This article is the fourth and final one in a series about the most important thing you can do in different stages of life to be able to “retire with dignity.”

Well, you’re finally there. You’re getting into your 60s, or maybe you’ve been there for a while. You’ve been working, saving, and investing for 30 or 40 years, and you’re ready to retire or have recently done so. You’re moving from the “accumulation” stage to the “distribution” stage.

To see a list of things you should do during this time to prepare for retirement, check out this article. It’s a fairly long list, but the most important thing at this juncture is to determine what your income needs will be in retirement and how you will meet them. To do that, you will need to identify your various income sources, and if savings are a part of that equation, decide on a strategy for converting your savings to a regular paycheck that you won’t outlive.

According to a survey done by Vanguard and published on Marketwatch, one of the areas where retirees say they need the most help is income planning:

The steps they find most challenging are those related to retirement income planning—how they will draw down their assets from sources like their 401(k), pension plans and personal investments. In other words, people struggle with creating a retirement paycheck.

Your income needs and sources

To start, you have to determine how much income you will need in retirement. One way to is to prepare a retirement budget. You could take your current budget and adjust it based on what you think will change. Some expenses will decrease in retirement, especially those related to your working life. Once you are eligible for Medicare, your health insurance costs may change. But others, especially in some discretionary areas and also healthcare, will probably increase.

Another way to do this is to use a percentage of your pre-retirement income. Many professionals estimate that you will need 80 percent of your pre-retirement income in retirement. The JPM Retirement Guide I have been referencing suggests that you will need at least 70 percent. Others propose a higher number (even greater than 100 percent), but almost nobody says you can get by on much less than 70 to 80 percent without making drastic changes. That doesn’t mean it’s not possible; it just means that most financial professionals don’t think it’s straightforward.

Of course, your actual income needs may be different, depending on your lifestyle, debt, medical expenses, etc. If you are extremely frugal in retirement, you may get by with less – say, 50 to 60 percent – but it could be challenging.

Next, you need to know what your sources of income will be in retirement. Most people will receive Social Security benefits, which will provide the bulk of their retirement income when combined with income from their savings. Others may have income from a pension (they are increasingly rare), real estate, an annuity, or a small business.

Finally, it is important to identify the portion of income that you need to have from your savings to meet your expenses. A simple way to do that is to add up all your non-savings income sources and subtract that amount from your expenses. For example, if you need $60,000 (70% of $85,000) per year of income and will have combined Social Security of $32,000 and no other sources of guaranteed income, you will need to generate $28,000 of income per year from personal savings.

Income strategies

Once you determine how much income you need from savings, you will need to decide on a plan for converting your savings into regular income. Income planning is one of the more complex (and highly debated) areas of retirement planning, but I will simplify it as much as possible. It is also one of the bigger challenges as you want to generate enough income to meet your expenses for life.

Here are a few of the simpler and most common approaches. Some people will use just one, whereas others will create a hybrid approach that combines two or more of them. Each has its pluses and minuses, which I will try to explain briefly.

Option #1 – annuity payments

With this option, you would purchase an annuity with savings to generate the needed income. A life annuity is not an investment, per se’. It is an insurance product typically sold by an insurance company that guarantees that you will receive regular payments in some amount for as long as you live. The payment amounts vary based on various factors, mainly your age, how much you hand over to them, and what type of annuity you purchase.

Because annuities can be structured to provide “guaranteed” lifetime income, they can address a major concern with some other strategies, like running out of money.

You could use annuities as your primary income distribution strategy IF you’re comfortable giving all of your hard-earned savings to an insurance company. (Most people are not.) However, there may be a better strategy that I discussed this at length in the article titled, “Annuities and Retirement Stewardship, Part 2.” In that article, I talked about using part of your savings to purchase an annuity to help create an income “floor” in retirement. This is a hybrid approach where you combine an annuity with Social Security to produce enough income to meet all your essential living expenses for as long as you live.

