Note: I first wrote about cryptocurrency a couple of years ago. This is the first of two new articles I'm going to publish about Bitcoin. In this one, I address Bitcoin as a long-term investment. In the second, I'll discuss what role Bitcoin might play in the event of a "fiscal crisis" precipitated by the ever-increasing federal debt. (Not a fun topic, for sure, but a necessary one as I believe that such a crisis, though avoidable, is possible if the Congress doesn't act to prevent it.)

When I start researching cryptocurrencies, it all seems like one big ongoing debate that’s unlikely to be resolved soon. Everyone has an opinion, and they all feel strongly (sometimes VERY strongly) about it.

There are secular “camps” and there are Christian “camps.” As you might imagine, they agree on some things and not others, even among their own camps.

I’ve primarily been in the “intrigued but a little leery” camp. However, I’ve found the underlying technology (the “blockchain”) to be promising in the vast arena of digital payments, and I believe this is for good reasons.

But as a conservative investor and someone who places a high priority on stewardship, I’ve been wary of volatile, speculative assets with uncertain long-term value (and, as a retiree, especially investments that don’t generate any income).

In its early days, Bitcoin was often associated with hype, anonymity, and a lack of regulation —not the characteristics most retirees look for in a sound investment. But it seems like “the times, they are a-changin’.”

The times they are a-changin’

Since I first wrote about Bitcoin a few years ago, it’s rapidly become more mainstream. It’s no longer just a contrarian bet for tech-savvy millennials or economic ideologues. In recent years, it has entered the financial mainstream, causing even risk-averse investors, such as retirees and near-retirees, to take a second look.

Perhaps most surprisingly, its acceptance by financial institutions has also grown. Fidelity, BlackRock, and other traditional asset managers now offer crypto-related investment products, including spot Bitcoin ETFs approved by the SEC in early 2024.

Additionally, retirement accounts, such as IRAs and 401(k)s, are now beginning to include Bitcoin exposure, something that was almost unthinkable a decade ago.

I don’t think we should interpret that as Bitcoin being a “safe” investment in the traditional sense, but it does mean it’s no longer being mostly dismissed as a fad.

In many ways, for many, it’s become “digital gold.” By that, I mean a potential store of value and hedge against inflation, like real gold is considered to be. Like gold, it is also relatively scarce (only 21 million Bitcoins will ever exist) and decentralized, meaning that in a world of increasing government debt and currency devaluation, Bitcoin may offer an alternative store of wealth that isn’t easily manipulated.

Many people find that aspect of Bitcoin very attractive, viewing its decentralized structure as a check against authoritarian governments or unethical financial manipulation.

However, that said, unlike gold, Bitcoin remains young and untested during prolonged financial crises or deflationary environments. Therefore, I think caution is still warranted.

That brings us to the question I posed in the title of this article: Is there a place for Bitcoin in a retiree’s portfolio? I think the short answer is: yes, maybe, for some, but probably not you or me, depending on your investing temperament and goals.

Is it a good diversifier?

From what I can determine, the only really good reason for a near retiree or retiree to include Bitcoin in their portfolio would be diversification. You might add it for the same reasons you would include a little gold: because you believe that if stocks and bonds tank, then Bitcoin will rally, perhaps disproportionately, and help mitigate your losses.

