This article is part of the Retirement Financial Life Equation (RFLE) series. It was initially published on January 18, 2023, and updated in January 2026.

Suppose you’ve decided to keep a portion of your portfolio in bonds, perhaps with a higher allocation percentage than stocks. In that case, you have another decision: whether to invest in individual bonds or a bond fund.

With interest rates at levels we haven’t seen since before the 2008 financial crisis, some folks (including yours truly) wondered in 2023 if they should try to “lock in” these higher yields by purchasing individual bonds and holding them to maturity. Or is it better to stick with bond funds?

It’s now three years later, having navigated the 2022-2025 period with both individual bonds and bond funds in my portfolio, I can now provide practical, experience-based guidance on this question. The short answer: bond funds continue to serve me well, though individual bonds and bond ladders have specific uses where they excel.

The improved yield environment that prompted this question in 2023 has continued into 2025. Current yields remain attractive (however, as I write this the Fed has been reducing the Fed funds rate):

- Investment-grade corporate bonds: 4.25-5.25% (5-10 years)

- Treasury bonds: 4.0-4.5%

- TIPS: ~2% real yield + inflation protection

- Bond fund yields: 4-5% across various durations

This makes the choice between individual bonds and funds more nuanced than during the ultra-low rate era, when funds were the obvious choice for most investors.

Why the sudden interest in individual bonds?

We first need to review how bonds work.

Bonds pay interest based on their “coupon rate.” The coupon is the interest rate paid by the bond. The rate is set when the bond is issued and doesn’t change. For example, a $10,000 bond with a coupon rate of 3% will pay $300 in annual coupons for the life of the bond—a yield of 3% on the bond’s original face value, known as its “par value” (in this case, $10,000).

A bond’s coupon rate differs from its yield. Yield is the actual return from a bond (or bond fund). A bond’s yield is the coupon rate divided by its current market price.

For example, a bond initially issued at a par value of $10,000, now priced at $9,500 with a coupon rate of 3%, has a market yield of (0.03 / 0.95) = 3.16%, which is 0.16% higher than the original yield of 3%.

Thus, if interest rates rise (or fall), the bond’s yield will change, but the coupon rate will not.

A bond’s price and its yield are inversely related. When interest rates rise, and bond prices fall, the yield increases. That’s because the coupon rate (unchanged) is a larger percentage of the bond’s current price.

If rates fall and bond prices rise, the yield will decrease—the coupon rate is a smaller percentage of the higher bond price.

However, none of this matters if you buy a bond paying a coupon of 3% and hold that bond to maturity. The market price may fluctuate due to interest rate changes, but you’ll get the promised coupon payments and the return of the bond’s par value.

This fundamental mechanic hasn’t changed, but the 2022-2025 experience provided a powerful real-world demonstration. When the Fed raised rates aggressively in 2022, bond prices fell sharply. Individual bondholders who held to maturity were unaffected by price fluctuations; they continued to receive coupon payments and received their principal at maturity. Bond fund holders, however, saw their fund values decline significantly.

This experience reinforced a key advantage of individual bonds: price certainty if held to maturity. However, as we’ll see, this advantage comes with trade-offs.

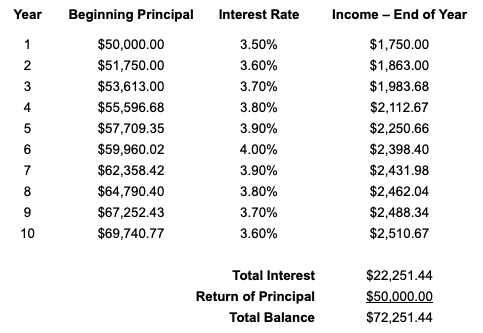

This simple spreadsheet illustrates how this would work if you invested $50,000 in a one-year bond and then let it mature, and then rolled it over into another one-year bond, and repeated that process for ten years at rising and then falling interest rates:

As you can see, you’d never lose money on your original principal amount ($50,000) and would receive total interest (coupon payments) of $22,251. At the end of ten years, you’d have $72,251 ($22,251 + $50,000).

Since interest rates are at normalized levels (~4% for high-quality bonds, but falling slightly), the promises of both fixed coupon payments (which retirees value as income) and the total return of principal by holding bonds to maturity (regardless of the direction of rates) are attractive. This attractiveness has increased relative to the ultra-low-rate environment of 2015-2021, when individual bonds offered little appeal.

Holding individual bonds

Individual bonds (or an individual bond “ladder,” which is built holding individual bonds with different maturities) differ in many ways from a bond fund. Still, both are good investing tools, depending on your situation. As we’ll see, individual bonds will be better for some, and a fund will do just fine for others.

