To say that we live in tumultuous times would be an understatement.

We’re experiencing turmoil and upheaval in multiple areas: political, financial, cultural, social, and even in the church. And there’s war in Europe on the largest scale since WWII.

None of this should be a big surprise to us—God’s Word tells us what to expect:

You will hear of wars and rumors of wars, but see to it that you are not alarmed. These things must happen, but the end is still to come. Nation will rise against nation, and kingdom against kingdom. There will be famines and earthquakes in various places. All these are the beginning of birth pains (Matt. 24:6–8, ESV).

Our natural tendency in response to the uncertainty this creates is to become fearful. If not outright fear, a low-grade sense of unease and anxiety simmering below the surface.

We may fear or feel anxious for many reasons, which can extend to how we think and feel about our retirement savings during times of crisis.

In times of global and domestic turmoil (and resulting financial instability) such as we are currently in, buying gold (and other precious metals such as silver) comes up even more frequently as a way to protect our assets.

We know that God is our strength and fortress (Ps. 18:2), and our ultimate security is in him (Matt. 6:26, 31–33). But we also endeavor to understand rightly and assess the risks we face, and make wise decisions about the financial resources God has made available to us, especially those we need to live on in retirement.

In this article, we’ll take a closer look at gold (although it could be a proxy for silver and other precious metals) and the part it could play in your retirement portfolio.

Are you “safe”?

In a previous article, I listed gold as a non-traditional investment that celebrity spokespersons sometimes market in commercials using persuasive language targeting those with concerns and fears about financial security in retirement. (You’ll also see ads for it in printed and online media.)

In a recent TV commercial from Rosland Capital about owning gold in your IRA, well-known celebrity spokesperson William Devane says:

In the White House press room…questions and answers about homeland security, global instability, and our devaluing dollar. . . the answers that come out of this room can threaten your savings. That’s why I buy gold from Rosland Capital. . . Gold gives me more control over my portfolio, and I want that; I need that… find out how gold can help shield your wealth… so ask yourself, are you safe?

I like William Devane. He’s a great actor—I liked him as President James Heller in the “24” TV series, and as Dr. Dix, an ex-cop turned shrink in the Jesse Stone movie series (starring Tom Sellick). But the commercial is a little over the top—not in terms of the risks we face, but the implication that gold is the ultimate safe harbor to weather any storm.

It plays to a common and familiar fear that many people have, which is as follows: The US economy is going to collapse (due to the federal debt and deficit, inflation, excessive government entitlement programs, market overvaluations, global political or economic upheaval. . . the list goes on and on), putting all of their savings and investments at risk.

Devane’s sales pitch is that the world is such a dangerous place that global events could hammer the value of stocks, bonds, and cash at any time. So putting your money into hard assets like gold will enable you to survive such a crisis. As he says in another commercial, “an IRA backed by gold and silver, not by paper and promises” (referring to fiat currency and government guarantees).

The value proposition is that we should all put money in gold because, when everything comes crashing down, it will be the store of value and medium of exchange that the world will fall back on. (Interestingly, gold has a new rival as the catastrophe-avoidance asset of choice: cryptocurrency. But that’s a discussion we’ll take up in my next article.)

This ad and others like it (Devane has done quite a few over the years) suggest putting your retirement savings in a gold or silver Individual Retirement Account (IRA) to protect your money (keep it “safe”) or help it grow faster. You can open an account and fund it with a current year’s IRA contribution or ask for an” IRA transfer kit” to move existing IRA assets.

The decision that anyone considering gold or silver as part of their retirement portfolio needs to make is whether it’s a wise choice or not. And as we shall see, there are concerns: high costs, relatively high volatility, and a mixed investment record. But there are also some potential benefits in exchange for the risks.

Gold as an inflation hedge

Gold has traditionally been viewed as an inflation hedge—mainly because it’s considered a store of value that is not a currency (dollar). It has generally held its value over the centuries, even though there have been years (and even decades) when it has done very poorly.

