This is the second of two articles about some of Donald Trump’s campaign promises, which, if enacted, could significantly impact retirees or near-retirees.

Interest rates

Promises

- Do what [he] can to reduce interest rates (not on the PolitiFact list but quoted elsewhere)

- Put a temporary cap on credit card interest rates

PolitiFact:

”Trump said ‘we’re going to cap’ credit card interest rates ‘at around 10%. We can’t let them make 25% and 30%.’ When he made the pledge in September 2024, the typical interest rate for credit card accounts that are assessed interest was 22.8%. The typical rate has never been as low as 10%, going back to at least 1994, when researchers began collecting the data on credit card interest rates. Rates briefly went as low as 12% in 2003. Skeptics say banks might counter by tightening standards for who can have cards.”

My take:

Trump has often said he will do what he can to reduce interest rates.

As we know, the “Fed” manages interest rates, not the president; the Federal Reserve operates independently from the executive branch. However, Trump has also said he should play a role in those decisions but later walked that back when he said,

“I think it’s fine for a president to talk. It doesn’t mean that they have to listen. A president certainly can be talking about interest rates, because I think I have very good instincts. That doesn’t mean I’m calling the shot, but it does mean that I should have a right to be able to talk about it like anybody else.”

https://thehill.com/business/4979431-federal-reserve-powell-trump-demand/

Trump does have some indirect influence; he can replace the Fed Chair (currently Jerome Powell, a Republican, whom he nominated in 2017 and Biden reappointed in 2021) when his term expires in 2026, ask him to resign when he takes office, and nominate different members of the Fed Board when the time comes.

Powell has said the president is “not permitted under the law” to fire or demote him or any other Fed governors with leadership positions. He also indicated no intention of resigning, even if Trump asks him to do so after taking office.

No matter what happens to Powell, I hope the new administration will work with the Fed to regulate inflation better than they did during the Biden administration.

Reduced interest rates are generally good for everyone (except perhaps for those who hold a lot of cash as part of their investments). They would be welcomed by retirees along with almost everyone else.

The stock market has been up and very active since the election. If that trend continues under Trump (and it may), and interest rates come down, holding cash and cash-like assets won’t be as attractive to investors as it has been; more may want to ”put their cash to work” in riskier assets.

Should that happen, the markets could rise to new levels. And as rates fall, bond prices could rise, a consolation to investors like me who have held on to their bond funds through all these ups and downs (although, as a retiree, I prefer higher yields to lower valuations).

Lower rates can also stimulate more consumer borrowing for spending and lower mortgage costs, which would fire up the housing market, but there is always the risk of inflation.

Many younger people may not realize that current interest rates are actually more ” average” than not. Everyone compares them to the anomalies of the last 10 or 15 years.

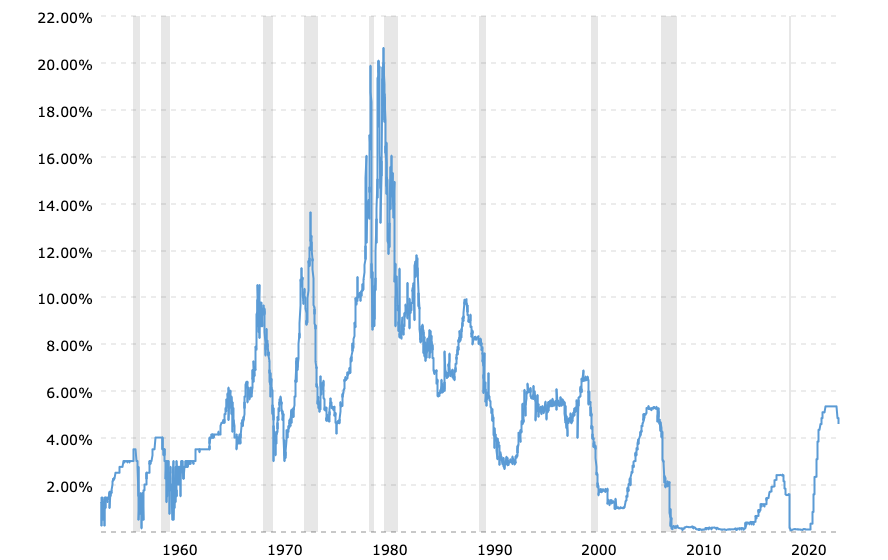

This chart shows the Fed funds rate over the previous 62 years:

Our recent “spike” since 2022 is apparent and stands in contrast to the last decade or so, but notice how it compares to other spikes in the past and the trend line in general.

