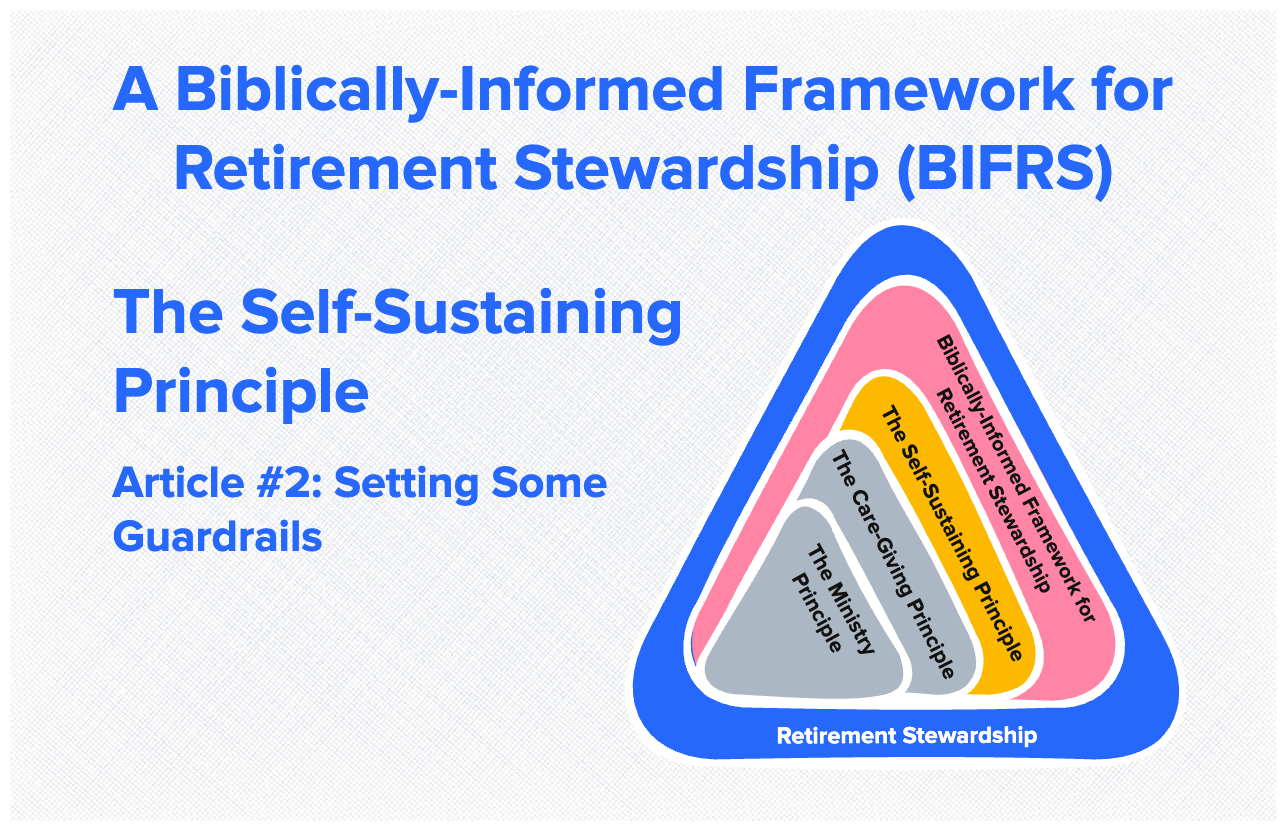

This article is part of the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series.

As we discussed in the introductory article, the Self-Sustaining Principle, grounded in Paul’s instruction to “be dependent on no one” (1 Thessalonians 4:12), calls us to wise stewardship. We plan ahead, save diligently, and live responsibly so we won’t burden others in our later years while maintaining freedom to serve God’s purposes.

This is faithful stewardship. This is biblical wisdom. This is good.

But there’s a danger lurking beneath the surface that can transform faithful stewardship into something unhealthy. The pursuit of self-sustainability can become an obsession with self-sufficiency through financial independence, which in turn becomes an idol.

When “financial freedom” becomes the ultimate goal rather than a means to serve God, when our security rests in our portfolio rather than in Christ, when we prioritize being able to retire more than anything else, when “retiring early” means escaping work rather than embracing new forms of service, we’ve crossed a line.

We’ve moved from biblical self-sustainability to secular self-sufficiency. From faithful stewardship to idolatry.

