You’ve learned in a previous article that most investments fall into two big buckets: you can own them directly, or you can pool your money with other investors and let a professional manage the bucket for you. You now also know the difference between an actively-managed fund and an index fund. You are aware of the importance of asset allocation and diversification. That brings us to the fun part: actually building your portfolio.

This is where people often get confused, usually because they make it much more complicated than it needs to be. However, I want to emphasize that your investment portfolio doesn’t have to be complex. When it comes to long-term investing, as with many things financial, simpler is often better.

If you’re new to investing, this should come as a relief. Why? Because nowadays we’re inundated with too much advice—some of it contradictory—you may easily experience decision paralysis and do nothing. Although it’s sometimes proper to do nothing (such as waiting out a down market), sitting idle is not a wise decision when it means leaving money invested that should be invested.

I’m going to give you some simple portfolio ideas that are perfect for a traditional or Roth IRA or even a taxable investment account. These investing strategies emphasize simplicity and low expenses while ensuring diversification through total-market index funds. The best part is that these simpler, less expensive portfolios may very well outperform more complex and expensive ones.

You can apply them or not, but if you don’t, ask yourself this question: Why? Unless you’re as smart as Warren Buffett (a really famous investor) or a hedge or pension fund manager, buying the entire market is more prudent than stock picking. That’s not meant to be an insult; most people just aren’t more intelligent than the market, which is the collective wisdom of all investors. If you think you are because of your prior successes with stock picking, or because your friend was, you and they are more likely the beneficiaries of previous “luck.” Congratulations, but “luck” isn’t a very sustainable investing strategy going forward.

The total U.S. stock market, as measured by the Vanguard Total Stock Market ETF (VTI)—more on ETFs in a bit, but suffice it to say that VTI is a widely used proxy for the entire U.S. stock market—delivered a total return of ~216 % over the last ten years, meaning a $1,000 investment would have grown to about $3,160. That translates to an average annualized return of roughly 12.3 % per year. This is an unbelievable return to the disciplined investor who “only” invested in this simple, low-cost index fund!

The argument that you can do better than the broad market by picking the hot stocks or a mutual fund is baseless—most investors can’t and won’t. Don’t become yet another RobinHood-minded investor messing around with risky individual stock-picking unless it’s money you can afford to lose, which is not something that wise stewards do.[1]

The first decision you’ll need to make as a young investor is choosing where to open your first brokerage or retirement account. (For your 401(k), your employer has probably already made that decision for you.) The three big names you’ll hear are Fidelity, Vanguard, and Charles Schwab. The good news is that you really can’t go wrong with any of them; they’re all reputable, low-cost, and beginner-friendly. But each has a slightly different flavor that might suit your style and goals better.

Fidelity is often a favorite among young investors who want a nice app, commission-free ETFs and stocks, and cash management features, such as a free checking account. (Disclaimer: I use Fidelity.) Vanguard is the go-to for die-hard index fund fans (they invented the index fund, after all). Their no-frills platform can feel a little clunky, but if you’re a “set it and forget it” type, their low-cost mutual funds are legendary. Schwab is a solid middle ground: they have a user-friendly website, strong customer service, and their own set of low-cost index funds and ETFs that compete head-to-head with Vanguard and Fidelity.

Of course, if you open a brokerage account with one, say Fidelity, you can invest in funds from any of the others, as well as other mutual fund and ETF providers. The bottom line? Pick one and start investing!

The next decision you’ll need to make is between mutual funds and exchange-traded funds (ETFs). In some cases, especially with the “big three,” you can choose between mutual funds and ETFs for the same type of investment. But I’m going to go out on a limb and say that for most young investors saving for retirement, this is not a big deal one way or another. But it’s still a good idea to know the difference.

Mutual funds and ETFs are two of the most common ways to invest in a mix of stocks or bonds without having to pick individual stocks or bonds. Both pool money from lots of investors, but they work a little differently.

Mutual funds are usually bought directly through a company or your retirement plan, and you buy or sell shares just once a day, after the market closes, at the fund’s set price for that day. They’re popular in 401(k)s and other workplace plans and often require a minimum amount to get started, though some brokers now offer lower or no minimums.

