I firmly believe that if you apply everything we’ve discussed so far, you’ll have little need for a paid financial planner/advisor in your 20s or 30s. (You might still want a tax “guy” or “gal” if you don’t keep up with yearly changes.)

But that may change as you grow older, your career advances, or you get married and have a family.

No matter what, don’t end up like a young couple I recently worked with: they had less than $10,000 in an IRA with a well-known financial advisory firm and were paying almost 2% a year (around $200) for “investment management services.” We covered fees back in a previous article, but I want to emphasize again how important it is to know how an advisor is compensated if you ever choose to work with one.

Advisory fees come from your investments’ “bottom line” and directly affect your annual returns, and they also “reverse compound.” As such, they negatively impact “interest earned” (IE) and the financial life equation (FLE), much like “interest paid” (IP).

On the other hand, having the right advisor in the right situation could be a net positive to your FLE if the advisor provides you with wise guidance and keeps you from making a big mistake you’d have a hard time recovering from. A good advisor can help you stay the course, especially when things get tough, which can pay big dividends over the long run.

Some people need an advisor because they’re too busy, too emotional about money, or they don’t understand financial concepts and have no interest in learning. Others don’t, especially if they enjoy learning about investing and feel comfortable picking and rebalancing a low-cost portfolio. Someone with a little time, knowledge, and interest, even if only in their 20s or 30s, can manage this. And keep in mind how simple (and super-inexpensive) it is to invest in a simple target-date fund.

If you decide to be a “do-it-yourselfer” (DIY), the best thing you can do is educate yourself about personal finance and stewardship; not to become an “expert,” but to confidently and faithfully steward your resources. When you’re young, investing can be relatively simple: save money in your 401(k) or IRA (or both), invest in a few index funds, and let it grow. But as your savings grow and life gets more complicated, you’ll eventually face a bigger question: Should I keep managing this myself, or is it time for professional help? How can I know?

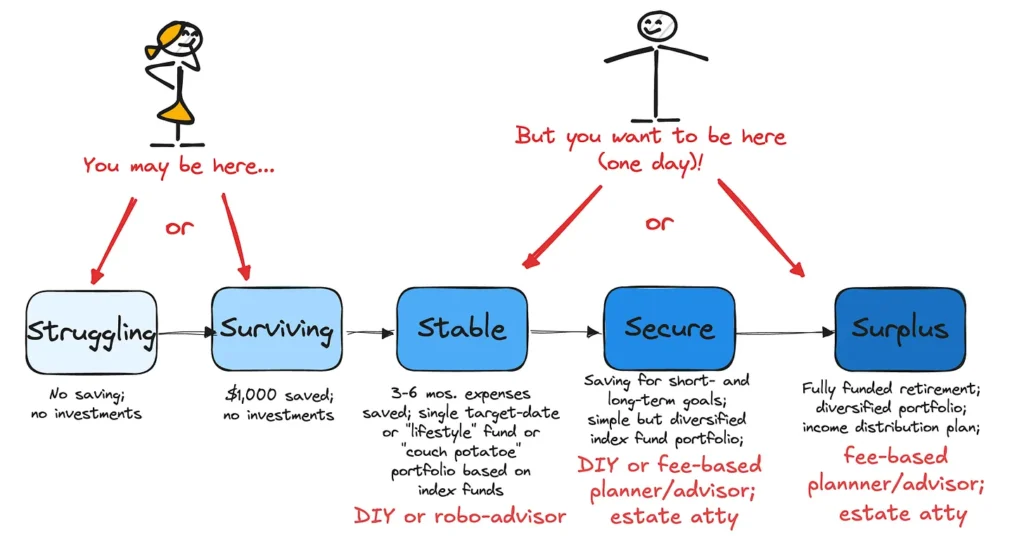

Your financial life may get more complex as you age. The graphic below illustrates how your savings and investments might mature over time and what your retirement portfolio might look like. These life stages are aspirational targets; everyone’s situation will differ. However, what most people have in common is that things do tend to become more complex as they age.

As shown in the graphic, by the time you reach the “secure” stage, unless you’re genuinely comfortable making your own decisions and have a working knowledge of investing (read, study, talk to others), consider getting some help. Additionally, in later life, converting your savings into a lifetime income stream in retirement is no small feat. You’ll need to plan withdrawals, manage taxes, and stay calm during bear markets. That’s when a trustworthy advisor can add real value, if you choose wisely.

Find a knowledgeable, humble, conscientious, wise, and godly financial advisor. (You might want to check out Kingdom Advisors.) You want someone with experience in good times and bad, not a newbie who has just obtained their Series 7 license. You should usually avoid stockbrokers and insurance salespeople who earn commissions; you’re better off with a “fee-only” financial planner or advisor who follows the “fiduciary standard.”