This shift is playing out dramatically in what’s called the FIRE movement—Financial Independence, Retire Early. While FIRE contains some legitimate financial wisdom, it also illustrates how the pursuit of financial independence can become an all-consuming goal that distorts our relationship with work, money, and, ultimately, with God.

Before we dive into practical strategies for building sustainable retirement income, we need to establish critical guardrails. We still need to understand the difference between pursuing self-sufficiency FOR mission and service versus pursuing financial independence FROM work; between planning wisely and hoarding obsessively; and between faithful stewardship and money-worship.

I need to note that, given the principle of Christian liberty, we all have a degree of freedom in this area. I’ll do my best to provide some recommended guardrails, but in doing so, I’m highlighting spiritual dangers, not imposing rules. These guardrails aren’t laws to bind your conscience; they’re wisdom for exercising your liberty without falling into idolatry. “All things are lawful, but not all things are helpful” (1 Corinthians 10:23, ESV).

You have the freedom to pursue early retirement, but you should do so for the right reasons. You have the liberty to make financial decisions before God. I’m not your judge. But liberty requires self-examination. So use that liberty wisely, ensuring your pursuit of financial independence serves kingdom purposes rather than becoming an idol. “For you were called to freedom, brothers. Only do not use your freedom as an opportunity for the flesh, but through love serve one another” (Galatians 5:13, ESV).

Understanding the FIRE movement

FIRE (Financial Independence, Retire Early) has gained significant traction in the personal finance space over the past decade. The basic premise is compelling: through aggressive saving, extreme frugality, and strategic investing, you can achieve financial independence well before the traditional retirement age, potentially in your 30s, 40s, or early 50s. No more work—just 30, 40, or 50 years of leisure!

The FIRE “formula”

The math is actually quite simple (though it may be hard to achieve in real life):

Step 1: Live on as little as possible (often 25-50% of income)

Step 2: Save and invest everything else (50-75% of income)

Step 3: Accumulate 25-30 times your annual expenses

Step 4: Retire early and live off 3-4% annual portfolio withdrawals

Example: If you can live on $40,000 annually, save aggressively for 10-15 years to accumulate $1,000,000-1,200,000, then “retire” and never work for money again.

The extreme version

On the far end of the spectrum is “Early Retirement Extreme” (ERE), which takes FIRE principles to their logical conclusion. ERE proponents argue that people in developed countries are wealthy by global standards, and that we can live materially sufficient and happy lives on 20-25% of typical spending through extreme frugality.

By living on $10,000-15,000 annually and investing the rest, some claim you can retire within 5-7 years of starting your career. A college graduate earning $60,000 who lives on $12,000 and invests $48,000 annually could theoretically accumulate $300,000 by age 30. At a 4% withdrawal rate, that generates $12,000 annually, which is exactly what they’ve been living on.

The theological problems with FIRE

I understand the attraction. I can even see how Christians might find FIRE appealing: “I’ll achieve financial independence, then I’ll be free to serve in ministry full-time without needing support-raising or worrying about income!”

But here’s the problem: FIRE is built on a fundamentally flawed theological foundation.

Problem 1: Financial independence as the ultimate goal

The very name—Financial Independence—reveals the core issue. The goal is independence itself. Freedom FROM constraints. Self-sufficiency. The ability to live life on your own terms without needing anyone, including, implicitly, God.

FIRE philosophy: “Once I hit my number, I’m free. I’ve escaped. I don’t need to work. I don’t need anyone. I’m independent.”

Biblical reality: “Whoever trusts in his riches will fall, but the righteous will flourish like a green leaf” (Proverbs 11:28). Complete independence is an illusion. We remain dependent on God for every breath, every heartbeat, every moment. We’re called to interdependence within the body of Christ, not radical independence.

The FIRE movement subtly promotes self-sufficiency as the highest good. But Scripture consistently warns against trusting in riches or thinking we can secure our own future apart from God.

Consider Jesus’ parable of the rich fool (Luke 12:13-21). The man accumulated great wealth, said to himself, “Soul, you have ample goods laid up for many years; relax, eat, drink, be merry,” and planned his comfortable retirement. God called him a fool that very night.

His error wasn’t saving or planning; it was treating financial independence as his ultimate security and self-focused leisure as his ultimate purpose. Sound familiar?

Problem 2: Work as a curse to escape

FIRE literature consistently frames work as something to escape from. The goal is to accumulate enough money so you never have to work for income again. Work is portrayed as a necessary evil during your accumulation phase, but the dream is to be done with it forever.

