I recently re-read Tim Challies’ article titled ”Rule #5: Ponder the Brevity of Life (8 Rules for Growing in Godliness), in which he wrote the following:

Aware of death’s inevitability, we must discipline ourselves to ponder just how short our lives will be. Though our hearts are set on immortality, we are heading toward certain mortality (Ecclesiastes 3:11, Hebrews 9:27). Moses says, “The years of our life are seventy, or even by reason of strength eighty; yet their span is but toil and trouble; they are soon gone, and we fly away” (Psalm 90:10).

And also,

Finally, we do well to consider that we do not know how much time we have left. “So teach us to number our days,” says Moses (Psalm 90:12). Life is short, and we have already lived so much of it. Only God knows whether we have decades remaining or mere moments. “Yet you do not know what tomorrow will bring. What is your life? For you are a mist that appears for a little time and then vanishes” (James 4:14).

I just had my 70th birthday. And Moses said I may make it to 80. I’m grateful to be in relatively good health, but still, I know, as Tim wrote, my days are numbered.

My father lived to age 86 despite a fairly unhealthy diet and some other bad habits. Perhaps some of his longevity was due to his high activity level and strong work ethic (36 years in the Marine Corps will do that for you—he was in WWI, WWII, and the Korean War).

He passed away in 1988 and was buried in Arlington National Cemetery. The headstone was originally placed in 1949 when his first wife passed away and was buried there. He married my mother a few years later. (Yes, I was born in 1952, when he was 50 years old, and I’m the oldest of four children he had with my mother!)

My mother died much younger, in her early 60s, primarily due to heavy smoking. However, there was some longevity in her family. I don’t know much about my father’s family, so I don’t know my genetic predisposition toward longevity. I only know that the Bible says that God alone has determined the length of our days on this earth (Job 14:5).

Thinking about the brevity of our lives and how much time we may have left, especially as we get older, can seem morose or morbid. Still, as Tim suggests, it can actually be an excellent spiritual (and, I think, practical) discipline. It can help us keep things in the right perspective and priority.

According to the Social Security Life Expectancy Calculator, someone like me who reaches age 70 can expect to live another 15.4 years to age 85.4. That’s pretty encouraging but by no means a certainty. The calculator doesn’t consider personal factors such as current health, lifestyle, or family history.

Some data suggests that a reasonably healthy 70-year-old man has a 5 to 6 percent chance of living to age 100. Those aren’t great odds and I have no expectation to that effect, but I guess I wouldn’t mind, depending on my physical and mental condition in years 90 to 100. I think I’d be okay if I could accurately tell you where I am, what I’m doing, and how old I am at age 95.

The research also says that lifestyle factors contribute to longevity, such as nutrition, exercise, relationships with family and friends, and faith. I don’t think I excel in any of these areas, but I try.

Even though I look forward to heaven, I’d like to think I have another 15 years on this earth. I would love to see my grandchildren grow up, graduate college, and perhaps marry. It would also be a huge blessing to have some great-grandchildren.

I would also like to have at least 10-plus years of productive involvement in my local church and community doing the things God has given me the gift and grace to do. (As you’ve probably noticed, that’s something I emphasize on this blog—retirement stewardship involves much more than just our finances.)

Still, I know I will experience physical decline, preventing me from doing more strenuous activities. (I have a house and yard to maintain, and sometimes I think I’d like to downsize to something less demanding of my time and money, but so far, we haven’t pulled the trigger on that.) Plus, an unexpected injury or illness could have a sudden impact on my ability to do these things.

Also, as you know, this blog and writing a few books have been a big part of my retirement—I’m approaching 200 articles on this site, plus three books. It’s been rewarding to know that my writing has helped and encouraged others in at least some small ways. I also have the privilege of coaching and counseling on stewardship and retirement in my church and occasionally with others.

As far as our finances are concerned, I’m not overly concerned about running out of money, but it’s not like that could ever happen. Five or ten years of losses with lots of overspending could cause some big problems, and like most of you, I’m dealing with down markets and a declining portfolio value right now.

My relatively conservative retirement portfolio is down over 16% YTD, but I’m trying to keep things in perspective. Due to what some might call an economic anomaly, stocks and bonds have been declining all year due to the fed’s quantitative tightening strategy in response to historically high inflation.

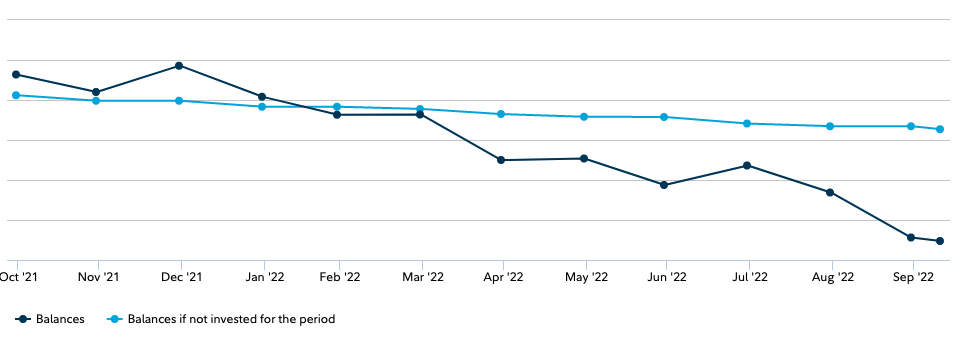

Here’s a chart directly from my Fidelity retirement account. It shows the trend line for our savings if I had not been invested (all cash) versus actual performance. As you can see, it has been pretty rough since July.

We seem to be entering recession territory. If that happens (and I would say it’s likely), we’ll have to see how long-lived it is.