ETFs are similar in that they hold a basket of investments, but they trade on stock exchanges like regular stocks. This means you can buy or sell shares at any time the market is open, and the price fluctuates throughout the day in response to changes in supply and demand. Many young investors like ETFs because they’re flexible, often have no minimum investment requirements, and are easily bought and sold with modern trading apps.

As for how to invest and which mutual funds or ETFs to invest in, I’d recommend one of two options:

Option One: Invest in a Retirement Target Date Fund. Invest 100% of every penny you save in your IRA or 401(k) in a target retirement fund offered by Fidelity, Schwab, or Vanguard. With these funds, you select your retirement year, say 2060, and invest all of your retirement savings in it. These funds gradually become less risky over time (less in stocks) and invest more in bonds (which historically have been less volatile).

Target date funds are “funds of funds,” meaning they aggregate multiple funds into a single fund and do all of the asset allocation (stocks versus bonds versus other assets) for you behind the scenes. The underlying funds, which are typically index funds, provide all the diversification you need, and then some.

Target-date funds charge a management fee—the average expense ratio for U.S. target-date mutual funds is about 0.68%, but some are much lower. Vanguard’s funds have an average fee of 0.08%. This fee is in addition to the individual fees in the fund. However, since most of them tend to use low-cost index funds, the total costs can be relatively low. The management fee is what you pay for the fund managers to invest directly into those index funds for you and to take care of the rebalancing and asset allocation adjustments further down the road.

You’ll likely have some of these to choose from in your 401(k) from your employer. However, please review the details, particularly the asset allocation (stocks vs. bonds), to ensure it aligns with your risk tolerance. (The target date you select should align with your risk capacity.) You should also understand how soon the fund will shift from stocks to bonds (though it is usually infrequent).

Some investors find target-date funds to be too conservative and suboptimal due to their one-size-fits-all approach. You also typically pay a little extra in fees for the convenience. That said, target date funds are ideal for someone who wants to set it and forget it; they're as simple as it gets.

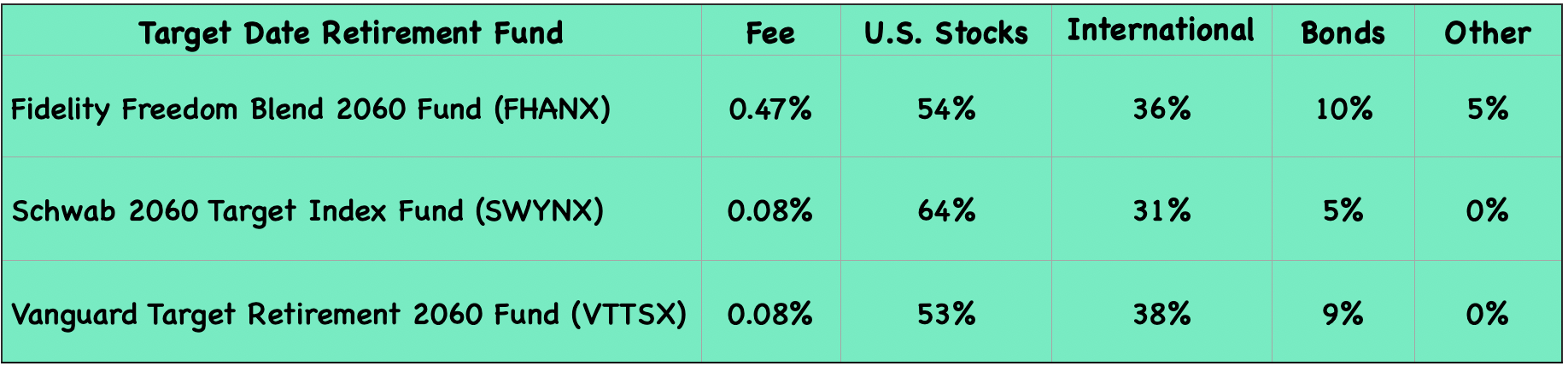

Here’s the breakdown in 2025 for the 2060 Target Date Funds (assumes you’ll retire in 35 years) from the three major providers, Fidelity, Schwab, and Vanguard:

You see right off that they’re not all the same. Fidelity’s “blend” of actively managed and passively managed funds carries a slightly higher fee. Schwab has the highest total stock allocation (95%), and Fidelity has the lowest (90%), but the difference is not significant. But overall, they are very similar, as one might expect. You’ll need to conduct further research to determine what their allocation might be in 2060; it may or may not be conservative enough for your needs.

