In my last article, I looked at Bitcoin’s potential as a long-term investment in a retirement portfolio. This time, I want to explore a related question: Could Bitcoin serve as a hedge against a future financial crisis brought on by our nation’s growing federal debt?

I don’t like to sound alarmist—and I’m not a doomsayer—but we (and by “we” I mean the public and the federal government) need to face the financial realities we’re living in. And the economic “elephant in the room” is the increasing US federal debt.

Scripture commends lending (Deut. 15:7–8), but it also warns about the dangers of borrowing: “The borrower is the slave of the lender” (Prov. 22:7). The Bible doesn’t call debt evil, but it does call it risky, and that applies to individuals and nations alike.

The state of America’s debt

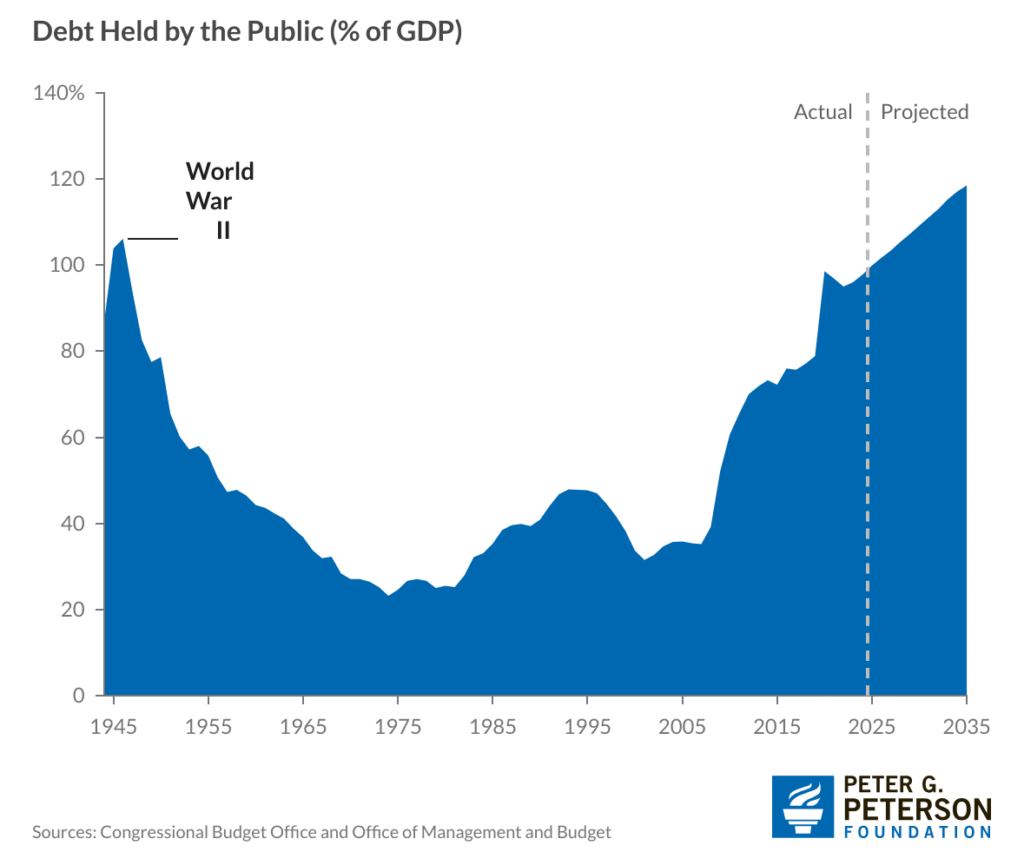

Our nation’s debt has reached historic levels. According to the Federal Reserve Bank of St. Louis and the Office of Management and Budget, total U.S. debt is now roughly 124% of our entire economy (GDP). (See the FRED chart below.)