When interest rates rise, the value of all bonds declines—both individual bonds and those held in funds. So how would having an individual bond be better than a bond fund?

If you buy individual bonds and hold them to maturity (which may not be possible if they are “callable“), you’ll get your original investment back—its “par value.” However, you’ll receive non-inflation-adjusted dollars that are worth less than when you bought the bonds (unless deflation occurred during that period).

Call risk deserves emphasis in the current environment. Many corporate bonds issued during the 2020-2021 ultra-low-interest-rate period had call provisions that allowed issuers to redeem them early. As rates rose in 2022-2024, these bonds became unlikely to be called; issuers aren’t going to refinance 2-3% debt at 5-6%. However, if rates fall significantly, call risk returns. Always check call provisions when purchasing individual bonds.

For example, if you own a $10,000 Treasury bond with a 5-year term and a coupon rate of 2%, you’ll receive $100 every 6 months ($10,000 × 0.02 ÷ 2 = $100). Assuming you bought it when it was first issued, at the end of 5 years, you’ll also receive your entire $10,000 back.

Your total earnings for the five years will be $1,000, or 10% ($200/year x 5 years = $1,000, which is 10% of $10,000). (Note: This is different from a bond’s “yield to maturity,” a more complex calculation that’s a discussion for another time.)

Suppose that five-year Treasury bonds are currently yielding 4%. The market price of your 2% bond will go down, but you’ll still receive the 2% coupon, plus you get the money you paid for the bond back at par value if you hold it to maturity.

But what if you sell your 2% bond and buy a new issue paying 4%? Our intuition tells us we should be better off in the long run, but are we?

No, not really, and here’s why: When you sell the 2% bond, you’ll take a loss—you’ll get less for the bond than you paid for it. If you sold 2.5 years into the five-year term, you’d get about $9,500 instead of the $10,000 you invested initially. That’s a loss of $500 or 5%.

However, you’ll earn an additional $200 a year in interest (based on the higher 4% interest rate) for the next 2.5 years, and your interest payments will total $1,000, which equates to the $500 loss of principal plus the $500 you would have received if you’d kept the original bond.

To sum up: you’re no better off than you were in the first place.

That said, you still have another 2.5 years to hold the new bond, and you’ll get the higher interest payments for that period. But if rates for 5-year bonds are still at 4%, you could buy a new five-year bond and lock in the new 4% rate for that term.

This shows that individual bonds are best when held to maturity, and selling before maturity for newer, higher-yielding bonds doesn’t significantly improve your situation. But what about bond funds—don’t they do just that?

Bond funds—same, but different

Now that we understand how individual bonds work, we can compare them to bond funds. And the answer to the question above is that bond funds do both—they buy and hold and buy and sell to optimize returns.

Bond funds hold individual bonds (securities) that are repriced daily based on current interest rates and, to some extent, where investors expect rates to be in the future.

I continue to own a total bond fund. Its current yield is approximately 4.5% (up from 3.5% in early 2023), and it holds thousands of bonds. This fund has fully recovered from its 2022 losses and has provided solid income throughout 2023-2025.

As you know, all of these types of funds lost money in 2022 due to rising interest rates. When rates rise, the value of all bonds goes down, whether you hold them individually or in a bond fund.

My total bond fund has an effective duration of five to seven years; it’s considered an intermediate-term fund with moderate interest rate risk. That’s one of the reasons its market value declined by approximately 15% in 2022. However, by 2025, those losses will have been fully recovered, and the fund will now trade near or above its pre-2022 price levels while yielding significantly more (4.5% vs. 3.5%).

I also own a short-term bond index fund and a TIPS fund. I continue to have a relatively conservative bond allocation, which seems appropriate for me at age 73.

Having held these bond funds through the entire 2022-2025 period, I can confirm:

- The 2022 losses were painful but temporary: All my bond funds have mostly recovered

- Income kept flowing: Even when fund prices fell, I continued receiving interest distributions (which is what I really want)

- Yields improved dramatically: My funds now pay 4-5% vs. 1-2% in 2020-2021

- Simplicity won out: Managing individual bonds would have required constant attention; funds handled everything automatically

Bond funds can operate indefinitely, paying interest dividends that fluctuate with interest rates. Bond funds are desirable for retirees seeking a reliable income.

To maintain the fund’s overall profile, it will periodically sell bonds that fall short of its maturity (or risk) target and purchase new bonds.

In a time of rising rates, a fund may sell bonds at a price below the purchase price and buy new bonds at higher prices that offer higher yields.

It will also keep many in their full maturity and replace them with new bonds offering higher coupon rates.

Over time, these activities will effectively “refresh” the bond fund’s holdings with higher-yielding securities, resulting in larger interest payouts to its shareholders. However, the upticks tend to come slowly—it takes time for a fund’s portfolio to turn over.