I have become increasingly fond of this approach, especially using simple single payment immediate annuities, and I am thinking of implementing it myself when I retire.

Option #2 – fixed withdrawals

There are two types of fixed withdrawals: fixed amount and fixed percentage. With a fixed amount, you decide how much you need to live on and withdraw that amount, perhaps with an increase for inflation, each year regardless of what the markets do. A positive of this approach is that you have a predictable level of income. The negative is significant – you could run out of money much sooner than expected.

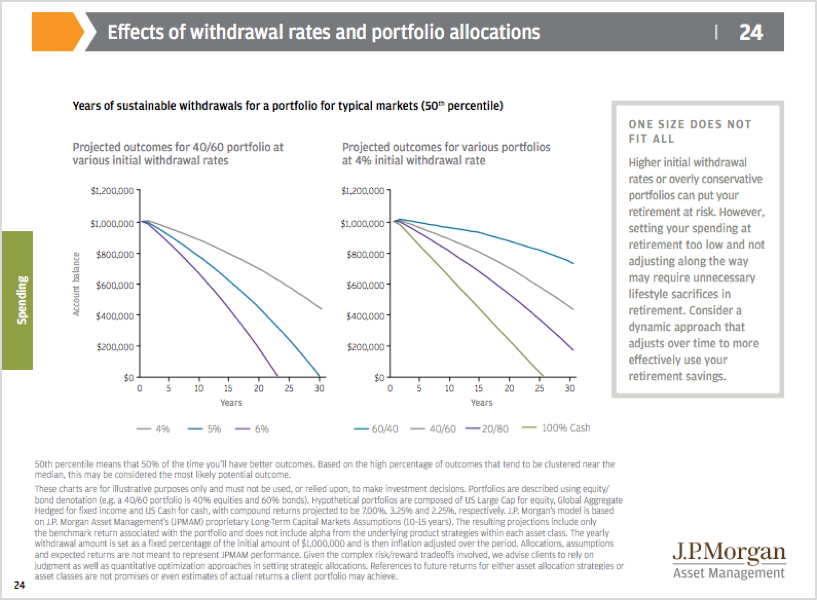

You can implement the fixed percentage approach by making regular withdrawals based on a consistent annual percentage. The fixed percentage is probably the simplest strategy, and the most common fixed withdrawal strategy is what is known as the “4 percent rule.” (It is the approach used in the JPM Retirement Guide.) This rule of thumb says you can withdraw up to 4 percent of your savings each year and increase it each year at the rate of inflation, with a minimal risk of running out of money during retirement. Withdrawing more than 4% plus inflation will significantly increase that chance. If you withdraw less, say 3 to 3.5 percent, your risk will decrease.

You will withdraw a larger sum with a fixed percentage when the markets (and your investments) are up. When things go down, you will remove a smaller amount. Your odds of running out of money are pretty low, but mathematically your portfolio could get very small, especially later in life. Finally, your lifestyle could be impacted year over year, perhaps dramatically during prolonged market downturns.

Option #3 – flexible withdrawals

Flexible withdrawals are based on variable performance data (known as “value-based” or “momentum-based” strategies that take into account how the financial markets perform from year to year). It is a little more complicated than fixed withdrawals but can also be more effective in the long run (see the right-side note in the JPM chart below).

I like the idea of a variable withdrawal strategy consisting of a fixed percentage with some boundaries – i.e., stability with flexibility. One approach, provided by author Bob Clyatt, is called the “95 percent rule.” He thinks it a better safe withdrawal method because it adjusts for poor market performance. With this approach, you can withdraw 4 percent, or 95 percent of whatever you withdrew the year before, whichever is greater. That means you would not reduce your income by more than 5 percent in any given year, even if your assets lose more than that. However, in a prolonged market downturn – say over a five-year period – it would have a large cumulative adverse effect on your income.