According to the Bureau of Labor Statistics CPI, the average inflation rate in the US from 1915 to 2021 was 3.16% per year, representing a cumulative increase of 2,615% over that period. In other words, in 2021, it takes $26 to buy what $1 would buy in 1915.

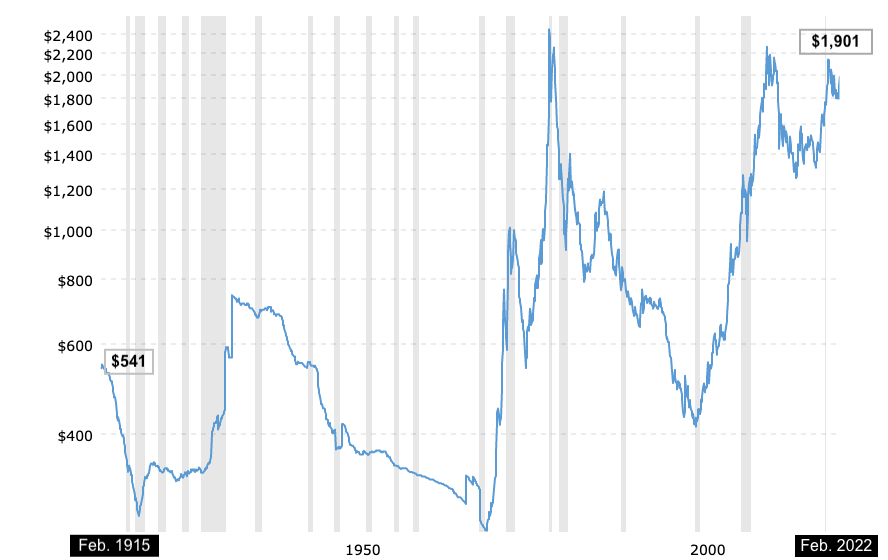

So let’s see precisely how well gold did during that same period. Take a look at this chart which plots the historical data for real (inflation-adjusted) gold prices per ounce back to 1915. (Recessions are shaded in gray.)

Inflation-Adjusted Gold Prices – 1915 thru Feb 2022

If you had purchased an ounce of gold in today’s dollars in Feb. 1915, it would have cost you $541. The price in Feb. of 2021 was $1,901. And as of March 14, 2022, the price was $1,960.

So, gold is currently selling for about 3.5 times (a cumulative 350%) what it did in 1915 in real dollars, an inflation-adjusted average annual return of only 1.2%.

That suggests that gold is closely correlated to inflation and even did a little better than inflation (by a little over 1% a year) for the last century.

If we zero in on the chart at specific periods, things look a little better. The price of gold rose by more than 500% to $2,228 from January 2000 to August 2011, while cumulatively, inflation was only 34%. Since then, gold has barely held its own—the current value is still around $1,900/oz.

Inflation has indeed taken its toll on the US dollar over the last century—it’s lost about 98% of its purchasing power since 1915. And you don’t need me to remind you that it’s at historic highs right now. But, surprisingly, despite over 7 percent inflation for the last 12 months, gold is about the same price it was a year ago.

Still, you’ll be encouraged to invest in gold to “protect the purchasing power of your money.”

But here’s a problem with that argument: Almost no one keeps all their savings in cash stashed under their mattress. If they did, their money would decrease in value by the rate of inflation year by year. And it’s also highly improbable that anyone would put all their cash into gold (unless they’re a pirate).

Instead, most people invest their long-term savings in stocks, bonds, or real estate. Or, if they’re ultra-conservative, they may put their excess cash in insured bank deposits and CDs (which are yielding next to nothing right now and therefore also getting hammered by inflation).