The “big 3” financial firms–Fidelity, Schwab, and Vanguard–all offer fiduciary advisory services. The fiduciary standard requires the advisor to act in your best interest, prioritizing your interests above their own. If your advisor won’t clearly explain how they’re paid, or you can’t understand it, that’s a huge red flag.

If you hire a financial advisor who invests in actively managed mutual funds for you, be aware that there could be multiple fees involved. These can be tricky to untangle, even for your advisor. Always ensure that the service’s value and your portfolio’s performance justify the costs (as compared to simply investing in a target-date fund or low-cost index funds on your own).

Finding the right advisor can be more challenging than you might think. “Financial advisor” is a broad term. You’ll see titles like Investment Manager, Wealth Manager, Financial Planner, Stockbroker, Financial Consultant, and more. They might work for banks, brokerage firms, insurance companies, or run an independent practice. Some are genuinely client-focused planners, or they coordinate a team of planners and portfolio managers. Others are mostly sales representatives for their company’s products (not always a bad thing, but it's essential to know the difference).

Once you find one, ensure you understand how they’ll be paid. Here’s a brief review:

- Commission-Based: They earn money by selling you stuff: mutual funds with sales loads, annuities, insurance, etc. Upfront commissions can eat up 3–5% (or more) of your investment, money that could have been compounding for you instead.

- Assets Under Management (AUM): This fee-based model entails paying an annual percentage of the assets they manage, typically ranging from 0.5% to 1.5%. For a $300,000 portfolio, a 1% fee equals $3,000 each year. Bigger portfolios mean bigger fees, and some advisors won’t work with clients below a certain amount.

- Fee-Only or Hourly: A growing number of planners charge by the hour or project, like $200/hour or $1,000 for a custom retirement plan. This “fee-for-service” approach can be cost-effective if you just want a second opinion or a one-time plan.

If you’re not ready for a human advisor, robo-advisors are worth considering. A robo-advisor is an automated investing tool. You answer a few questions, and an algorithm picks your fund mix, rebalances it, and keeps you on track. They have improved significantly in recent years and typically charge about 0.25%–0.50% per year, which is usually far less than most “huma-advisors.”

Popular robo options include Betterment, Wealthfront, Schwab Intelligent Portfolios, Fidelity Go, and Vanguard Digital. For simple, low-cost investing, a robo can be a great way to start. Still, many people will prefer the personal touch, an advisor they can look in the eye and ask, “What should I do?”. (A good one will usually say, “nothing”.)

There are a few other things you may want to know about a potential advisor:

- What experience do they have? A fancy credential (like CFA or CFP) is good, but that plus experience is even better. The ability to help you navigate a prolonged bear market is almost priceless.

- What is their investing and portfolio management strategy? Do they favor actively or passively managed funds? Do they lean toward low-cost, index funds?

- Do they have a specialty area? Young couples? Professionals? Entrepreneurs? Near retirees?

- What do their clients say? Check reviews, ask for references, and read their firm’s disclosures. You can also look up an advisor on the Financial Industry Regulatory Authority (FINRA).

There’s one more excellent option for Christian investors: it’s a service called Sound Mind Investing. They offer, “…time-tested, objective strategies for mutual fund investing (including specific fund recommendations), along with biblically informed, practical teaching on a range of personal-finance subjects.” Part of their service includes a variety of model investment portfolios tailored to different risk profiles, which you can follow yourself for a small annual fee. If a hybrid approach appeals to you, I strongly recommend that you take a look.

The good news is that you don’t have to go it alone, but you also don’t have to overpay. Great advice is worth paying for if you get clear value in return. Understand the costs. Know how your advisor gets paid. And make sure they always put your interests first. Do that, and you’re very likely to get your money’s worth.

For reflection: One of the things that gets investors into trouble, leading to underperformance and sometimes unnecessarily large losses, is pride. You need to honestly assess both your risk tolerance and your ability to stay the course when the going gets tough. If you’re sure you can DIY, you may still need input and advice; don’t presume too much, especially if you don’t have a lot of experience. If you think you might struggle, you’re probably a good candidate for an advisor, especially if you're overwhelmed by investing and recognize that you’ll need help. Whether you DIY or delegate, wise advice is worth seeking and worth paying a fair price for when it truly serves you. Humbly acknowledge your need, ask God for wisdom in finding a good, low-cost fiduciary, and get on with life.

Verse: “Plans fail for lack of counsel, but with many advisers they succeed” (Proverbs 15:22, ESV).

Resources:

Robo Advisors:

Websites:

Books: