If asset allocation is your blueprint for your overall investing strategy, then “asset classes” are your building materials. These are the smaller blocks that comprise the larger blocks, such as stocks, bonds, and alternatives.

In this article, we’ll explore the different types of investments that make up a diversified portfolio. Think of them as ingredients in your investment recipe. Each one adds a unique flavor: some are spicy, some are stable, but all are essential in the right mix.

First, let’s walk through the major asset classes, what they bring to the table, and how they fit into a strategy that honors both biblical stewardship and long-term wealth building.

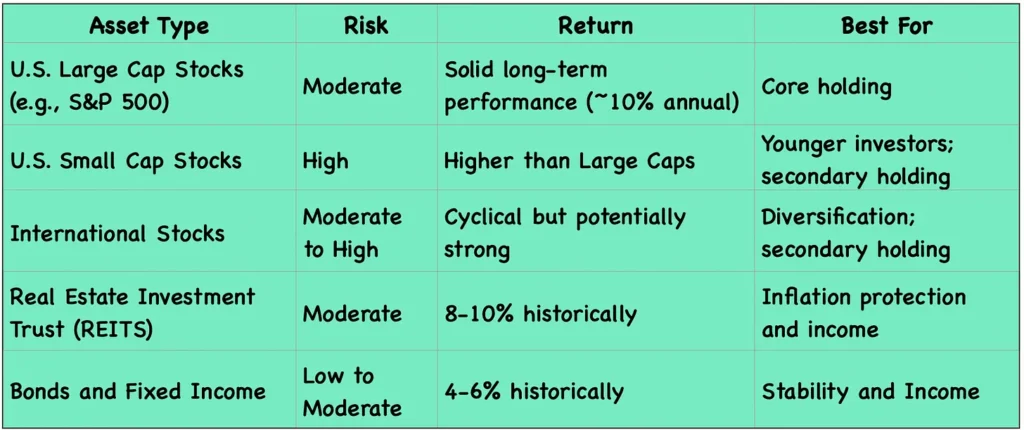

An asset class is simply a category of investments that behave similarly. Remember our risk/return chart in the previous article? If you do, you’ll recognize most of these; they’re the most common:

1. U.S. Large-Cap Stocks: These are America’s biggest companies—Apple, Microsoft, Google, etc. They form the foundation of most portfolios and represent the broad U.S. economy.

2. U.S. Small-Cap Stocks: These are smaller companies with higher growth potential and higher risk. Historically, they’ve outperformed large caps over the long run.

3. International Stocks: These include developed markets (such as Europe and Japan) and emerging markets (including India, Brazil, and others). While sometimes volatile (especially emerging markets), they provide diversification beyond U.S. borders. In some decades, international stocks outperform U.S. equities, so don’t miss out by staying too “home-biased.”

4. Real Estate (REITs): REITs allow you to invest in real estate (commercial buildings, apartments, warehouses) without becoming a landlord. REITs can be an excellent hedge when inflation rises, since rental income tends to grow with it.

5. Bonds (Fixed Income): Bonds provide stability. They don’t grow as fast as stocks, but they help smooth out the ride, especially when markets get turbulent. Bonds shine when stocks stumble. They also help you stay invested by reducing fear-driven decisions.

There are others in the “alternatives” category (commodities, cryptocurrency, and private equity), but for most long-term investors, these five options offer more than enough diversification and performance potential.

Here’s a chart I put together that shows the fundamental differences between these different asset classes:

Here’s the real superpower of diversification: asset classes don’t all move together. When one zigs, another zags (usually). That means lower volatility and steadier growth. The table below is a 20-year correlation matrix (2004-2024). A lower correlation indicates better diversification, resulting in less overall portfolio volatility and smoother returns.

From this, you can see that U.S. and international stocks are somewhat correlated, but there is some diversification there. Bonds are much less correlated with U.S. stocks, and even less so with international stocks. I think you get the idea. Rarely do uncorrelated assets move in the same direction, but it does happen sometimes.

Now comes the big question: "How much should you own of each asset class? I said before that there’s no one-size-fits-all answer, and I can’t tell you what precisely the best answer is for you. I can, however, suggest a sample allocation for a 30-year-old with a high risk tolerance (age minus 20 years in bonds = 30 – 20 = 10) using these five asset classes.

Begin with an overall asset allocation of 90/10. Then diversify across the stock portion (90%) using large-caps, small-caps, and REITs (if you wish). The remaining 10% is allocated to bonds.

This mix offers growth, income, and a buffer when markets get jumpy (and bumpy). You have a lot of flexibility here. You can increase or decrease any of these asset classes based on any of the factors we have already discussed.

You may be surprised to learn that as of today (June, 2025,) the U.S. accounts for 62.6% of global market capitalization, while international stocks make up 37.4% (based on this fund description at Vanguard: Portfolio Composition ⇒ Weighted Exposures ⇒ Markets) so this model portfolio technically has an “equity home bias.”

So why invest in international stocks in the first place? Well, as we’ve seen, they can be an excellent diversifier. But also because neither you nor I have a crystal ball. International stocks haven’t done that great in the past, but they may do better in the future.

A 30-year-old who uses this sample portfolio should probably de-risk their portfolio at some point in life through the introduction of additional fixed-income investments. But they have many decades ahead of them to ride out the volatility of a 90% stock portfolio.

I want to encourage you that you don’t need to be an expert in every market to build a wise portfolio. You just need to:

- Know what each asset class does;

- Own a little of each;

- Stay consistent over time (i.e., ride out the market storms); and

- Adjust as your risk capacity or tolerance changes.

But there are a few more critical decisions to make, such as how to invest in each of these asset classes and whether you want to do it yourself or hire someone to do it for you. I’ll tackle those things in the following few articles.

For reflection: Diversification is more than just a financial strategy; it’s an ancient principle of wisdom. Ecclesiastes (see verse below) reminds us to “cast your bread upon the waters” and to “divide your portion to seven, or even to eight,” because we cannot know what trouble may come. Spreading your investments wisely reflects humility before God’s sovereign control of the future. Take time to consider: Are you going for the “hot stocks” and relying too heavily on them, or are you wisely diversifying your resources, trusting the Lord as you do?

Verse: “Cast your bread upon the waters, for you will find it after many days. Give a portion to seven, or even to eight, for you know not what disaster may happen on earth. If the clouds are full of rain, they empty themselves on the earth, and if a tree falls to the south or to the north, in the place where the tree falls, there it will lie. He who observes the wind will not sow, and he who regards the clouds will not reap. As you do not know the way the spirit comes to the bones in the womb of a woman with child, so you do not know the work of God who makes everything. In the morning sow your seed, and at evening withhold not your hand, for you do not know which will prosper, this or that, or whether both alike will be good” (Ecclesiastes 11:1-6, ESV).