FIRE philosophy: “Retire as early as possible so you can finally start living. Work is what you do until you have enough money to stop.”

Biblical reality: Work is a gift from God, instituted before the Fall (Genesis 2:15). While sin has made work toilsome, work itself remains good—a way we image God, serve others, and fulfill our calling.

“Whatever you do, work heartily, as for the Lord and not for men.” (Colossians 3:23)

Notice Paul doesn’t say, “Whatever you do, work grudgingly until you can retire early and do what you really want.” He presents work as an act of worship, something done for the Lord, regardless of whether we’re paid for it.

The FIRE movement divorces work from calling. It reduces work to merely a means of generating income. Once you don’t need the income, you’re done with work.

But what if your work—even your paid employment—is part of how God has called you to serve Him and others? What if the problem isn’t work itself but our attitudes toward work, our choice of work, or our work-life balance?

Problem 3: Retirement as an escape rather than mission

FIRE adherents typically envision retirement as freedom to pursue hobbies, travel, leisure, and personal interests. Those things aren’t bad in themselves—in moderation, of course. The problem is that there’s no mention of serving God, advancing His kingdom, or using time and resources for others. It’s fundamentally self-focused.

FIRE philosophy: “I’ll spend my retirement traveling, pursuing hobbies, doing whatever I want. I’ve earned it. It’s my time now.”

Biblical reality: “They still bear fruit in old age; they are ever full of sap and green” (Psalm 92:14). Our calling doesn’t end when we achieve financial independence. God’s purpose for our lives continues until we die.

As John Piper challenges us: “The Bible has no conception of what Americans typically think of as retirement—that is, working for forty or fifty years and then playing for fifteen or twenty years.”

If you retire at 35 and spend the next 50-60 years primarily focused on personal leisure, travel, and hobbies with no significant investment in kingdom work, how is that faithful stewardship of all the gifts (time, talent, and treasure) that God has given you?

Even secular observers recognize the emptiness here. Many FIRE retirees discover that endless leisure isn’t fulfilling. Within a few years, many start businesses, take on consulting work, volunteer extensively, or return to traditional employment. Why? Because humans need purpose, productivity, and contribution to flourish.

Problem 4: Misplaced security

FIRE creates a dangerously specific “magic number.” Once you hit 25-30 times your annual expenses, you’re “financially independent” and “secure.”

But what if markets crash 40% the year after you retire? What if inflation runs higher than expected? What if healthcare costs explode? What if you live to 105? What if your investments underperform?

FIRE philosophy: “Hit your number and you’re set. You’ve achieved security.”

Biblical reality: Security is found in God alone, never in wealth. “Do not lay up for yourselves treasures on earth, where moth and rust destroy and where thieves break in and steal, but lay up for yourselves treasures in heaven” (Matthew 6:19-20).

The FIRE community acknowledges these risks intellectually but often proceeds as if achieving “the number” provides real security. It doesn’t. It provides a cushion, a resource, a tool—but never security itself.

Beware the subtle shift

Here’s what makes this dangerous: The subtle shift from faithful stewardship to financial idolatry often occurs gradually, almost imperceptibly. It typically begins with good things: legitimate, biblical motivations aligned with the Self-Sustaining Principle. There’s nothing wrong with any of them.

Then, almost unnoticed, the focus gradually shifts. You may have thoughts such as: “Once I hit my number, I’ll finally be secure,” “Financial independence means I’ll be truly free,” or “My goal is to never have to work for money again.”

Notice the difference? You begin focused on responsibility, service, and sound planning. But then you end up focused on self-sufficiency, personal security, and freedom from obligation.

Here are warning signs that your pursuit of self-sustainability has become unhealthy:

Your “number” keeps rising. First, it was $500,000. Then $750,000. Now $1 million. Somehow, it’s never quite enough. This betrays anxiety and misplaced security.

Financial planning consumes more time and mental energy than prayer or Scripture. You check your portfolio daily, read financial blogs constantly, run endless calculations, and think about money all the time.

You resent giving because it delays financial independence. Tithing or generous giving feels like an obstacle to your goal rather than a joyful response to God’s provision.

You’ve stopped enjoying your work entirely. Everything is viewed through the lens of “how many more years until I can quit.” You’re no longer present in your current calling.