The current rate is around 4.5%, and the average federal funds rate has been approximately 4.61%. The median rate during this period is around 4.83%. We’re actually below normal!

Lower rates would undoubtedly be helpful to retirees who are carrying credit card balances. However, as PolitiFact points out, it could have unintended consequences as credit card companies have to 1) borrow at prevailing rates, 2) plan for defaults (losses), and 3) still make a profit.

I’m not a big defender of credit card companies’ interest rates or many of their practices, but it’s misleading to say that they “make 25% and 30%.” While they may charge that to their least credit-worthy accounts (which I contend they shouldn’t lend to in the first place), that’s not what they net on all the credit they extend.

A better indicator of credit card companies’ earnings is “return on assets” (ROA). (For accounting purposes, credit accounts are tracked as “assets,” not liabilities, in lending and credit card companies.)

The chart below from McKinsey & Co. shows the ROA of the weighted average of the largest card companies in America (American Express, Bank of America, Capital One, etc.):

As you can see, in early 2023, the ROA had fallen to about 4.6% (it declined 39 bps year-over-year from 1Q 2022 to 1Q 2023). Of course, that doesn’t mean they charge an average of 4.6% to all their customers; the average rate is currently closer to 21%. Credit card companies charge their customers the prime rate plus an additional margin based on creditworthiness.

Due to rising interest rates, borrowers’ effective rates have increased significantly in the last few years.

Would credit card users benefit from a reduction in interest rates? Yes! Is 21% a ridiculous amount of interest to charge someone? Yes! However, lower rates will encourage cardholders to use their cards even more, sending some further into debt (one of those unintended consequences).

Perhaps the lesson here is ”use a card if you must, but be sure to pay it off every month.”

Insurance

Promise:

- Cut car insurance rates by 50%

PolitiFact:

”It’s unclear how Trump could lower car insurance rates by this much.”

My Take:

I’m also unsure how he will accomplish this, although it would be good for retirees if he did.

Insurance pays benefits out of premium risk pools, which include drivers of different ages and risk profiles. Maybe Trump is mainly thinking about younger drivers whose premiums tend to be much higher (and shouldn’t they be because of greater risk?).

If their premiums are reduced, would that affect the premiums of older drivers or those with fewer accidents?

I guess we’ll have to wait and see.

Health and human services

Promises:

- Leave Social Security and Medicare unchanged

- Keep the Social Security retirement age unchanged

PolitiFact:

”Trump, during his business and political career, has sometimes said he’d be open to cutting Social Security or Medicare. As president, he proposed budgets that would have cut Social Security’s disability programs (but not retirement benefits) and Medicare (but in ways that experts say would have increased efficiency, not harmed beneficiaries). During the 2024 campaign, Trump has been consistent in his written platforms and in public remarks that he will not cut either program. However, Social Security is at risk of running out of money by the 2030s, which would trigger significant across-the-board cuts.”

My take:

Like Biden and Harris, Trump has said he’s opposed to reforms addressing predicted Social Security and Medicare cash shortfalls. But if something doesn’t change, the Social Security Trust Fund may be depleted by 2033, when Congress must either 1) reduce benefits, 2) bail it out with deficit spending, or 3) devise other more creative means to keep it solvent.

