In my last article, I discussed using a “regret minimization” strategy to help with making critical retirement planning decisions. I illustrated how you might apply it to your Social Security claiming and retirement account investing choices.

Deciding when to claim your Social Security benefits may be the most important decision you’ll make when you choose to retire. One reason it’s so critical is that, in most cases, it’s irreversible. If you make a mistake, you (and your surviving spouse, if you have one) have to live with it for as long as you live.

The second most critical decision may be how to manage investment risk while generating enough income to live in retirement, especially if you plan to rely heavily on a risk-based investment portfolio to fund a substantial portion of it.

But a close third is your choice of a Medicare plan.

You may be thinking, “Hey, wait a minute—doesn’t everybody who qualifies get the same Medicare plan?” Well, the answer is yes and no. And selecting the right plan may be more complex and consequential than you think. Fortunately, unlike some Social Security and investing choices, your decision can be reversed, but as we’ll see, not always.

Same but different

We’re less than two months away from the Medicare “open enrollment” period that runs from October 15 – December 7. Before you know it, we’ll be inundated with TV commercials featuring smiling spokespeople (I’d love to know what kind of teeth whitener they use) who’ll tell you that you may not be getting everything you’re entitled to from Medicare and if you call the 1-800 number on the screen the nice people on the phone will hook you up.

The problem is they’re not actually talking about Medicare, at least not Original Medicare, which is Parts A and B. They’re referring to Part C, Medicare Advantage plans. But this can be confusing because Part C isn’t just an “add on” to Original Medicare that gives you things you’re entitled to that you weren’t getting before. (I’ll explain more later).

Yes, Medicare is Medicare—it has Parts (A, B, C, and D). How the government defines these plans affects all Medicare benefit recipients, regardless of which plan they choose. But there’s much more to it than just the A-B-Cs.

You could just opt for Original Medicare, which would be just Parts A and B. So, it’s important to understand the basics of Medicare Parts A and B; you can read this article to get a brief overview. Also, the government’s Medicare website is a great source of information.

But if you only go with Parts A and B, you’ll have significant exposure to the expenses they don’t cover. That’s why choosing the right Medicare plan is so important.

My wife and I went on Medicare almost three years ago, so I know from experience how confusing it can be. For the first time in about 40 years, we had to transition from the relative safety and security of an employer-sponsored group health insurance plan to a government-sponsored and administered plan.

Like other 60-somethings, we had to make our own decisions about Part B, Part C (Advantage Plans), Supplemental Plans (Medigap), Part D (prescriptions), Visual, Dental, etc. And like almost everyone else, we had to choose between the two main paths: Original Medicare (Parts A and B) with a “Medigap” supplemental plan along with a visual and dental plan, or a Medicare Advantage plan (Part C) to get the coverage we needed to prevent significant out-of-pocket expenditures for the things Parts A and B don’t cover.

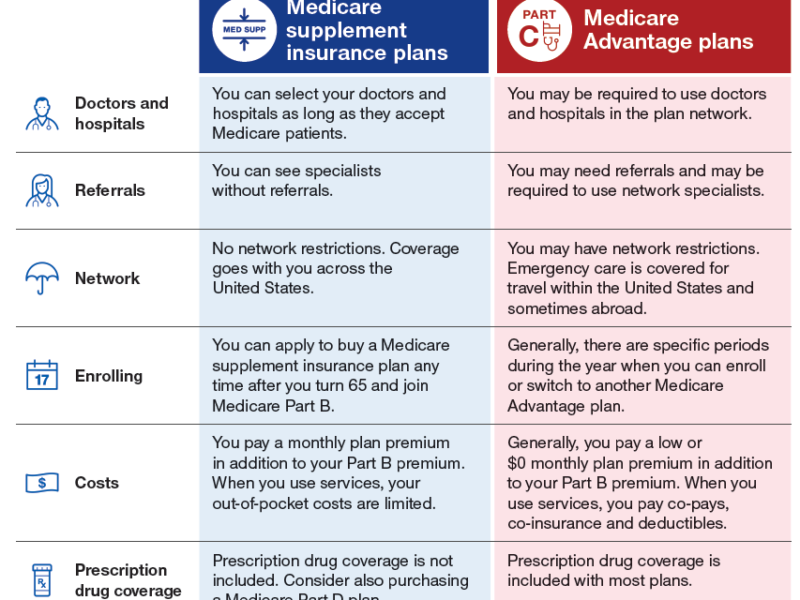

Here’s a nice graphical comparison of the two types of plans:

Note that neither Original Medicare nor either of the above-described plans covers long-term (nursing home) care. If you want insurance for that, you’ll have to purchase long-term care insurance (LTCI). If not, you’ll have to pay it out-of-pocket. If you can’t afford it, you may have to go the Medicaid route.