Adding to this financial ‘discomfort’ is that we’ve also been spending from our portfolio. Beyond our everyday expenses, we took an extended vacation (from retirement, LOL) in September to several national parks (Banff in Canada and Glacier, Yellowstone, and Grand Teton in the U.S.). We were celebrating our 50th wedding anniversary. We were gone for several weeks, so it wasn’t ‘cheap’ (flights, rental car, gas, hotels, food, souvenirs, etc.). I put over 3,000 miles on a rental car.

I even had to buy a new pair of hiking shoes after mine came apart at the soles while on a trail in Glacier National Park. (Note the safety pins holding the outer hard rubble sole to the softer inner sole of the shoe; I didn’t have any duct tape.)

This trip was to celebrate and commemorate our 50th wedding anniversary. It seems like yesterday when this wedding picture was taken. We’re grateful for God’s grace in sustaining and blessing our marriage and for the 50 years we’ve had together. (We’re also very thankful that God made it possible for us to adopt two children and has also blessed us with grandchildren.)

Rather than buy each other expensive gifts, since we haven’t traveled much over the last couple of years, we decided to take the trip to the national parks in the Northern Rockies. This picture was taken in Yellowstone (looking back and down the canyon toward the lower falls):

I wrote an article back in 2019 about taking a vacation from retirement. What was true then is still true: Though I’m retired and no longer work a regular job, it still feels like a vacation when I break from the usual routine. This one was no exception. We enjoyed lots of hiking and sightseeing (and some gift shops, of course); the beauty and wonder of God’s amazing creation were displayed everywhere we went.

I’ve set aside the money for the trip over the last few years, and frankly, my conservative tendency would have been to delay the trip until the overall financial outlook got rosier than it is now. But, as Tim’s article reminds us, life is brief—we’ll only have one 50th wedding anniversary, and we may not get another opportunity to see those beautiful parks in our lifetimes. So, we took our trip (which we had planned for over a year) and enjoyed it very much.

Returning to finances, like anyone else, I don’t like seeing such significant losses in my retirement portfolio, but I try to remember that these losses aren’t ”real”; i.e., they’re paper losses (not realized until I sell assets, which I have no plans to do). I’m hoping asset values rebound in the future (though it may be a long time before they return to their late 2021 highs).

The other reason I don’t plan to sell assets until I have to is that they generate income that I use to add to my ”cash bucket.” I withdraw from our cash bucket, which, added to our Social Security, funds our living expenses. (I also ‘save’ in virtual accounts for predictable future expenses such as travel.) I also have two relatively safe short-term bond funds that could be used to help fund expenses without having to sell any stock funds, which make up a smaller percentage of my portfolio.

Our retirement income consists of Social Security (mine plus my wife’s spousal benefit) and withdrawals from our retirement savings. I’m withdrawing about 3.5% per year and plan to stay at that level until I start RMDs at age 72, increasing them slightly (to 3.65%). (Pending legislation before congress would push the mandatory RMD age to 75, but it’s also possible the RMD factors will change based on new actuarial data.)

I’ve thought about annuitizing part of our savings, especially since we’ve reached our 70s, but I haven’t done so. According to immediateannuities.com, a single premium immediate annuity based on a premium of $300,000 will pay $1,744 per month. That’s cash flow or a payout rate of 6.98%.

Due to rising interest rates, that’s better than they’ve been for a long time; but remember, you’re receiving a distribution that includes both interest and a return of a percentage of the principal. A 70-year-old won’t break even for 14 years (at age 84), which is almost the same as my life expectancy.

Of course, should I predecease my wife (a statistical probability) and she lives to age 95, the annuity will return 174% of the premium—not too shabby!

Many economists (but not as many financial advisors) recommend the total or partial annuitization of retirement assets to prevent running out of money in retirement. In addition to immediate income annuities, longevity annuities, QLACs, and others are on the scene.

For that reason and others, this has stayed on my radar as something I need to consider. However, the lack of inflation protection and control over the money I allocate to the premium still bothers me. Maybe I need to get over it, but that’s easier said than done.

My wife and I recently updated our wills, various directives, etc. We spelled things out to a certain level of detail while trying to keep things as simple as possible. The most complex thing for our heirs would be dealing with the division of our real property—our house, its contents, our cars, and so on.

Our ”everyday” financial accounts are held jointly, and my wife is the primary beneficiary of my IRAs (one traditional, one Roth; the former is the largest). They include my original IRA plus rollovers from my 401(k)s.

In addition to my will and directives, I also maintain a document for my wife and family that I call ”A Letter From Your Husband Who is Now in Heaven.” It contains information on all kinds of things, most importantly, all our financial and insurance accounts, online accounts and subscriptions, passwords, etc.

I want to be a responsible steward, not only with the financial resources God has entrusted to me but all the other gifts. As Tim Challies also wrote,

We should not only consider the brevity of life but also how much of our short lives have already elapsed. Job says, “My days are swifter than a weaver’s shuttle and come to their end without hope” (Job 7:6). . . We do well to ponder what we have done with the time given to us, as well as the talents, gifts, and opportunities bestowed upon us. Have we redeemed the time by using our talents, blessing others with our gifts, and making the most of every opportunity?

I want to use God’s good gifts for our good, the good of others, and his glory for as long as he grants me life on this earth. I fall short many times, but I press on, knowing that I am not too far from eternity because life is brief, and by the time we reach age 70 it’s even briefer. Despite the challenges it brings, living to an old age is a blessing and a time to be a blessing to others.

Whoever brings blessing will be enriched, and one who waters will himself be watered (Prov. 11:25, ESV).