Also, if interest rates decline (which they inevitably do), the market price of those bonds will increase, thereby increasing the value of a fund’s holdings.

After the Fed’s aggressive rate hikes in 2022-2023 (raising rates from near zero to 5.25-5.5%), the Fed has begun making modest rate cuts as inflation has moderated. This has caused some bond prices to appreciate modestly, although yields remain elevated relative to historical standards. The Fed is expected to make 2-3 additional cuts in 2026, which would provide some tailwind for bond fund prices while still maintaining relatively attractive yields. (The funny thing is that I would rather have the higher yields than the appreciated fund prices.)

Which is better?

We now know the critical distinction between holding individual bonds and bond funds. We’re discussing two distinct uses of bonds in retirement portfolios beyond diversification for stocks.

Investors who purchase and hold individual bonds to maturity will receive a predetermined yield and the total return of principal (if the bond isn’t called or defaults). But bond fund yields and prices fluctuate, so selling shares can result in capital gains or losses.

Thus, during periods of rising rates, holding individual bonds to maturity will usually outperform holding bond funds for similar periods. That suggests that holding individual bonds rather than funds may be preferable for those who need a specific sum of money at a particular future date and can’t afford losses from market repricing.

Having lived through the 2022-2025 cycle, the picture is more nuanced:

Individual bonds win when:

- You need a specific dollar amount on a specific date (college tuition, major purchase)

- You can’t tolerate any principal fluctuation

- You have enough capital to build a diversified ladder ($100K+ minimum realistically)

- You’re comfortable managing bond purchases and maturities

- Current yields are attractive enough to justify locking in

Bond funds win when:

- You need a regular income but flexibility on timing

- You want instant diversification (funds hold hundreds/thousands of bonds)

- You have a smaller portfolio where individual bonds aren’t practical

- You value simplicity and professional management

- You’re comfortable with daily price fluctuations, knowing long-term total return matters more

The 2022 experience taught us:

- Bond fund losses were real but temporary (fully recovered by 2024-2025)

- Individual bondholders who held to maturity avoided paper losses but missed opportunities to sell high-priced bonds before rates rose

- Both approaches work—it depends on your specific needs and temperament

That makes individual bonds an ideal way to fund a known future spending liability, such as a car or house purchase, a year of college, or retirement income. [2025 Update: Morningstar’s research showing TIPS ladders can support 4.5% inflation-adjusted withdrawal rates reinforces this use case.]

The investor most interested in income who does not need to sell bond fund shares to help fund their retirement may be comfortable holding bond funds over the long term.

What about retirees?

If you’re using bonds mainly to diversify your portfolio and provide income in retirement, then funds may be the way to go. That’s my main objective, but in 2023, I was attracted to the idea of ‘locking in’ higher yields by purchasing individual bonds, especially TIPS, for inflation protection.

After considering individual bonds extensively in 2023, I ultimately stuck with bond funds for several reasons:

- Simplicity: Managing fund distributions and rebalancing is straightforward

- Diversification: My funds hold thousands of bonds across issuers, maturities, and sectors

- Yield improvement happened anyway: My fund yields increased from 3-4% to 4-5% as portfolios refreshed

- Recovery validated the approach: All my bond funds recovered from 2022 losses

- Professional management: Funds handle call risk, credit risk, and reinvestment decisions

That said, I see the appeal of individual bonds for specific purposes, particularly:

- TIPS ladders for inflation-protected income (4.5% withdrawal rate per Morningstar)

- Treasury ladders for ultra-safe known future spending

- Short-term CD ladders now paying 4-5% with FDIC insurance

I’ve made my current fund selections and allocations based on duration and quality. Generally, in keeping with my bucket strategy, I’ve matched the fund’s duration to an anticipated holding period, but not precisely, since I’m primarily aiming for interest income and not to sell appreciated bond fund shares unless I have to.

Yes, my intermediate-term bond funds lost money in 2022, but since their durations are six years or more. I don’t plan to sell shares of those funds for retirement income during that period, I was less concerned.

I have short-term needs covered in my “cash bucket,” and, as noted previously, I also hold a short-term bond fund and a short-term TIPS fund. If I need cash in the near term, which I do, it will come from there in accordance with my bucket strategy.

I’m still intrigued by the potential of individual bonds and a bond ladder, in particular, to lock in today’s attractive yields while protecting my principal if held to maturity. However, after three years of experience with bond funds through the 2022-2025 period, I’m increasingly comfortable with my fund-based approach.

So, in the next article, I’ll discuss bond ladders in greater detail (and the type of ladder many professionals recommend for retirees—particularly TIPS ladders).