You are probably familiar with the Bible story about Joseph. His interpretation of Pharaoh’s dream told of a seven year famine that was about to come upon the whole world.

It also told of a seven year period of abundance and prosperity that would immediately precede the famine. Joseph was given the responsibility to gather grain during this seven year agricultural boom as a savings account against the prophesied seven years of severe famine.

In the end, God used Joseph to not only enrich the house of Pharaoh, but to save his own family as well. The story ends with Joseph reconciled with his brothers and father in Egypt where they prosper and grow to become the nation of Israel.

This story shows us the importance of saving during times of abundance for times of scarcity, which is a wise principle of retirement stewardship. In this guest post from Ray Mulligan, he discusses the importance of saving during the current improving economic climate.

Our saving rate is pretty low

Most adults have less than $1,000 in their savings account, was the headline that captured my attention on the MarketWatch Article published a couple of months ago (full article here). How could that be, I asked myself. Does that really mean that most adults are basically two weeks from running out of money, if they were to lose their income?

If people are not saving, then I guess they must be spending. The saving rate in October 2015 was 5.6% according to the Bureau of Economic Analysis. In an earlier article, Chris discussed what might be an appropriate percentage for you to target in terms of saving for retirement. For most people, that will be between 10% and 20%, depending on your age. Even at the low end of that range, it is twice as much as the average of 5.6%!

A 5.6% rate means that 94.4 cents out of every dollar earned is either being spent, used to pay off debt, or is being contributed to the various tax collection agencies to support the local, state, and national taxing authorities. Spending and debt are the biggest culprits. According to a recent Bloomberg article:

As of 2013, the average debt of middle-class families — those that fall within the middle three-fifths of the population by earnings — amounted to an estimated 122 percent of annual income, according to the Federal Reserve. That’s down a bit from before the 2008 crisis, but still nearly double the level of 1989.

Put another way, the average debt an average middle income family in the U.S. is 1.2 times their annual income. To be fair, this includes mortgage debt, but many middle class families are renters. As the article points out, there is no good way to say what that number should be for each household, but it is clear that for many, especially those for whom the multiple is larger, it is dangerously high.

Another article on CNNMoney cited a 2014 study by the Brookings Institution and further described the spending and saving habits of the American middle-class:

About one-third of American households live “hand-to-mouth,” meaning that they spend all their paychecks. But what surprised the study authors is that 66% of these families are middle class, with a median income of $41,000.