The next best option (two) is to construct a simple portfolio by buying the underlying index funds yourself, which gives you greater flexibility and may result in a slightly lower expense ratio. You may also want to simplify your portfolio to a two- or three-fund approach.

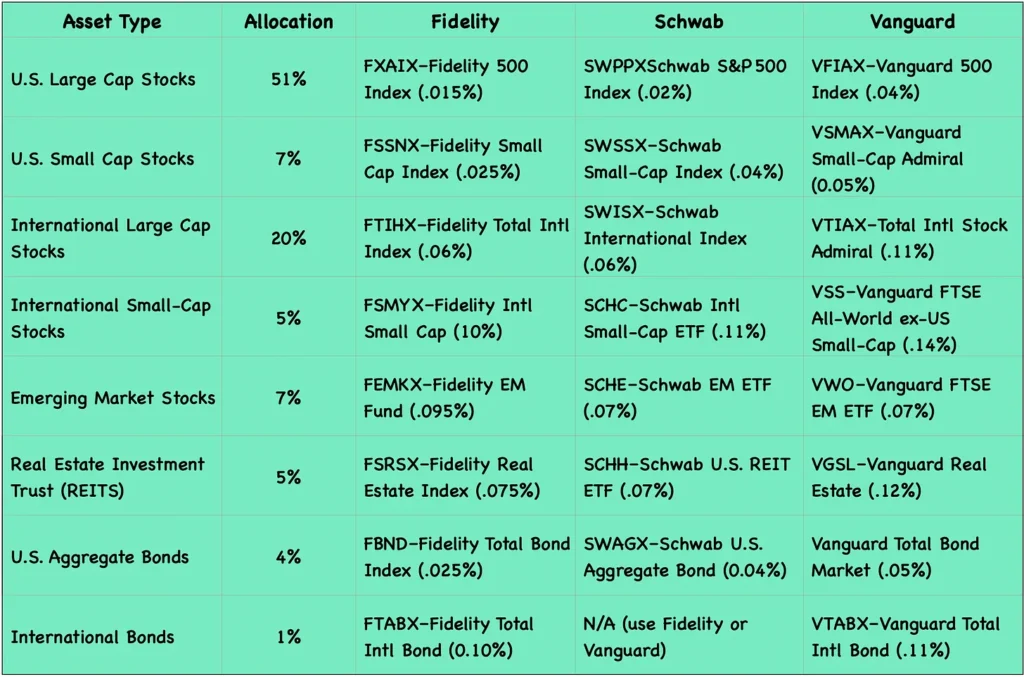

I will use each company’s index funds to replicate a 2060 target-date fund. I’m going to use the well-diversified Schwab allocation model to work from, and add in the international bonds that Vanguard included, the international small-cap stocks that Fidelity has in theirs (Fidelity has many more individual funds in their target date fund than the others covering these basic asset classes), and then simplify from there:

- U.S. Large-Cap Stocks

- US Small-Cap Stocks

- International Large-Cap Stocks

- International Small-Cap Stocks

- Emerging Markets Stocks

- U.S. REITs

- U.S. Aggregate Bonds

- International Bonds

This is the asset allocation at a high level:

- Stocks (95%): U.S. Large‑Cap (51%), U.S. Small‑Cap (7%), Int’l Large (20%), Int’l Small (5%), EM (7%), U.S. REITs (5%)

- Bonds (5%): U.S. Aggregate (4%), Int’l Bond (1%)

