This article, the third in a series, is focused on those in their 40s and 50s. If you’re younger than that, you may want to take a look at the first two installments, what to do if you’re in your 20s and 30s or your 30s and 40s.

The ten or twenty years before retirement is a critical time. These may be your peak earning years, but they can also be a time of much higher expenses. Things like a child’s college expenses and care for aging parents may now be a part of your spending equation.

Many people in this stage of life are becoming more conscious of the need to plan for retirement. Hopefully, as discussed in the last article, you’ve reduced or eliminated your non-mortgage debt and have kept your housing and automobile expenses in check. As your income has risen, you may have increased your giving as well. If that is your goal, a good way to do that is to cap your living expenses once your income reaches a certain level.

Once you’ve got your spending and debts under control and are saving for your future, you need to make sure you’re on track with saving for retirement. There is still time to make some course corrections if necessary. If you wait until you’re in your 60s to find out that you’re way behind, you won’t have much time to catch-up.

I noted in an earlier article that, according to an Employee Benefits Research Institute study, the average 50-year-old has a little over $40,000 saved for retirement. That is an abysmally low amount; it’s not even the equivalent of one year’s salary for many families. The good news is that if you are 50 years old, you may have at least 15 or 20 years before retirement. Even if you have saved very little, you still have a relatively long time to grow your savings.

Determine where you are

Lewis Carrol famously said, “If you don’t know where you are going, any road will get you there.” The main idea, of course, is that you need some idea of a destination, a goal, in planning for retirement. Knowing what you need to do to reach a target also means that you need to know where you’re starting from. Plus you need to monitor your progress along the way.

The Bible, in Luke 14:28 says,“But don’t begin until you count the cost. For who would begin construction of a building without first calculating the cost to see if there is enough money to finish it?” This verse has mainly to do with the cost of discipleship, but as a principle, it also has relevance in this context. If you are saving toward a goal, such as retirement, wouldn’t it be wise to do regular assessments to see if you’re on-track? That way, if you’re not, you can make the necessary course corrections.

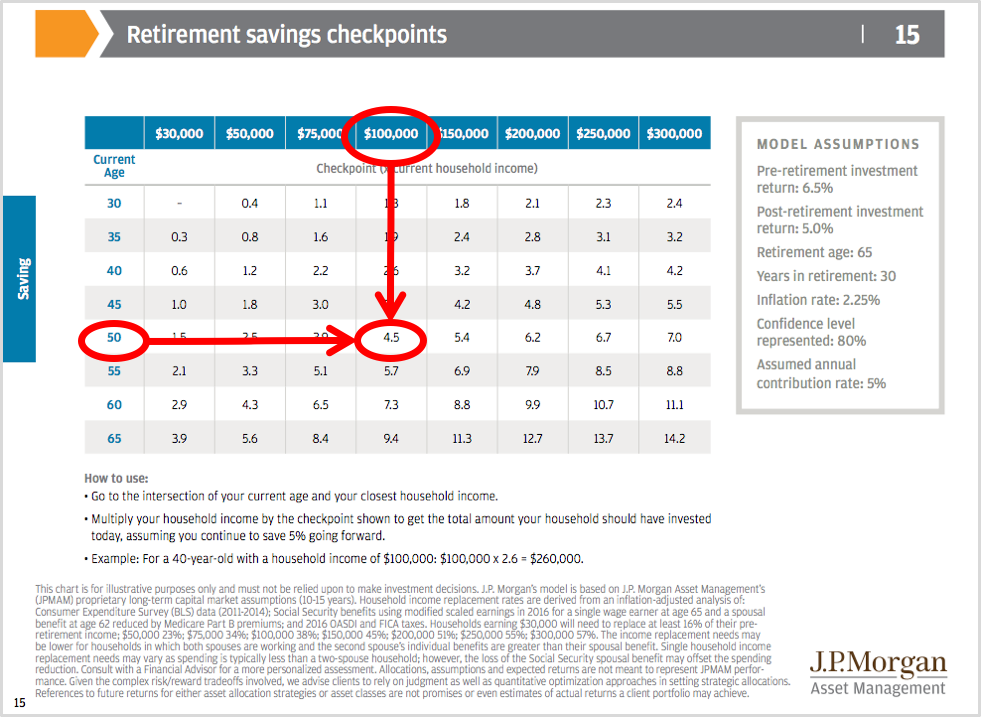

JP Morgan’s (JPM) 2016 Retirement Guide, which I have referenced in the first two articles, has a handy retirement savings checkpoint guide to help you with just that. For example, the chart assumes that someone making $100,000 will need to replace at least 38% of their income at retirement. That amount, when combined with Social Security, would provide approximately 70% of their pre-retirement income.

According to the chart below, a 50-year-old making $100,000 per year should have approximately $450,000 saved for retirement ($100,000 times 4.5). A 45-year-old making $60,000 a year would need approximately $144,000 ($60,000 times 2.4). You can do a quick check based on your current age and income.

This chart makes some assumptions that may or may not apply to you. For example, in addition to the percentages I alluded to above, it assumes a 6.5 percent pre-retirement return and a 5.0 percent post-retirement return. The 6.5 percent return is consistent with what a balanced (60 percent stocks, 40 percent bonds) portfolio would have returned over the last few decades. However, you may or may not be able to achieve a 5 percent return in retirement, depending on how conservatively or aggressively you invest, what happens with the markets, etc.

