I recently discussed asset allocation and diversification with some friends, a couple in their 50s. In the context of that conversation, they asked me what I thought about Dave Ramsey’s investing recommendations. (They were concerned that they may invest too conservatively for their age and goals.)

I told them that I respect Dave and agree with his advice on most things, but I diverge with him to some extent on his suggestions on investing for retirement.

Build a solid foundation

Dave stresses his “Baby Steps‘ which help with saving, budgeting, paying off debt, wise spending, and especially generosity; a pretty good combo if you ask me. If you don’t watch your spending and take on too much debt, saving, investing, and giving will be very difficult.

His overall retirement planning philosophy is building wealth on this debt-free living foundation with what he calls a “simple, conservative investing strategy.” (I think his investing philosophy isn’t all that conservative—more on that later.)

It’s wise because it doesn’t put the cart before the horse. It may be unwise to save large sums if you’re deep in debt and struggle to pay your bills.

Once you have a good foundation, you can follow Dave’s investing advice. But as we’ll see, you may want to think long and hard about some of his recommendations.

Save and invest 15% for retirement

I agree that most people should save and invest 10-15% of their income for retirement. Dave (and most financial planners and advisors) suggests starting as soon as possible during your working life after you have an emergency fund and are debt-free.

But in reality, most people aren’t debt-free, don’t budget as they should, and have little or no short-term savings. So, a more reasonable approach might be to ‘smooth’ consumption over time, resulting in low, no, or even negative “dis-savings” rates early on but higher savings rates in mid-life. Then, back to negative savings (i.e., distributions) during retirement.

This chart illustrates consumption smoothing:

If you don’t have enough income, saving for retirement takes money from short-term savings, giving, paying current bills, getting rid of debt, and living life. Saving for retirement—while extremely important—may be a luxury for some, and they need to wait until they are in a better position to do so.

In my book “Redeeming Retirement: A Practical Guide to Catch Up,” I show how a sample couple (whom I name the Samples—haha) can save enough even though they start later in life. To do this, most will have to save upwards of 20%, especially if starting in their 40s or 50s.

If you start early, saving 10% may be adequate, but that assumes you get consistent average annual returns of between 5 and 10 percent. That was a reasonable assumption in the past but may not hold in the future. (More on expected future returns a little later.)

Use tax-advantaged retirement plans

Dave recommends using tax-deferred plans such as a 401(k) or 403(b), especially the Roth IRA. Tax-advantaged vehicles are the way to go. And if you can get a Roth 401(k) and/or a Roth IRA, all the better.

But be aware that an “all Roth” strategy means you won’t get a tax deduction, as you pay taxes before depositing the money into a Roth. If you believe your tax rate will be higher in retirement (all things considered, it certainly could be), that makes a lot of sense.

Most workers will qualify for a Roth IRA as the upper-income limit is $153,000 for single filers and $228,000 for married couples filing jointly in 2023.

However, the maximum allowed contribution to IRAs is relatively low. Most people will need other retirement vehicles to save enough for retirement. The 401(k)/403(b) comes in here.

Signing up for your employer’s plan and taking full advantage of their matching contributions is the way to go. Even if you don’t get a match, there may still be benefits of saving in your employer’s plan, most notably, a much higher contribution limit, as shown below:

| 2022 and 2023 Common Retirement Account Contribution Limits | ||

| Retirement Account | 2023 Contribution Limit | 2024 Contribution Limit |

| IRA | $6,500 | $7,000 |

| IRA Catch-Up Contribution | $1,000 | $1,000 |

| 401(k) | $22,500 | $23,000 |

| 401(k) Catch-Up Contribution | $7,500 | $7,500 |

On the other hand, if your employer’s 401(k) plan has high fees or limited investment choices, or you don’t plan to invest more than the IRA limits, you may want to invest your money in an individual retirement account (IRA) instead.

Dave recommends a strategy that uses both, and I agree. It’s a strategy I used much of my working life, especially when playing “catch up” in my 40s and 50s. He describes it this way:

The best way to remember where to start is with this rule: Match beats Roth beats traditional. An employer match is free money; you don’t leave free money on the table—so that’s where you start.

After that, use a Roth IRA instead of a traditional IRA to get those tax benefits. You won’t have to pay taxes when you withdraw money from a Roth IRA, which will pay off more in the long run!

I built this little chart to show how this works (read it from the bottom up):

Spread your money around

Here, Dave is referring to asset allocation and diversification.

When it comes to investing, asset allocation is the equivalent of deciding how many of your eggs you will put into how many different baskets—or asset classes. Diversification is spreading your investments among and within different asset classes.

He recommends investing in mutual funds rather than individual stocks, which is usually the best approach for most people (you get instant diversification within a specific asset class).

If you’d rather invest in individual stocks, have an MBA in Finance, and are an expert on analyzing corporate income and balance sheets, have at it. I don’t suggest investing by watching CNBC or Fox Business News or based on the latest hot tip in Money magazine.

