Like millions of others, I watched the Super Bowl this year, which some dubbed the “Crypto Bowl.” The reason? A bunch of crypto exchanges (places online where you can buy and sell cryptocurrency) aired ads during the game at the cost of ~$7 million (or about 167 bitcoins) per 30-second spot. (One of my favorites was “Larry’s Cut,” an ad for the FTX exchange and app.)

Back in 2000, the Rams-Titans Superbowl game was known as the “Dot-Com Bowl,” as 20% of the ads were for dot-com startups. As many of us are (perhaps painfully) aware, the dot-com bubble burst that same year.

According to Wikipedia, of the 14 that advertised, “4 are still active, 5 were bought by other companies, and the remaining 5 are defunct or of unknown status.”

Will the same thing happen to crypto? No one knows. But although actor Matt Damon says that “fortune follows the brave” in his Crypto.com commercial, it may not be so kind to those who forget the lessons of the past.

Despite all the noise, if you’re like me, you’ve kept your distance while keeping an eye on what appears to be a new, intriguing, promising, and potentially disruptive technology enabling an innovative means of commerce and exchange.

Crypto is touted as much more than just a new kind of money—a “digital currency.” It’s also viewed as a store of value, perhaps more useful than gold, a possible hedge against inflation and market volatility, and a way to grow wealth (perhaps more quickly than in stocks and other investments).

Maybe you’ve read or heard unbelievable stories of investors starting with a few hundred or thousands of dollars who’ve made millions (of dollars) in crypto. Are those stories true? Well, yes, in some cases, they are.

Someone who jumped in early and bought Bitcoin (BTC), which was the first and is now the largest of many crypto ‘coins,’ with hard currency (like dollars) in 2010 and bought $100 worth when it was valued at 10 cents (a purchase of 1,000 bitcoins), would now be worth about $50 million!

No wonder you hear the phrase “bitcoin millionaire” used quite often.

But while it’s true that you could’ve made a fortune if you jumped into the Bitcoin fray early, does that mean you or I should do so now? Should we add some crypto to our retirement portfolio (or hold some outside it) to build wealth or to protect it by mitigating the problems with inflation and stock market volatility? Or is it really best suited for another purpose altogether?

Despite all the interest and hype, according to the Wall Street Journal, a “January survey from BitWise Asset Management of 600 financial advisers found 15% allocated a portion—usually 5% or less—of their clients’ portfolios in crypto in 2021. That is up from 9% a year ago and 6% two years ago. Yet, 85% of advisers still aren’t investing in cryptocurrencies for clients.”

I’ll try to address what I can to help you understand this complex topic. But, as you may already expect, there are no easy black-and-white answers when it comes to deciding whether to invest.

What’s “crypto”?

There’s a lot of information about crypto available online, but a few months ago, I picked up an interesting little book titled Thank God for Bitcoin: The Creation, Corruption, and Redemption of Money by the “Bitcoin and Bible Group” (multiple authors).

Apart from the catchy title (it reminded me of a sign I once saw on the back of a food truck that said, “Thank you Jesus for funnel cakes”!), I was attracted to the book for a couple of reasons:

1) I wanted to learn more about the subject. The book devotes several chapters to topics like understanding money, the history of money, inflation, problems with fiat money, and corrupt money. These chapters are basic economic lessons focused on the shortcomings of our current monetary system and how the authors argue it’s been politicized and corrupted. (Even if you don’t agree with all their conclusions, you may find them instructive.)

2) The authors are Christians who strongly believe that BTC is a more ‘biblical’ medium of exchange than traditional fiat money (especially the U.S. dollar) as it’s a known limited supply that cannot be changed. They point out that BTC has a cap and a known limit built-in, unlike the constant pricing of dollars that are believed to drive inflation. The last couple of chapters of the book address bitcoin in particular, and the final one is titled “The Redemption of Money.”

