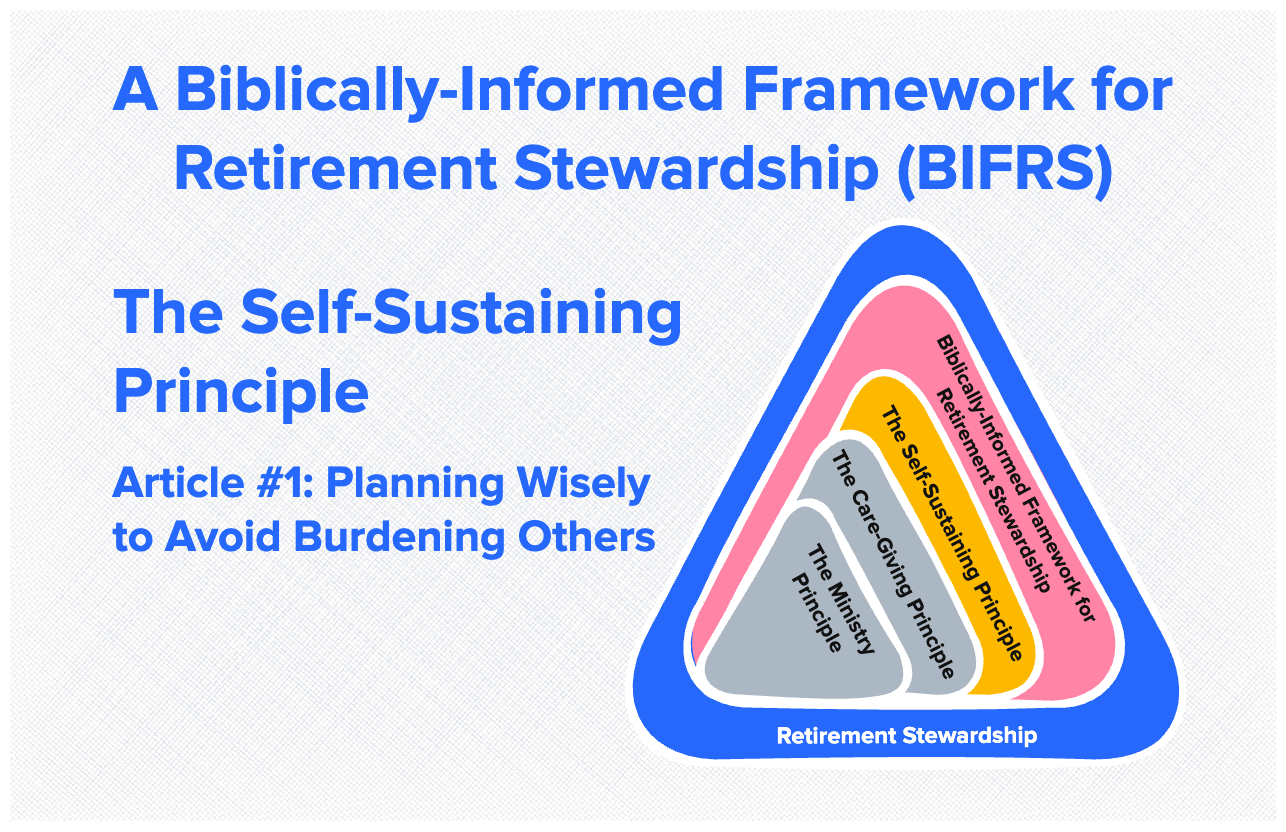

The Self-Sustaining Principle—Article #1: Planning Wisely to Avoid Burdening Others

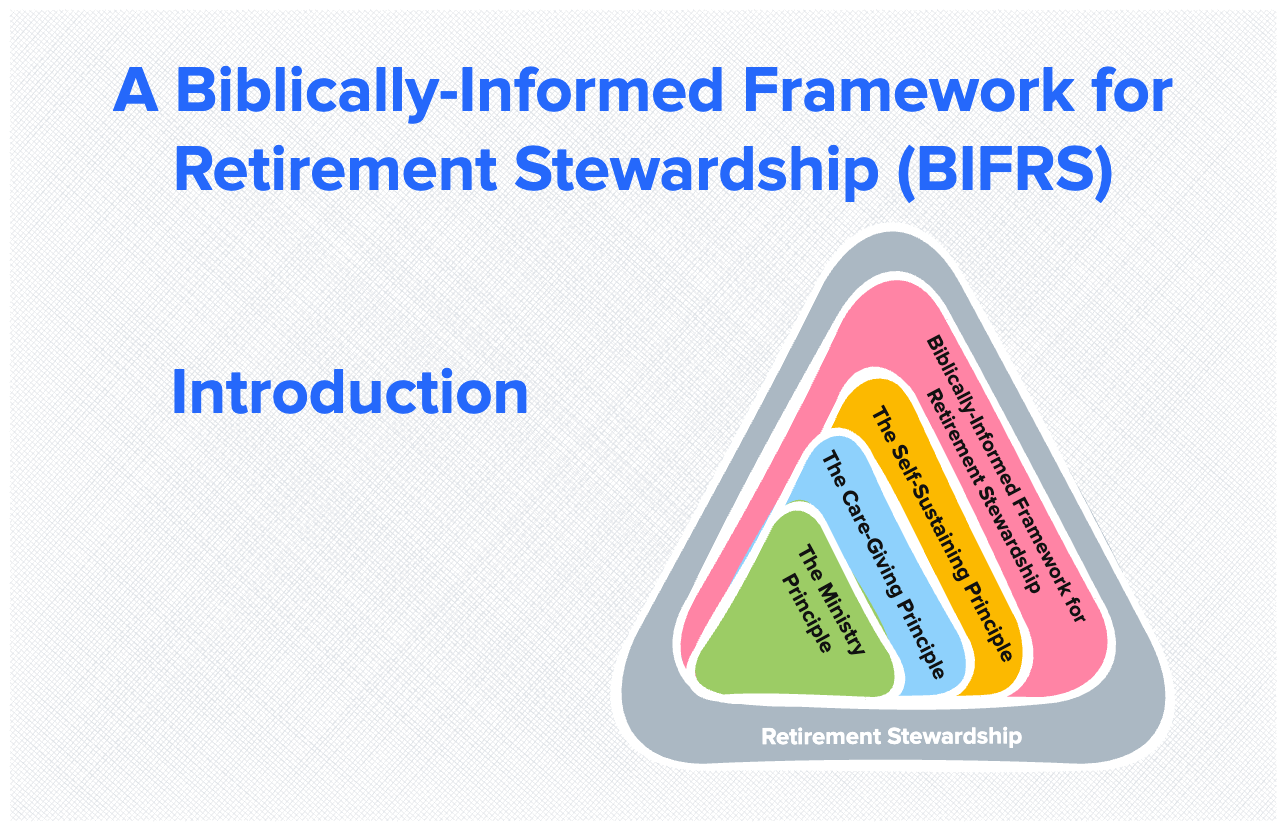

This article is part of the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series. In the previous article, I introduced a biblical framework for retirement planning based on three principles from John Piper: the Self-Sustaining Principle, the Caregiving Principle, and the Ministry Principle. Together, these three principles provide a simple but theologically well-grounded approach to retirement … Read more