Whether you’re just starting out in your 20s or 30s or are getting close to retirement, Dave Ramsey has a lot to say to you about saving and investing for retirement. In fact, my involvement with Dave and Financial Peace University (FPU) and also his Financial Coach training program were some of the main inspirations behind my decision to start-up this blog about retirement stewardship.

In FPU, Dave devotes a couple of sessions to saving and investing for retirement. But a while back I read a blog post on Dave Ramsey’s website with the title, “Can Your Retire Like Dave? 5 Simple Steps for Successful Retirement Saving“. I thought to myself, “Hmmm…retire like Dave… what are the chances of that happening?”

[Kind of reminds me of a great scene in an older movie titled “IQ” in which Albert Einstein (Walter Matthau) helps a young mechanic (Tim Robbins who plays Ed Walters) who’s in love with Einstein’s niece, Catherine (Meg Ryan) to catch her attention by pretending temporarily to be a great physicist. Einstein and Ed, along with a group of his hilarious genius professor friends, are walking together eating ice cream trying to figure out how to get Catherine (who is quite intelligent herself) interested in Ed. Well, you really should watch the scene (the whole movie, actually), but Ed says that he would need to have Albert’s brain, whereupon Albert says, “Are you thinking what I’m thinking?” to which Ed shrugs and responds, “What would be the odds of that happening?” What odds, indeed!]

I’m no Dave Ramsey (although some say I look a little like him – take a look at this photo) – certainly not in terms of retirement savings and income as Dave is a very successful entrepreneur.

I read the article and quickly realized that it wasn’t really talking about retiring exactly like Dave himself might retire (i.e., his “lifestyle” in retirement). Truth is, I have no idea exactly what Dave’s retirement will look like except what I am able to glean from his teachings and what he occasionally shares about his personal life. Rather, I’m referring to what he teaches about how to “retire with dignity.” (You may have noticed that Dave uses the phrase “retire with dignity” quite often in his teachings on getting out of debt, saving, investing for the future, and living in retirement.)

The article itself sums up “how to retire like Dave” like this:

…he [Dave] was determined to build his nest egg on a secure foundation of debt-free living and simple, conservative investing.

Notice that this all begins with “debt-free living”. That’s because Dave teaches that being debt-free will presumably lead to saving and if you are saving for retirement you will need to think about how to invest. It is indeed that simple, but there are details that also have to be considered. The article continues by listing the following 5 Steps to “Retire Like Dave”:

Step One: Invest 15% for Retirement

I agree with this, and I would actually re-word it slightly to say, “Invest at least 15% (of your gross income) for retirement, especially if you didn’t start in your 20s.” If you did start early, you may be able to do less (say, 10% to 12%) but I think many people should try to save even more, perhaps upwards of 20% depending on their particular situation.

If you haven’t already, you may want to read an earlier article titled, “What About Dave Ramsey’s 15% Rule?” In that article, I delve deeply into the numbers behind Dave’s 15% “suggestion.” I also discuss when you may actually be able to save less (if you start very early in your 20s) and also what to do if you are in your 40s or 50s and need to save more.

If you are in your 50s or 60s and are concerned about being behind in saving for retirement, I would suggest reading my series “Behind in Saving for Retirement?”.

One thing is for sure – 5 to 10%, or less, which is more the norm, just won’t cut it for many people. As that earlier article points out, some pretty in-depth academic research seems to suggest that 15% is in the “sweet spot” in terms of what most people need to do.

Step Two: Use Tax-Advantaged Retirement Plans

The keyword here is TAX-ADVANTAGED. Don’t underestimate how powerful this is, especially when combined with #1 above and the “magic” of compounding (earnings on earnings) over many years.