The book offered a surprising take on the subject (as exemplified by the catchy title) and a lot of helpful information, as I mentioned.

Here’s a simple, non-technical definition: A cryptocurrency is a digital form of payment that does not involve ‘hard’ currency (e.g., actual dollars you can hold in your hands) transfer that can be executed securely online for goods and services without the use of a third party.

There you go, that’s it. Overly simplistic, indeed—there’s much more to crypto than that (the blockchain being one of the most fascinating), but I hope you get the idea. Don’t think traditional “electronic funds transfer (ETF)” or “PayPal”—they involve the electronic transfer of dollars and the debiting and crediting of transactional bank accounts—crypto is something else altogether.

If you’d like to learn more about the history of crypto and Bitcoin in particular (what it is and how it was developed), I’d suggest this introduction to the topic on Bitcoin.com: What is Bitcoin? Another really good one is “The Latercomer’s Guide to Crypto,” published by the New York Times. I also liked this comprehensive article on crypto by Mark Biller on SoundMindInvesting.com (which requires a subscription).

It’s important to remember that Bitcoin isn’t the only cryptocurrency out there. It’s the largest and most highly valued one currently available, but there are many alternatives (sometimes called “altcoins”). These include Ethereum (ETH), Ripple (XRP), EOS (EOS), Litecoin (LTC), Tether (USDT), and others.

Ethereum is different from the rest as it’s an open-source software platform (a blockchain) that developers can use to create cryptocurrencies and other digital applications. Its native cryptocurrency is Ether (ETH), the second-largest in market cap behind BTC. So, I’ll mainly refer to Bitcoin (BTC) in this article as, for now, it’s the big guerrilla when it comes to cryptocurrencies.

Is it ‘money’?

Based on everything I’ve read, even though it has a lot of potential, the consensus seems to be that it isn’t ‘money,’ at least not yet, or to the degree that a currency like the U.S. dollar is. And I think it’s important to explain why many have apparently come to that conclusion.

Bitcoin isn’t a standard accounting unit

If you ask someone, “what’s your net worth?” they won’t answer, “I’m worth three bitcoins.” And if you talk to someone who owns (or has been trading) Bitcoin, they almost always describe their profits (while not always mentioning their losses) in terms of dollars, not Bitcoin.

The crypto market is also described in dollars, not Bitcoin or other cryptocurrencies. (Just look up BTC for a quote, and you’ll see what I mean.)

For those reasons, Bitcoin isn’t ready for use as a primetime universal accounting unit and may not be for quite some time.

It isn’t a common medium of exchange

Bitcoin can be (and has been) used to purchase goods and services; however, prices are usually set in dollars but can be paid with Bitcoin.

Few vendors accept Bitcoin as direct payment for goods and services. Those that do have to immediately convert it to fiat currency (the dollar in the U.S.) so that the account can settle (due to the volatility of crypto).

Moreover, dollars are considered legal tender in the U.S. (meaning they must be accepted if offered in payment of a debt), while cryptocurrencies are not.

It isn’t scalable

It may surprise you, but scalability is currently a significant issue facing most crypto and blockchain technology platforms. A worldwide shared medium of exchange needs near-infinite scalability—the ability to execute multi-millions, even billions, of transactions per second.

Bitcoin’s technology can only process a small fraction of all transactions in today’s global economy. While people are working to increase its scalability, it won’t be ready anytime soon.

It’s very volatile

The price (in U.S. dollars) of Bitcoin has been highly volatile. As measured in dollars, its value can fluctuate wildly on any given day. But the dollar, which may fluctuate in value a little relative to other currencies, is relatively stable (one reason why it’s the “world’s reserve currency“).