You plan your entire “retired” life around personal interests. Travel, hobbies, leisure, personal projects—but nothing about serving God, His church, or others in significant ways.

Market fluctuations create disproportionate anxiety. A 10% portfolio drop doesn’t just concern you—it devastates you, revealing where your security actually rests.

You view everyone still working as somehow less free or enlightened. You’ve developed a subtle superiority complex around your pursuit of FIRE.

You’ve sacrificed important relationships or opportunities to maximize savings. Skipping family gatherings to avoid travel costs, saying no to mission trips because they’d slow your progress, and missing your child’s events because you won’t reduce working hours.

You’re less generous now than you were before starting your FIRE journey. Instead of increasing giving as income grows, you’ve reduced it to maximize your savings rate.

You think about retirement more than you think about Jesus. Your daydreams focus on “the day I’m financially independent” rather than growing in Christ or serving His kingdom.

These symptoms reveal that financial independence has become an idol—something you’re depending on for security, identity, and purpose that should come only from God.

When financial independence makes biblical sense

Before you think I’m entirely against building substantial resources that could enable early retirement from paid work, let me clarify: There are legitimate, biblical reasons to pursue what might look like early financial independence.

The critical difference between faithful stewardship and the FIRE trap comes down to one question: Is financial independence your goal or your tool?

If pursuing financial independence is about escaping work, maximizing personal freedom, or enjoying leisure without constraints, you’ve fallen into the FIRE trap. But if it’s a means to serve overseas missions, care for aging parents, transition to a lower-paid ministry, launch a kingdom-focused enterprise, address health limitations, or leave a toxic work environment, it could be faithful stewardship.

What distinguishes these legitimate use cases? In every scenario, financial independence serves a larger kingdom purpose. It increases your capacity for ministry rather than maximizing personal leisure. And critically, reaching “financial independence” doesn’t mean stopping productive work; it means gaining freedom to work in ways that might not generate income or generate less income than before. You’re not retiring FROM your calling—you’re using resources to pursue it more fully.

The heart question remains: Are you building resources to serve better, or to escape serving others? Your answer reveals whether you’re pursuing biblical self-sustainability or secular self-sufficiency.

The Promised Land of Retirement (2020) uses the analogy of Israel’s journey to the Promised Land from Joshua 1 to draw eight parallels to help Christians think more biblically about retirement. Just as Israel faced a wilderness before reaching Canaan and some never entered at all, our journey to retirement involves difficulties beyond our control, and many won’t reach their envisioned retirement due to death or circumstances. The Promised Land was God’s sovereign choice, not Israel’s; similarly, our retirement may look different from what we planned, requiring us to submit to God’s purposes. Most importantly, the land was meant to bless all nations through Israel, just as retirement should be a time to bless others through service rather than mere self-enjoyment.

Imagining Your Retirement (2019) explores how our God-given imaginations, powerful tools for envisioning possible futures, have fallen and must be guided by Scripture to avoid leading us astray, especially when we dream about retirement. While surveys show most people imagine retirement focused on security, flexibility, relaxation, travel, and leisure (spending 35% of time traveling, 21% with family, 14% just relaxing), alarmingly few Christians envision a retirement that glorifies God, and even fewer have adequate financial preparation.

Church Fathers, Catechisms, and Retirement Stewardship (2017) examines timeless teachings on money and stewardship from church fathers (Augustine, Luther, Calvin, Edwards, Spurgeon) and Reformed catechisms, finding surprisingly consistent themes throughout 2,000 years of church history: moderation, self-denial, charity, and condemnation of luxury and greed—teachings that contrast sharply with today’s prosperity gospel yet remain desperately needed. The church fathers, despite living in far harder times with minimal possessions, still warned against the power of money and taught that wealth should serve God’s kingdom and help others, not just benefit ourselves. The Westminster Larger Catechism’s treatment of the eighth commandment (“you shall not steal”) provides eight practical principles: giving and lending freely, moderating desires for worldly goods, exercising prudent stewardship, working hard, practicing frugality without greed, avoiding lawsuits, refusing to co-sign loans, and acquiring wealth honestly to help others and build God’s kingdom.

Some practical guardrails

How do you plan wisely and build adequate retirement resources without crossing the line into idolatry? Here are five helpful guardrails:

Guardrail 1: Set an “enough” line

One of the most insidious aspects of wealth accumulation is that “enough” keeps moving. First, you need $500,000. Then $750,000 feels safer. Before long, $1 million seems barely adequate, and $2 million would really provide security.