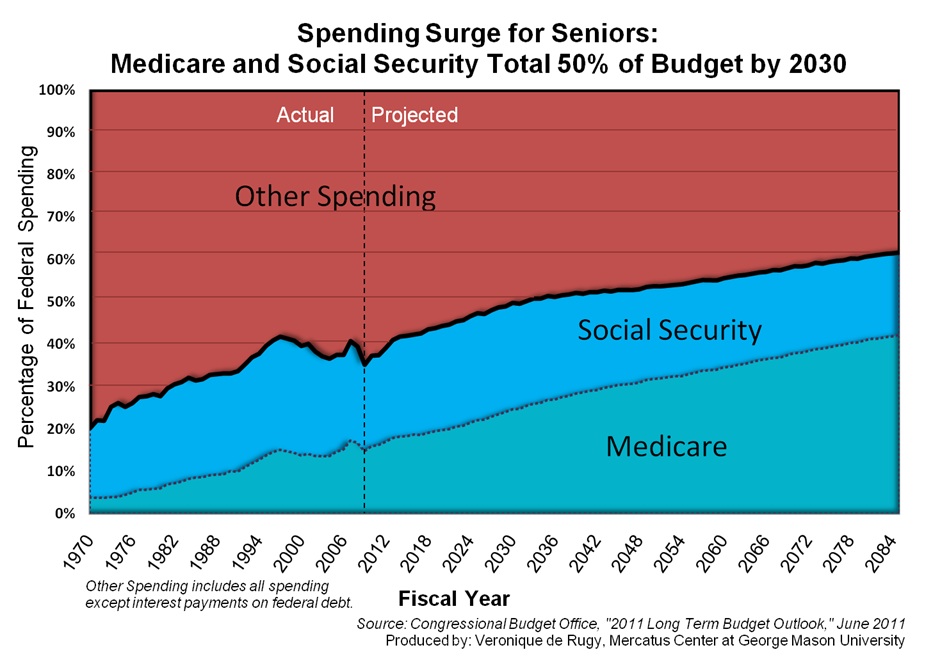

These entitlement programs are significant components of total federal spending (although the revenue sources are slightly different), with Social Security being the largest, about 20 percent of total federal spending. In 2023, Medicare expenditures totaled $839 billion—14 percent of total federal spending.

Based on research done by George Mason University in 2011, that percentage is predicted to reach 50 percent by the early 2030s:

Given their high and ever-rising costs, Trump believes these programs contain a lot of waste and offer opportunities for cuts. But since he has also promised not to cut any of them, it’s hard to say what his administration will do.

If he doesn’t reduce benefits directly, he may consider changes to eligibility or other areas.

Trump is less ambiguous about the Affordable Care Act (ACA) and Medicaid. He has called for an overhaul of the ACA, which wouldn’t affect all retirees, just those who retired early and use the federal health insurance marketplace as a ”bridge” to Medicare.

He has also identified Medicaid as a potential reduction target, which could affect retirees who receive long-term care benefits. However, most analysts think his administration will focus on inefficiencies and fraud.

That may be a good idea, but those savings would probably be a “drop in the bucket” relative to total costs.

Generally speaking, no older person (myself included) wants significant changes to these entitlement programs, especially if they’re already receiving benefits. However, their long-term health may depend on the government’s willingness to make changes, such as increasing the Social Security full retirement age (FRA) to 70 for younger workers who have many years to go before retirement.

Promise:

- Give a tax credit for family caregivers who take care of a parent or a loved one

PolitiFact:

”Trump (said) he’d offer a tax credit to people who are caring for relatives who need home-based aid. (He has not) released many details about (his) proposals, but a tax benefit is likely to be more limited than a plan that harnesses Medicare to pay for much or all of in-home health care costs. Few people pay enough in taxes to benefit from a credit as large as they would need to pay up front for in-home health care.”

My take

This would benefit retirees and older Americans, providing some financial support to family members who are providing care. It would also make in-home care less costly for those needing care and those providing it, perhaps encouraging more families to take it on.

Promise:

- Invest record amounts in American police

PolitiFact:

“Part of Trump’s approach to crime has been to bolster rights for police officers, who he says are hobbled by lawsuits and second-guessing.”

My take

Most people I know would like their streets to be safer and the government to fulfill its fundamental charter, which is to restrain evil in society and protect the freedoms given to us by the Constitution. This is necessary for the people in any nation to flourish.

Although it may be necessary, crime and policing are much more complex than just ” hiring more good guys to get the increasing number of bad guys.”

Our increasingly secular, humanistic, and relativistic culture needs to wake up to the things that are causing crime to increase, especially the spiritual and moral void that exists in our families, classrooms, and communities.

Federal spending

Promises:

- Cut the federal government’s budget every year

- Challenge limits on the president’s ability to cut federal spending

- Create a “government efficiency commission” that will “eliminate fraud and improper payments”

PolitiFact:

”Republicans have long pushed to shrink the federal government, and Trump would try to exercise “impoundment,” which refers to presidential powers to withhold congressionally appropriated funds from their intended use. This authority is not certain to pass judicial muster, since Congress has worked to limit presidential impoundment authority in the past, including through the Congressional Budget and Impoundment Control Act of 1974. Trump’s future attempts would draw legal challenges.”

My take:

We all know that federal spending is high; many would say it is too high. But spending isn’t the whole problem: it’s the difference between spending and income, called ”the deficit.”