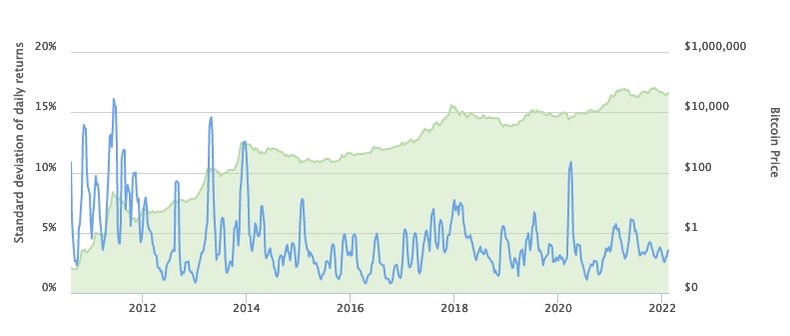

Take a look at this BTC volatility chart from 2010 to now. It shows how much Bitcoin’s price (in blue) fluctuates daily relative to its price (in green).

Bitcoin Volatility Time Series Chart

As you can see, there have been fluctuations (deviations) of 10% to almost 15% from the average on many occasions. And, over extended periods, as shown in the price chart below, there have been some huge movements—up and down—in the price beginning in 2018.

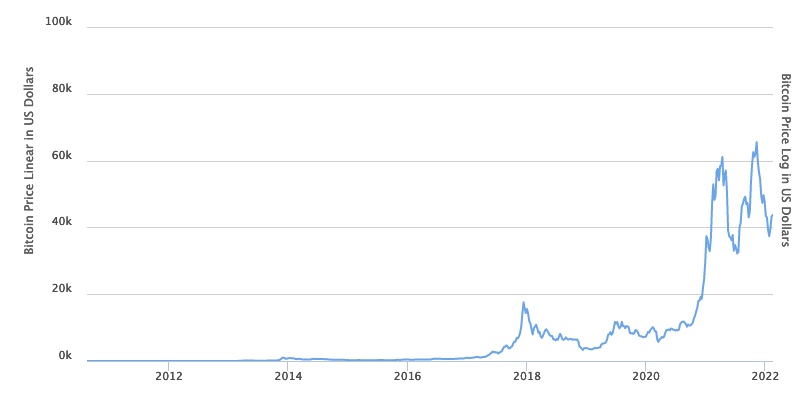

Bitcoin Price History Chart

For example, during 2017 and 2018, it went from $1.7K to $20K and then crashed by 85% back to $3K. In early 2020, it traded for about $5K but went to nearly $65K by April 2021 and then back to $32K by June before repeating almost the same scenario all over again before the end of 2021. (It’s currently trading around the $40K level.)

This kind of volatility can be bone-rattling and is not for the faint-hearted. This tends to limit demand and, therefore price and makes it difficult to use as a relatively stable medium of exchange, further reducing demand.

Sovereign nation control may be an issue

Because new Bitcoins can’t be created (although other coins, like those mentioned above, can be “mined,” but that’s a different matter), it limits nations’ ability to put monetary regulations and controls in place.

Some, like China, have already developed their own digital currencies, which they can control. The U.S. is also considering a “Central Bank Digital Currency.” These are threats to one of the main underlying principles of crypto: decentralization, which simply means that no single authority can control it.

This may tempt some nations to form alliances to enact laws, making it challenging to use crypto as currency.

Is it a good ‘investment’?

The answer to this question depends partially on what you define as a “good investment.”

I differentiated between trading, speculating, and investing in a previous article. To me, investing means putting money into something of value, such as a stock, bond, real estate, or small business that can be reasonably expected to deliver (intrinsically) some kind of valuable goods and services.

Bitcoin would seem to only partially fit that bill (and gold appears to have the same weakness). Unlike companies and tangible assets (like land), there’s really nothing there other than the ‘man behind the curtain’: its utility to provide underlying support for the price of Bitcoin.

In other words, if people decide they don’t think Bitcoin will be all that useful after all, there’s nothing to support its value—it has no intrinsic worth apart from its underly technology (which is pretty amazing). In such a case, its value could go to zero.