Savings rate versus GDP

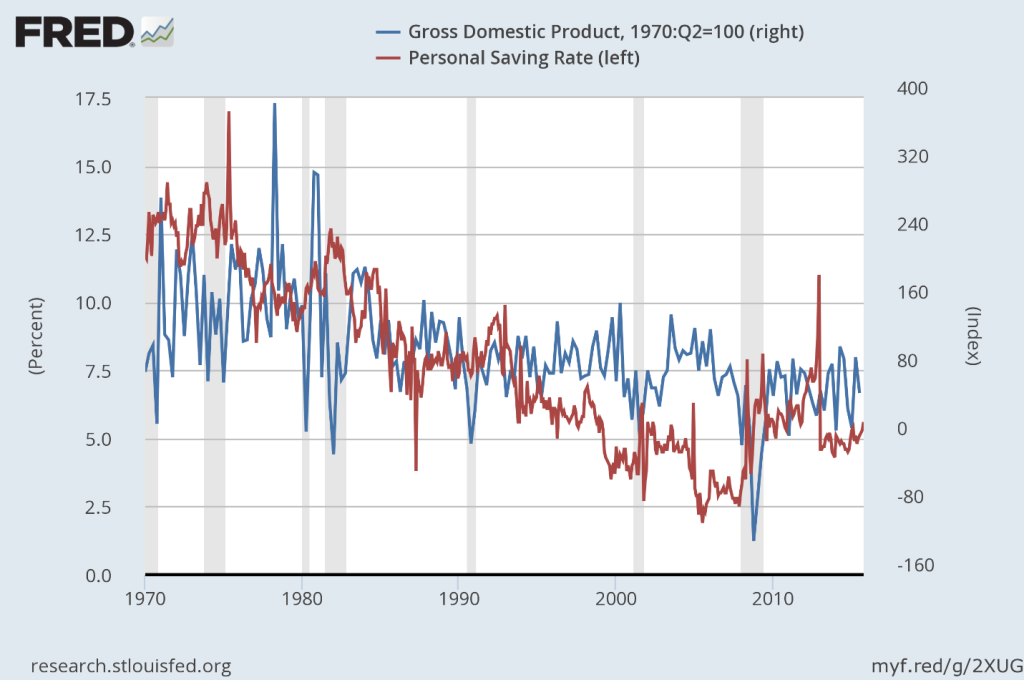

Below is the trend line of the Personal Saving Rate since 1970 versus the GDP. The dark lines on the graph across years represent the years that there was a decline in growth – a recession or a business cycle downturn. Let’s compare the GDP growth during these same years and see if we can observe some historical behavior trends from which we can draw some conclusions, and apply that to how we should be thinking about our own personal savings rate.

One would expect to see the old adage that “you need to make hay while the sun is shining” would be at work here – when there are good times and the economy is growing, the saving rate would go up, as people would be seeing and experiencing growth around them, as there are more jobs and more transactions being completed.

Yes, that means that people are spending money, but it should also mean that there is more money being made as there are more goods and services being produced. It is at these points in the economic cycle that one needs to prepare for the downturn and take advantage of the relative level of prosperity by not doing following the crowd.

Don’t build bigger barns

Remember the parable of the rich fool in Luke chapter 12 who decided to tear down his barns and build bigger ones? Take the opportunity to fill your barn, don’t tear it down to build a bigger one and go into debt doing it.

The time to build barns is when there are people looking for work and commodities are cheap, and because you were wise and saved money when the economy was booming. Not only will you be ready for the next growth cycle, but you now have assets that will be worth more as the economy grows.

The data implies that the exact opposite is taking place, Look at when the saving rates when the GDP is growing; it is almost always declining, until we have a downturn, and then depending on how steep the decline there seems to be a strong desire to save! Seems like more of a panic reaction than a planned one.

Stock the one you have

So, as we are in this sixth year of “recovery” (although some may take issue with that statement), think about what you should be doing in terms of saving while the times are relatively good, so that when you have opportunities in the future, everything will be on sale as there will be fewer buyers and more sellers.

Wealth is not only about gathering quality assets, but getting them at a price where there is a high likelihood that there will always be an opportunity to sell them at a higher price. As famous investor Warren Buffet says: “Be fearful when others are greedy and greedy when others are fearful”. The parallel here is that while other spend and borrow because “times are good” and credit is cheap, make an purposeful decision to save your money now and build wealth, and create a “waiting for a better opportunity” fund.

If you do, you will be glad that you did.

Surplus to share

Saving during times of relative prosperity and abundance has another great benefit: it can help us to serve others who are in need during times of scarcity.

As you have probably observed, times of plenty and times of scarcity tend to come in cycles. Although we have been in a period of increasing abundance (although certainly not a “boom”) it was preceded by a time of severe contraction resulting in scarcity and need. This will most certainly happen again. Economists call these cycles economic “expansion” and ” recession”, and they appear to be inevitable.

During these times of recession, there tends to understandably be more need. Those who have saved during times of abundance (“expansion”) can help those who are hurting, often through no fault of their own, during such times.

Proverbs 22:9 says,

Whoever has a bountiful eye will be blessed, for he shares his bread with the poor. (ESV)

Although the Bible encourages both those with abundance as well as those who lack to be generous (see I Corinthians 8:1-5), the more you have the more you can give and enjoy the spiritual blessings that come from generosity and helping others.