The guardrail: Prayerfully determine a specific, realistic “enough” number based on actual needs, not inflated lifestyle aspirations or anxiety. Write it down. When you reach it, STOP accumulating and shift to increased generosity and service.

This doesn’t mean you stop managing money wisely or that your portfolio won’t grow. It means you stop letting accumulation drive your decisions.

Practical step: Calculate your actual retirement income need using the methods in our previous articles. Add a reasonable buffer (20-30%). That’s your target. When you reach it, focus your energy elsewhere.

Guardrail 2: Maintain generosity

If your pursuit of financial independence requires cutting giving to achieve your goals faster, you’ve revealed an idol.

The guardrail: Commit to a minimum giving percentage (10% is a good floor, but giving should ideally increase as income grows) that continues regardless of your savings phase. Giving is not something to defer until after you achieve financial independence—it’s the heart of stewardship at every stage.

“Honor the Lord with your wealth and with the firstfruits of all your produce” (Proverbs 3:9)

Notice it doesn’t say, “Honor the Lord with your wealth after you’ve saved enough for early retirement.” First fruits means first, not leftovers after you’ve hit your number.

Practical step: Set up automatic giving that happens before you see the money. If you’re aggressively saving 30-40% of income, make sure 10-15% is also going to kingdom work. If you can’t afford both, you’re pursuing FIRE, not stewardship.

Guardrail 3: Regularly examine your heart

This is the most important guardrail. You must regularly and honestly assess your motivations.

Questions to ask yourself monthly or quarterly:

- When I imagine reaching financial independence, what excites me most? Freedom from work, or freedom to serve?

- Where does my mind wander during idle moments—to my portfolio balance or to God’s kingdom purposes?

- How do I feel when I have to dip into savings for an unexpected expense or a generous opportunity? Anxious and resentful, or peaceful and trusting?

- Am I becoming more generous or less generous as I accumulate wealth?

- Can I articulate specifically how I plan to serve God and others once I’m “financially independent”? Or is my vision mostly travel, hobbies, and leisure?

- If God called me to give away half my savings tomorrow for kingdom purposes, could I do it joyfully?

- How much do I think about money compared to how much I think about Christ?

- Has my pursuit of financial goals improved or harmed my relationships with family, church, and God?

Be honest. If you find yourself making excuses, rationalizing, or getting defensive, you may be crossing the line.

Practical step: Share these questions with a trusted friend, your spouse, or a small group, and ask them to hold you accountable. Give them permission to call out warning signs they observe.

Guardrail 4: Don’t retire FROM your calling

Even if you transition out of paid employment, continue productive work that serves God and others. Biblical stewardship means working (in some form) as long as you’re able.

The guardrail: Before leaving paid work, answer this question clearly: “What will I DO with my time and energy that serves God’s kingdom and others’ good?”

If your answer is primarily about what you’ll stop doing rather than what you’ll start doing, you’re not ready to retire. Some better answers could be, “I’ll serve as a missionary in [location],” “I’ll start a ministry to [group], “I’ll volunteer at [organization] 20 hours weekly,” or “I’ll write/teach/counsel others in [area].”

If your answers are more like, “I’ll finally relax and do what I want” or “I’ll travel and pursue my hobbies,” you may be headed in the wrong direction.

Practical step: Before retiring from paid work, have concrete plans for at least 20 hours weekly of productive service (paid or unpaid) that uses your gifts to bless others.

Guardrail 5: Hold money loosely

Your financial plan can collapse tomorrow through market crashes, health crises, economic changes, or countless other factors beyond your control. That possibility should concern you (which is why we take steps to mitigate certain risks), but if it terrifies you, your security is probably misplaced.

The guardrail: Regularly remind yourself that everything you have belongs to God, can be taken away in an instant, and was never your true security anyway.

Do not toil to acquire wealth; be discerning enough to desist. When your eyes light on it, it is gone, for suddenly it takes wings to itself, flying like an eagle toward heaven. (Proverbs 23:4-5, ESV)

Practical step: Regularly meditate on this hypothetical: “Lord, if I lost everything tomorrow—job, savings, house—and had to start over, would my faith remain strong? Would I still trust You? Would I still serve You?” If that thought is unbearable, your security needs adjusting.

