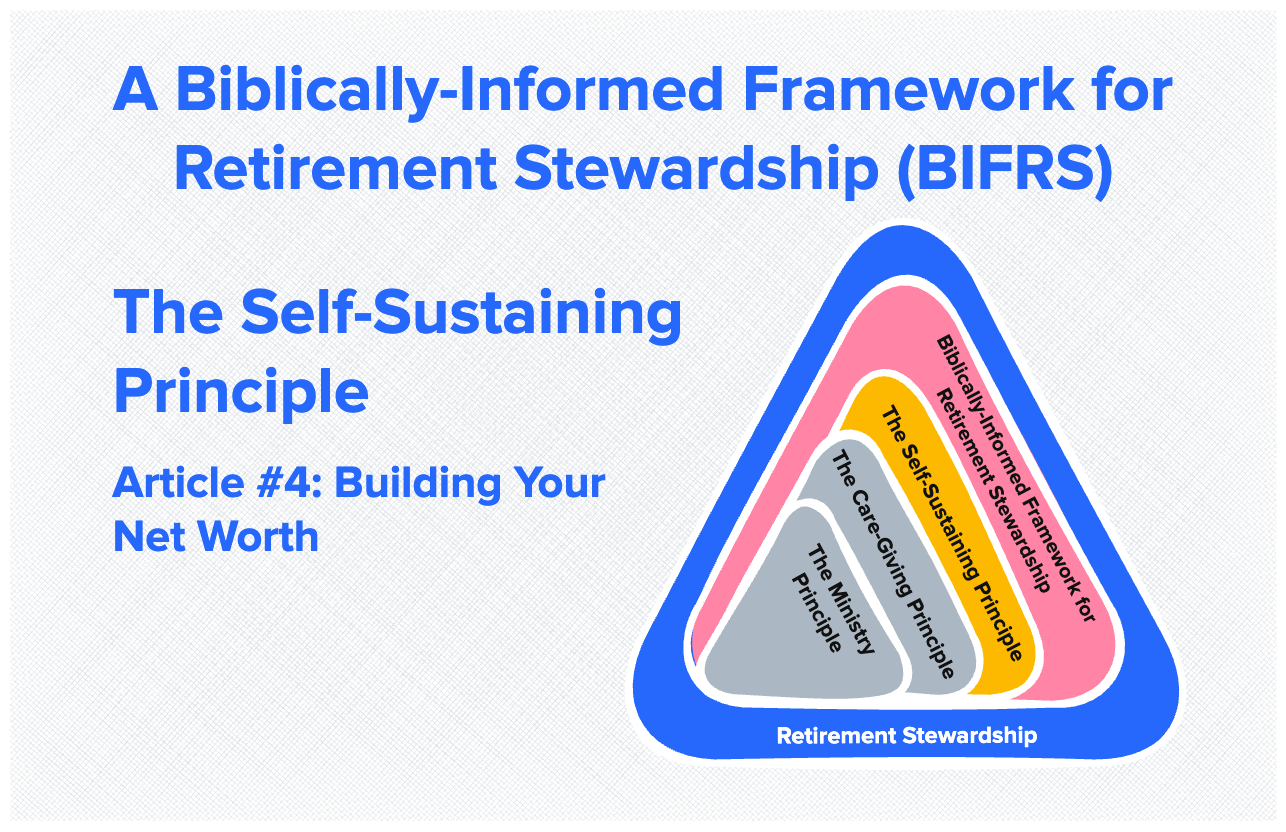

The Sustainability Principle—Article #4: Building Your Net Worth

This article is part of the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series. In the previous article, we explored what net worth means, why it matters for sustainable retirement, and how to calculate and track it. We established that your current wealth forms the foundation for everything else in the Sustainability Principle—you can’t generate sustainable … Read more