I remember when I was a teenager and could buy a gallon of gas for less than 50 cents. (I think I remember paying 35 cents at a Hess station near my home.) That may surprise you, but consider that the minimum wage at the time was around $1.50/hour. Now, in NC where I live, the minimum wage is $7.25/hour. On a straight percentage basis, a gallon of gas should cost about $2.17, which is very close to the actual price today. However, as recently as 2012, it was near $4.00 per gallon, almost double.

My first house cost about $32,000 in 1976. It was a 1,500 sq. ft. concrete brick ranch with a double garage in Orlando, Florida. We had two orange trees in the front yard. Today, that house would probably sell new for over $200,000, depending on where it’s located.

Many of you could tell a similar story, but the lesson is the same: inflation has a significant impact, especially over a lifetime. That’s especially true for retirement savings and income planning as even if there are only slight increases in inflation from year to year, the impact is magnified over long periods of time.

Yet another risk, really?

In a previous article, I discussed “sequence risk” as it relates to retirement stewardship. In this article, I will discuss yet another type of risk to your retirement savings: Inflation.

You don’t hear much about it these days, but inflation is one of the more insidious threats. That’s because it’s hard to notice in the short term, but it can do serious damage over the long term. It can rob you of some of the growth in your investments when you’re saving and reduce their purchasing power when you are spending them later on.

According to the Bureau of Labor Statistics Inflation Calculator, $1.00 in 1990 should be worth about $1.92 today. Put differently; it takes $1.92 in 2017 to buy what $1.00 would in 1990. The average annual inflation over that time frame was about 2.6% – pretty low, relatively speaking.

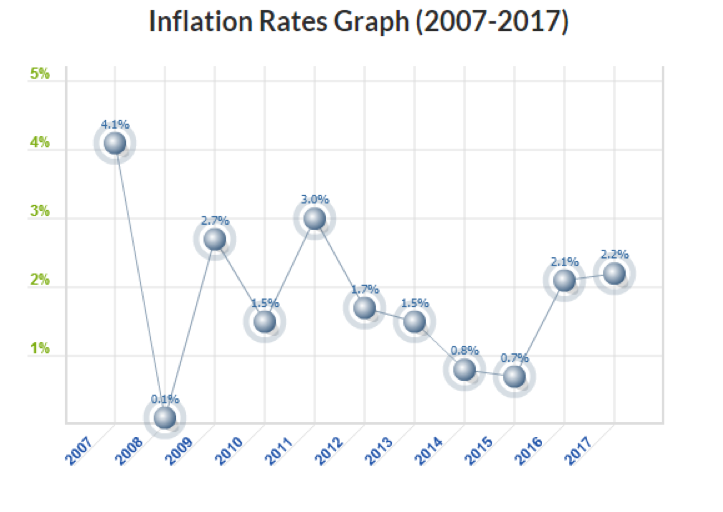

In fact, since the “great recession” about ten years ago, it’s been averaging just a little over 2% per year. Take a look at the chart below. Inflation went down dramatically from 2007 to 2008, and then again quite a bit from 2011 until 2015, and has risen only slightly since then.

The stock market, on the other hand, has been going gangbusters (if you hadn’t noticed). It’s been climbing steadily upward since 2011, after some very bad years before that. Take a look at another chart below. If you had invested $10,000 in the S&P 500 (represented by SPX) in early 2007, it would have been worth only $7,000 by early 2009. But if you held on, it would be worth over $17,000 today!

If you look closer at the chart, you’ll see a familiar pattern that repeats itself multiple times: climb, climb, and then slip backward dramatically. So, history tells us that this cycle will continue to repeat itself again and again. When it will happen again, and how deep and how long it will be, is anyone’s guess; but make no mistake, happen it will!

So why show the growth of the S&P 500 in the context of inflation? Well, because of inflation, even though your retirement assets may increase due to higher stock valuations, they are also decreasing in real value every year based on the rate of inflation, unless inflation is zero or we are in “deflation” mode.

What – really? Yes, really. But that doesn’t mean you won’t have a positive return; it just means that the REAL value of your savings will be reduced.

