This is the first article in the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series.

Over the past almost ten years of writing on this blog, I’ve tried to communicate retirement planning in a way that honors both the practical realities we face and the biblical purposes God has for this season of life.

The overarching biblical principle I’ve used to build out the content and balance that tension as best I could is “stewardship.”

What is Retirement Stewardship? concisely explains the concept of retirement stewardship and how I developed and applied it in this blog.

Retirement Stewardship Pillars defines fifteen foundational pillars of biblical retirement stewardship: holistic life management, proactive early planning, challenging decisions, continued service and work, balanced leisure, provision for basic needs, financial planning, conservative estimates, health prioritization, minimizing government dependency, avoiding burdening others, generous giving from surplus, and eternal perspective. Summarized as: save diligently, invest wisely, give generously, live abundantly.

Finding Balance in Retirement Stewardship examines how to navigate seven key tensions using biblical wisdom rather than cultural norms. These include work/life balance (avoiding both laziness and workaholism), saving/giving balance (planning wisely while being “rich toward God”), debt management (avoiding slavery to lenders), trusting God while working diligently, redefining retirement (rest without abdication of service), pursuing passions within God’s glory, and accepting aging gracefully while remaining fruitful. The article cautions that not everything requires a middle ground—sometimes biblical teaching leans toward one extreme. Proper balance arises from Christ-centered living, in which loving God supremely aligns all other areas through grace.

In the broader context of retirement stewardship, financial frameworks and methodologies are invaluable, if not essential. As are calculations, whether done manually or with a computer.

We need to understand income sources, withdrawal strategies, tax implications, and expense management.

Most retirement planning books and blogs focus heavily on the mechanics and help us answer tough questions like: Will I have enough? How long will it last? What’s my safe withdrawal rate?

These are legitimate questions. I’ve written extensively about them, and I’ll continue to do so. But they’re not the only questions, and probably not the most important ones either.

There’s More to Retirement Stewardship Than Getting the Numbers Right explores multiple areas of concern in retirement beyond the strictly financial ones.

After publishing a comprehensive series on taxes and retirement in late 2025, I stepped back to evaluate my entire body of work over the last almost ten years. I realized that while category labels help organize content, they don’t show readers how the pieces connect. What was missing was a framework demonstrating how individual articles published over nearly a decade complement one another to provide a comprehensive understanding of biblical retirement stewardship.

This insight sparked a fairly ambitious project: systematically updating older articles with current 2025-2026 data while restructuring the site around a simple set of biblical principles that integrate purpose with practice, showing not just what to do but why it matters.

The catalyst came from an unexpected source. Last year, I came across a podcast interview in which John Piper discussed retirement planning (he answered a listener’s question). His response resonated deeply with me and the work I’d already done, so I wrote an article about it: John Piper’s Framework for a Biblically Informed Retirement. Piper articulates three biblical principles to guide Christian retirement planning, transforming retirement from a primarily leisure pursuit into purposeful stewardship.

As I reflected on the positive response to my 2025 Year-End: Wrapping Up My Retirement Tax Planning Journey article—which many of you found helpful—I realized Piper’s framework offered exactly what I’d been looking for: a biblically grounded structure for organizing all my content. His three principles provide the organizing lens through which every financial topic can be understood as an expression of faithful biblical stewardship.

You can reread the Piper article, but to refresh your memory, here are the three biblical principles that Piper suggested should guide how Christians approach their later years:

The Self-Sustaining Principle (2 Thessalonians 3:7-12, 1 Thessalonians 4:11-12): Live quietly, work diligently, and plan wisely so you don’t burden others.

The Caregiving Principle (1 Timothy 5:8, 16): Prepare to both give and receive care, recognizing the biblical order of family, church, and society.

The Ministry Principle (Psalm 92:14): Retirement isn’t withdrawal from purpose—it’s new opportunities to serve and bear fruit in old age.