For these reasons, it should not be viewed as an investment in the traditional sense but more as speculation based on the notion that it will probably go up in value, but there may be wide disagreement about that at any given time.

But if we assume just that—that Bitcoin is a speculative investment with significant promise and potential benefits—here are some reasons why we may or may not want to invest at this time:

As a store of value

This seems to be the main reason many people are buying (or investing) in crypto—they view it as a store of value, much like gold. (Some even refer to it as “new gold.”)

One could argue that this is based on ‘trust’—people trust it as a store of value due to many of its underlying properties (see the Bitcoin.com article). But what if we decide that only one main store of value is necessary? If it’s not Bitcoin or something better comes along, its value won’t hold.

Another argument against Bitcoin as a reliable store of value is that, if it were, it would lose 20%, 30%, or 40% of its value in a single day.

As a hedge against inflation

If Bitcoin eventually becomes the “new gold,” it would be logical to ask whether it can hedge against inflation.

In 2021, as inflation heated up, the price of Bitcoin also finished the year up, which seems to support its use as an inflation hedge and store of value.

But BTC has been averaging over 62% average annual growth during times of low or no inflation, so it’s hard to establish a close correlation.

Another argument is that, unlike fiat currencies, there is a limited supply of Bitcoin tokens (there are no actual shiny coins, by the way). And new coins (tokens) can only be released by “mining,” which is the creation and validation of new coins in the blockchain. (Anybody can become a ‘miner,’ but it requires a lot of computing power.)

Theoretically, due to the finite supply of a coin’s structure (similar to gold, which tends to have an inverse relation with inflation), it should, by design, retain its value over time.

Surprisingly, however, as inflation has surged over the past year, gold has not. It has actually decreased over the past 12 months. The same is true for Bitcoin. Inflation is up 7.5% over the last year, but Bitcoin is down almost 18%.

Although it has undoubtedly outpaced inflation in the past, nobody knows whether it will continue in the future.

As a hedge against stock market volatility

We’ve seen how volatile Bitcoin is, at times, much more so than the stock market. Therefore, investing in it is risky—you could lose some or all of your investment as the price fluctuates. But, as with stocks and stock funds, commodities, and other investments, you don’t actually lose unless you decide to sell for less than you originally invested.

The question, then, is whether Bitcoin is a hedge against stock market volatility.

Bitcoin (and crypto in general) is viewed as its own asset class. That means it doesn’t show discernible sustained market behavior patterns with any other asset class. But that doesn’t mean it protects against a prolonged down stock market.

I won’t bore you with any more charts or stats, but it sometimes moves opposite the stock market, in no relationship with stocks, or moderately correlated, and then back again.

As I publish this article, the stock market (as measured by the S&P 500) is down 6.76% YTD, and the price of Bitcoin is down about 7.5%.

While we can’t come to any sweeping conclusions about this, we can say that crypto sometimes tracks stock market performance and, at other times, seems to have a mind of its own.

As a way to grow wealth (perhaps quickly)

Many people find this one more intriguing than the first three. Why? Take another look at the BTC price chart above.

As you can see, Bitcoin’s value has increased by over 30,000% since its inception and well over 9,000% over the past ten years! So, on the surface, it looks like a way to “get rich quick,” if ever there was one.

Well, here’s the challenge with that. Over the next ten years, the price would have to increase astronomically.

Further, there has been extreme volatility along the way. (It’s had numerous down days of 30% or more and crashed 50% over the two-day pandemic panic of 2020—so much for its role as a “safe haven” and protection from stock market volatility.)

Could we see a repeat of the astronomical growth of the last two decades? Perhaps. But is it likely? Probably not. It could be worth more—maybe a lot more—in ten or twenty years than it is today. But the whole thing could collapse like many dot-com stocks fueled by excessive speculation in 2000.

I’m reminded of a familiar saying: “Those who fail to learn from history are doomed to repeat it.”

Should you take the plunge?