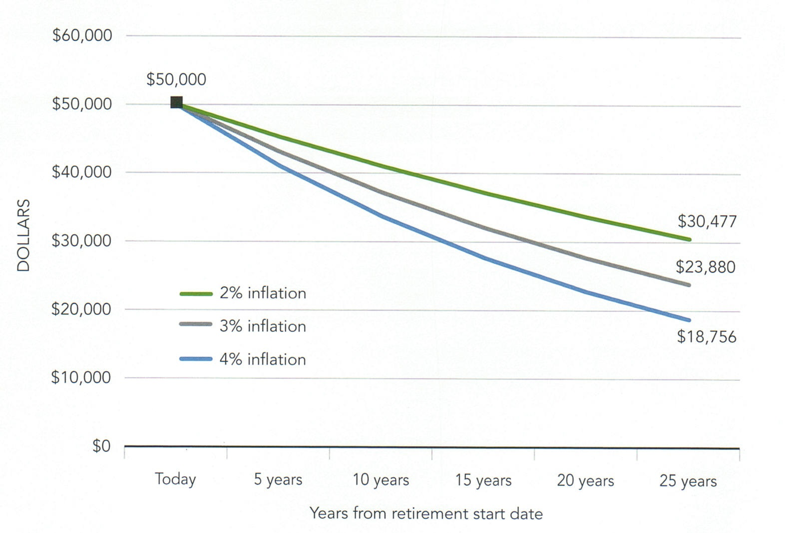

Here’s another chart that shows the significant impact of even low to moderate inflation on retirement savings over a long period. If you saved $50,000 today and inflation averages just 2 percent per year for the next ten years, it would be worth approximately $10,000 less. If it averaged 4 percent per year, your account would lose almost $20,000 of its purchasing power.

Most of the time, we hardly notice, especially when inflation is low. It may be more noticeable when it is high, but long periods of low to moderate inflation can take their toll as well. The cumulative inflation rate since 2007 has been approximately 18%. That means that the $17,000 investment in the S&P 500 that I mentioned above is actually worth 18% less in terms of real value (i.e., purchasing power) in 2017, or $13,900.

Some basic definitions

The popular understanding of inflation is that it is simply a general increase in prices. More specifically, according to Investopedia, inflation is “the rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling.” If the inflation rate is 4%, something that costs $100 now will cost $104 next year, $108.16 the following year, etc. It works in the reverse of compound interest on a saving account – not a good thing, especially when you are saving long-term for retirement.

There are several different ways to measure inflation. The most familiar is the Bureau of Labor Statistics (BLS) Consumer Price Index (CPI or CPI-U), which is a measure of the average change in prices paid by an urban consumer for a particular “basket” of goods and services.

According to the BLS, the CPI “basket” is taken from eight areas: food, housing, apparel, transportation, medical care, recreation, education, and other. Because the CPI is weighted by the amount of income a typical consumer spends in each area, it also constitutes a cost of living index. The CPI is used extensively to adjust for many factors throughout the economy including government benefits (like Social Security), and also income tax brackets.

Another measure is Core CPI which removes volatile food and energy prices from the calculation, things that can change in the short term due to supply shortages. The Core CPI might be useful in some cases, but for most of us, these things are a big part of our cost of living.

But what is it really?

From a Biblical perspective, inflation is not just about higher prices, although that is how you and I typically experience it. Many say that it is “unequal weights and measures” brought on by increases in the money supply due to the “fiat currency” decrees of the federal government. (Proverbs 20:10 reads, “Unequal weights and unequal measures are both alike an abomination to the Lord.”)

“Fiat currency” is just paper money that has been decreed as legal tender that is not backed by gold or silver. As currency is added to the money supply in a variety of different ways (printing more money, overextended credit by banks, government debt financing and Federal Reserve Bank purchase of government securities, etc.) the value of existing currency is diminished, which translates to reduced purchasing power. An excellent article by William Larkin explains it this way:

Inflation is the creation of excess purchasing media or credit beyond that which represents the wealth, the production of goods and services, of a country. It violates the biblical commands to have just weights and not steal. Its immoral consequences are the oppression of the poor, especially the elderly; the promotion of sloth and covetousness; and the destabilization of society.

This is why some have called inflation, “the cruelest tax of all.” As Scripture clearly forbids unjust and arbitrary weights and measures, it also seems to condemn artificial increases in the money supply. As Christians, we should do all we can to encourage fiscal discipline in the government to protect the vulnerable from inflation. And as good stewards, we must understand all of its negative consequences, including the harm it does to the resources that God has entrusted to us.

Inflation can sneak up on you

We’re all pretty relaxed about inflation right now due to the low, stable rate that has existed since the early 1980s. Even gas prices are relatively low. In the last 30+ years, we’ve mostly forgotten the inflation nightmare of the 1970s. (Although, I vividly remember having a 12% ADJUSTABLE RATE mortgage back then – and that was a good rate since fixed rates were averaging around 16% at the time!) The inflation rate is pretty stable right now, and for 2017 it probably won’t be much over 2%, in fact, it may be under (it was only 2.1% in 2016).

