In the last article, we discussed how, over long periods, you have a high probability of growing your wealth (a/k/a “net worth”) by investing in the stock market.

You were first introduced to stock market returns in our earlier article on investing, particularly how real returns are calculated by adjusting market returns for fees, taxes, and inflation. We represented it with this simplified formula:

∑IEt+1 = Market Return (Growth + Dividends + Interest) – Fees – Taxes – Inflation

In this article, we’re going to take it a step further. We’ll unpack what the cumulative interest earned term (∑IEt+n ) really means and how the markets, contributions, dividends, interest, and time work together to drive exponential investment growth over the long haul.

When we talk about investment growth, we’re referring to how your money grows when it’s put to work in things like stocks, bonds, real estate, or even cash-based investments. That growth happens in two main ways:

Investment contributions – These include your savings, regular deposits, and (for retirement accounts) any employer matches.

Investment gains – This is the growth generated by the market: capital appreciation, dividends, and interest earned, especially when reinvested.

These elements combine into a simple formula for how your investments grow over time:

Investment Balancet+n = Investment Balancet + Investment Contributionst+n+ Investment Gainst+n

Here:

t = the starting point (e.g., beginning of the year)

t+n = a future point (e.g., one year later)

This breakdown helps you clearly see where your growth is coming from. If you want to isolate just the gains from the market, you can rearrange the equation:

Investment Gainst+n = Investment Balancet+n – Investment Balancet – Investment Contributionst+n

This formula tells you exactly how much of your growth came from market performance, not just how much you contributed. It makes the relationship between time, reinvestment, and growth more apparent. This is how you track the real power of compounding, which we’ll discuss in the rest of this article. It also reminds you that while saving and contributing to things like retirement accounts are essential, letting your investments grow and reinvesting their earnings over time is what fuels long-term wealth.

We now turn to one of the most potent drivers of long-term investment growth and a foundational principle in personal finance: the Time Value of Money (TVM). At its core, TVM reminds us that a dollar today is more valuable than a dollar tomorrow, not because of inflation, but because of what that dollar can become if it’s invested and allowed to grow. It’s the idea that time + money + compounding = exponential growth potential, and understanding this principle can change how you think about saving and investing for the future.

Let’s put some numbers to this concept of compounding. Suppose you invested $10,000 and let it sit for 40 years, earning the historical average stock market return of around 9% per year. By the end of that period, your account would grow to approximately $314,094. That’s what we call the future value (FV), what your money becomes after compounding over time. Flip it around, and you see that the present value (PV) of $314,094 received 40 years from now is just $10,000 today.

But here’s what’s truly remarkable: you didn’t add a single dollar after the initial investment. The growth occurred because you earned 9% each year, and then I earned 9% on the 9% you had made the previous year, and so on. That snowball effect is the essence of compounding. It’s not just earning a return; it’s earning returns on your returns. And over long periods, that’s where the real magic happens.

That’s why, when it comes to investing, the earlier you start, the better, if you can. That’s not just a nice saying, it’s a mathematical reality. Because of the compounding effect, every dollar you invest in your 20s or 30s can be worth many times more than a dollar invested in your 40s or 50s.

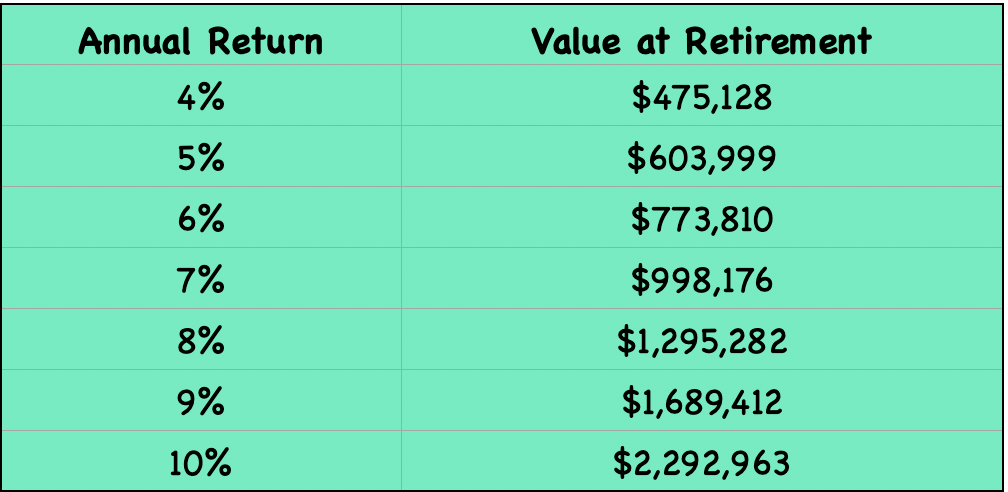

To illustrate, suppose you invest $5,000 per year for retirement from the age of 25 to 64. That’s 40 years of steady contributions–$200,000 in total. Here’s what that can grow into at different average annual returns:

