I will write a future article about choosing a financial or investment advisor if you need one, but be advised (no pun intended): no matter who you choose, there will be some fee. Furthermore, depending on the types of investments you choose, there will likely be fees associated with them as well.

Unfortunately, they’re not something people tend to pay a lot of attention to. They’re usually buried in the fine print of a mutual fund prospectus or your brokerage account statement. They seem small, and you may be thinking, “How much could a 1% fee really hurt me?” Turns out, a lot.

Whether you're investing through a brokerage app, a 401(k), or with the help of a financial advisor, you're paying fees. Some are obvious, others not so much. But all of them can eat into your returns over time, and that makes a huge difference when you're trying to increase your net worth over the long haul.

Here are the different types of fees you’re likely to encounter:

Fund Management Fees (a.k.a. “Expense Ratios”)#

Every mutual fund or ETF charges a fee to cover operating costs.[1] This fee is typically expressed as a percentage, such as 0.10% or 1.00%, and it’s deducted from your investment returns, not charged directly to you. For example, if a fund earns 6% but has a 1% fee, your actual return is 5%. If you invest $10,000 in a fund with a 1% annual fee, it will cost you $100 per year. Over 30 years, it can eat away up to 25–30% of the fund’s value in your portfolio value due to lost compounding.

You won’t see a line item for this fee in your account; it's just quietly deducted from the fund’s Net Asset Value (NAV) in the background. That’s why it’s easy to overlook but essential to know. If you read the literature about your fund (called a “prospectus”), it will inform you of the fees.

It should be noted that if a mutual fund consistently outperforms its benchmark after accounting for its fees, it could be considered a better investment than just “buying the benchmark,” which is usually an index fund. However, the reality is that actively managed mutual funds may not consistently outperform their benchmarks over the long term, and their higher fees can erode returns. (More on this when we discuss specific investments.)

Trading Fees#

Many brokerages offer $0 trading commissions. But not all do. Some still charge $5 to $20 per trade, especially for mutual funds or if you're using a full-service advisor. These fees will show up on your brokerage account statement and are in addition to the fund and advisor fees.

Advisor Fees#

If you use a financial advisor, you're likely paying one of two ways:

- AUM (Assets Under Management) Fee – Usually 0.25% to 1.00% of your total portfolio, charged annually. (I have seen AUM fees as high as 2% for SMALL BALANCE ACCOUNTS—OUCH!)

- Flat or Hourly Fees – A set rate for advice or services. Some prefer this over the AUM model.

An AUM fee may seem small, but on a $100,000 portfolio, a 1% fee equals $1,000 per year. And yes, that compounds over time against you.

Another potential pitfall with advisor fees is that they may also steer you toward funds that their firm manages or sponsors, which may be higher than other comparable funds.

Front-End Load Fees#

Some mutual funds charge a “load,” which is simply a fee paid upfront to invest. These are often 5% or more! So, if you invest $10,000 in a fund with a 5.75% front-end load, you end up investing only $9,425. The rest is gone before you’ve even made a cent.

My suggestion is to avoid these whenever possible; there are almost always better, no-load options.

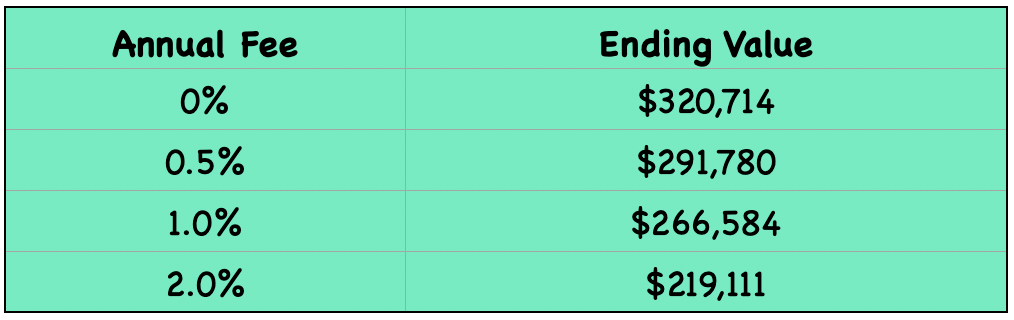

Now that you understand the types of fees you may encounter, let’s look at the long-term “negative compounding” they can have. Say you invest $100,000 for 20 years and earn 6% per year:

As the table shows, there is over a $100,000 difference between no fees and a 2% total fee. Even if you don’t notice it year to year, fees compound against you just like returns compound for you.

Most of these fees are ones you can control. You can decide not to hire a financial advisor and manage your investments yourself, saving the AUM fee. Alternatively, you could opt for a very low AUM fee service, such as a Roboadvisor (see resources below). You can select a brokerage firm that doesn’t charge a transaction fee and avoid trading fees. You can choose low-cost (or no-cost) mutual funds or ETFs and avoid high fund management fees. You can also avoid purchasing funds with front-end loads, which reduce your investment from the outset.

You might be thinking: “If high fees are bad, why do people pay them?” In my experience, it can be because they don’t know they’re paying them; their advisor purchased the fund for them, and that’s that. Or, they often confuse advisor fees with fund fees. (A State Street study found 47% of investors thought fund management fees were part of their advisor fee—they’re not.)

Another reason is that they don’t know what “high” is. They may pay a 1.5% AUM fee, not realizing that there are some (but not many) advisors who charge between .50% and 1.0%. (AUM fees tend to vary based on the size of your portfolio—larger percentages for small accounts and smaller percentages for larger ones.)

It’s important to know what you’re paying. Then you can make a decision: Am I getting the returns and value from the funds and services I am receiving? If not, you have other options. We’ll discuss your options in future articles on choosing an advisor and selecting specific funds for your portfolio.

For reflection: The Bible says that workers deserve their wages (1 Timothy 5:18), and that includes financial professionals. However, it also calls us to be wise stewards (Proverbs 21:5). Understanding what you’re paying for and what you’re getting in return is simply smart stewardship. Have you taken the time to understand precisely what you’re paying in fees? Is it a reasonable amount? If you have an advisor, ask them to explain all the fees to you if necessary.

Verse: “Behold, I send you forth as sheep in the midst of wolves: be ye therefore wise as serpents, and harmless as doves” (Matthew 10:16, ESV).

Resources:

Best Robo Advisors (Forbes): https://www.forbes.com/advisor/investing/best-robo-advisors/

Advisory fees of the “Big Three”:

- Charles Schwab: https://www.schwab.com/legal/schwab-pricing-guide-for-advisor-services

- Fidelity Investments: https://www.fidelity.com/why-fidelity/pricing-fees

- Vanguard: https://investor.vanguard.com/advice/compare-investment-advice

- “Unbiased” comparison: https://www.unbiased.com/discover/financial-advice/vanguard-vs-fidelity-vs-schwab

Notes:

[1] There are exceptions here and there. Fidelity Investments offers several zero-fee index funds.