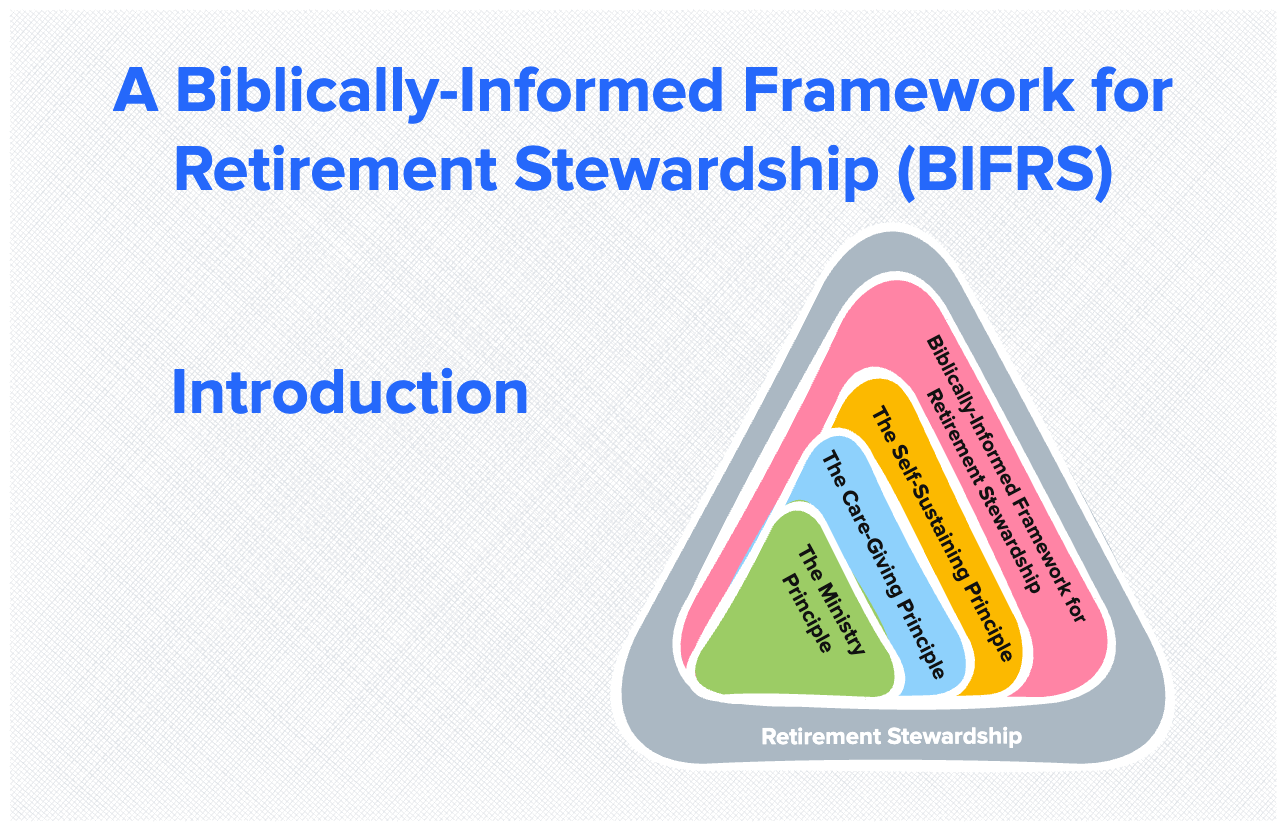

As I’ve reflected on these three principles, I realized they provide precisely the framework I was looking for—one that seamlessly integrates the financial realities of retirement with the biblical purposes that should shape this season of life we call “retirement.” I’m calling it the “Biblically-Informed Framework for Retirement Stewardship” (BIFRS).

The 3 principles of the BIFRS

This will be a little repetitive with the original Piper article, but let me explain each principle and why it matters:

Principle 1: The self-sustaining principle

Piper draws from Paul’s letters to the Thessalonians:

You yourselves know how you ought to imitate us, because we were not idle when we were with you, nor did we eat anyone’s bread without paying for it, but with toil and labor we worked night and day, that we might not be a burden to any of you. (2 Thessalonians 3:7–8)

Aspire to live quietly, and to mind your own affairs, and to work with your hands… so that you may walk properly before outsiders and be dependent on no one. (1 Thessalonians 4:11–12)

Piper described this principle this way:

The principle is that, insofar as we are able, we should earn our own living, pay our own way. And I think that applies from the day we start earning to the day we die.