Let’s look at another chart. It shows the inflation-adjusted performance of the S&P 500 from its inception thru Feb. 2022:

S&P 500 Inflation-Adjusted Historical Chart

As you can see, in Nov 2021, the inflation-adjusted S&P 500 was 16 times its value starting in 1928, which is an average annual return of about 7% (or approx. 10% without inflation).

Compare that to the performance of gold with a 3.5 times increase and an average inflation-adjusted annual return of 1.2%.

It seems that long-term investing in stocks (individually or through funds) can also provide inflation protection. And unlike gold, businesses are functioning in the real economy, buying and selling products and services that have real value.

During periods of inflation, individuals face rising costs because companies have cost increases for the things they buy, whether raw materials or wholesale goods, and the wages and salaries they pay their employers. But they can generally raise the price of what they sell by a similar amount and thereby maintain their profit margins. (However, depending on the industry, total revenues may be less due to less demand for discretionary items.)

Consequently, stock market performance isn’t that different during times of inflation from any other time. Consider what’s going on right now. Inflation in 2021 was the highest in almost 40 years (and there are no signs of it subsiding in 2022), but the S&P 500 was also up by nearly 25%.

If you invest in a diversified stock portfolio (or stock mutual funds or ETFs), your money is invested in profitable businesses that deliver real value to consumers. Inflation won’t necessarily have too big an impact.

We have seen that stocks are also a good hedge against inflation and outperformed gold on an inflation-adjusted basis. But, to be fair, there have been times when stocks were down and gold was up. So, for that reason and others, some view it less as an inflation hedge and more as a “safe haven” in the event of a prolonged market meltdown.

Gold as a ”safe haven”

The commercials for gold I alluded to above repeatedly use words like “protect,” “shield,” and “safe.” Recalling Devane’s words in one of his recent Rosland gold commercials, “Find out how gold can help shield your wealth…so ask yourself, are you safe?”

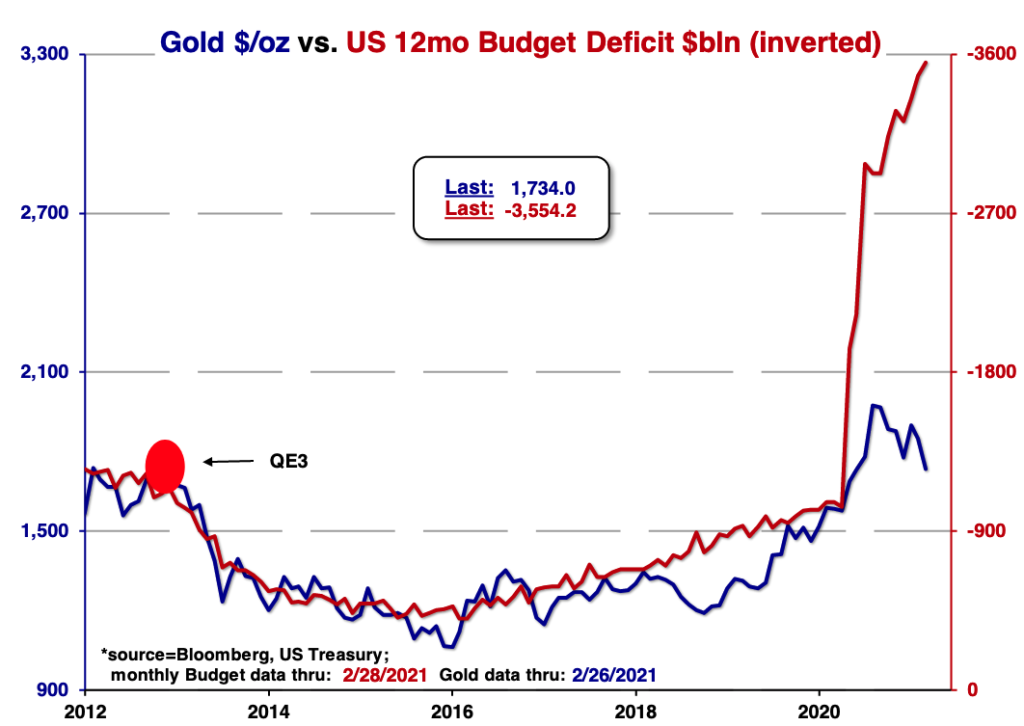

One might think that gold would be again reaching new highs considering the level of federal deficit spending over the last ten years or so. Surprisingly, that’s not been the case.