Notice the difference between 6% and 7% returns: over $200,000; or 9% and 10% returns: over $600,000! The latter is more than 3 times your total investment of $200,000, just from a 1% improvement. Let that sink in for a minute. Reasonable returns, over long periods, create future value that is a multiple of the total of your contribution.

But the Time Value of Money isn’t just for interesting math calculations; it’s the foundation of almost everything in personal finance and investing:

Banks use it to structure mortgages and car loans.

Retirement plans like your 401(k) use it to estimate how much you’ll need to save to hit your goals.

Investors use it to value companies and compare investment opportunities.

And every decision you make about spending vs. saving involves some form of time tradeoff.

The key to successful investing is to harness the power of compound growth, working for you, not against you, as it does with debt. Compounding is a fascinating thing. On the spectrum of real-world magic, compound growth falls somewhere between the water cycle and magnetism. (Actually, there’s no magic involved, although Albert Einstein once called it one of man’s greatest inventions. I suppose he liked it because it involved math. But man didn’t invent it, God did.)

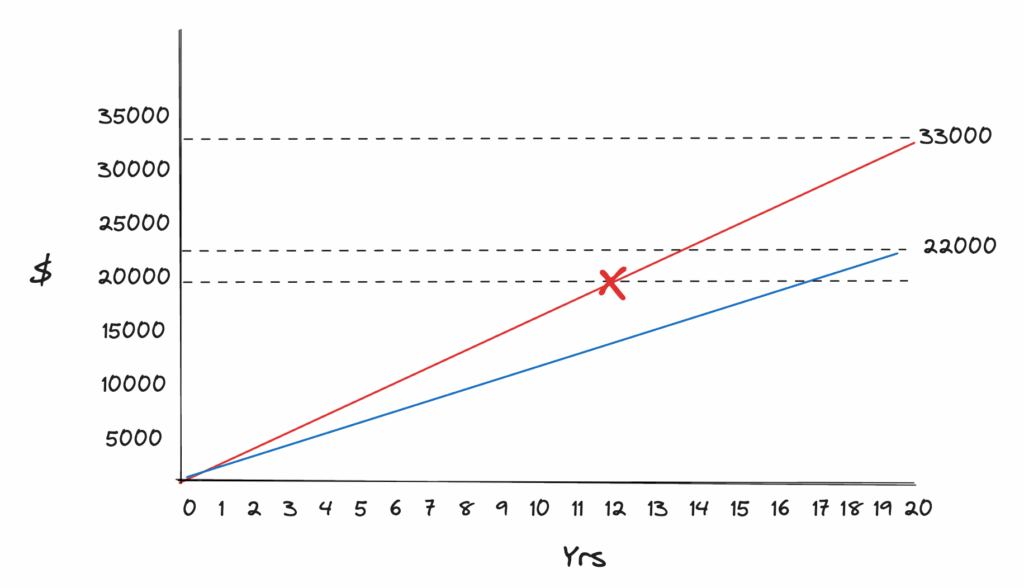

The concept of exponential growth can be a challenging concept to grasp. A great way to visualize it is what’s called the “Rule of 72”:

This rule says that the number of years it takes to double the value of an investment is 72 divided by the compound interest percentage earned by the investment. For instance, As shown on the slide, if you were to invest $10,000 with compounding interest at a rate of 6% per annum, the rule of 72 gives 72 ÷ 6 = 12 years required for the investment to be worth $20,000; it would double again and be valued at $40,000 in a total of 24 years, and so on.