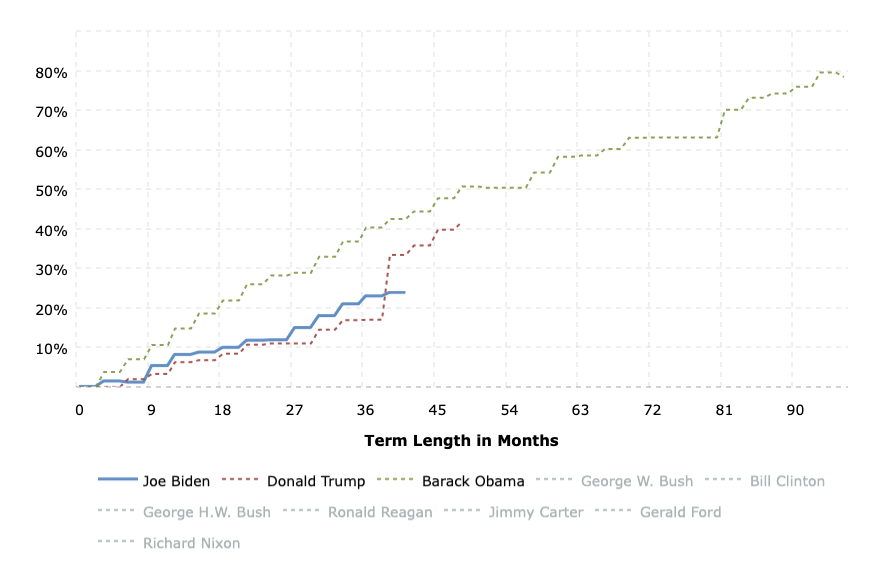

Here’s a chart that shows how much the federal debt grew (on a percentage basis) under each recent president (y-axis) over their time in office (x-axis):

As you can see, every recent president has increased the national debt, which is defined as the total amount of money the U.S. government owes. It’s the cumulative effect of past deficits minus any surpluses.

It rose gradually, albeit significantly, during the GW Bush and Obama administrations, with more dramatic growth during the first Trump and recent Biden administrations.

This shows that our recent presidents have all increased federal spending, yearly deficits, and the federal debt. So, unless the new administration’s efforts to eliminate fraud, waste, and inefficiencies are wildly successful, Trump’s policies, like his predecessor, will likely increase federal spending while hardly touching Social Security and Medicare, which could only exacerbate the debt problem we already have.

If implemented, Trump’s policies could decrease government overhead expenses in many areas and increase tax revenue through economic growth. Still, I haven’t seen anything that suggests it would be enough to pay for all the new spending (some of which is sorely needed).

Energy

Promises:

- Make American energy the cheapest in the world

- Lower energy costs within the first year by 50%

PolitiFact:

”Trump has criticized Biden’s handling of energy, notably gasoline prices, which peaked at record highs after Russia’s invasion of Ukraine. U.S. energy production under Biden has reached new highs.”

My take:

There is only so much a president can do to control oil and gasoline prices. They can 1) flood the market with oil from the Strategic Petroleum Reserve, which Biden did, but it only provided limited, short-term relief; 2) Reduce gas taxes, which I don’t think he did;3) Influence a significant oil-producing country (or countries), which Biden also did with Russia when he stopped importing Russian oil after their Ukranine invasion, but that hurt the US; or 4) Reduce or eliminate regulatory restrictions to increase domestic oil production, which Biden did the opposite of when he canceled the Keystone Pipeline project.

I can understand the geopolitics behind the Russian oil decision, but the problem was an inability to backfill that oil with other sources. I also understand that the Biden administration has taken steps to increase domestic oil and natural gas production, such as easing some fracking regulations.

However, Biden’s decision to cancel the Keystone pipeline seems to have had short- and long-term negative impacts. There are strong indications that Trump plans to restart it once he takes office.

This all points to the possibility that oil prices may decrease further during a Trump presidency. However, how much will depend on the global oil market, not just on the president-elect’s specific actions.

Lower oil and gas prices benefit almost everyone’s pocketbooks, including retirees. However, many don’t drive as much as they used to.

Promise:

- Fill up the Strategic Petroleum Reserve “immediately”

PolitiFact:

”High gasoline prices have driven Biden to sell off some of the nation’s Strategic Petroleum Reserve, leaving the supply at its lowest level in decades.”

My take:

You may not know that the U.S. currently produces more oil and gas than anyone else. It’s been increasing since 2009 in both Democrat and Republican administrations:

However, there are (and have always been) significant challenges.

Most U.S. energy production is enabled by “fracking,” which involves hydraulic fracturing and horizontal drilling to find new oil and gas pockets. The practice has made relatively clean natural gas so abundant and cheap that it has replaced coal in many power plants.

While the Biden administration has allowed some fracking but is mostly against it, Trump wants to do more, significantly increasing oil production to reduce its cost by half.

In terms of basic economics, increasing the supply of any commodity should bring its costs down in the short term if the demand remains the same. However, oil prices are set in the global market based on global supply and demand and are heavily influenced by geopolitical events, especially in the Middle East. If the price falls, producers usually produce less, and vice versa.

