This article is the second in a four-part series on the most important thing to do in different stages of life to be able to retire with dignity.

This time, I’m focusing on those in their mid-30s and 40s. Some may call them the “Gen Xers” – those caught in the middle between the millennials and the baby boomers.

Although many baby boomers are ill-prepared to retire with dignity, and millennials are just getting started, according to an article on Bloomberg.com,

Gen Xers are in even worse shape financially than the baby boomers who preceded them or the millennials who followed… Gen Xers are still paying off student loans while raising families on wages that have barely budged in recent years. They have more debt than other age groups and are more pessimistic about ever being able to afford to retire, according to many surveys.

It may be challenging, but this period of life can also be fun and fulfilling. You’ve been in the workforce for a while now (hopefully) and may be progressing in your career. You are probably married and have some children. You may be actively serving in your church and involved with a lot of family activities. You may even be homeschooling. The pace is fast, your life is full, and your expenses have probably increased significantly since your 20s and early 30s.

If you’re at this stage of life and haven’t done what I recommended in the first article in this series for those in their 20s and 30s; i.e., to start saving, you have some catching up to do. But if you find yourself with a lot of debt, you may need to postpone saving a while longer.

Perhaps you’ve been saving since your 20s but know you need to be saving more. If you’ve also accumulated some debt, you may need to wait to increase your saving or even reduce it or suspend it altogether to put all your focus on getting rid of the debt. You will still have some savings to make up, but it won’t be as much as if you hadn’t been saving at all.

The primary goal of retirement stewardship in this stage of life is to be regularly saving while keeping debt to a minimum, preferably just an affordable mortgage. (Of course, you will want to pay that off one day too.) Carrying too much debt will prevent you from saving during a time when matters the most. It can also keep you from giving as generously as you may want.

Avoid debt in the first place

The Bible seems to teach that while it is a blessing to be able to lend, borrowing is discouraged. One verse (Proverbs 22:7) describes debt as “slavery.” In biblical times, taking on debt may have been necessary for survival. But life for debtors was hard, particularly those who had trouble paying. Nowadays, it’s often more about financing our wants than our needs. A more modern application of this verse may mean that indebtedness, especially when we owe more than we can pay, puts us in bondage to our creditors and constrains us regarding what we can do with our money. So, it’s best to avoid it if at all possible. And if we must borrow, such as a mortgage for a home, we should try to pay it back as soon as possible.

The best way to avoid getting into debt in the first place is to maintain an emergency fund of at least three to six months of expenses, avoid using credit cards unless you are sure you can pay them off every month, and avoid spending too much (and borrowing too much) for things like a new house or a new car.

From a retirement stewardship perspective, houses and cars can be potentially financially crippling expenses. If too much of your net income (take home pay) is going for these high-ticket items, or you are carrying too much unsecured debt, you may be unable to save enough for retirement.

A new, larger house comes with a bigger mortgage, more property taxes, and steeper maintenance costs. New cars typically come with large car payments for a long period of time. If you pay and then borrow too much for them and put too much stress on your budget, you are putting your ability to retire with dignity at risk. For some guidance on making wise decisions in these areas, see these past articles about major purchases: Your House Purchase Decision and Your Car Purchase Decision.

Even if you’ve tried to be careful, you may have built up some consumer debt (credit cards, car payments, etc.), and perhaps a first (and second) mortgage. You may also have an old student loan that is still hanging around like an unwanted relative. If so, now is the time to get serious about doing something about it.

Debt is on the rise

When it comes to debt, our financial system makes it very easy to get credit and defer loans and debt. Our consumer-oriented culture promotes a reality that expects and demands expensive purchases, frequent turnovers of pricey items, and perceived necessities that may not be so necessary. It is very easy to take a shortsighted view of your personal finances and make mistakes that could have a significant impact on your future retirement.

Just recently (Feb. 17, 2017), the Wall Street Journal reported that household debt grew more in 2016 than in any year in the last ten. Surprisingly, it’s not mortgages that are driving it up – it’s automobile and student loans.

Total household debt climbed by $226 billion in the final three months of 2016, according to a report Thursday from the Federal Reserve Bank of New York. Total household debts are now just $99 billion shy of the all-time peak of $12.7 trillion set in the third quarter of 2008 just as the banking system began crashing down. The New York Fed estimates that debt is highly likely to set a new record in 2017.

It was also reported elsewhere that auto loan delinquencies in the fourth quarter of 2016 were at the highest level since the financial crisis. Higher delinquencies mean that we are borrowing more and having more trouble keeping up with the payments.