Supplemental plans (”Medigap” insurance)

A Medigap plan is supplemental to Medicare Parts A, and B. Medicare typically pays up to 80% of covered charges, and a Medigap plan typically pays “the rest.” How much of “the rest” depends on which type of Medigap plan you select.

Neither Medicare nor Medigap plans cover prescriptions, visual, or dental like most employer plans do. So, if you choose a Medigap plan, you may also need to purchase additional supplements to get that coverage.

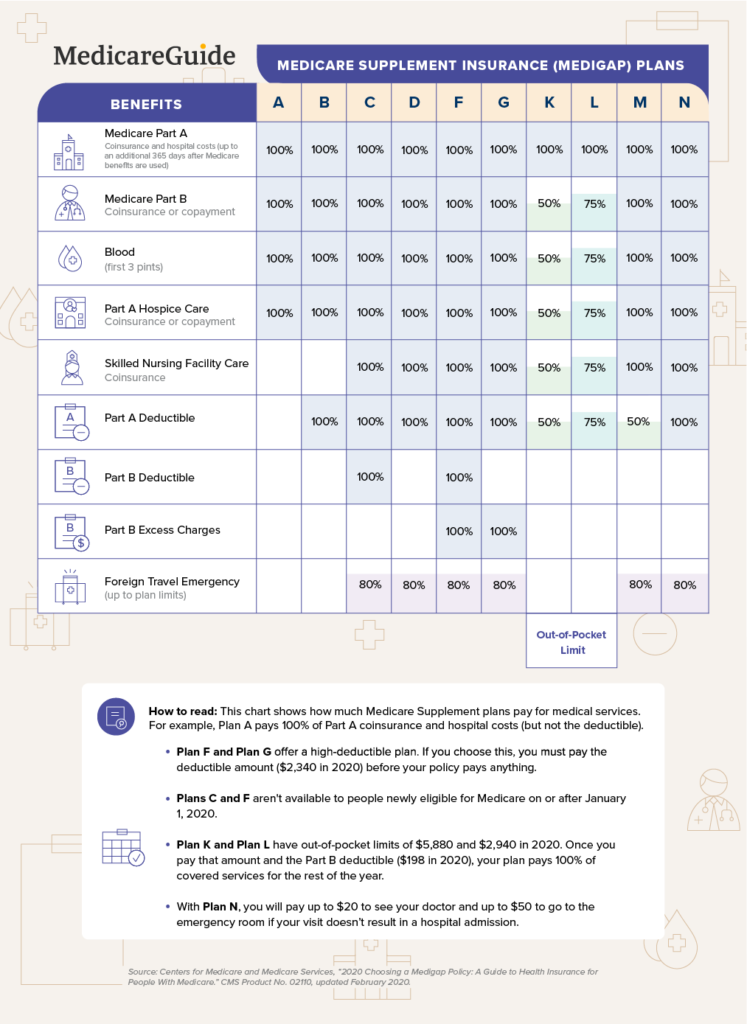

Medigap plans cost approximately $150.00 per person per month. The cost can vary based on your age, location, tobacco use, insurance carrier, and which Medigap plan you select. Plans A through N differ primarily in co-insurance, co-pays, and deductibles—see below. And remember: the Medigap “plans” (A thru N) are different from the Medicare “parts” (A, B, C, and D).

Medicare Advantage plans

The best way to think about Advantage plans is to think of them as a ”bundled” product that includes Parts A, B, C, and D, and sometimes visual and dental coverage as well.

Private insurance carriers such as Blue Cross, Humana, United Health Care, Cigna, etc., offer these plans. The government specifies that they must provide at least what original Medicare (Parts A and B) offers. Still, they usually add more benefits to make their products attractive (free home meal delivery, anyone?).

The most important thing to know about Advantage plans is that they’re managed-care plans with networks, co-pays, and co-insurance. They also have out-of-pocket in-network maximums, which is $7,550 per person in 2021. That means that the most you’d have to pay out-of-pocket for all in-network services are $7,550 and $11,300 for a couple combined in- and out-of-network in a calendar year. Some providers may set the maximums lower, but they can’t go higher than that.

Unlike Medigap plans that average around $150.00/month, many Medicare Advantage plans claim to be “free”—there are zero-premium costs per month. You heard that right—zero premiums!