Contentment With Retirement Stewardship is Great Gain (2017) addresses why Christians struggle with contentment (trusting in possessions, cultural influence, love of money, not seeking God’s Kingdom first) and balances two biblical truths: God’s promise to care for His children and our responsibility to plan wisely for retirement. Without contentment, we can’t live below our means, give generously, or save prudently—discontentment leads to overspending, debt, and poor financial decisions driven by restlessness rather than wisdom. True contentment doesn’t come from accumulating wealth (even though 89% of Americans have a standard of living above the global middle class), but from pursuing God Himself through worship, prayer, gratitude, and recognizing that we already have the greatest treasure—Christ, forgiveness, and eternal life. As John Piper wrote, “The greatest commandment implies: ‘Thou shalt be happy in God.'”

Questions to ask yourself

If you’re considering pursuing early financial independence or aggressive retirement saving, wrestle with these questions:

1. Is this even feasible for you?

Most middle-income earners cannot achieve FIRE-level retirement without extreme lifestyle restrictions that may strain relationships, harm health, or compromise present stewardship responsibilities.

Be honest: Can you actually save 50-70% of your income without neglecting current obligations? Or are you chasing an unrealistic goal that creates frustration and anxiety?

For many, the wise path is steady saving (10-20% of income), reasonable spending, consistent giving, and retirement at a traditional age. That’s not failure—that’s faithful stewardship within your circumstances.

2. Why do you want early financial independence?

Dig deep and ask yourself: Are you running FROM something or TO something? If your primary motivation is escaping a job you hate, exhaustion from work itself, desire for unconstrained personal freedom, or burnout—these are red flags. You’re running from problems rather than toward purpose.

But if you’re running TO something—serving in missions, starting a ministry, caring for family members, or using your skills in lower-paid kingdom work—that’s potentially healthy. The key difference: If you’re primarily running from rather than to, fix what’s wrong about your current situation instead of fantasizing about financial escape.

Address the root problem—whether it’s a wrong job fit, poor boundaries, or misplaced expectations—rather than assuming financial independence will solve it.

3. What about generous giving?

Can you simultaneously pursue aggressive savings AND maintain generous giving? Or does reaching financial independence faster require cutting giving?

If you can’t do both, you need to reconsider your approach. Giving isn’t something to defer until after you’re financially secure—it’s the heart expression of stewardship at every stage.

4. How will you spend your time?

If you achieved financial independence tomorrow, what specifically would you do with your time? Can you articulate it clearly?

If your answer is vague (“I’ll figure it out,” “I’ll relax,” “I’ll travel”), you’re not ready to stop working. Humans need purpose, productivity, and contribution to flourish.

If you have specific plans for service, ministry, family care, or productive work that just doesn’t pay much, that’s different.

5. Do you need financial independence or life balance?

Sometimes what people really need isn’t financial independence but better life balance in their current circumstances.

Would reducing work hours, changing jobs, setting better boundaries, or simplifying your lifestyle address what’s really bothering you—without requiring years of extreme saving to “escape”?

6. What if you already “retired early”?

If you’ve already achieved financial independence and left traditional employment, the question is: Now what?

Are you using your time, freedom, and resources to serve God and others? Or have you settled into comfortable leisure?

As John Piper warns: “Don’t waste your retirement.” Whether you retired at 35, 55, or 75, faithful stewardship means bearing fruit in whatever season you’re in.

The heart of the matter

Let me close with the fundamental issue: Where does your security rest?

The FIRE movement, despite its appeal and practical wisdom about frugality and intentional living, ultimately promotes misplaced security. It says: “Hit your number, and you’re safe. Achieve financial independence, and you’re free—free from work and free to do what you please.”

But Jesus says:

Do not be anxious about your life, what you will eat or what you will drink, nor about your body, what you will put on… But seek first the kingdom of God and his righteousness, and all these things will be added to you. (Matthew 6:25, 33)

And:

Take care, and be on your guard against all covetousness, for one’s life does not consist in the abundance of his possessions. (Luke 12:15, ESV)

Your life—your security, your purpose, your significance—doesn’t consist of financial independence. It consists in knowing Christ and serving His kingdom.

The Self-Sustaining Principle calls us to plan wisely, save diligently, and live responsibly. But it does NOT call us to make financial independence our ultimate goal, our security, or our salvation.

Financial independence pursued as an idol will leave you empty, anxious, and ultimately disappointed. Financial sustainability pursued as faithful stewardship will set you free—free to serve, free to give, free to follow God’s calling regardless of paycheck, free to finish well.

That’s the critical difference.