This doesn’t mean every believer must hit a certain financial number or retire with total financial independence. It means we plan wisely today so we won’t unnecessarily burden others tomorrow.

Saving, investing, and preparing for future needs is not a lack of faith; it’s an expression of wise biblical stewardship and personal responsibility.

This principle encompasses everything we typically think of as “retirement planning”:

- How much do I need to save?

- How should I invest my savings?

- When should I claim Social Security?

- How should I structure my retirement portfolio?

- What’s a sustainable withdrawal rate?

- How do I minimize taxes?

- Should I downsize my home?

- What about healthcare costs?

We don’t pursue these things to maximize comfort or accumulate wealth for wealth’s sake. We do them so that we can, as much as possible, be self-sustaining and continue serving God’s kingdom without burdening others.

Principle 2: The caregiving principle

Of course, no one is guaranteed lifelong health or independence. The Bible also teaches that family and church step in when self-sustainability is no longer possible.

As Paul wrote in 1 Timothy:

If anyone does not provide for his relatives, and especially for members of his household, he has denied the faith and is worse than an unbeliever. (1 Timothy 5:8)

If any believing woman has relatives who are widows, let her care for them. Let the church not be burdened, so that it may care for those who are truly widows. (1 Timothy 5:16)

This establishes a clear order of responsibility:

- First, family members care for one another

- Then, the local church supports those with no family

- Lastly, social safety nets play a role in broader society

This principle reminds us that retirement planning doesn’t stop with financial projections. It must include:

- Honest conversations about future needs with family members

- Preparing to care for aging parents

- Planning to protect our surviving spouse

- Estate planning that expresses love and care

- Long-term care considerations

- Building community support systems

- Preparing to both give and receive care gracefully

The Caregiving Principle transforms estate planning from “protecting my assets” to “loving my family well.” It reframes long-term care planning from “avoiding being a burden” to “preparing to receive care with dignity and gratitude.”

Principle 3: The ministry principle

Perhaps the most impactful part of Piper’s perspective is his view of retirement not as leisure but as mission. He first introduced this in his Don’t Waste Your Life book and his now ”famous” sermon delivered at a Passion Conference in 2000 that is often referred to as his ”seashells message.”

Boats, Seashells, Softball, and Retirement Stewardship is about John Piper’s 2000 “seashells” sermon at the Passion Conference, which challenged Christians not to waste their lives on frivolous pursuits, particularly in retirement. His example of a couple spending their golden years cruising boats and collecting shells became an iconic warning against retirement-as-leisure. The message, later expanded into “Don’t Waste Your Life,” influenced an entire generation—both young people planning their futures and older adults rethinking retirement. It’s the theological foundation for viewing retirement as a continued mission rather than earned rest.

In that sermon and others, his books, and in the three principles podcast, he pushes back against the cultural assumption that retirement is primarily a time to relax, play, and check off bucket lists:

The Bible has no conception of what Americans typically think of as retirement—that is, working for forty or fifty years and then playing for fifteen or twenty years: fishing, golfing, shuffleboard, pickleball, yard work, travel, hobbies, bucket lists, as if heaven was supposed to begin at 65 rather than at death.

Instead, he calls believers to stay on mission to the very end:

As long as you are able, you lean toward meeting needs. That’s what you do. That’s what Christians do. They lean toward needs, not comfort… You don’t just give to missions—you become missions. You don’t think mainly of play; you think mainly of ministry.

Psalm 92:14 captures this calling:

They still bear fruit in old age; they are ever full of sap and green.

This principle addresses the questions retirement planners rarely touch:

- What will I do with my time?

- Does my life still have purpose?

- How do I continue making a difference?

- Can I still be productive?

- What about generosity and giving?

- How do I finish well?

The Ministry Principle transforms retirement from “earned leisure” to “new season of fruitfulness.” It means we plan our finances not just to cover expenses, but to enable continued service, generous giving, and purposeful living until the end.