Some experts suggest that allocating wisely is more important than the individual investments you select. That may be true, but how much you save and how early you start trumps everything.

Focus on stock mutual funds

Dave suggests that you invest 100% in stocks (no allocation to other assets, like bonds) and do so across four different stock asset classes:

- 25% Growth and Income (Large Cap) – growth and dividend-paying stocks

- 25% Growth (Mid Cap) – less risky than aggressive, but can still be volatile (extremely, at times)

- 25% Aggressive Growth (Small Cap) – these are among the most risky funds (super-volatile at times)

- 25% International – these can be risky, so care must be taken when selecting them

This is a reasonably diversified stock mutual fund portfolio, at least to the extent it covers the major stock fund classes. It also keeps things pretty simple, which is also a plus.

By the way, I don’t think Dave is saying we should only invest in 4 mutual funds, each being a different stock asset class. You could hold multiple funds in the four fund classes for additional diversification.

On the other hand, you may want to keep things at a reasonable number to adhere to the “keep it simple” principle.

But here is where I diverge: I (and many others) differ from Dave’s recommendation that you invest only in stock mutual funds.

I agree fundamentally with Dave when he says bond funds generally provide lower performance at only slightly reduced risk. But I and MANY professional financial planners and investment advisors would disagree with him on the 100% stock portfolio.

An exception would perhaps be for younger savers/investors with a long horizon and a high-risk tolerance. However, young people overestimate their risk tolerance; risk is an acquired taste.

It is one thing for investors to look at a spreadsheet when they are 25 and decide that they can tolerate an 80/20 portfolio that might, under extraordinary circumstances, lose 40 percent of its value. It is something else entirely to live through such an event with equanimity.

On the other hand, older individuals have survived bear markets; they know market declines usually end. Not infrequently, they lament having missed buying low when they were younger and resolve that next time; they will take that opportunity.

I think it’s appropriate for younger investors to own more stocks because they can apply their regular savings to the markets at depressed prices. However, as we age, this becomes less wise because older investors have less time to make up losses from wide fluctuations in the stock market.

Therefore, I suggest you include some bond funds in your portfolio, especially as you age and need to reduce your risk. (Even if you have a high-risk tolerance, your risk capacity may diminish as you age.)

The “flip side” to this reasoning, of course, is that bond prices can fluctuate as well, mainly in response to interest rate changes, but they don’t generally tend to be as extreme as stocks in some cases. Moreover, bonds are more about income and less about capital appreciation, so price fluctuations may not be as significant a concern for some.

Most investors fall between the extremes of those who invest exclusively in stocks or bonds. So many people might want to divide their financial assets between stock and bond funds in a way that makes the best sense. And in most cases, age should be the first factor in determining the overall stock/bond allocation.

Choose actively managed mutual funds

This is a real hot-button issue in the financial community. The consensus popular opinion is to invest only in passively managed index funds, and most economists and academics support it.

Yet, actively managed funds are still pretty popular. According to one source, in 2022, 45% of assets were invested in passive funds and 55% in active ones. (The percentage for active was 78% in 2012, so the trend is undoubtedly downward.)

The biggest problems many people have with actively managed funds are 1) they often don’t beat their industry benchmarks and 2) high fees.

If you read our listen much to Dave, he’ll say that there are funds that beat their benchmark (such as the S&P 500). That’s certainly true sometimes—in 2022, for example, a period of high market volatility tends to favor active management.

According to Morningstar, 49% of all active funds topped their benchmark index in 2022. Among the larger asset classes, active U.S. stock funds fared well (62% beat rate), taxable bond funds less so (48%), and int’l stock funds even worse (40%).

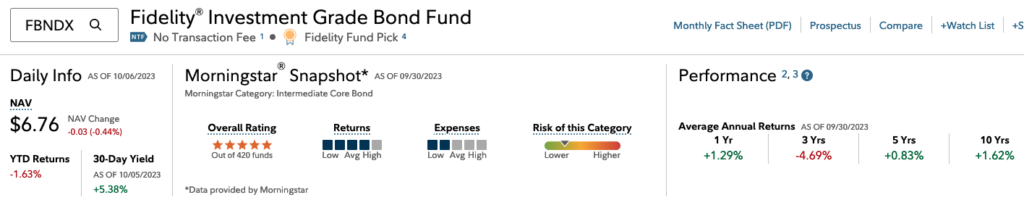

Finding actively managed funds with low fees, or at least lower than their peers, is also possible. But you have to do your homework. I like using the Morningstar’s Analysis on the Fidelity website as a starting place:

This actively managed bond fund (FBNDX) from Fidelity has a 5-star rating, above-average returns, and a below-average expense ratio of .45%.

