Many of you, if you’re retired or nearing retirement, are probably already using strategies like Qualified Charitable Distributions (QCDs), donating appreciated assets, or perhaps Donor Advised Funds (DAFs) as part of your giving strategy.

If so, you may be wondering how the new ”One Big Beautiful Bill Act” (OBBBA) affects your giving—in these ways, or with straight cash—in terms of the tax implications.

Before we get into any specifics, we need to remember that, as Christians, we know that giving isn’t about saving on income taxes. We give because God first gave to us:

For God so loved the world, that he gave his only Son, that whoever believes in him should not perish but have eternal life. For God did not send his Son into the world to condemn the world, but in order that the world might be saved through him. (John 3:16-17, ESV)

We give as an act of worship, from a heart full of love and gratitude, because of God’s unsurpassible gift of his only begotten Son. Therefore, we give cheerfully, for the sheer joy of it, not because we might get a tax deduction.

Each one must give as he has decided in his heart, not reluctantly or under compulsion, for God loves a cheerful giver. (2 Cor. 9:7, ESV).

But if we can reduce your tax bill and increase Kingdom impact, that’s a win-win.

So, no matter what, continue to give generously, but also be wise stewards and take advantage of any tax deductions that are available to you.

What determines your retirement tax rate?

A formula doesn’t set your tax rate; your personal situation shapes it. Here are the major factors:

- How much income do you need? More taxable income = more taxes. Simple, but worth stating.

- Your filing status. Married couples filing jointly enjoy wider brackets; surviving spouses often face higher taxes when switching to single filer status.

- Where do you live? State taxes vary dramatically. Some states have no income tax; others tax Social Security and retirement accounts.

- Which accounts do you draw from? Withdrawals from traditional IRAs/401(k)s are taxable, whereas Roth accounts are tax-free. Additionally, taxable brokerage accounts can be very efficient because long-term capital gains often fall into the 0% bracket.

- Your generosity. If you itemize (the majority of retirees don’t; in fact, 90% of all taxpayers don’t), charitable contributions can reduce taxable income. Better yet, once you turn 70½, Qualified Charitable Distributions (QCDs) from your IRA can keep money completely off your tax return while still counting toward your RMD. This is a HUGE benefit for those who want to be generous in retirement!

- Current tax laws. We’ll look at this more in the next section, but that’s (ostensibly) what the ”OBBBA” was supposed to be all about. However, as with many laws Congress passes these days, it was full of other things.

- Your effective tax rate. This is determined by many of the factors above, but the key is that your effective rate (the average tax you pay) will almost always be lower than your marginal rate (how much tax you pay on the next dollar of income you receive). The more income you have at your marginal rate, the higher your effective rate will be. You’ll be surprised by the effective rate in a couple of examples later in this article.

What’s Changed Under OBBBA?

The OBBBA, passed this summer, made several changes to the tax code that impact charitable giving. I touched on these and other changes in an earlier article, but they bear repeating and expanding on here.

The standard deduction increased and was made permanent

The increased Standard Deduction implemented in the 2017 Tax Bill has been made permanent and also increased again. In 2025, the Standard Deductions are $31,500 for Married taxpayers and $15,750 for Singles. Single taxpayers 65 years and older receive an additional standard deduction of $2,000. Married taxpayers receive $1,600 each if both spouses are over 65, for a total of $34,700 (=$31,500 + (2 * $1,600)).

New “bonus” deduction for seniors

The bill also implemented a temporary bonus deduction for taxpayers 65 years and older, effective only for tax years 2025 – 2028 (emphasis on temporary; this provision is instead of the ”no tax on Social Security” that Trump promised). It actually functions more like a personal exemption than a deduction. Each person can claim an exemption of $6,000 per person per year in addition to the standard deduction.

This provision has a 6% phaseout of the exemption that begins for married taxpayers with an Adjusted Gross Income (AGI) of $150,000 and Single taxpayers with an AGI exceeding $75,000. The exemption is in addition to the Standard Deduction or Itemized Deductions and can be claimed by itemizers and non-itemizers who qualify. The Bill also permanently eliminates exemptions for taxpayers and dependents under 65 years of age.