Why I like this framework

The best thing about it is that it’s theologically grounded. It’s built on the foundation of the Bible, not economics. The principles won’t change when tax laws or market conditions shift.

I also like how it integrates all aspects of retirement: finances, purpose, relationships, and mission aren’t separate compartments; they’re all part of faithful retirement stewardship.

It also addresses issues that retirees face. Not just “Will I run out of money?” but “Will my life still matter?” and “How do I love my family well?” and “What does God want from this season?”

The framework is counter-cultural in that it directly challenges the retirement-as-endless-leisure narrative that pervades our culture, even Christian culture to some extent.

Finally, the framework enhances the overarching principle of stewardship: faithfully stewarding retirement in accordance with the three biblical principles.

For example, consider how the principles reframe some common retirement challenges:

Social Security claiming decision:

- Financial framework: “Maximize lifetime income by claiming at 70”

- Self-Sustaining Principle: “Delay if you can to avoid burdening others and maintain independence”

- Caregiving Principle: “Delay to 70 to protect your widow with maximum survivor benefits”

- Ministry Principle: “Bridge the gap with part-time work that allows continued service”

Same decision, but understood through multiple lenses that connect financial wisdom to biblical purposes.

Portfolio withdrawal strategy:

- Financial framework: “Follow the 4% rule to avoid depleting assets”

- Self-Sustaining Principle: “Withdraw sustainably so you remain self-sufficient”

- Caregiving Principle: “Preserve enough for potential long-term care needs so family isn’t burdened”

- Ministry Principle: “Create margin for generosity and unexpected opportunities to serve”

Estate planning:

- Financial framework: “Minimize taxes and avoid probate”

- Self-Sustaining Principle: “Don’t leave chaos or burden for your executor”

- Caregiving Principle: “Express love for your family through wise provision and clear documentation”

- Ministry Principle: “Consider how your legacy can advance kingdom purposes beyond your lifetime”

As you can see, the financial mechanics remain essential, but they’re now integrated into a larger biblical framework that addresses purpose, relationships, and mission.

Planning with the BIFRS

Given these realities, here’s what a biblically informed retirement plan looks like—one that honors all three principles:

It starts with stewardship

Stewardship begins with recognizing that all we have belongs to God, and we’re called to manage it faithfully, not only for our benefit but also for the good of others and the glory of God.

This encompasses every area of life, including how we approach work, retirement, and the decisions we make throughout all seasons.

It pursues self-sustainability

We save and invest faithfully, not to hoard, but to avoid being a burden and to enable continued service and generosity. This requires:

- Income planning: Social Security optimization, pension decisions, part-time work consideration

- Withdrawal strategies: Sustainable rates, tax efficiency, flexibility

- Portfolio management: Growth with stability, inflation protection, risk management

- Tax optimization: Minimizing lifetime taxes, not just annual taxes

- Healthcare planning: Medicare, supplemental insurance, out-of-pocket budgeting

- Housing decisions: Right-sizing, geographic choices, equity management

It includes a caregiving plan

We consider our family and church in our planning—how we might care for others now and how they might care for us later. This involves:

- Protecting your spouse: Survivor benefits, inherited IRAs, financial simplification, the “Letter from Heaven”

- Estate planning: Wills, trusts, beneficiary designations, powers of attorney

- Long-term care preparation: Insurance, savings, family conversations

- Multi-generational considerations: Supporting parents, helping children wisely

- Community building: Church relationships, support systems

It moves us toward ministry

We don’t retire from our calling or purpose. Whether mentoring, volunteering, giving, or simply being present for family and church, we plan to stay active in service as long as God provides strength. This includes:

- Purposeful work: Continued employment (paid or unpaid), using skills in new ways

- Generous giving: QCDs, donor-advised funds, strategic philanthropy

- Active service: Church involvement, mentoring, family presence

- Living your legacy: What you model now is what you leave behind

- Finishing well: Staying on mission until the end

It’s grounded in faith and hope in God

We make wise decisions based on what’s likely—not just what’s ideal—and trust God for what we can’t control. We avoid unnecessary risks and the trap of fear-driven hoarding.