The assumption of 2.25 percent inflation is also pretty accurate, but it’s possible that it could be higher, which, along with a lackluster stock market and persistently low interest rates, could significantly reduce your returns in retirement.

If you think that Social Security won’t be around when you retire (and it may not be, at least not in its current form), then you will need to increase the multiplier. A simple way to do that would be to double it. You will also have to make adjustments if you think inflation will be much higher than it has historically been.

No matter what, keep in mind that this is not an exact science. We can’t accurately predict what our future needs will be because we don’t know all the factors that will be in place when that time comes. We can only make informed estimates based on the information we do have.

Your expenses are a wild card

As stated earlier, the chart assumes that you will need income of at least 70 percent of whatever you are earning before you retire. That assumes, of course, that your spending has kept up with your income plus inflation, which may not be the case.

Using the JPM approach, someone who is at retirement age (65) with an income of $100,000 would need $70,000 in retirement (70% of $100,000). According to the chart, at age 65 they would need to have $940,000 saved to supply 38% of the $70,000 with the rest coming from Social Security. That is a lot of money! $940,000 at a 4% withdrawal rate would provide an annual income of $37,600. That means they would also need to receive at least $32,400 a year in combined Social Security benefits to total $70,000.

If they have saved significantly less, and have no other sources of income except Social Security, they may need to continue working past age 65 (which many are not able to do) or adjust their spending. Other strategies, such as annuitizing a portion of savings or tapping home equity are outside the scope of what I am discussing here – but they are relevant and therefore are topics for another day.

The reality is that many people will have some flexibility with their spending, especially if they are debt free (including the mortgage) and have no children living at home. Most retired couples in the U.S. can live on somewhere between $3,000/month and about $10,000/ month without a significant change to their overall lifestyle and general well-being.

Most will fall somewhere in the low to middle part of that range. In fact, surveys by the Bureau of Labor Statistics (US Consumer Expenditure Survey) shows that in 2014, total annual expenditures averaged $48,885 among those ages 65 to 74.

Every family is different, so your actual cost of living in retirement will dictate how much income you need, which in turn will determine how much you will need to have saved in addition to what Social Security and a pension may provide. The more you have from “guaranteed” sources such as Social Security, pensions, etc., the less you need in savings.

So, one of the big questions that every retiree will need to answer for themselves is, “how much is enough?” If you aspire to a more luxurious retirement (i.e., lots of travel, dining out, etc.), or want to give a lot away while you’re living, and/or leave a large legacy when you’re gone, you might say that “enough” is on the high end of the range I cited above. If you are very frugal, you can get by with saving much less, especially if you have other sources of income or have retiree health benefits beyond Medicare. If you are fortunate enough to have a pension and Social Security, you may be able to get by with much less than the estimates in the above chart.

Determine what you need to do

Once you get an idea of what you should have saved by now, you can decide what changes you may need to make. If you’re close to the suggested amount, then just keep doing what you’re doing.

If you are far short of the what the table suggests, at least you now have an idea how much catching-up you need to do. You can still hit your retirement age savings target, or get close to it, but you may have to make some difficult choices: seriously “power save,” or delay retirement and work a while longer, or both. If you’re seriously behind, I suggest you read my series on Behind in Saving for Retirement. It may provide you with hope and encouragement, as well as some practical things you can do to catch-up.

As previously noted, if you are a 45-year-old making $60,000/yr. you should have about $144,000 saved. But let’s say you have $80,000 saved toward retirement at age 45 instead of the recommended $144,000. The table also says that you will need approximately $940,000 by the time you reach age 65. Therefore, you will need to have saved an additional $860,000 by that time.

That may seem unachievable, and it certainly won’t be easy. But starting with a balance of $80,000, if you can save at least 10 percent of your gross income per month, get a 50 percent employer match for the first 6 percent, for 20 years earning 6 % annually, you could have $632,572 by age 65. That is somewhat short of $940,000, but still a very respectable sum. If you can increase your saving to 15 percent, you could have $777,187. The point is that the 20 years between age 45 and age 65 is very critical, especially if you are trying to catch-up.

Obviously, to reach the estimated target amount of $940,000, you would have to save much more (over 20 percent). That just won’t be possible for many people. If you come up short, there are things you can do. First, you can take steps to reduce spending significantly in retirement. Another option is to delay retirement until age 68 or later. If you can wait until age 70, all the better. Your Social Security payments (if it’s still around) will also be higher if you don’t claim benefits until age 68 and will be highest at age 70, which would put you in an even better position. You may also have other options, such as part-time work, tapping the equity in your home, or cashing in old life insurance policies.

Most importantly, don’t fear

No matter what, don’t let an apparent shortfall cause you to become fearful or discouraged about your future. Our Heavenly Father has promised to supply all our needs according to his riches and glories in Jesus Christ (Philippians 4:19). Yes, you need to do your part by working hard, saving diligently, and investing wisely. And you will need to watch your spending in the retirement. But even if you know that you may not be able to retire in the best possible position, you need not fear because God has promised to be faithful to those who hope and trust in Him.