I ran a quick simulation for a portfolio that increased in year one and then decreased each year after that for the next four years. It had a total loss of 17 percent over that time, resulting in a 9 percent overall reduction in income from withdrawals in year 5. As you can see, this approach smooths out your income year-over-year with minimal additional risk of running out of money.

There are other options for flexible withdrawals, which are more complicated and vary your withdrawals directly based on market performance. I may discuss them in greater detail at another time.

Option #4 – capital preservation

With this strategy, you live off the interest, dividends, and growth of your investments without significantly decreasing your “net worth” year over year. Your assets’ value would not be significantly reduced each year unless there is an awful year for the markets.

This can be a good approach, especially in the early retirement years, when you don’t want to be selling the very assets that could be used to generate income in the future. Your goal is to preserve your income-generating assets, at least in the early years, although you may have to sell some further down the road. Of course, this assumes that you can generate enough interest and dividend income, along with some growth, to live on – a big assumption!

This strategy is also a good one for people who want to give some of their assets away while they live, retain them for a legacy after they are gone, or both.

For this strategy to work, you will need to use a “total return” approach to managing your retirement portfolio. Such an approach anticipates the receipt of interest income and stock dividends, as well as some capital growth of your investments. However, conservative- to moderate-risk portfolios don’t typically generate 4 percent of income in the very low-interest-rate environment we currently find ourselves in. So, you may occasionally need to “dip into principal” to meet your target income requirements – you want to do it in a way that preserves principal year over year.

One of the most common ways of doing this is by simply selling assets that have done well. Another way is through “rebalancing,” which uses withdrawals to bring your asset allocation back to your target stock/bond percentage mix (e.g., 50/50, 60/40, 70/30, etc.).

Fixed withdrawal example

As I stated above, a fixed withdrawal strategy is the most common and easiest to implement. That doesn’t mean it’s best for every person in every situation. It has some drawbacks. A fixed amount locks you into a certain spending level and lifestyle. You know exactly how much you’ll have to spend, but you won’t have much flexibility, and you don’t know how long your money will last. A fixed percentage…

That’s a big drawback – the fact that you can’t know for sure how long your money will last. (Only an annuity can give you a high level of confidence in that.) However, we can make some educated projections. As the chart below from the JPM guide shows, a 40 percent stock/60 percent bond portfolio with a 4% withdrawal rate has a reasonable chance of lasting at least 30 years with a significant legacy amount remaining. The legacy number increases with a 60/40 portfolio with a 4% withdrawal rate but decreases as the portfolio allocation to stocks goes down.

Let’s look at an example. A retiree making $80,000 per year before retirement would need an estimated $56,000 in retirement (70 percent of $80,000). If they have $600,000 in savings, they could withdraw $24,000 (4 percent of $600,000) in year one and increase it by the rate of inflation each year after that without a significant risk of running out of money. In fact, extrapolating from the chart on the left, they could leave a legacy of approximately $300,000. They would then need an additional $32,000 in income from Social Security and other sources to get to the $56,000 target income amount.

Factoring in Social Security

In the example above, the JPAM charts used in this series assume that someone making $80,000 will need to replace at least 35 percent of their income at retirement. That amount, when combined with Social Security, would provide approximately 70 percent of their pre-retirement income. That means that Social Security has to provide the remaining 35 percent. Generally, the lower your overall income requirement, the greater the percentage covered by Social Security and vice-versa. That makes it all the more critical to maximize your Social Security benefits.