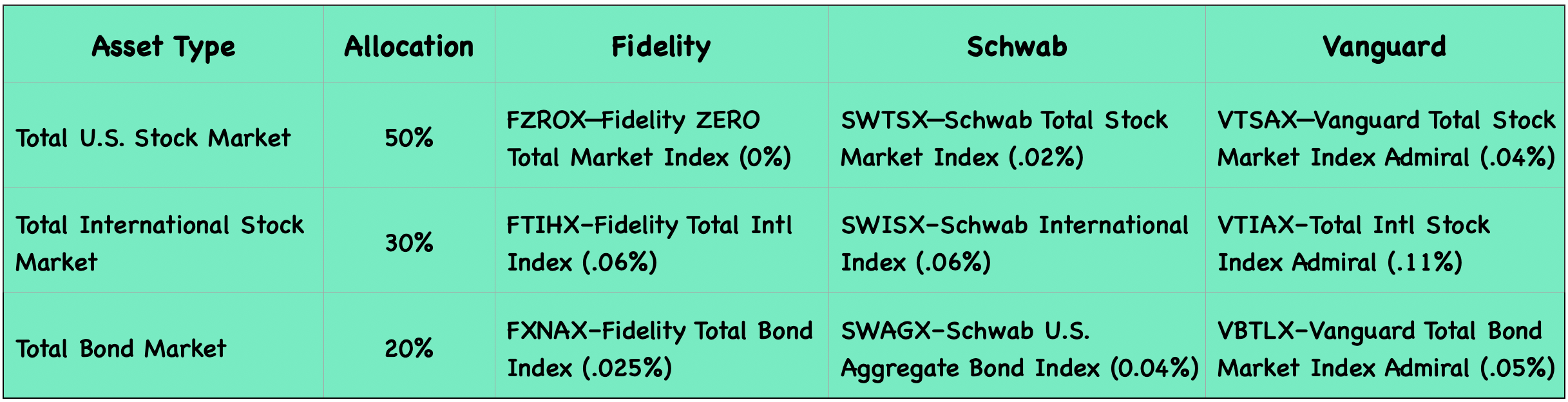

The challenge with this portfolio, regardless of which fund provider you use, is that it has a lot of funds to manage (certainly as compared to a single target date fund). This brings us to Option 2, which is to construct a simple “lazy” portfolio consisting of just three funds allocated to:

- Total U.S. Stock Market Index Fund

- Total International Stock Market Fund

- Total Bond Market Index

This is the portfolio originally proposed by Vanguard founder John Bogle, the father of the low-cost index investing movement. It was a radical concept at the time; no one thought “buying the market” would be as successful as placing bets on a few successful companies. But study after study has shown that not only was indexing as successful as active investing, but it also generated higher returns adjusted for expenses.

One challenge with this portfolio is that you must decide how much of your stock investment to allocate between the U.S. fund, the International fund, and the Bond fund. Your asset allocation is one of the most personal decisions you’ll make. As we discussed, it depends on your age, how long you plan to invest, and how much risk you can stomach. If I were building this portfolio inside an IRA and planning to retire around age 65, here’s how I’d set it up (I’d probably be more conservative than you):

This portfolio embodies simplicity, making both allocation and diversification straightforward. A Total U.S. Stock Market Index Fund spreads your stock money across thousands of companies–large, mid, and small caps–all in one fund. The Total International Stock Market Fund takes your stock diversification global, providing exposure to companies worldwide. And your Total Bond Market Index Fund handles the safer, income-producing side of your portfolio. (If you wanted to make the portfolio more aggressive, you could knock the bond allocation down to somewhere between 0% and 10%.)

Although I hate to bring it up, I know that some of you will want a slightly more customized portfolio, allowing you to give more weight to specific classes. Here’s a still relatively simple five-fund portfolio:

- Total U.S. Market Index Fund

- U.S. Small-Cap Value Index Fund

- Total International Stock Index Fund

- Total Bond Market Index Fund

- U.S. Short-Term Bond Index Fund

In this version, we keep the Total U.S. Stock Market Fund but add a Small-Cap Value Fund. Why? Because smaller companies are often underrepresented in a total market index, adding this slice boosts your exposure to stocks with higher growth potential.