It has historically been somewhat correlated. But more recently (since early 2019), the annual federal budget deficit has quadrupled, but the nominal (not inflation-adjusted) price of gold has only doubled (based on a current spot price of about $1,800).

Beyond deficit spending, how likely is it that the entire US or global economy will collapse and revert to the gold standard of exchange in a worst-case scenario? It’s certainly not impossible, and we Christians know from scripture that there is a time of great calamity coming (Matt 24:21).

Global unrest, such as we saw with the emergence of the coronavirus in 2020 and now the war in Ukraine, had a significant impact on the financial markets. As I discussed in a previous article, most stock indexes are now in “correction territory.”

So let’s see how gold held up. The chart shows the nominal (non-inflation-adjusted) price of gold since 2002.

Historical Nominal Gold Price – 2002 to Present

After the global financial meltdown and recession of 2007–2009, gold rose to an all-time high in 2011, reaching $1,825/oz. (It was caught up in a commodities “boom,” as the country came out of the reception, and perhaps also due to emerging market demand and investor interest.)

But then that bubble burst, and it languished for almost ten years when it hit another 10-year high during the early months of the pandemic, closing at $1,972/oz. in July 2020.

And not surprisingly, it’s approaching its highs again due to Russia’s invasion of Ukraine and the threat of war in other parts of Europe.

It’s clear that gold is a reliable store of value and may even increase in value during times of extreme uncertainty.

Still, a final, end-times-type event—a situation so bad we have to use gold to buy food—would be an economic catastrophe on a scale that may be impossible to be completely prepared for, no matter how much gold you own. And gold may be less precious than clean water in such a time.

But that doesn’t mean that holding some amount of gold wouldn’t be wise. As Chuck Bentley of Crown Financial Ministries wrote,

Today, many investors hoard precious metals, especially gold, as economic crisis insurance. Caution and preparation are wise, but no one can prepare for every possible calamity. Because the buying and selling of precious metals are oriented more toward a long-term investment strategy, any long-term financial planning could conceivably include the purchase of some precious metals.

Bentley goes on to say,

Precious metals are long-term stores of value and internationally recognized assets of last resort. They can diversify and stabilize a person’s portfolio, protect it against market fluctuations, and offer insurance against a currency collapse.

However, precious metals are volatile, speculative, high-risk investments. This investment area is for investors with a strong heart and cash only. Unless an investor can afford to lose what they have invested, this is probably not an area in which a person would want to risk much money, especially savings or retirement funds.

He’s talking about using gold and other precious metals as a hedge for diversifying our portfolios. Still, many financial advisors view gold as a generally poor investment or not an investment at all because it produces no income.

I have discussed the difference between investing, speculating, and gambling in previous articles. Based on those categories, I would agree with Chuck that gold is not an “investment” (since it doesn’t generate income—you can only make money if you sell it for more than you bought it). But I don’t think it’s gambling either; it falls more into the speculating category (as historical data shows it has a higher probability of increasing in value over long periods than not but can fall precipitously in the short term).

That said, gold is about as volatile as the stock market, though it’s not always closely correlated. Most of the time, when stocks go down, gold goes up, and vice-versa. So gold may be a good asset to hold to compensate for stock market volatility. The challenge is timing. Do you sell gold when it’s up and buy stocks when they’re down, and vice-versa? If so, to be successful over the long term, you have to time each transaction just right.

