This article is the second of two about retirement account transfers and rollovers. First, we focused on transfers, which I defined as moving assets between two of the same type of retirement account, e.g., from a Traditional IRA with one provider to a Traditional IRA at another.

In this article, we’ll look at rollovers, which are when you move assets between two different types of retirement accounts, such as from a Traditional 401(k) to a Traditional IRA, one of the most common kinds of rollovers.

(Remember, these terms are often used interchangeably, and the IRS doesn’t distinguish between them since most of their rules apply to both. I am making the distinction to more effectively communicate the different options available to you.)

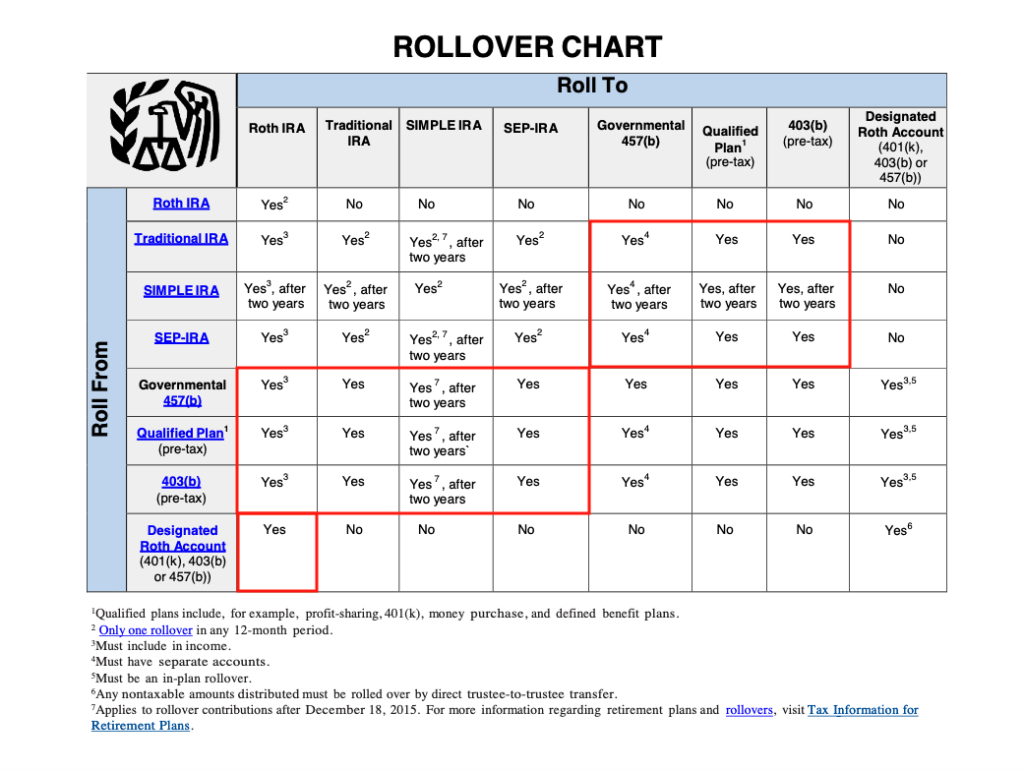

I have modified the IRS Rollover Chart to highlight all the rollover possibilities:

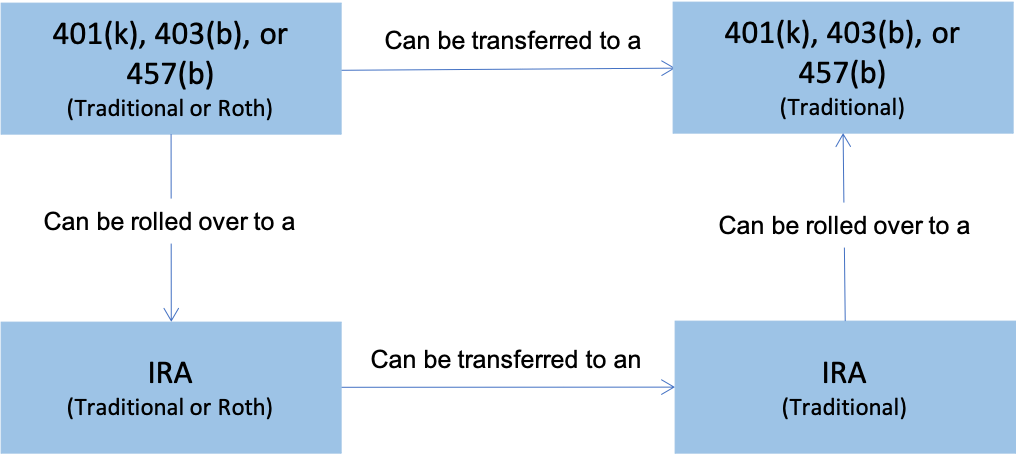

And here again is my simplified diagram showing the most common scenarios:

As you can see from the visuals, you are permitted to do a tax-free rollover from:

- a Traditional 401(k) to a Traditional IRA

- a Roth 401(k) to a Roth IRA

- a 403(b), 457, or Thrift Savings Plan to an IRA

- a Traditional IRA to a Traditional 401(k), including a Solo 401(k)

Note that a Roth IRA can’t be rolled over to a Roth 401(k) due to the IRS’ “Five Year Rule”—more on that later.

A “Solo 401(k)” is an individual 401(k) set up for a business owner with no employees. It can, however, be used to cover both spouses. A self-employed individual or couple can also use it in addition to an IRA. Refer to this IRS publication for more information about retirement account options for the self-employed: Retirement Plans for Self-Employed People.

401(k) rollover to IRA

As said, this is the most common scenario. It usually occurs when you change employers, become self-employed, or retire and want to move your retirement savings from an employer-sponsored plan, such as a 401(k) or 403(b), to an IRA.

And as discussed in the previous article, there are two types of rollover: direct and indirect. And as with transfers, direct rollovers are generally considered the least ‘risky’ in triggering a taxable event.

Some reasons to do a rollover

There are many reasons to consider a rollover:

1 – Simplification through account aggregation and consolidation

If you currently have one or two employers’ 401(k), as well as a Traditional and Roth IRA, it may make sense to consolidate the 401(k)s with the IRA for simplification and ease of management. Asset allocation and account performance monitoring and management are more straightforward with fewer accounts (see #4 below).

Also, when you reach age 72 (it used to be 70½), you will be required by the IRS to take Required Minimum Distributions (RMDs) from your non-Roth accounts. Consolidating your traditional accounts makes it easier to calculate the RMDs and make regular withdrawals.

2 – Access to a broader range of investment options

Many employer plans offer a limited menu of investment options. (There are, however, an increasing number offering a self-directed brokerage account option within their plan, which dramatically increases your options.) You can invest in literally thousands of stocks, bonds, mutual funds, ETFs, and other securities with an IRA.

3 – Lower investment and management fees

It’s important to know what your 401(k) investments are costing you, both in terms of any account management fees (if you and not your employer pay any) and fund fees (some plans include higher-cost mutual funds). These fees can be difficult to identify as they tend to be buried in the minutia of plan and fund documents and disclosures.

If you’re a do-it-yourself investor in your IRA (meaning no management or advisory fees) and invest in low-cost index funds or ETFs, you can keep your costs in the 20 to 80 basis points range (.02% to .08%). That means that for every $100,000 of assets, you’re paying an average of $50 per year in fees. ($100,000 x .0005 = $50).

4 – More control over asset allocation

Consolidation can reduce the number of individual funds you need to hold to build a diverse portfolio. That enables you to view your portfolio’s big picture, making asset allocation, comparative performance, and rebalancing easier. It also helps you better analyze a new investment’s appropriateness and fit.

5 – Account-size benefits

When you consolidate with a single provider, such as Vanguard or Fidelity, a higher account balance may entitle you to greater levels of benefits (or lower cost of advisory fees should you choose that service).

Some reasons not to do a rollover

There are also some reasons not to roll over or wait, which I summarized based on information from Investopedia in a previous article. However, some of them warrant further discussion in the context of rollovers.

1 – Age-related benefits to a 401(k)

Some of the rules that regulate qualified employer-sponsored retirement accounts are different from those that pertain to IRAs. For example, if you want to retire early (or just need the money for some reason), you can start withdrawals from a 401(k) sponsored by an employer you are no longer working for at age 55 without penalty. (You will have to pay taxes on it, however.)

By the way, it doesn’t matter why you left the company—whether you were terminated, laid off, or quit. You can’t be still working there when you start withdrawals.