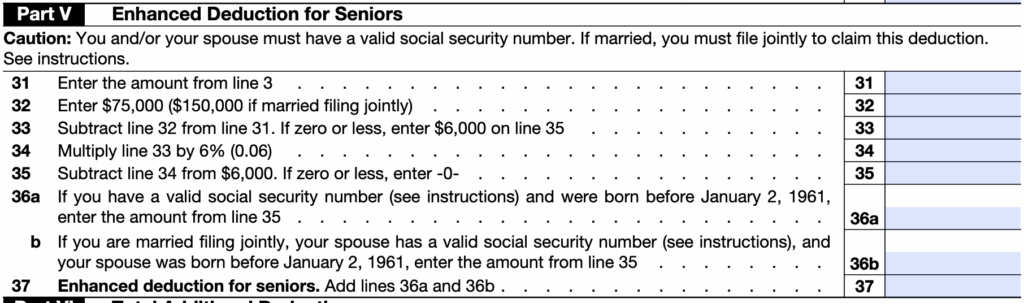

The IRS has released Schedule 1-A, which includes all the new tax deductions enacted by the OBBBA. Here’s the section for the “bonus” deduction for seniors:

As you can see, if you’re 65 or over and married filing jointly, you can receive a $6,000 deduction if Line 3 is below $150,000. If it’s over the threshold, it will be reduced by 6%. If your spouse is also 65 or older, they will receive the same amount.

Combined deductions are significant

Considering the two provisions above, a married couple who qualify would have a total deduction of $46,700 (= $31,500 + $1,600 + $1,600 + $6,000 + $6,000), which will be a significant percentage of their Adjusted Gross Income (AGI).

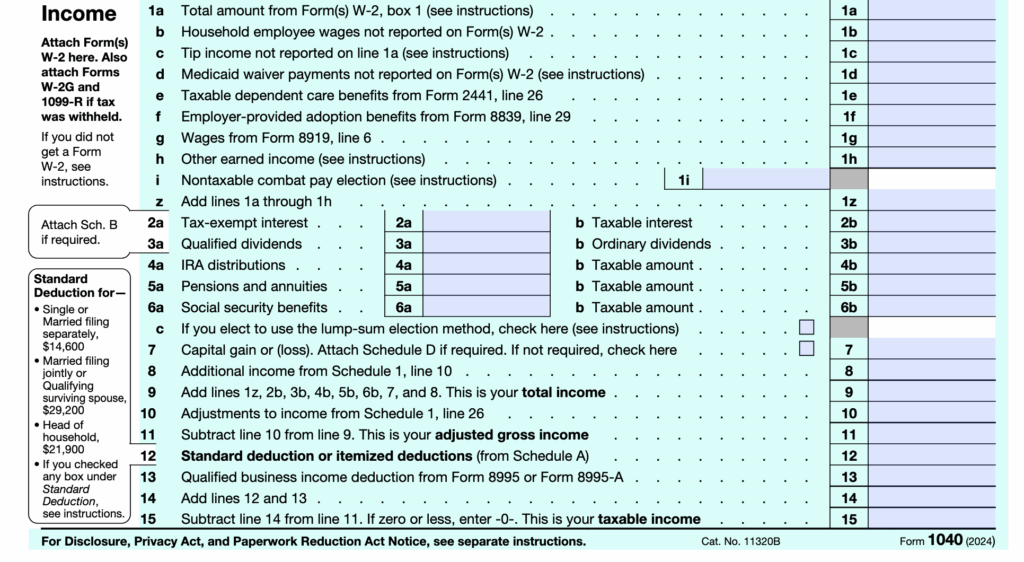

All of these deductions are summarized and entered on Line 13b of your Form 1040:

The implications of this are apparent. Many of us had already transitioned from itemizing to taking the standard deduction after the standard deduction was increased by the Tax Act of 2017. This significant increase in the deduction will further reduce taxable income, particularly for retirees whose income sources are from Social Security, IRAs, or pensions. It may indirectly lower or eliminate the tax on Social Security, and for some, possibly reduce IRMAA or other income-based phase-outs.

Because of the phase-out provision, higher-income retirees who are close to the phase-out limits may want to monitor their plan withdrawals and other income to try to stay under the thresholds where possible. Some may want to consider Roth conversions to help with that.

The implications of this for those who give generously are clear: They would have to give higher amounts, or have other large itemized deductions, to make itemizing worthwhile, but they can still enjoy the benefits of the higher deduction.

Increased SALT deduction

The OBBBA increased the State and Local Tax deduction (a/k/a “SALT”) cap to $40,000 from $10,000 for tax years 2025–2029, making an additional $30,000 deductible if you itemize. However, it phases out once Modified Adjusted Gross Income (MAGI) reaches $500,000. This provision will likely revert to $10,000 after 2029 unless Congress takes action.