Some economists expect it to go higher as the economy slowly heats up, but the overall forecast is that it will remain below 3% per year for the next several years. In fact, most of today’s economic policymakers consider a certain amount of inflation a good thing: 2% annually is often used as a “reasonable” target.

One thing is clear: If you want to have enough to be able to retire with dignity one day, you need to be looking out for inflation and taking actions to protect yourself. Don’t let it sneak up on you; the effects may be greater in the future, and certainly over an extended period, even if it remains relatively low.

Even if inflation stays between 2 and 3 percent, it is something to be mindful of. If you earn 5% a year on your investments, and inflation is 2.5%, your REAL return is only 2.5%. You’d be doing better than inflation, but not by much. If yields are lower, or fees are higher, or inflation is greater, you could end up with minimal or even negative returns.

What can you do about it?

We can’t control what the inflation rate will be, but we do have some control over our “personal” inflation rate and what types of things we invest our retirement savings in.

Your personal inflation rate

In general, we need to avoid spending more than we have and also most debt. This is the problem our government faces – deficit spending, or spending more money than they have in revenue from taxes. We can also maintain some control over our cost of living by practicing an appropriate level of frugality and thriftiness, without hoarding. We can avoid hoarding by pursuing generosity and helping those in our churches and communities who are most vulnerable and therefore most impacted by inflation.

As it pertains to our retirement savings, you could just accept that a fair amount of the value of your hard-earned retirement assets will disappear before you ever get to use them, which means you may need more of them. Or, you can take action to retain (and hopefully increase) their value in a way that at least keeps up with inflation.

Alternative #1 is the easier one to follow because it takes so little effort, but the impact on your retirement will not be good. Alternative #2 is the focus of the rest of this article. I will discuss some things you can do to mitigate inflation’s damaging effects.

Some problem assets (when it comes to inflation)

An investment’s return after inflation is called the “real rate”; it’s what you need to focus on, but many people miss this. Using the “nominal” rate (the one that’s usually quoted for bonds) implicitly assumes that you’ll experience zero inflation. Not likely.

When it comes to dealing with inflation, the most important thing is to be aware of the types of assets can be positively affected by inflation and those that can be negatively impacted. In other words, their “real return” after inflation. First, let’s look at the ones that can be adversely affected:

Short term bonds. I know this sounds crazy, but even though they are part of many retirement portfolios, “ultra-safe,” high-quality bonds (generally short-term with low-interest rates) can be a problem; they pay less than a (possibly) higher inflation rate. For example, the current rate on a ten-year T-Bill is roughly equal to inflation. Shorter-term treasuries pay even less. If you buy a ten-year T-Bill in 2017, and inflation stays constant (just over 2%), your real return will be about zero each year and the principal returned to you will be what you paid for bond for in the first place. If inflation is higher, it could be less.

You may need to have some short-term bonds or bond funds in retirement, but use them to balance more risky assets and not as the majority of your portfolio unless you are okay with seeing their real value erode due to inflation. I own a few bond funds in my retirement account, and they tend to be short to medium duration. As such, my expectation is that they will at best keep up with inflation.

Cash. If large cash amounts (at least on a percentage basis) are a part of your retirement portfolio, you should consider investing them in assets that hold their value in the face of inflation.

Holding some cash is always a good idea. If you continue to hold a large amount of cash while inflation increases, it will just continue to be worth less and less. It may make sense to invest some of it in things that tend to do well during inflationary times.

Long-term bonds (maturing more than about ten years in the future) will mature and pay with dollars of much less value than the dollars you pay to buy them today. Typically, when inflation is rising, interest rates rise along with it. So, when interest rates rise, the value of the underlying security falls, usually because investors sell to chase higher yielding alternatives. A 30-year bond paying 3 percent could decline as much as 40 percent should interest rates on new bonds rise to 5 percent.

The obvious solution is to hold bonds with shorter durations and therefore less sensitivity to rate increases. But as noted above, if inflation is high, they may not keep up and may lose real value regarding purchasing power.

Either the bonds themselves or mutual funds holding them may be worth keeping because of the likely changes in the bond marketplace over the next few years, especially in the face of probable increased taxation. The value of fixed-income instruments is very dependent on expectations of the future, including interest rates, tax rates, and inflation rates, so deciding on these investments should use the same analysis as purchasing investment assets.

At a minimum, that analysis must make some projection about the future state of inflation and tax rates.