You can’t start IRA distributions without penalty until you reach age 59½. If you withdraw earlier, you could be subject to a 10% penalty plus taxes.

2 – Cyber threats and other technology risks to consolidated accounts

As I have mentioned previously, I consolidated my Traditional and Roth 401(k)s with Traditional and Roth IRAs I already had at Fidelity. I also consolidated my banking and savings accounts there (as separate cash management accounts).

I’ve been operating in this mode since I retired (over three years) and haven’t encountered any problems (availability or cybersecurity-related), but that doesn’t mean it couldn’t happen. If the company’s online systems should fail or be compromised, I would have virtually no access to any of my accounts.

That said, I like the simplicity of ease of use of having all my accounts in one place. So, I have to weigh that against the potential risks. I know that Fidelity spends a TON on technology and cybersecurity, but the benefits to risks trade-offs are hard to quantify objectively.

I like that Fidelity guarantees that they “. . .will reimburse [me] for any financial losses that result from unauthorized activity on [my] accounts.” And if Fidelity’s systems were down for a day or even a week, it might hardly impact me at all. But if it went on for weeks or months due to a massive or systemic IT failure or cyber hack, that would be a very different situation.

3 – Protection from lawsuits

401(k) plans, deferred compensation plans, and profit-sharing plans are ERISA-qualified retirement plans. But Traditional Roth IRAs and some work-sponsored plans, including SIMPLE IRA and 403(b) accounts, aren’t.

Therefore, there are some asset protection benefits to staying in a qualified ERISA plan relative to protection in bankruptcy and from creditors. However, these are complex matters, and you could consult with an attorney should this be of concern to you.

4 – You’re eligible for a minister’s housing allowance

For those reading this who participate in a 401(k) or 403(b) church or denominational retirement plan and are currently claiming a housing allowance, keeping your savings in your church or denomination’s plan is imperative if you want to continue to claim a housing allowance in retirement.

I strongly recommend this post from Amy over at The Pastors Wallet: “How to Take a Pastor Housing Allowance in Retirement” for more information.

How to rollover a 401(k) to an IRA

Generally speaking, the process for rolling over a 401(k) or another qualified employer plan to either an established or new IRA is the same regardless of whether you do a direct (funds or assets-in-kind are sent directly from one custodian to another) or indirect (funds are sent to you, less withheld taxes, and you roll them over to an IRA within 60 days) rollover.

The primary prerequisite is having either a new or existing IRA to roll over to. If it’s a new account, you need to open one, which you can typically be done online, although you may have to sign some physical documents to finalize things. (This is similar to the transfer process we discussed in the last article.)

Once you have the target account set up, you will need to start the rollover process online or with a rollover form, which authorizes the new provider to initiate the rollover process. As with a transfer, you need all the pertinent information about your current account and custodian.

There may or may not be a funds wire fee involved. Otherwise, there is usually no charge for processing a rollover. (Companies want your business, so they don’t want to make it any more difficult than it has to be to fulfill SEC and IRS rules.)

Rollover while staying invested

I have a friend who once did a rollover and told me that it took so long that he missed a significant positive move in the market. Like many people, he liquidated his investments in his 401(k), and if my recollection is correct, the provider sent a check to the new IRA provider. His money was not invested for the time it took for that process to complete and for him to reinvest it in his IRA.

There is a way to minimize or eliminate this, but it depends on whether your 401(k) provider also offers IRAs (or, even better, you already have an IRA with them).

In that case, you can move the assets ‘in-kind’ (moving fund shares instead of cash) while staying with the same provider. (My brokerage, Fidelity, can do that. But, when I retired, my 401(k) was not with them, though my IRA was, so I had to use the direct rollover method, which took a few days to complete.)

Once you have moved the money to an ‘in-house’ IRA, you can keep it there (if you want to stay with that provider), or you can do an IRA transfer (see the previous article) to a different provider. Both keep your money in the market while the transfer is being processed.

IRA rollover to 401(k)

This is a less common scenario than the 401(k) to IRA one just discussed, but there are reasons why someone might consider it:

- Account consolidation

- 401(k) loan options

- Early withdrawals (prior to age 59½)

- Delay of RMDs

A key factor in this decision is whether your employer’s 401(k) plan accepts IRA rollovers (not all do). If so, request a direct transfer to avoid any income tax or the 10% early withdrawal penalty.