This could be particularly helpful if you own a home in a high property tax state or have state income taxes. It could make itemizing worthwhile again for some retirees who previously always took the standard deduction because of the low SALT cap.

If you itemize, re-run your numbers: compare itemizing vs standard deduction under the new SALT limit. Think about bunching property tax payments (or other deductible state/local taxes) in years when itemizing pays off.

Charitable deduction enhancements for non-itemizers

Starting in 2026, non-itemizers will be able to deduct more of their cash donations to qualified charities. The limit will be larger (e.g. $1,000 for single filers and $2,000 for married filing jointly).

This gives a benefit even to those who don’t itemize. In past years, many retirees took the standard deduction because their itemized deductions (tax, property, mortgage interest, contributions) didn’t exceed it. This change gives an incentive for even small charitable giving. It can also affect how you structure your giving (lump it or spread it) and whether you prefer giving via QCDs or direct cash gifts.

For non-itemizers, consider planning your giving earlier, knowing these new allowances will be available. Compare whether giving via QCDs (if you’re old enough) or direct giving will yield better tax efficiency. Also consider the timing of gifts around the changeover in 2026.

Many assume that this new charitable deduction will be reported on Schedule 1 (not Schedule 1-A) of Form 1040, starting in the 2026 tax year; however, this hasn’t been finalized by the IRS. This deduction is separate from itemized deductions and is intended for cash donations made directly to qualifying charities.

QCDs (Qualified Charitable Distributions) were preserved

Once you turn 70½, you can make gifts directly from your IRA (up to $108,000 in 2025). These QCDs count toward your Required Minimum Distributions (RMDs) but don’t show up as taxable income.

That’s a double blessing: You can support ministries and charities you care about while lowering your tax bill, even if you don’t itemize your deductions. I’ve written extensively about QCDs, and the good news here is that the OBBBA didn’t change them at all. They are even more attractive since higher standard deductions mean more people will not itemize.

The AGI limit was increased

Starting in 2026, itemizers will only be able to deduct charitable contributions that exceed 0.5% of their AGI. Example: If your AGI is $80,000, 0.5% = $400. That means your charitable deductions must be above $400 to matter. The first $400 is “floor” (i.e., no tax benefit).

For smaller donors or those who give relatively modest amounts over time, this floor may reduce how much of their giving can be deducted. It encourages either giving more in big chunks or combining (bunching) donations in years when you itemize.

Permanent 60% AGI limit on cash gifts to public charities

Under prior law (TCJA), cash gifts to public charities had been increased temporarily to a 60% of AGI limit (instead of 50%). OBBBA makes the 60% ceiling permanent. Good news: If you want to give large cash gifts, the higher ceiling remains in place and won’t revert in 2026.

Also, carry-forward for excess gifts is still allowed: If you donate more than allowed in a year (over AGI limits), the excess may be carried forward (for up to 5 years) under the usual rules. Limits for non-cash gifts, appreciated property: The usual rules (e.g., 30% of AGI for certain non-cash gifts) remain relevant.**

Examples

Now that we’ve reviewed the changes, here are two examples to show you how they might play out in ”real life.”