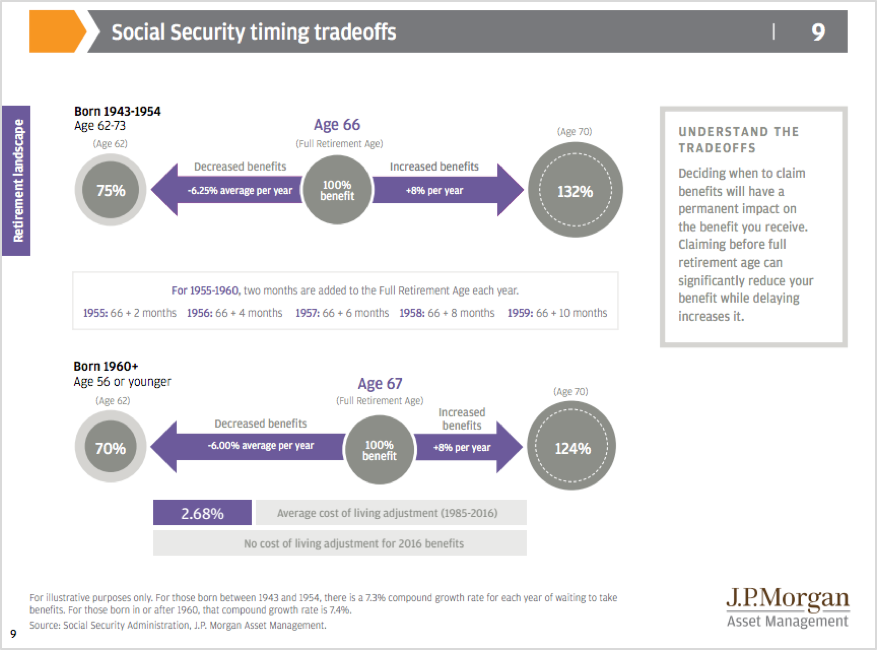

Your Social Security benefits are mainly determined by your earning record while employed and the age you claim your benefits. You probably have more control over the latter than you do the former. In fact, deciding when to claim Social Security benefits is one of the most important decisions you will make.

Currently, over 60 percent of retirees take benefits at age 62. As the JPM chart below depicts, if you take benefits before your full retirement age, which is 66 for most baby boomers, your monthly payments will be permanently reduced by 25 percent. If Social Security will be approximately 50 percent of your retirement income, then your total income is reduced by 12.5 percent (25 percent of 50 percent) for the rest of your life.

If you wait until age 66, you will receive 100% of your benefit. But if you can wait until age 70, your benefits increase significantly to 132% of your full retirement age benefit.

Of course, if you are in poor health and don’t expect to live to a very old age, you may be better off claiming sooner. But keep in mind that, according to figures from the Society of Actuaries, a 65-year-old man has a 41 percent chance of living to age 85 and a 20 percent chance of living to age 90. A 65-year-old female has a 53 percent chance of living to 85 and a 20 percent chance of living to age 90.

The percentages are even higher for couples. If the man and woman are married, they increase the chance that at least one of them will live longer. There’s a 72 percent chance that one of them will live to age 85 and a 45 percent chance that one will live to age 90. There’s even an 18 percent chance that one of them will live to age 95. Therefore, couples need to optimize their benefits together. For example, an unhealthy spouse that was the higher earner should consider securing a higher survivor’s payment for his wife by delaying his own Social Security benefit.

You could also annuitize some of your savings to guarantee some increase the payout. You could even tap the equity in your home as a source of additional income.

Decide on a strategy, but remain flexible

You need to choose a plan that makes the most sense for you. Just keep in mind that you may need to be flexible as things can change.

You may have to adjust spending or your withdrawal rate, or both. Or, you may need to consider a flexible withdrawal rate tied to market performance. But no matter what, it would be folly to retire without some idea of how you’re going to convert a lifetime of savings to a regular paycheck that will last the rest of your life.

Proverbs 16:9 says, “The heart of man plans his way, but the Lord establishes his steps.” We need to plan, but always with the recognition that our loving, sovereign God is the One who ultimately determines whether they will come to fruition or not. Therefore, we must continually seek His wisdom and guidance and trust Him in all things.

A final word: Quite frankly, this article doesn’t do justice to the complexity of the retirement income decisions challenge that we all face. If you want to do some further reading on this subject, I highly suggest Steve Vernon’s excellent book, Money for Life, or Wealth to Last by Larry Burkett and Ron Blue.