Even before the pandemic, it was already high. Still, the COVID response—massive government spending and stimulus—and subsequent major spending bills, as well as more recent tax breaks, have further increased it. While seniors have benefited from some tax breaks, these measures have contributed to the growing debt burden.

Debt held by the public (that’s money the government owes to investors, not itself) now equals about 99% of GDP, meaning it’s nearly the size of the whole U.S. economy. The Congressional Budget Office (CBO) projects that it will exceed 100% by 2026, reach 122% by 2034, and could hit 172% by 2054—far above the previous record of 106% during World War II.

In dollar terms, publicly held debt is around $30.6 trillion, and total national debt is approximately $38.1 trillion as of November 2025. The CBO expects publicly held debt to reach $48 trillion by 2034, with annual budget deficits climbing from $1.9 trillion to $2.8 trillion over the next decade.

Those are numbers we can hardly get our heads around, but they matter because they impact everything from interest rates to inflation to retirement savings.

Globally, it’s not much better. The International Monetary Fund (IMF) warns that worldwide public debt will exceed 100% of global GDP by 2029, the highest since the 1940s.

Economists at the American Enterprise Institute (AEI)—my “go to” think tank for these kinds of things, by the way—call the U.S. fiscal situation “unsustainable.” And they’re not the only ones.

Even before recent spending bills and tax cuts, the U.S. deficit was about 6.5% of GDP, and it’s expected to keep growing indefinitely. AEI points out warning signs of fiscal uncertainty that are plain to see: Long-term Treasury yields rose substantially in late 2024, and gold prices reached record highs above $2,790 per ounce. While these assets don’t typically move together, their concurrent movement in 2024 reflected unusual market conditions in which geopolitical concerns and fiscal uncertainty were driving investment decisions.

Treasury yields and gold prices (and perhaps Bitcoin) can be indicators of whether investors are concerned about Washington’s ability to manage its debt without resorting to inflation. The recent behavior of these markets suggests heightened uncertainty about fiscal policy.

What a debt crisis could look like

A sovereign debt crisis occurs when investors doubt a government’s ability to repay its debts. That leads to higher borrowing costs, first for the government, then for everyone else. Businesses and households pay more for loans, slowing the economy and pushing it toward a deeper recession.

The U.S. likely wouldn’t “default” in the traditional sense since it can always print more dollars—what Bitcoiners call “fiat currency” or money “ex nihilil.” But that’s not a “go home free” card; it would fuel inflation, weaken the dollar, and reduce the value of retirees’ savings. In fact, the government has done this many times before.

But unlike they did during and just after the 2008 crisis, investors might not rush to buy U.S. Treasury bonds for safety. Instead, they might pull back from government debt altogether, worsening the downturn. Recovering from that would require painful choices, such as higher taxes, reduced spending, or both. Unfortunately, those choices often come only after a crisis forces them.

And the impact on retirees could be severe: falling investment portfolios, shrinking Social Security trust funds, rising inflation, and reduced purchasing power for those living on fixed incomes.

The dangers of “printing money”