Circumstances and goals may change, markets shift, and health may decline. A good plan adjusts over time and is revisited regularly.

We strive to live knowing that our ultimate destination is not a dignified retirement in this life but an eternal home in heaven. This knowledge guides our decisions about how we spend our money, time, and talents.

As Piper says, “You stay zealous for good deeds right to the end. You magnify Jesus by serving. Heaven is coming. It’s not meant to drag forward. It’s meant to sustain hope and ministry.”

The framework applied

To help you understand how financial realities align with biblical principles, I’ve organized key retirement planning areas around the three principles. As I’ll explain further, I plan to use this construct to refresh and reorder some of the content on the blog:

Principle 1: The self-sustaining principle

Core financial topics:

- Saving and investing: How much and where to save, how to invest

- Tier 1 income: Social Security optimization and claiming strategies

- Tier 2 income: Pensions, annuities, guaranteed income sources

- Tier 3 income: Portfolio withdrawals and investment income

- Tax planning: Minimizing lifetime taxes, RMD strategies, Roth conversions

- Portfolio management: Allocation, risk management, sequence risk

- Healthcare costs: Medicare, supplements, budgeting

- Housing decisions: Downsizing, equity management, expenses

The main questions: How do I fund my retirement responsibly without burdening others? How do I do that without becoming the “rich fool” that the Bible talks about?

Principle 2: The caregiving principle

Core planning topics:

- Spousal protection: Survivor benefits, inherited IRAs, financial simplification

- Estate planning: Wills, trusts, beneficiaries, powers of attorney, digital assets

- Long-term care: Planning for giving and receiving care

- Family relationships: Supporting parents, helping children, multi-generational stewardship

- Community building: Church involvement, support networks

The main questions: How do I prepare to care for others and be cared for should I need it?

Principle 3: The ministry principle

Core purpose topics:

- Identity, calling, and purpose: What will you do in retirement?

- Productive work: Continued employment, service, creativity

- Generosity and giving: QCDs, strategic philanthropy, living generously

- Living your legacy: What you model matters more than what you leave

- Finishing well: Staying on mission, bearing fruit, facing mortality with hope

The main questions: What am I called to do in retirement? How do I stay on mission until the end?

Coming up

Over the next few months, I’ll walk through each major area of retirement planning in the framework, organizing and presenting new and updated content around these three biblical principles. Each article will:

- Ground the topic biblically in one or more of the three principles

- Explain the financial mechanics clearly and practically

- Link to relevant updated articles with current 2025-2026 data, regulations, and economic conditions

- Show how to steward that area well in light of biblical purposes

You’ll be able to identify updated articles by the notation (Updated 2025) or (Updated 2026) next to the title, and brand new articles will be marked (New). Each will note: “This article is part of the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series.”

Because each major article may include links to several supporting articles, I’ll occasionally publish on a longer schedule than my usual two-week cadence. This gives you time to explore linked content for deeper understanding.

Why this matters

Retirement introduces complexity, risk, and urgency that the working years lacked. But with a clear, biblically informed perspective, it also offers unprecedented opportunities for fruitfulness, generosity, and faithfulness to the end.

The financial mechanics matter. Understanding Social Security, managing withdrawals, optimizing taxes, and preparing for healthcare costs is essential, so I’ll continue to write extensively about them.

But they’re not ends in themselves. They’re means to biblical ends: being self-sustaining so we don’t burden others, caring well for family and being prepared to receive care, and staying on mission through generosity, service, and purpose until the very end.

As we work through each topic in upcoming articles, you’ll discover that retirement planning doesn’t have to be mysterious or overwhelming. It’s understandable. It’s manageable. And most importantly, it’s something you can steward faithfully in a way that honors God and blesses others.

My goal is to help you understand not only the mechanics of generating retirement income but also how to steward this season well, with wisdom, generosity, contentment, purpose, and peace. I plan to do this, Lord willing, with new and refreshed content delivered in a way that gives you a more holistic view of retirement based on this constructive 3-principle BIFRS I’ve borrowed from John Piper.