What if you’re self-employed?

The self-employed will usually have a Roth or Traditional IRA, SIMPLE IRA, or Roth or Traditional Solo 401(k). The rules are basically the same, but to summarize:

- A Roth Solo 401(k) can only be rolled over to a Roth IRA.

- A Traditional Solo 401(k) can be rolled over to a Traditional IRA (it can only be rolled over to a Roth IRA with a Roth Conversion).

- A Traditional IRA can be rolled over to a Traditional Solo 401(k).

- A Traditional IRA can be rolled over to a SIMPLE IRA under certain conditions (refer to the IRS chart above).

- A Roth IRA can’t be rolled over to a Roth Solo 401(k). (The reason for this is the Roth IRA “Five Year Rule.”)

Understanding the Roth IRA “Five Year Rule”

One of the great things about Roth IRAs is that you can withdraw your contributions (but not earnings) without penalty at any age. (Yes, that’s true, but I don’t recommend it unless you absolutely have to. Better to let them stay in the account and continue to grow tax-free.)

Also, at age 59½, you can withdraw both contributions and earnings with no penalty with one big caveat: The “IRS Five Year Rule.” This rule states that assets have to be held in a Roth IRA for at least five years before they can be distributed tax-free.

When the clock starts

If you have a single Roth IRA account, the clock starts when you make your first contribution. If you own multiple accounts, the five-year clock starts with your first contribution to a Roth IRA, and it doesn’t have to be the one you begin withdrawing funds from later.

In other words, you only have to satisfy the five-year requirement for one Roth IRA—the IRS considers any other Roth IRA to have been held for five years. Plus, rollovers from one Roth IRA to another don’t reset the five-year clock.

There’s also a five-year rule for withdrawals from Roth IRAs containing traditional IRA assets converted to Roth assets.

In those cases, the five-year rule starts when you convert from a Traditional IRA to a Roth IRA and fund the account. It’s also important to know that each Roth conversion has a five-year period. (This is all fairly complex, so best to work with an advisor or accountant on this if it applies to you.)

Implications for different types of Roth accounts

The Five Year Rule applies differently due to different distribution rules for different types of accounts.

For example, the IRS rules for partial distributions from a Roth IRA before age 59½ differ from those from a Roth Solo 401(k) before age 59½. The difference has mainly to do with the ordering of the different distributions.

For both Roth IRAs and 401(k)s, a tax-free distribution is what’s called a “qualified distribution” (QD). The rules for QDs are more favorable for Roth IRAs than those for Roth 401(k)s.

For example, you can withdraw for a first home purchase from a Roth IRA but not from a Roth 401(k). Also, the Five Year Rule for a Roth starts with your first contribution to any Roth IRA, whereas for Roth 401(k)s, the five-year holding period applies to each plan you have.

The rules are also different for “non-qualified distributions” (NCDs). (NCDs are distributions that could trigger taxes and penalties.) The regulations for NQDs from Roth IRAs are more favorable than Roth 401(k)s.

That means that you would sequence your distributions such that you withdraw from a Roth IRA, taking contributions first and earnings last. Only funds that would be taxable before age 59 ½ would be withdrawn after all other Roth IRA funds have been distributed.

But for Roth 401(k)s, the rules are different. An NQD is subject to the “pro-rata rule,” and a portion of each distribution will be taxed.

This can be more than a little complicated and confusing, so if this pertains to your, refer to the IRS rules or speak with your tax accountant or financial advisor for more information and guidance.

Plan with wisdom, implement in faith

I trust that the information I provided in this article gives you a helpful set of criteria to make the best decision for your situation.

Although most people do a rollover to an IRA by the time they retire or shortly after that, there is no one-size-fits-all answer for everyone.

So, as with everything about the ‘in the weeds’ aspects and mechanics of being wise stewards of our retirement savings, seek wisdom (Prov. 2:6) and put together a plan you can implement in faith:

- Get informed (know the rules that apply to your situation)

- Think about timing (it matters, sometimes a lot)

- Get help (tax and investment advice)

- Pick a good provider (use one lots of experience with rollovers and low-cost investments)

- Pull the trigger with faith and confidence (if and when it makes sense for you)