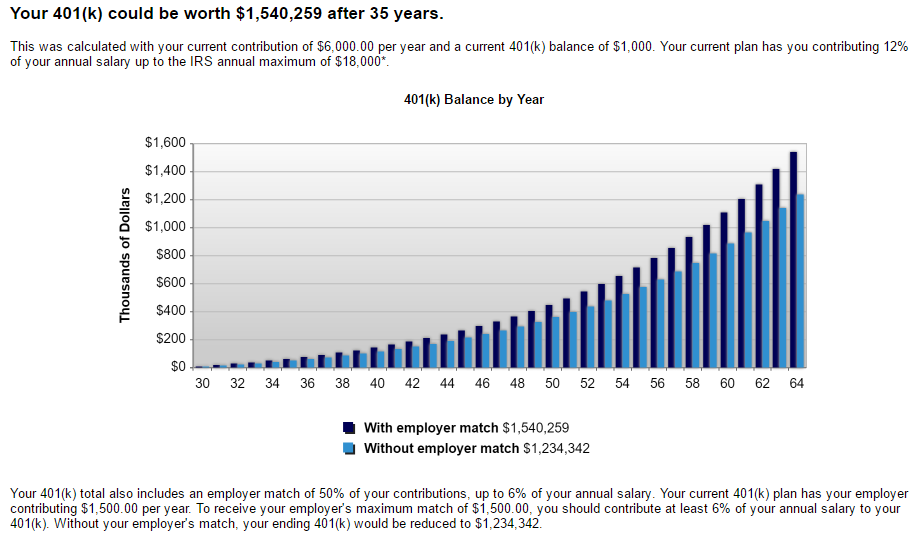

Here’s an illustration for an “average” income household making $50,000 a year. You can see the assumptions that I made listed below, but the result of saving 12% (either all in a 401K, or split between a 401K and an IRA), with a 50% employer match up to 6% of the 15%, conservatively earning 7% per year, over a period of 35 years, is pretty dramatic:

As you can see, you could end up with over $1.5 Mil. in retirement savings by age 65!

So, using tax-deferred plans such as a 401K (especially if you get an employer match) and/or a Roth IRA are definitely the way to go. Don’t forget to take full advantage of your employer’s matching contributions in 401k/403b plans. Do that before you starting funding an IRA. No match? You may be better off with a Roth IRA because it may have lower costs and more flexibility in investment options. (Check out this article for more information on comparing the benefits of a 401K employer plan and a Roth IRA.)

Step Three: Spread Your Money Around

This is really, really important. As a matter of fact, some financial planners/advisors would say that how you invest is more important than how much you invest.

What Dave is referring to here is “asset allocation” (which is deciding how much to put in different kinds of investments like stocks, bonds, cash, etc.) and “diversification” (deciding how much to put different types of investments within those categories). He recommends investing in mutual funds rather than individual stocks, which is usually the best approach for most people. (If you have an MBA in Finance and are an expert on analyzing corporate income and balance sheets, have at it. But I don’t suggest that you make investment decisions based on what they say on CNBC or Fox News, or based on the latest hot tip in Money magazine.)

Diversification should be the cornerstone of your investment program. If you have your wealth in one company, unexpected troubles may cause a serious loss; but if you own the stocks of 12 companies in different industries, the one which turns out badly will probably be offset by some other which turns out better than expected.” (Sir John Templeton, famous author and investor)

Step Four: Stick with it

Meaning, stay the course. Once you come up with a strategy and a plan, don’t start buying and selling thinking you can time the market.

Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years….

Our favorite holding period is forever. (Warren Buffet, famous investor)

This can be the hardest part, especially when the financial markets become volatile, (which is almost all the time) but it very important to your long-term success. Why is this so hard? Because of greed (some would prefer “irrational exuberance”) we buy investments when they are too high priced, and because of fear (some would prefer “rational preservation”) we sell when they are too low. This is a recipe for disaster and perhaps a good argument for #5 below.

Just a small caveat here: this doesn’t mean that you should never sell any of your investments – there are times when you should. What’s in view here is the natural tendency that people have to “chase returns” by buying and selling at the worst times.

Step Five: Rely on Personal Advice

I might rephrase this as “get help”, which is very important whether you choose to use a personal financial advisor (a Dave Ramsey ELP or other professional) or not. Although most people should use an advisor or perhaps a financial coach, some may choose not to. If you don’t, then you will need some education and a lot of confidence in your own ability to make good investment decisions and also to stick with them when the going gets tough (see # 4 above).

If you become a do-it-yourself investor, you are in essence your own advisor. If you want to be your own advisor, you need to be sure you know what you are doing as there is too much at stake here.

Is there a better way?

Probably not, as this is all pretty sound advice. However, Dave does have his critics when it comes to retirement planning. There are those who would take issue with some of the finer details, but it’s very hard to argue with the simple plan laid out in the blog post referenced here, in Financial Peace University, and his book, Total Money Makeover.

One thing is for sure: starting early with a sound plan based on consistent, tax-advantaged saving and sticking with it over the long haul – in other words, “retiring like Dave” – is of much greater importance to your meeting your financial goals than some of the finer points that some folks like to argue about.