 10.0% |

| U.S. Investment Grade Corporate Bond ETF | 12.0% |

| U.S. Government Money Market Fund (Cash) | 10.0% |

As you can see, my fixed-income investments are tilted toward shorter-term bond EFTs. I also have about 10 percent cash in a government money market fund, which is currently yielding a surprising 3.9%. (Short-term rates are higher than long-term rates right now—it’s called an “inverted yield curve.” Some economists suggest this is a sign of a coming recession.)

I’m not holding anywhere near 100% TIPS. Still, 14.5% of bonds (which is 8% of my total portfolio) is a sizable portion. My short-term and total bond index funds do not hold any TIPS, but they have a significant percentage of U.S. Treasuries, so I think I’m reasonably well diversified.

I haven’t thought much about buying individual TIPS or building a TIPS ladder until now. I hope my stock funds keep up with inflation, and I own a short-term TIPS fund to further mitigate inflation risk and also interest rate risk.

But my stock allocation is considerably less than 50%, which may mean I need more inflation protection. Plus, higher yields for TIPS and the prospect of higher-than-normal inflation in the years ahead have gotten my attention.

Generally speaking, purchasing TIPS after such a dramatic rise in inflation (such as what happened in 2022) means we may have to pay a premium for that investment.

The real yield of a TIPS is its yield above what investors think future U.S. inflation will be over the term of the TIPS. The current 10-year TIPS real yield is 1.3%, which means that its yield to maturity will exceed inflation by that percentage for ten years.

If inflation is 2.2%, you’ll get a nominal return of 3.5%, roughly equal to the current yield of a nominal 10-year U.S. Treasury bond, which is currently about 3.5%.

This suggests that ten-year TIPS are fairly priced relative to expected inflation—they’re neither under nor over-priced. If you think inflation will be higher than expected, TIPS will outperform the nominal Treasuries and may be a better deal.

If you’d like to add some TIPS to your portfolio and are brand new to them, buying a mutual fund or ETF that holds exclusively TIPS is the simplest and easiest way to go. (As I stated, the large bond index funds don’t include TIPS.)

TIPS funds work much like any other bond fund except that the value of the underlying securities is adjusted yearly for inflation. When you buy into a fund, you buy into all its underlying securities at the current price and yields. These will vary from day to day.

If you look at a fund’s current performance, the “yield” or “SEC yield” is the Real yield based on the fund’s prior 30-day performance. You’ll notice that bond fund yields are much higher than usual. That’s because NAV prices have gone down as interest rates have risen. It’s simple math.

I’ve invested in both intermediate-term and short-term TIPS ETFs. As I’ve said, I currently use a short-term fund, which I switched to early last year as short-term rates and inflation began to rise.

Here are some examples of short-term TIPS funds (maturities of less than five years):

| Name (Symbol) | Minimum Investment | Expense Ratio |

| iShares 0-5 year TIPS Bond (STIP) | None | 0.03% |

| Vanguard Short-Term Inflation-Protected Securities ETF (VTIP) | None | 0.04% |

| Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX) | $3,000 | 0.06% |

These funds invest in TIPS of all maturities:

| Name (Symbol) | Minimum Investment | Expense Ratio |

| Fidelity Inflation-Protected Bond Index Fund (FIPDX) | None | 0.05% |

| Schwab Treasury Inflation Protected Securities Index Fund (SWRSX) | None | 0.05% |

| Vanguard Inflation-Protected Securities Fund Admiral Shares (VAIPX) | $50,000 | 0.10% |

| Schwab U.S. TIPS ETF (SCHP) | None | .04% |

| iShares TIPS Bond ETF (TIP) | None | .19% |

If you want to buy individual TIPS, you can do so through the government site Treasury Direct (using a non-retirement account) or in your brokerage IRA (Fidelity, Schwab, Vanguard, etc.). My brokerage (Fidelity) allows its clients to buy new TIPS at auction (not always directly online) as well as existing issues on the secondary market (more on this in another article).

What about a TIPS ladder?

I hope this article has given you a better understanding of TIPS. I can’t say whether TIPS will be a better investment than nominal treasury or corporate bonds because I can’t predict future inflation. But I do know that they offer protection from unexpectedly high inflation and full return of principal if held to maturity.

TIPS coupon payments are higher than they’ve been for a long time due to inflation, and I don’t think inflation will be below average any time soon, so it may be a good time to buy them.

But they are also sensitive to rising interest rates, which is why there’s more interest in individual TIPS and building TIPS ladders, for the reasons we’ve discussed.

That’s where my interest is, and I’ll discuss that in the next article in this series.