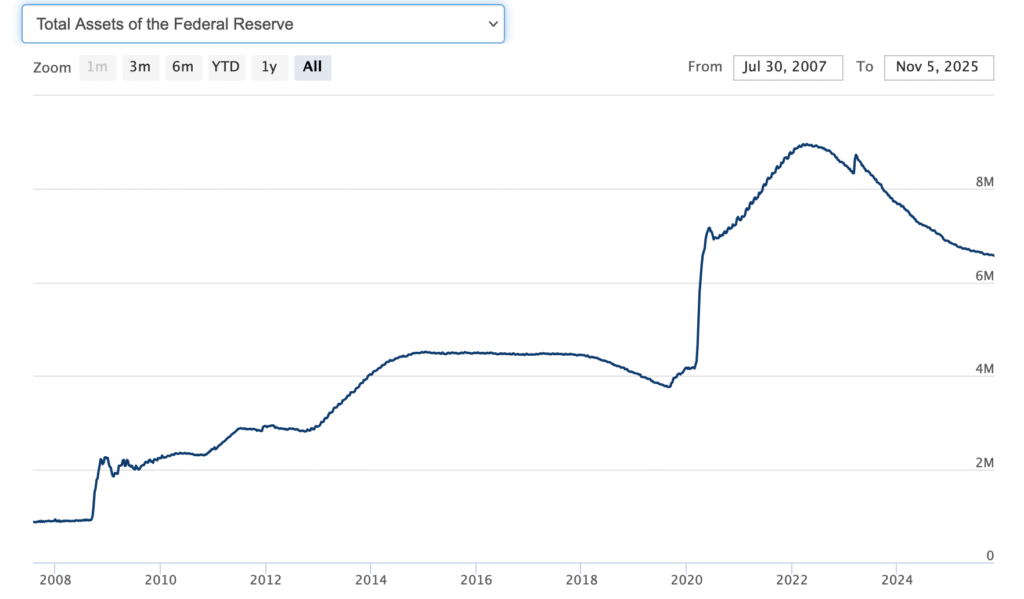

Bitcoin’s supply is fixed by design, but the U.S. government faces no such limit; it can expand the money supply whenever it needs to finance spending. Economists call this “quantitative easing” (QE), which is just the Fed’s fancy way of saying it’s creating new money digitally to buy government bonds and other assets in hopes of keeping the economy (and the stock market) afloat. It sounds sophisticated, but it’s really just money printing in a modern, electronic form.

Since 2008, the Federal Reserve has expanded its balance sheet by multiple trillions of dollars through large-scale purchases of Treasuries and mortgage-backed securities. For example, it grew about $4.6 trillion from March 2020 to March 2022. Meanwhile, the U.S. M2 money supply increased by nearly 40 percent between the end of 2019 and the end of 2021.

The problem with that is that creating money doesn’t create real value; it simply dilutes the dollars already in circulation. The result is the “invisible tax” of inflation: rising prices and falling purchasing power. When there’s no external restraint (like the gold standard once provided), governments can spend without real limits.

For Christians, that’s not just an economic issue—it’s an ethical one. Many would argue, as would I, that reckless borrowing and spending by the U.S. government violates the biblical principles of wise stewardship, prudence, and intergenerational responsibility because it forces future generations to pay for today’s excesses.

The Bible frequently condemns dishonest weights and measures, which today can be considered a metaphor for economic injustice and manipulation. Proverbs 11:1 says, “A false balance is an abomination to the Lord, but a just weight is his delight” (ESV). In the ancient world, tampering with weights was a way to cheat others in trade.

Today, when governments devalue money through excessive borrowing or inflation, it’s a modern form of the same deceit. The result is a quiet transfer of wealth from savers to spenders, from the prudent to the not-so-much-so. God delights in honesty and fairness, and that applies as much to national economic policy as it does to personal finance.

Scripture consistently calls God’s people to manage resources wisely and avoid the bondage of debt. Prov. 22:7 reminds us that “the borrower is the slave of the lender,” and Romans 13:8 urges believers to “owe no one anything, except to love each other.” While there is ongoing discussion among Christian scholars about whether these passages apply to government debt in the same way as personal debt, they nevertheless reveal God’s concern for integrity, restraint, and fairness in every area of economic life.

When nations ignore those principles, they risk not only financial instability but also moral compromise, shifting the burden of today’s indulgence onto tomorrow’s taxpayers and retirees.

Is Bitcoin part of the solution?

Some, like Christian Bitcoin authority and author Jimmy Song (Thank God for Bitcoin: The Creation, Corruption, and Redemption of Money), argue that Bitcoin could one day serve as a replacement or reserve currency because it’s immune to “money printing.” There will only ever be 21 million bitcoins, and neither politicians nor central bankers can manipulate its supply.