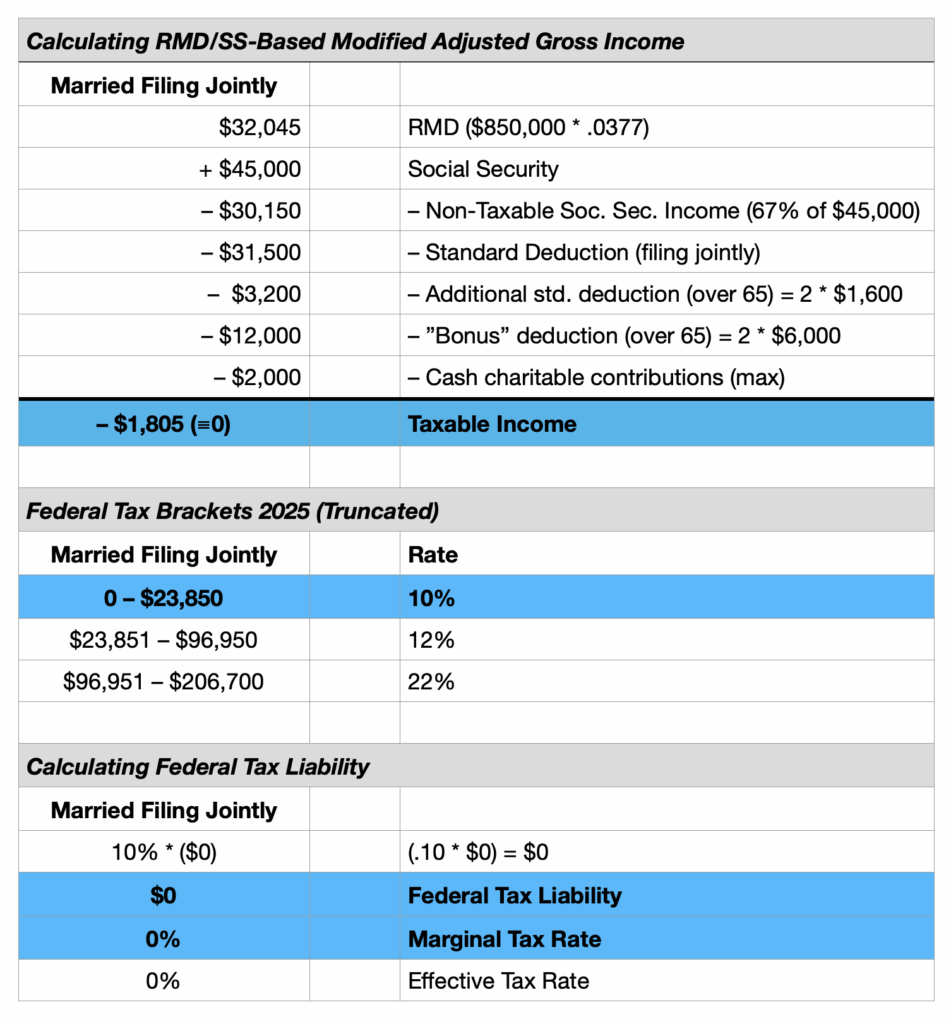

The first is a middle-income earner ($77,045) couple over age 65 who take the standard deduction, including the new “bonus” deduction, and make the maximum charitable contribution, but do not take QCDs:

Note that this couple will pay zero in Federal Income Tax as their taxable income is negative. (The IRA considers a negative taxable income to be equivalent to zero. Also, that amount can’t be carried forward as a negative to next year’s return.)