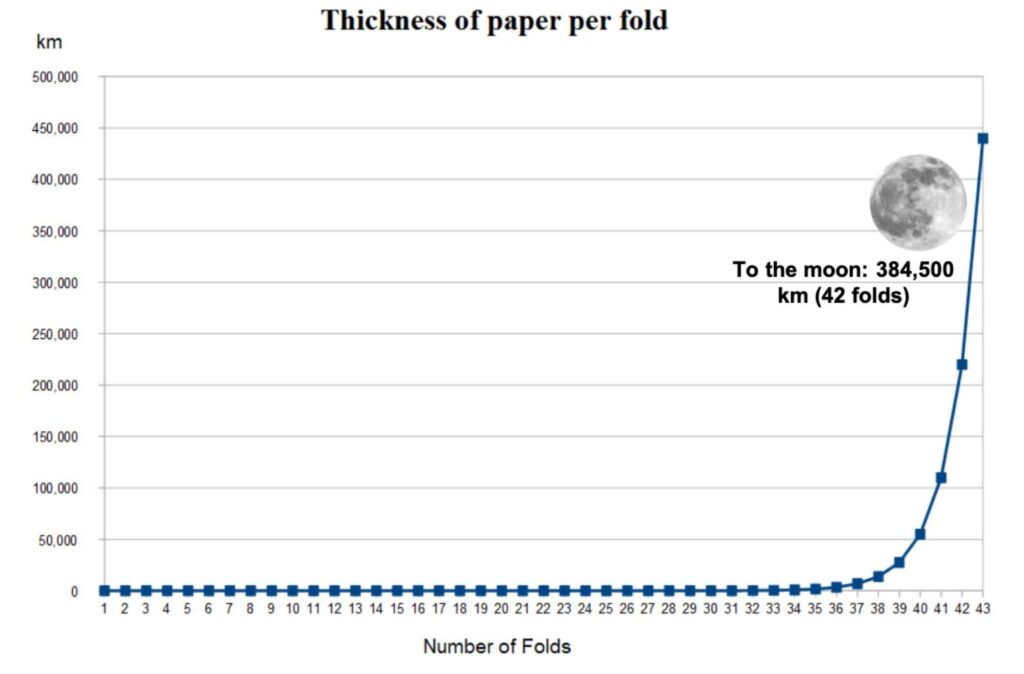

Here’s another fun example: Did you know if you fold a standard sheet of paper in half 42 times, it will reach the moon? In the folded stack, there will be almost 4 trillion layers of paper when you get there, depending on the thickness of the individual sheet. (I think the record of actually doing this is 18 times or something like that before you can’t physically fold it anymore, but you get the point.)

Note also the slope of the simple interest line versus the compound interest line—the longer the time frame, the steeper the slope becomes (meaning growth is gradually accelerating). This is the exponential math at work that Einstein was fascinated by. The principle of compounding means the paper stack doubles in size every time it is folded in half. It’s not 42 times the paper thickness—it’s 2⁴² times! That’s over 4 trillion layers thick.

If you could fold a piece of paper 42 times (which you can’t, practically speaking), it wouldn’t just be a tall stack—it would reach the moon and back. And here’s the kicker: most of that explosive growth happens in the last few folds. The final fold doesn’t take you from the ground to halfway; it takes you from halfway to the full distance—all the way to the moon. That’s the magic of compounding—it looks slow at first, then suddenly becomes unstoppable.

That is the main reason for starting to save sooner rather than later, even if it means foregoing your daily latte and saving the money. Once you have your emergency fund in place and have paid off your credit card debt, it’s time to start. Remember, growing wealth happens little by little over time (Proverbs 13:11).

I trust this gets you a little excited about investing, but you have more to learn. But before we move on, I want to tell you about the kind of investing that should make you even more excited: investing in eternity (a/k/a “treasure in heaven”—Matthew 6:19-21).

Any discussion about investing must have at its foundation the biblical principle of “investing in eternity,” what the Bible calls building “treasure in heaven”. We do that by investing our time, talents, and treasure into the building of God’s Kingdom on earth. In doing so, we will also be “storing up treasure in heaven and growing rich toward God.” If our hearts and lives are anchored to that, we can plan, save, and invest for the future with a clear conscience without becoming the “rich fool” that Jesus talks about in Luke 12.

For reflection: When you think about investing, does your vacation fund or retirement account come to mind? Or do you think about how you want to first invest in the Kingdom of God? We’ve seen that saving and investing can be good uses of the money that God gives you to steward, but a much higher use is to invest in loving and caring for others, funding the work of your church, and spreading the good news of the gospel around the world. Mediate on and pray about that before you make any significant investment decisions. And when you do invest, remember that you are investing God’s money. Jesus’ parable of the talents (Matthew 25:14-30) commends those who wisely multiplied what was entrusted to them, not through high-risk speculation, but through faithful and wise investing for productive purposes.

Verse: “But seek first the kingdom of God and his righteousness, and all these things will be added to you” (Matthew 6:33, ESV).