While I share many of Song’s concerns about U.S. fiscal policy, I’m not convinced Bitcoin is a perfect solution. It still faces volatility, regulatory uncertainty, and limited adoption. Bitcoin has existed only since 2009 and hasn’t been tested during a major sovereign debt crisis. It’s also worth noting that Bitcoin has experienced drawdowns of 70% or more on multiple occasions, and during the March 2020 crisis, it initially fell sharply alongside other assets. Still, the situation could change in the future as the technology matures and adoption increases.

The American Enterprise Institute (AEI), which is full of brilliant people, also takes a cautious view. It acknowledges Bitcoin’s innovation but doubts that it’s ready to serve as a stable monetary foundation for the U.S. economy.

Instead, AEI emphasizes that dollar-backed stablecoins and a possible digital-dollar framework offer significant promise by modernizing the existing U.S. monetary system, but doing so as an evolution rather than a revolution.

In contrast, Bitcoin is a decentralized alternative that isn’t tied to any central authority or the dollar and is governed by sophisticated computer code and math rather than policy.

For Christians, that distinction matters. Stablecoins may make payments easier, but because they remain denominated in dollars, they don’t protect against dollar inflation or fix the moral problems of overspending. Bitcoin, while imperfect, points toward a system that values honesty, accountability, and restraint—virtues that seem to align with biblical stewardship.

Is Bitcoin a good hedge in an uncertain future?

Although Bitcoin is unlikely to replace the dollar anytime soon, it may serve as a “hedge.” It could be a way to protect part of your savings against inflation, debt crises, and fiscal mismanagement. Just as gold has long been a store of value during uncertain times, digital assets like Bitcoin are emerging as a modern counterpart.

I’m not suggesting you go “all in” with Bitcoin or any cryptocurrency. But for retirees or near-retirees, it may be wise to diversify some with it, perhaps by holding traditional assets like stocks and bonds for income and stability while allocating a small portion to assets that aren’t tied to political or Federal Reserve policies.

Most advisors would recommend holding no more than 5% of your assets in Bitcoin, similar to the allocation you might make to gold (though you may not want to do both). I think 1-3% is a reasonable amount if you decide to do it.