So, if you find a fund that fits your strategy, with a strong performance record and lower-than-average fees, I have no problem with you investing in it. Just remember: history is not a reliable predictor of future performance. Actively managed fund performance is very unpredictable.

Here’s something else to look out for: Some actively managed funds charge a “front end load” fee. This lump sum you pay upfront to purchase the fund is IN ADDITION to recurring fund-managed fees.

Some people build their portfolio with a ”core” of passive index funds and then invest around the edges with select active funds. I don’t have any problem with that approach, especially if the tactical funds you choose are highly rated and carry low fees.

Allocate 75% to risky stocks

Dave recommends investing equally across four classes of stock funds: Growth and Income, Growth, Aggressive Growth, and International. This portfolio would be considered very aggressive (volatile and high-risk).

Take a look at this risk chart:

Note that small, mid-cap, and international stocks are the farthest out on the risk spectrum. That means a 25% allocation to each, while offering the potential for higher returns, also carries the most risk. Such a potentially volatile portfolio isn’t for the faint-hearted.

Most financial planners and advisors recommend investing in these asset classes, but not necessarily in these percentages. Small- and mid-cap stocks may or may not be attractive. Holding international stocks provides further diversification.

However, international stocks are more volatile and perform worse than U.S. stocks. These funds usually have higher fees, more risk, and don’t do as well as the U.S. As the largest economy in the world, I assume that the rest of the world wouldn’t do well if the U.S. didn’t do well.

I’m not saying to never invest in international markets, but you have to be a lot more picky about the international funds you choose to invest in. A 25% allocation to international is too much for most people.

Rely on professional advice

Whether you choose to use a personal financial advisor is essential.

Although most people should use a financial planner, advisor, or financial coach, some may choose not to. If you don’t, then you will need some education and a lot of confidence in your ability to make sound investment decisions and stick with them when the going gets tough.

If you become a DIY investor, you are, in essence, your advisor. If you want to be your advisor, you want to know what you are doing.

Some people don’t know this, but Dave Ramsey is in the investment advisory business. Not directly, he operates a referral network to connect his readers and listeners to one of his ”Smartvisors” (who wants to work with a ”Stupidvisor”?).

These financial advisors must apply to be part of Dave’s referral network, agree with Dave’s methods and practices, and are “vetted” to ensure they’re a good fit. Sounds reasonable to me, but here’s where things get tricky.

The financial advisor must also pay a fee to Ramsey Solutions to be featured on his website and get client referrals. Yes, Dave is providing them with a service, but recommending an advisor because they pay you to is not the best practice, in my opinion.

But business is business, and there certainly isn’t anything unethical about it. But wait, there’s more!

You may or may not know that Dave recommends purchasing mutual funds with front-end sales charges called “loads.” These are sales commissions paid to the fund manager but also help pay a smaller commission to the advisor. See the issue here?

In addition to any sales charges, Smartvisors will typically charge to manage your investments and advise you on them.

This is not in line with the industry, but the advisor fee comes directly from your account (whether up or down for the year) and can add up over time. So be clear about their services and what they will cost you.

I want to be clear that I’m not against using a financial advisor, and I think advisors deserve to be paid for their services just like everyone else. I prefer them to adhere to a fiduciary standard and recommend low-cost, passively managed funds for the core of your portfolio.

And many advisors do “earn their fee,” which is money well spent.

Don’t annuitize

Dave is against purchasing annuities of any kind. His concerns concern their complexity, high expenses, and early withdrawal charges. He also avoids them because they aren’t investments.

The public, in general, and many financial advisors hold similar sentiments.

In reality, many annuity products are guilty as charged and should be avoided. That’s especially true of specific variable and indexed annuities that combine an insurance and investment component.

But there is a type of annuity that many retirement planning professionals and academics prefer, which is the “lifetime income annuity,” also sometimes called a “single premium immediate annuity” (SPIA) if purchased with a lump sum.

These annuities are pure insurance contracts, not investments. They tend to have low fees, are simple to compare and purchase and carry surrender charges only when there are excessive withdrawals.

I agree with Dave that there is no need to purchase an annuity instead of investing in a 401(k) or an IRA during the accumulation stage leading up to retirement.

However, the benefit of income annuities, especially for those with limited savings, is to provide a steady stream of income that they can’t outlive that can supplement whatever they receive from Social Security.

When purchased with a lump sum at age 65, income annuities currently offer “guaranteed” payouts in the 6 to 7 percent range, the highest they have been in a while.

Stick with your plan

This can be the most challenging part, especially when the financial markets become volatile (almost always). But it’s essential to your long-term success.

Why is this so hard? Because of greed (some would prefer “irrational exuberance”), we buy investments when they are too high priced, and because of fear (some would prefer “rational preservation”), we sell when they are too low.

This is a recipe for disaster and perhaps a good argument for having a trusted advisor who can help you keep a steady hand on the wheel when the going gets tough.