Trump may give oil companies more freedom to “drill baby drill,” but they still have to make business decisions about whether that makes sense if producing more means they have to sell for a lower price. If they receive government incentives or are incentivized in other ways, their additional production could be offset by foreign producers who might cut back to keep prices high.

What about the second part of the claim? Has President Biden “virtually drained” the SPR? It’s easy to see where there is more than a nugget of truth to that. Biden has reduced the level of the SPR to its lowest level since 1984. So, while some may quibble with “virtually drained,” it is true that Biden has significantly depleted the level of the SPR.

The SPR is supposed to be a kind of insurance policy against major oil supply disruptions, and drawing it down reduces our ability to respond to such occurrences. (Nonemergency sales are permitted in response to lesser supply disruptions but are usually small.)

If we have a true oil emergency and need the SPR (rising oil prices may be concerning, but they’re not typically an “emergency”), depleting the SPR will have been a bad decision.

Trump plans to resupply the SPR, but that comes at a cost. The government usually likes to purchase oil at rock-bottom prices; however, oil prices aren’t there right now.

Filling the SPR has more to do with national security than it does with regulating oil and gas prices. However, when Biden released oil from the SPR in some areas in 2023, prices fell by 13 to 31 cents per gallon. However, they rose again later on.

For these reasons and others, it may not be possible for Trump to cut oil prices in half, but if he makes significant progress, it should be a massive boost to businesses and consumers, including retirees who use their cars a lot or take long driving trips.

My big concerns

My biggest concern about Trump’s promises isn’t that I disagree with them (although I like some more than others) but that they could have some unintended negative consequences, especially when combined.

#1—Inflation

If we combine higher corporate earnings (good), rising personal income (good), increased tariffs (can be good or bad), lower interest rates (good), increased federal spending (not so good), and large numbers of deportations (not good for workforce supply), it all adds up to inflationary pressure at a time when we’re still trying to get it under control.

Consequently, we may experience interest rate hikes again after a year or two of cuts.

From an investor viewpoint, the key is to have a diversified portfolio that can roll with inflation, including real estate, which for many retirees is their house.

Owning stocks that benefit from inflation and perhaps some gold can also be an excellent way to benefit from inflation instead of being harmed by it. Moving out of cash, which will pay less interest, may also be a good move.

But remember, as I have written previously, who’s in the White House may matter less than you think regarding market performance. The S&P 500 has historically done well under both Republican and Democratic administrations.

That’s because many other factors are at work besides administrative policies, most notably American ingenuity, productivity, and company performance relative to others in the world.

#2—Federal debt and deficit

Neither Biden, Harris, nor Trump have seemed overly concerned about the federal deficit or the federal debt.

In fairness, Trump has promised to reduce federal spending and has proposed numerous tax cuts. I assume he is counting on economic growth to increase tax revenues, which, in combination with reduced spending, would start to whittle away at the deficit.

Space does not permit me to delve into the possible consequences of higher government borrowing and growing deficits, but here are some of them generally:

Increased government borrowing can make it more expensive for businesses and entrepreneurs to invest, a phenomenon often referred to as “crowding out.”

When the government borrows heavily, it issues bonds to finance the deficit. This increases the demand for loanable capital in the financial markets, and higher demand pushes up interest rates.

Higher interest rates increase the cost of borrowing for private entities like businesses and entrepreneurs. This can lead to reduced investment in capital projects, research, and innovation, as the return on investment may no longer justify the higher borrowing costs. Economic growth slows.

Also, more borrowing without commensurate spending cuts may necessitate higher taxes, and Trump wants to reduce tax rates even more.

In a worst-case scenario, the government will run into trouble borrowing, and interest rates will rise dramatically. This may create uncertainty among lenders about the government’s ability to pay back or devalue the dollar to lower its real debt obligations.

Hold fast

Whether you voted for Donald Trump or not, please pray that he succeeds in enacting the promises that resonate with you most.

Still, as Christians, we know that our ultimate hope is not in what a president-elect may or may not do; we hold fast to the hope we have in Christ!

Even amid political and economic storms, we know that the greatest “factor” at work is our Sovereign God, who is in control of everything. But the great hope that is our source of greatest peace and joy is that is ours through faith in Christ:

May the God of hope fill you with all joy and peace in believing, so that by the power of the Holy Spirit you may abound in hope (Rom. 15:13, ESV).

As good stewards, let us wisely manage what he has entrusted us with, even as the political and economic winds swirl around us.