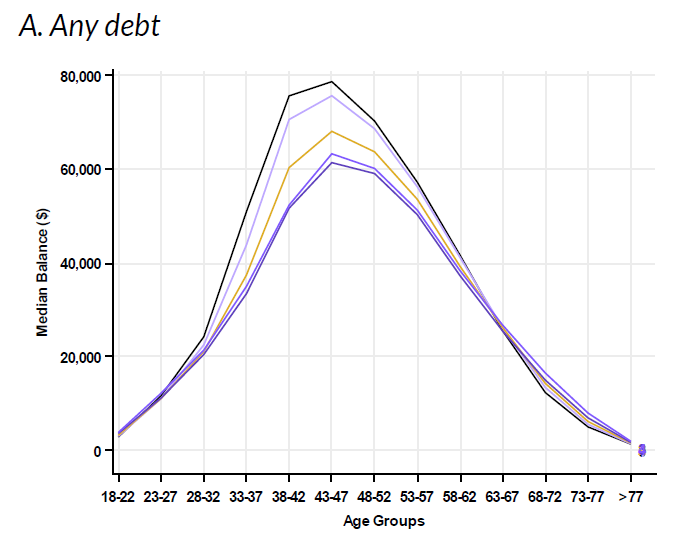

Which demographic do you think is carrying the largest total debt burden? Not surprisingly, a 2015 research study by the Urban Institute found that consumers in their 30s and 40s bear the highest debt burden of all age groups, peaking between ages 38 and 52. As you can see from their chart below, it peaks between age 43 and 47.

Your 30s and 40s is a time when you need to keep your saving for retirement on-track, or if you got started late, you might need to ramp up your saving. Debt can significantly constrain your ability to save like you need to. A bad scenario is one where your debt payments and living expenses equal or are greater than your income, which means you can’t save anything. If you find yourself in that situation, you need to make some changes.

Let’s do some math

If you get out of debt and stay out, two good things happen. First, you will have more discretionary income to spend, give, or save. Second, if you stay out of debt, and perhaps pay off your house mortgage before retirement, your expenses will be less when you retire. In that case, you may need fewer savings to generate the income you need to meet your expenses.

Let’s say you’re paying $200 (principal plus interest) per month on credit card debt; also, you have a student loan costing you $200 a month and an auto loan costing $350 a month. Those payments would total $750 per month. If you paid off all those loans and increased your monthly saving for retirement by the same amount starting at age 40 and earned 5% per year compounded annually until age 65, you would have an extra $420,000! If you aren’t currently saving anything for retirement, that could be your retirement nest egg.

Another way to think about this, especially as you get older, is what is known as the “25 times rule.” That is a somewhat conservative and fairly rough “rule” that says that you need 25 times an annual expense saved to cover that expense in retirement. (It’s based on the standard 4% retirement income withdrawal rate “rule.”) If you have a monthly recurring debt expense of $750, then you would need 12 times that amount times 25, which equals $225,000! That is a multiplier of 300 for any monthly recurring expense, which is why ongoing loan payments are a significant concern in retirement.

So, the most important thing at this stage of life is to reduce your debt and avoid new debt. Use the debt snowball approach to get rid of it – you may find you can get it done sooner than you think. Start with the smallest debt and knock it out as quickly as possible, then “roll” what you were paying on that debt to the next largest and so on. Ideally, you will be close to paying off any student loans by this time. Although they do tend to be low interest, try to get them paid off fairly soon so that you divert that money to other goals.

You may have to make some sacrifices to get this done, but it will be worth it in the long run.

Different strategies for different kinds of debt

Student loans. These guys tend to hang around for what seems like forever. First of all, make sure there aren’t any debt forgiveness or repayment grants that you are missing out on. (These tend to be restrictive, but they’re out there. An article on NerdWallet does a good job of listing many of them.) If your loans are extremely low interest, and especially if the interest is tax deductible based on your income, you can take your time, but stay at it. Remember, every dollar you don’t have to put toward these loans can be used for other purposes. If you’re able, making extra student loan payments to get them out of the way is a good move, especially if they carry a higher interest rate than what you are getting from your investments. If you owe more on these than you do any of the debts in the next section, just make them the last one you tackle with your debt snowball. But the time you get to that point, you should be able to knock it out pretty quickly.

Personal loans, credit cards, and auto loans. Unlike mortgage interest and student loan interest under certain circumstances, these types of loans also tend to have higher interest rates and lack any potential tax benefits. Because many people have all or most of these types of debts, they can really eat up your income and reduce both your standard of living and your ability to save. Use the debt snowball described above to retire these debts – it works!

Mortgage. Once you pay off your consumer and student loan debts, turn your attention to your mortgage. But don’t wait to start saving, or to save more, until you pay off the mortgage. Make sure you’re saving at the level you need to before diverting extra money toward the mortgage. The easiest way to pay it off early is to make additional payments to principal. If you have more than 20 years remaining, consider refinancing to a 10 or 15-year mortgage if you can easily afford the slightly higher payments. Downsizing is another way to go. If you do, be sure to get a 10 or 15-year mortgage on the smaller house. You can take your time with this one, but try to get it done before you retire.

Then what?

The ultimate goal is to go into your retirement years with little or no debt. (Check out this earlier article titled, “Don’t Carry Debt into Retirement” – it gets into the details about why that can be such a positive thing.) The bottom line is that once you are out of debt, including the house, you will have much more flexibility, freedom, and peace with your finances.