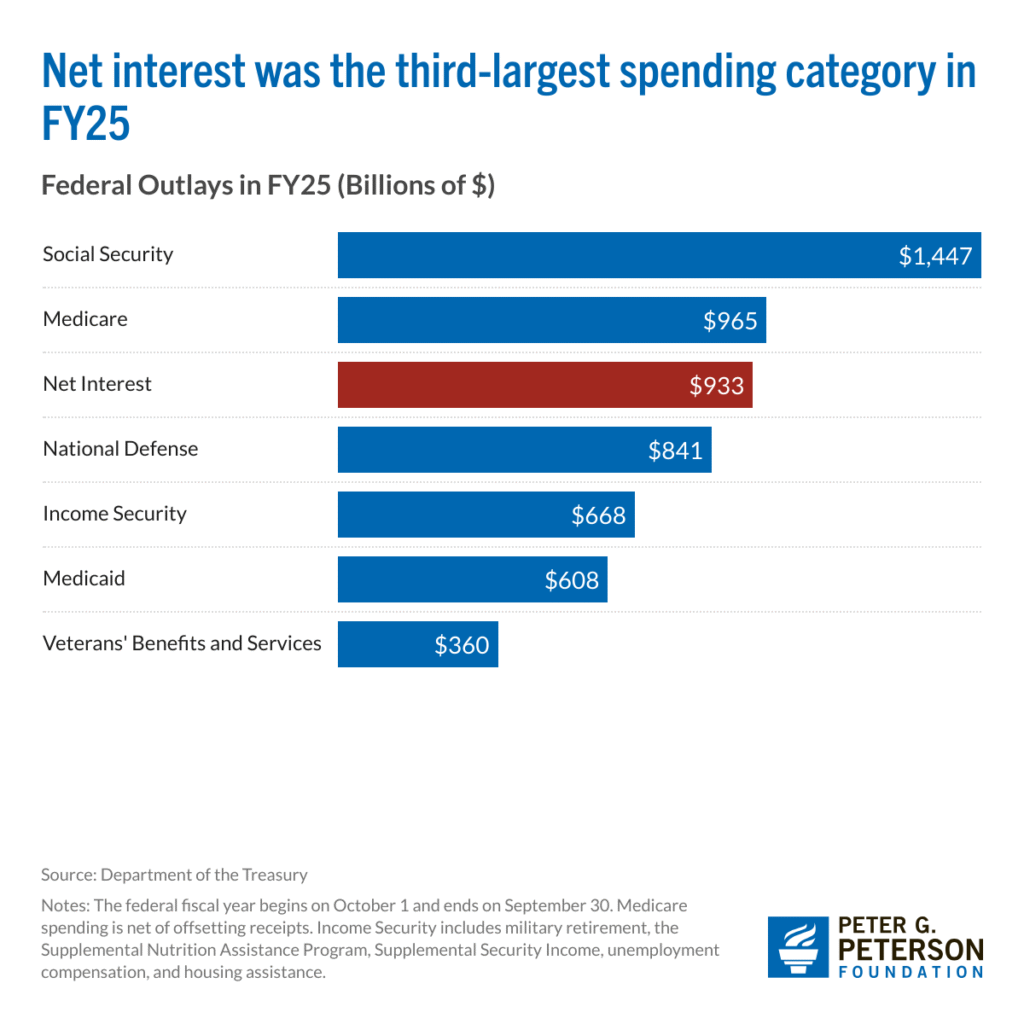

It’s worth noting that interest on the federal debt has already become a major expense. In fiscal year 2024, interest on debt held by the public was $909 billion—an 83% increase from just two years earlier. This growing burden further underscores the fiscal challenges ahead and the importance of considering how to protect retirement savings.

It’s challenging to purchase Bitcoin directly, but it’s become easier with the introduction of Bitcoin funds (ETFs). Bitcoin ETFs are investment funds that allow investors to gain exposure to Bitcoin without directly owning the cryptocurrency. They can track the price of Bitcoin futures or the spot price of Bitcoin, enabling investment in Bitcoin through traditional stock exchanges.

A couple of examples are the iShares Bitcoin Trust (IBIT), managed by BlackRock, which offers direct exposure to Bitcoin, and the Fidelity Advantage Bitcoin ETF (FBTC), another option for investors seeking direct Bitcoin exposure.

Discerning the times

History shows that unsustainable debt always leads to difficult adjustments. Wise stewards prepare for that reality; they “discern the times”:

And in the morning, “It will be stormy today, for the sky is red and threatening.” You know how to interpret the appearance of the sky, but you cannot interpret the signs of the times” (Matt. 16:3, ESV).

Even though the Congress as a whole seems mostly unconcerned about the rising federal debt (though many individual legislators are), that doesn’t mean we shouldn’t be. It poses a significant threat, but it’s unclear at what point it will reach a size that forces Congress to act—150% or 200% of GDP?

At some point, it could cost more to pay the interest on the federal debt than it does to run the entire government (it’s already the third-largest spending category for the federal government):

Clearly, despite record debt levels, it’s not high enough yet, so let’s hope and pray that they don’t wait until it’s too late.

When they do act, it will cause some pain. The critical political question is always this: which demographic will feel the pain the most? Cutting entitlements, which many say will absolutely be necessary, cuts across a broad swath of the population, including retirees.

There is no easy solution to this problem. Bitcoin may be a help depending on what happens, but there’s no way to know for sure. Whether or not you ever buy Bitcoin, it’s worth understanding why it exists: as a response to the failures of our financial system. But nothing, including Bitcoin, offers true security; that can only be found by trusting in our Heavenly Father. Yes, we do what we can, but ultimately our future is in His loving hands.

“And my God will supply every need of yours according to his riches in glory in Christ Jesus” (Phil. 4:19, ESV).