You’re probably wondering, ”What the catch?” Well, there really isn’t any. They aren’t hiding anything. However, there are trade-offs when you choose one over the other, and that’s the main thing you need to know and what I want to address in this article.

If you’re like me, you’d want a Medigap plan from the chart above that costs zero like Medicare Advantage; one that includes prescriptions, visual, dental, and the other ”perks” you hear about on TV. Sorry, that’s not going to happen; there’s no such thing. (The closest is Medicaid, which varies from state to state and doesn’t typically include visual and dental benefits.)

Trade-offs

You may have read my previous article about Medicare commercials on TV. The next time one comes on, listen for the phrase “things you’re entitled to” (which, as I wrote in that last article, is a little misleading) and the word “free” (which is true but doesn’t tell the whole story). You’ll hear both repeated several times.

If you choose Medigap, you aren’t going to get all the things that friendly announcer on TV talks about in that commercial: the free dental, transportation, meal delivery (yes, some include that), vitamins, gym memberships, trips to the Bahamas (just kidding), etc. Those things aren’t covered by Medicare Parts A and B, and Medigap policies follow original Medicare.

The commercials are for Medicare Advantage plans. And if you pick Medicare Advantage, there’s a trade-off. You may not be able to go to any doctor you want. On the other hand, you may not have to pay a larger premium or no premium at all, depending on where you live.

If you (and your spouse) are relatively healthy and take a prescription or two and typically only visit the doctor once or twice a year for a check-up, you’ll probably gravitate toward a Medicare Advantage plan. After all, it may be free. Why pay more than free if you don’t anticipate a lot of additional medical expenses. Plus, you can go to the gym for free and get your teeth cleaned twice a year for free as well. (Sorry, that trip to the Bahamas won’t be free.)

Meanwhile, your friends with Medigap (if they are a couple) are probably paying $400 plus per month for Medigap, visual, and dental insurance. That’s in addition to the costs for Medicare Part B, which is $297.00 for a couple, but it may be higher based on your modified adjusted gross income (MAGI).

I have a Medigap plan, visual, and dental. And my wife and I were a lot like the couple I described above, with only occasional doctor visits and a few prescriptions. But then my wife had a ruptured appendix last Fall (which required her to be hospitalized but with no surgery) and has been receiving treatment for a torn rotator cuff that may require surgery in the future.

So far, with my Medigap plan, I haven’t paid anything out of pocket for her hospital stay of several days in late 2020. If we had been on a Medicare Advantage plan, we almost certainly had to pay the out-of-pocket maximum for 2020 (assuming all her doctors and services were ”in-network”), which was $8,150 for an individual plan ($16,300 for a couple). (As noted above, the maximum out-of-pocket for Medicare Advantage Plans is lower in 2021.)

So, if I had to pay the maximum in 2020 for my wife’s treatment ($8,150), that would’ve been in place of spending approximately $2,000 for her Medigap supplemental plan. That’s a difference of about $6,000, and the break-even on that is almost three years.

Changing plans

People are turning 65 every day, and they need to start thinking about this two or three months before. Once you get Parts A and B set up with Medicare, you then need to decide which of the two coverage options you prefer—Medigap or Medicare Advantage.

But the situation is different for those already enrolled in one plan or another.

Suppose you have a Medicare Advantage Plan but would like to switch to Original Medicare with a Medigap policy to get better coverage and more options for a serious diagnosed condition. You may run into a problem. You may not qualify for the Medigap plan if you’ve been diagnosed with a condition such as ALS, Cancer, COPD, Diabetes, ESR, or Stroke. You can only opt for Original Medicare (Parts A and B) and pay the 20% that Medicare doesn’t cover (not a very good option) or reenroll in the same or a different Medicare Advantage Plan in your area.

You may run into the same problem if you want to switch from one’s carrier’s Medigap plan to a different carrier’s plan. They can consider pre-existing conditions and can deny coverage or charge a higher premium for it. (A few states have special rules that allow their residents to switch Medigap plans regardless of preexisting conditions. Others allow it at certain times.)

You can, however, change Medigap plans from the same carrier (such as going from Plan C to Plan G). You’ll just have to pay the higher premium.

So don’t assume that you can switch plans at will. When you enroll in Medicare Part B, you have a special six-month period when you can’t be denied a Medigap or Medicare Advantage plan due to a pre-existing condition. It’s your “personal open enrollment window.” But this only happens when you’re a new Medicare Part B enrollee and are over age 65. (Remember, you must enroll in Part A when you turn 65, but many people remain on their employer plan and don’t enroll in Part B until later.)