Think about it: it’s far easier for a $100 million company to grow tenfold into a $1 billion company than for a $10 billion company to grow tenfold into a $100 billion giant. Small-cap value stocks have historically offered higher returns (with more ups and downs) than large-cap stocks alone.

We also keep the Total International Stock Market Fund to maintain broad global diversification. For bonds, we utilize two funds: the Total Bond Market Index Fund and a Short-Term Bond Index Fund. The short-term bond fund holds bonds with shorter maturity dates, which helps cushion your portfolio when markets get choppy.

If you’re starting out and have decades until retirement, you may not need a short-term bond fund yet, unless you’re very conservative. However, when you’re within 25 years of retirement, adding it can help add stability and reduce interest rate risk.

You can easily construct this portfolio using Fidelity, Schwab, Vanguard, or iShares (for ETFs) index funds. You would add Small-Cap Value funds from either Vanguard, Fidelity, or iShares (Schwab’s is not value-only); and short-term bond funds from Vanguard, Fidelity, iShares, or Schwab (short-term treasuries only). The allocation for a 25-year-old for this portfolio might look something like this:

- 40% Total U.S. Market Index Fund

- 20% U.S. Small-Cap Value Index Fund

- 30% Total International Stock Index Fund

- 10% Total Bond Market Index Fund

- 0% U.S. Short-Term Bond Index Fund

You may already have a preference for Fidelity, Schwab, or Vanguard (iShares ETFs can be bought commission-free at Fidelity), so pick your favorite. Otherwise, it’s totally a matter of personal opinion. It’s possible to build a simple, well-diversified portfolio with any of them. (Fidelity offers a large number of mutual funds and ETFs, including all of the BlackRock iShares ETFs. Some would say that their online experience and (possibly) customer service are a little better.)

What about crypto? Bitcoin and other cryptocurrencies have exploded into the financial mainstream, and many in your generation are paying attention. According to recent surveys, nearly half of Gen Z and millennials have either invested in crypto or are considering it.

Bitcoin is a decentralized digital currency that operates on a technology called blockchain. Unlike dollars issued by the U.S. government or stocks issued by companies, Bitcoin isn’t controlled by a central authority. It’s more like “digital gold”: scarce, secure, and not inflationary (only 21 million will ever exist).

In many ways, it’s a revolutionary idea. But that doesn’t mean it’s risk-free. Bitcoin has seen massive gains, but also major crashes. Some investors have become millionaires. Others lost everything because they bought high and sold low.

The Bible warns us not to be hasty or foolish with money. That includes jumping into risky assets because of FOMO (Fear Of Missing Out). A wise steward takes the long view, not just the moonshot. Given that Bitcoin is high risk, if you decide to invest in it, consider investing modestly and with diversification. Some advisors suggest keeping crypto to 1–5% of your total portfolio.

If you remember nothing else, remember this: investing isn’t about chasing hot tips or flipping stocks every week. It’s about owning quality assets, spreading out your risk, paying as little in fees as possible, and letting time and compounding work in your favor.

For reflection: This article is all about coming up with a simple, easy-to-manage investment portfolio that we can patiently leave alone (for the most part) so that it can grow. Some trust in chariots and others in horses (Psalm 20:7), and others in the stock market, but we trust in the name of the LORD our God. He is the ultimate provider of whatever good comes from our investments, not the markets alone. The verses below are not about money or investments, but the principle is the same.

Verse: “I planted, Apollos watered, but God gave the growth. So neither he who plants nor he who waters is anything, but only God who gives the growth. He who plants and he who waters are one, and each will receive his wages according to his labor. For we are God’s fellow workers. You are God’s field, God’s building” (1 Corinthians 3:6-9, ESV).

Resources:

Bogleheads Coffeehouse Portfolio

Notes:

[1] Robinhood is a zero-commission trading platform and app that, according to Wikipedia, “facilitates trades of stocks, exchange-traded funds, options, index options, futures contracts, outcomes on prediction markets, and cryptocurrency. It also offers cryptocurrency wallets, wealth management, credit cards and other banking services, some in partnership with banks insured by the FDIC, as well as a news website, Sherwood.News.”