If you don’t want to be a trader, but as Chuck suggested, want to have some assets that are isolated in some way from the global financial system, consider having at least a small percentage of your assets in something that you think would hold up during times of extreme economic upheaval. How much you hold is open to debate, but I suggest no more than 5 to 10 percent of your total portfolio.

Buying gold

There are lots of ways to own gold outside of a retirement account. But if you want to purchase gold and hold it in one, you have a couple of options:

1) Set up a physical gold or silver IRA. You can set up a special, self-directed, alternative-asset IRA to hold physical gold coins or bullion. The assets in the IRA must be held by an IRS-approved custodian or trustee, which is where firms like Rosland Capital come in.

The IRS specifies what kinds of precious metals and in what form are allowed, such as the American Gold Eagle, and also sets standards for gold, silver, platinum, or palladium bars in such accounts. Other coins and jewelry are forbidden.

If you choose to go this route, keep in mind that there may be base fees and storage costs. There is also the potential problem of cashing out. To sell to a third party, you may have to sell for less than what it is selling for in the open market.

2) Buy a gold or silver Exchange Traded Fund (ETF). You can invest in an ETF that tracks the price of the metal. Like SPDR Gold Shares (GLD) and the iShares Gold Trust (IAU), these funds are set up as trusts that hold large quantities of gold bullion. There are also gold and silver mining company stocks and funds.

The advantage of a gold (or silver) ETF is that you can buy and sell shares and hold them in an IRA or even a 401(k) if that option is available. You also don’t have to keep the physical metal yourself.

Proceed with caution

Before I retired, I had a small position in GLD. Once I retired and wanted to generate more income from my portfolio, I sold GLD (which had appreciated) and used the proceeds to buy more shares of a dividend stock fund.

Gold and the stock market tend to be inversely correlated. As I think we might be heading into a one or two-year bear market with a likely market “shock” or two along the way, I decided to shift a small percentage of my stock assets back to gold (GLD), even though I knew I was buying at a premium as gold has been getting close to its all-time highs.

(This is why gold works better as a long-term “buy and hold” investment. If you had bought it for around $1,300/oz in 2018—just a few years ago it would have almost doubled in value by early 2022.)

Because precious metals can help diversify an investment portfolio, especially during times of extreme uncertainty, it may make sense to invest a portion of your portfolio in gold or silver to keep pace with inflation or dampen stock market volatility. As discussed, it keeps pace with inflation and then some (albeit with about the same volatility as stocks, and sometimes more).

But I don’t think it will be a completely safe harbor in the event of a global economic crisis. Still, there is a fair amount of historical data to suggest it can withstand certain types of financial crises.

After it rose 2.6 percent in 2008, the gold price increased 12.8 percent in 2009 as the United States was smack in the middle of economic and financial crises of the Great Recession, and the Fed was deploying multiple countermeasures, most notably quantitative easing.

But, if you’re looking for growth and are convinced that gold is going to double from its current price of $1,900/oz to $4,000/oz or more in the next few years because of “whatever,” that may be a sign you are making an investing mistake—when you’re reasonably sure of something that’s possible but not very likely to occur. The real world is way more uncertain than that.

On the other hand, if the war and inflation continue to rage, could it reach new highs in 2022? Sure it could, and I think the probability of that is relatively high, or I wouldn’t have purchased GLD. But the war could end tomorrow, and we might see the bottom fall out of gold prices. There’s no way to know what will happen.

Still, given the level of uncertainty we must all deal with, the many options and choices we have, and the wisdom we need to be good stewards, consider this from Proverbs:

Choose my instruction instead of silver, knowledge rather than choice gold, for wisdom is more precious than rubies, and nothing you desire can compare with her. (Proverbs 8:10-11 ESV)

Proceed with caution. Put a little of your savings in gold if you’re so inclined (or talk to your trusted financial advisor about it), but it’s no substitute for the wisdom of trusting in God while prudently investing all the resources he has entrusted to us.