Annuities. Some assets are especially important to manage in the face of inflation. Fixed income annuities, if not adjusted for inflation, will have far less value after several years than you’d expect. That is one of their most significant weaknesses. I am not against annuities, especially the simple, immediate income variety, but if you decide that you need one, consider getting one that adjusts for inflation. The initial payouts may be lower in the short-term, but they will be better over longer periods.

Certain types of variable and indexed annuities can help with inflation because they have an investment component. But be careful, they tend to be overly costly and complex. Do your homework before you purchase any such product.

Some more appropriate investments (when it comes to inflation)

I’ve listed some assets that can be particularly vulnerable if inflation is part of our economic future. Putting all your money into those things may not be wise; you need some better alternatives. Here a few possibilities to consider:

Real Estate: Your home may well be your most valuable asset, and its real value is pretty much independent of the inflation rate. Unfortunately, a “housing bubble” occurred less than ten years ago, and as values have rebounded considerably and interest rates have remained low, we could be heading toward another. You may invest in residential real estate by default — you need somewhere to live. In general (over ten years or so), real estate maintains its value in the face of inflation and sometimes is even higher. But as we know all too well, it can fall precipitously.

I don’t currently own any real estate investments in my retirement portfolio, but I have owned REITs in the past.

Commodities: What I’m referring to here are things that can be bought and sold in the commodities markets; things like oil, natural gas, gold and silver, wheat and corn, even currencies. Commodities prices tend to rise when inflation is on the increase so they may offer some protection from its effects. As the demand for goods and services increase, prices usually follow, as do the price of the commodities used to make those goods and services. A word of caution: Commodities are considered “alternative” investments and should not make up the majority of any portfolio. They can be very volatile at times.

I have a small position in gold and also in an ETF that owns oil and gas pipeline stocks.

Stocks: Equities tend to be reasonably independent of inflation, but their inflation-adjusted return hasn’t been very encouraging. In fact, according to an article on Advisor Perspectives, for the period 2000 to now (August 2017), for $1,000 invested in SPY, an S&P 500 Index Fund, the total return would be $2,213, or 4.68 percent compound annual return. That sounds pretty good, “but the real (inflation-adjusted) purchasing power of that $1,000 is currently only 545 dollars above break-even, a real compounded annual return of 2.54%.” That’s still a positive gain after inflation, but much less than 4.68 percent. That would suggest that stocks are still a pretty good investment when it comes to inflation, but they may not be as good as you think.

As someone nearing retirement, I tend to be fairly conservative and invest in low volatility stock funds that pay dividends and some potential for dividend growth. I currently own both domestic and international dividend-paying stock funds.

Inflation-Linked Bonds: Treasury Inflation Protected Securities (TIPS) are bonds issued by the Federal Government that provide interest income on their principal, but they also adjust their principal to keep their real value constant based on inflation. I haven’t been very interested in TIPS lately because their interest rates are so low and inflation has also been relatively tame. But that’s not the whole picture. The real interest on normal (“nominal”) short-term bonds will be NEGATIVE unless the interest rates are higher than inflation, but TIPS guarantee a POSITIVE return. That makes it worthwhile to compare TIPS to commercial bonds. For many, it will make sense to invest in both, with inflation-linked government bonds providing some protection from inflation.

I don’t currently own any TIPS, but I have in the past. I would certainly consider them if inflation show signs of increasing significantly.

Mattress Fund. The technique of putting your cash under the mattress (or in a low-return fund where management fees eat up all the income) will protect you from the possibility that other kinds of investments will end up being a bad decision. However, the probable rate of inflation indicates that putting it under the mattress would be unwise; you need to look around for investments that will protect your assets and give you (at least) some real increase in value.

I’ve shared previously that I currently have a fair amount of my retirement savings in cash. That’s because I consider the markets to be overvalued, not because I think it’s a good way to deal with inflation. I am always looking for buying opportunities but I am in no hurry to invest my cash; I want to be patient.

Conclusion

It certainly seems as though hyperinflation isn’t on the near horizon, but as we have seen, just 2% inflation year-over-year can take its toll. Plus, we don’t know when higher rates might return.

Whether your retirement assets are in 401(k)s, pension plans, or in your IRAs, make sure that that the assets in them are invested in a way that mitigates the effects of inflation, especially if it starts ramping up from the 2 percent range. If your current investments won’t do well with inflation, find out how to move them to investments that will protect your money (and perhaps even increase with inflation). No one can accurately predict what inflation will be over the next 20 years, but I’m pretty certain that it won’t stay at 2 percent or less forever.