In my last article on “regret minimization,” I suggested that you pretend that you are older, say 70 or 80 or beyond, and consider whether you might regret a particular decision you make today at that time. A Medicare plan may seem right for now, but what if your situation changes?

It’s hard to cut through all the noise about “free this and free that” and “making sure you get everything you’re entitled to.” Such statements may be “true,” but they are not 100% of the truth. You really have to do your homework to understand the whole truth to make a wise decision. So take the things you hear from TV personalities or your friends with a grain of salt.

Choosing a plan

I want it to be clear that I am not suggesting that Medicare Advantage Plans are bad and that no one should enroll in one. I’m saying that you need to be a wise, educated consumer so that you understand the pros and cons of the different plans and choose accordingly.

One thing that makes it confusing is how the federal government labels the programs. Medicare Supplement plans are called “Medigap” plans, but Medicare Advantage Plans are called “Medicare Part C.” Why do they do that? It makes it sound like you enroll in Parts A and B, and add C and D if you want to—done! Medigap plans (Medicare supplements), which lots of retirees have (including yours truly), don’t even get their own “Part.” What’s with that?

Or, perhaps it’s because Advantage plans are funded by the government in partnership with private health insurance companies, unlike Medigap plans. When you enroll in one, the government transfers money each month to your insurance carrier in return for their services in managing your plan. In doing so, the government knows what they will spend on you each much, versus 80% of your unknown future health expenses under Medicare Parts A and B.

Medicare Advantage Plans are often marketed as “all in one” alternatives to Original Medicare. These plans do include Part A, Part B, and typically Part D (prescription coverage). And, to be fair, they’ll probably have lower out-of-pocket costs than original Medicare.

But to get to the “100% truth,” you need to know that if you enroll in a Medicare Advantage Plan, you’re no longer enrolled in Original Medicare (i.e., no Parts A and B). However (and this is important), you’ll still have to pay a premium to the government each month for Part B coverage (unless you are on Medicaid).

The government collects those dollars and adds more to it and then transfers those dollars to your insurance carrier managing your Advantage plan.

Here are some of the other most important things to know about Advantage plans:

Medicare Advantage Plans vary from state to state. Because commercial carriers provide them, they’re regulated by the individual state insurance commissions.

Medicare Advantage Plans have networks. When you receive a service, you’ll be in or out of the network. Your costs will be lower in-network, but make sure you’d be okay being told which doctors you can and cannot use.

You may pay little or no premium (in addition to the Part B premium), but you will have co-pays and co-insurance fees. As noted previously, they can be high (up to $7,550 per person per year).

Medicare Advantage Plans must cover all of the services that Original Medicare covers. However, a plan can choose not to cover the costs of services that aren’t deemed medically necessary under Medicare guidelines. Advantage plans offer coverage for things that aren’t covered by Original Medicare, like vision, hearing, dental, and wellness programs (like gym memberships). (Not trips to the Bahamas, as far as I know.)

Your plan may require prior authorization. You’ll need to carefully read your plan’s coverage contract to determine which services, or how many, require prior approval.

Costs and trade-offs matter

I said earlier that what I really want is a no-cost Medigap plan. Maybe you would too, but as you now know, there is no such thing (although Medicaid comes close). The thing about Medigap policies is that many can’t afford the additional premiums (in addition to Part B). Plus, they may also need a Part D prescription drug plan. And they may also want a dental and visual supplement, adding more costs.

Now we’re talking at least a few hundred dollars per person per month, so a zero premium ”all in one” Advantage plan may be much more attractive. But remember, you’ll make some sacrifices if you go that route.

The bottom line: Medicare Advantage plans are good for the government (risk transfers to the private insurance carrier). They’re also good for the carriers (their payments from the government are basically guaranteed). One may also be good for you, but as we’ve seen, they’re not everything they’re made to sound like on TV commercials.

That said, I view Medicare and the various Medicare plans as God’s part of God’s gracious provision for those who need healthcare in retirement, which is pretty much all of us. But no plan is perfect. There’re always trade-offs, but what you give up matters. So, if you’re Medicare eligible, before even thinking about one plan or another, think about what kinds of coverage you need, what you’re willing to pay each month, whether you’re willing (and able) to pay out-of-pocket for some services.

Then look at your plan options carefully, make sure you understand all the terms and conditions and associated costs (get advice and counsel if you need it), and come to grips with what you are willing to sacrifice in one type of plan for something you really want in another. And before you decide, visualize yourself 3, 5, 10, or 20 years out and consider whether your decision may be one you might regret should your health significantly deteriorate or you develop a serious condition requiring highly specialized care.