I’m sorry, but as with most financial decisions, I can’t say what’s best for you. I don’t currently own any crypto, but that doesn’t mean I would never purchase some. (Nor does it mean I don’t sometimes wish I had bought some back in 2009-2010.)

But I can say this: you and I should thoroughly understand this technology and its market risks before thinking about buying into Bitcoin or any other cryptocurrency.

I would go further and say that while it seems very promising, especially as what it was initially created for (as a secure, reliable medium of exchange), investing in it is very risky, therefore probably not for conservative investors who are near or already in retirement.

I have other concerns:

- No one knows if Bitcoin or some other cryptocurrency will become the preferred medium of exchange in the future (see reasons above).

- They have storage and security issues. Where do you store it—in the “cloud.” What if you lose your password or need access and can’t get on the internet? What can you do if it’s hacked or stolen; there is no government insurance backing it up. (Some have lost their password along with millions in crypto!)

- Will current cryptocurrency take over government currencies? Would the U.S. Treasury allow that? They’re likely to come out with their own, which is already happening. If they “win,” what happens to Bitcoin and the others?

Returning to the Superbowl ads, crypto brokerages and exchanges mainly rely on FOMO (fear of missing out) to convince us to open accounts and start trading (because that’s how they make money).

So, other than for pure speculation, I don’t know why anyone—especially a retiree—would buy it at this stage in the game.

One exception, suggested to me by a reader who is a professional financial advisor (and CFA), might be to take a very small (1% to 3%) “insurance” position to have something that might function like gold in an extreme ”deep risk” situation, perhaps better. As the reader suggested: “To be able to get out of Dodge with nothing for the powers-that-be to confiscate and then rebuild your life somewhere else with a small stake.”

That’s a very different idea than buying Bitcoin as a possible way to “get rich quick” just because it has done extraordinarily well at certain times.

Finally, I would offer these words of “biblical caution” from Chuck Bentley at Crown Ministries. Citing 1 Tim. 6:9, Prov. 13:11, and Prov. 30:8–9 as references, he wrote,

The bitcoin frenzy is attracting a high percentage of gamblers, not serious investors. We’ve seen the devastation in the lives of those who win the lottery. Most just don’t know how to handle a sudden increase in wealth. I consider the purchase of bitcoin a wager, not an investment. It has similarities to gambling and wild speculation versus a measured approach to wise investing.

This is why it’s so important to size your allocation correctly and go into this new asset class with your eyes wide open. Setting the right expectations for the potential risk in crypto is far more important than setting the right expectations for returns.

As for me, I’m going to keep an eye on it. But since I don’t have a lot of investable assets outside my retirement accounts, I doubt I’ll be doing much of anything anytime soon, if ever.

If you want to invest (or trade)

You can’t directly buy crypto coins in your IRA; you have to set up a special account with a coin exchange to hold them (similar to what you have to do to hold physical gold). But there are other options: crypto ETFs.

Those ETFs invest indirectly in the crypto market, such as GBTC, which invests in BTC futures. (The SEC has not yet approved any ETFs that track the spot price of BTC like what GLD does for gold.)

Like any investment, how much Bitcoin you might buy should depend on your risk tolerance. Remember that Bitcoin is a gamble and needs to be treated as such. Don’t invest more than you would feel comfortable losing.

Summing up

I’ll sum up with this by Mark Biller from the SoundMindInvesting.com article I mentioned earlier:

. . . this article should be interpreted more as an “it’s-still-early-so-be-careful” warning than as an indictment of the crypto space. Early tech cycles always take time to develop to the point where the general population can use them easily and safely. . . One day, we’ll be using crypto-related services and evaluating a new slate of investing opportunities. But we’re not there yet. The risks remain high.

So, like Mark, and as I wrote earlier in this article, I’m going to keep my distance for now “while keeping an eye on what appears to be a new, intriguing, promising, and potentially disruptive technology enabling an innovative means of commerce and exchange.”