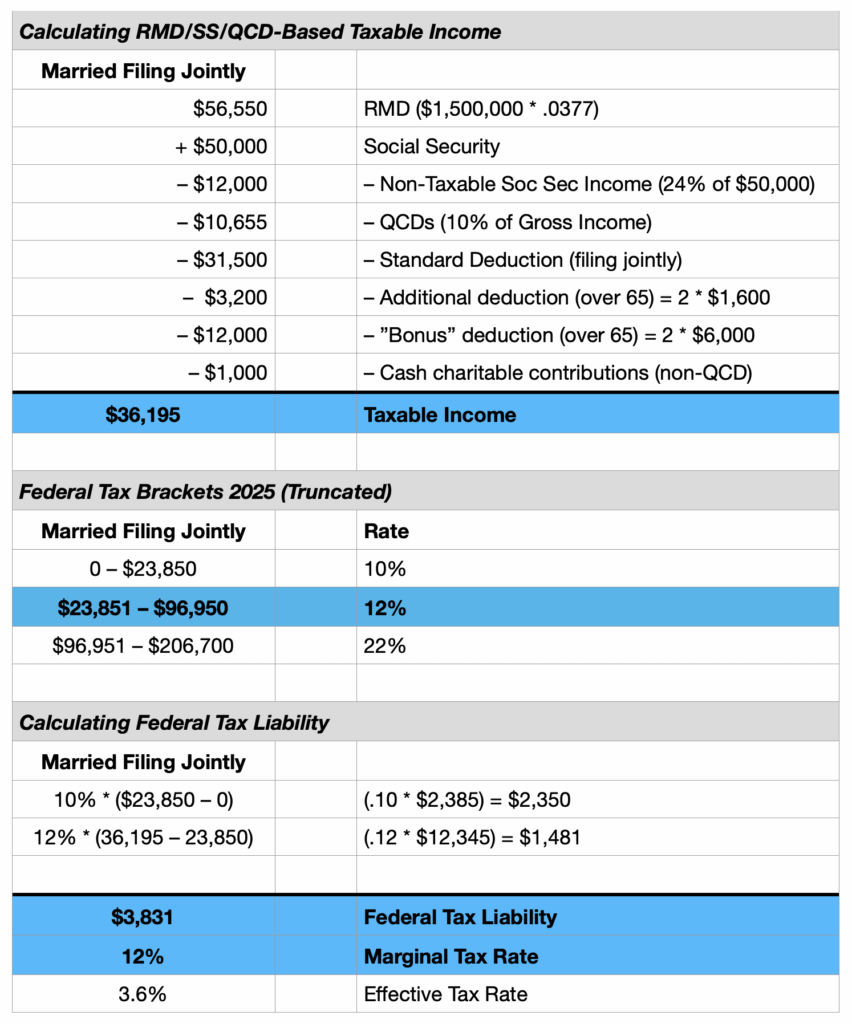

The following example is a higher-income couple ($106,550 gross) over age 65 who take the standard deduction, a $1,000 “out of pocket” charitable deduction, and also take QCDs:

The key number to look at is their ”effective” (average) tax rate, which is only 3.6% (= $3,831 ÷ $106,550). That’s a very low tax considering the gross income of over $100K. This shows the significant impact these additional deductions have.

Implications & practical strategies

Here are some ways you might use these changes to maximize their impact:

Consider “bunching”

Because of the 0.5% floor and higher standard deduction, making large gifts in certain years (or using a donor-advised fund) can make itemizing worthwhile vs taking the standard deduction. Bunch several years of giving into one year to cross the floor threshold.

Year-end giving matters

As 2025 is before many of the new rules entirely apply, there’s an opportunity to do some giving in 2025 to avoid losing deductions to the floor. If you typically spread giving, consider larger gifts before year-end.

For high-income itemizers, realize that deductions carry slightly less weight

With the cap on benefits for top bracket individuals (the “37% → 35%” limit), each dollar of itemized deduction yields slightly less tax savings. That may change whether a significant charitable gift is “worth it” for tax purposes vs other methods (e.g., QCDs, legacy giving, or timing gifts).

Make use of the permanent 60% AGI rule

If you plan large cash gifts to public charities, knowing the 60% AGI ceiling stays allows more flexibility. You can plan around it, knowing it’s not a temporary perk that will go away.

Donate appreciated assets

Appreciated asset donations remain powerful tools to eliminate capital gains while supporting the causes you care about. If you’re holding appreciated investments in a taxable brokerage account, donating them instead of selling them first is often more efficient. You avoid capital gains taxes and may get a deduction for the full fair market value if you itemize.

Donor-advised funds (DAF)

Several of these tax-friendly giving strategies are better than a regular cash donation. If you’re retired and give consistently every year — say, $10,000 to $20,000 — but your total deductions still don’t exceed the standard deduction, you might be missing out on the benefit of itemizing. That’s why the “bunching” strategy can be helpful. But what if you have a windfall or a large income and want to spread out the actual distribution of those gifts over time? That’s where donor-advised funds (DAFs) come in.

With a DAF, you can make a large, deductible contribution in one year — using appreciated stock or cash — and then recommend grants to charities in subsequent years. The IRS treats the entire contribution to the DAF as a completed charitable gift in the year it’s made, even though the money hasn’t yet been distributed to final recipients.

So, if you make a $100,000 donation in a year when your AGI is $100,000, but the IRS limits your deduction to $60,000, the remaining $40,000 can be used to offset income over the next five years. This makes “giving big” in one year more manageable over time.

Stewardship with eternal impact

The tax aspects can be interesting (to some) and beneficial to most, but generosity is ultimately a heart matter. The apostle Paul wrote, “Command those who are rich in this present world…to be generous and willing to share. In this way, they will lay up treasure for themselves…so that they may take hold of the life that is truly life” (1 Tim. 6:17–19, ESV).

Sure, tools like deductions, QCDs, DAFs, and bunching can help you steward God’s resources well, but they are not the goal. The goal is faithfulness in joyfully, sacrificially, and wisely stewarding whatever resources God has given you for His glory and the good of others.

The OBBBA has changed some of the mechanics, so take the time to understand the new laws. Then, pray, plan, and ask God how to align your giving strategies with your values and eternal priorities. Then give in a way that reflects the grace you’ve received. Whether you give through a checkbook, an IRA, a QCD, or a donor-advised fund, your stewardship has eternal consequences.