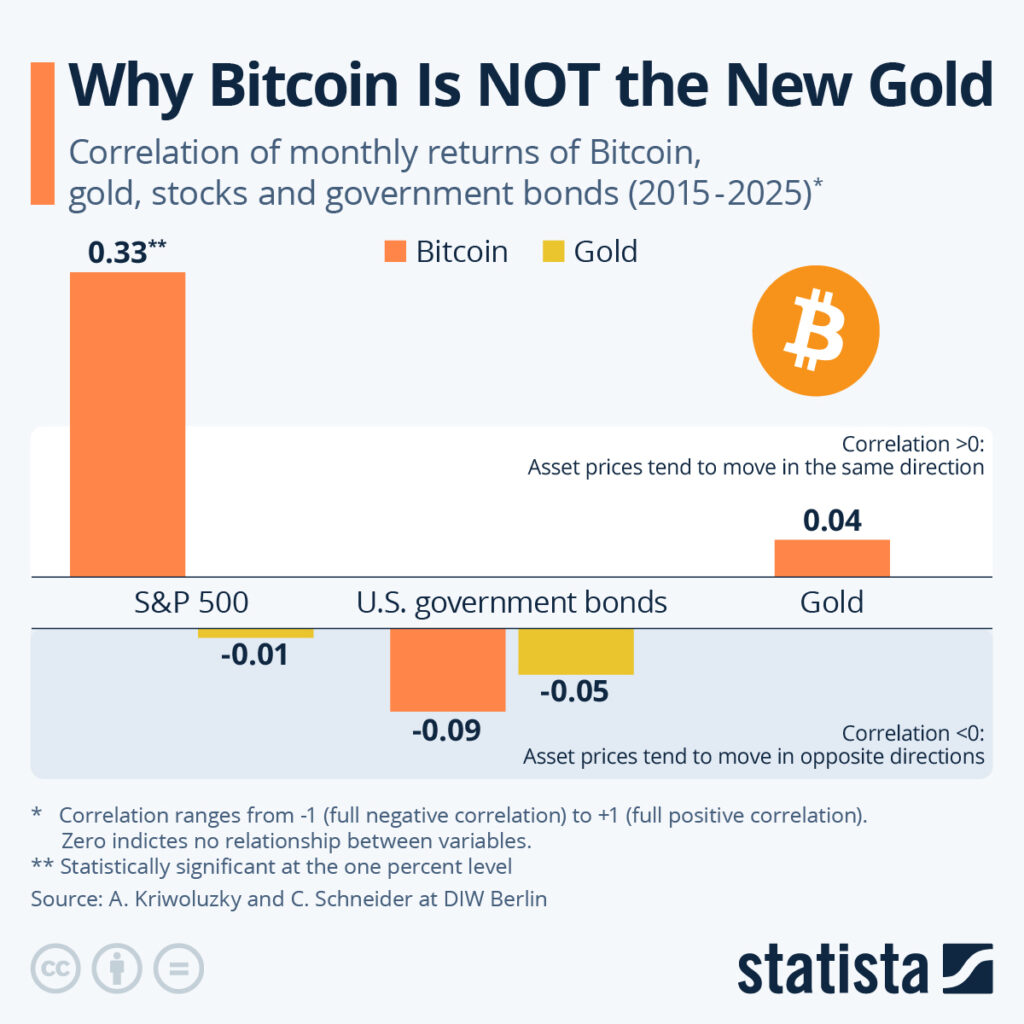

The whole problem with that line of reasoning is that the data doesn’t really support it. Look at this chart from Statista that shows the correlation of Bitcoin with gold, stocks, and government bonds over the last 10 years:

The hope would be that Bitcoin is fully negatively correlated with stocks (which would be a -1), but as you can see, it is positively correlated at +.33 with the S&P 500 while gold has a slight negative correlation of -0.01.

I found these stats to be surprising. I’ve read elsewhere that a small allocation to Bitcoin—say 1 to 3%—may enhance returns without substantially increasing overall risk. Some studies have shown that adding a modest amount of Bitcoin can improve a portfolio’s risk-adjusted returns, even for conservative investors. So, what gives?

Well, it may be because data also shows that a Bitcoin “buy and hold” strategy has served investors fairly well. In other words, rather than trading it, you would add it to your retirement portfolio as a long-term investment. If you had done that 5 or 10 years ago, you wouldn’t be regretting it today. (That said, because of its volatility, you may have regretted it many times along the way.)

This graphic shows the market value of an investment company (Strategy–MSTR) that is the largest bitcoin treasury:

Strategy’s (formerly MicroStrategy) share price is up 3,500 percent since August 2020, mainly due to its Bitcoin holdings appreciating by roughly $30 billion.

Of course, past performance is no guarantee of future results. One thing we absolutely know to be true about Bitcoin is that it is very volatile, which means it is more likely than other assets (including gold) to experience significant fluctuations in value.

Therefore, Bitcoin’s volatility is a measurement of how much Bitcoin’s price fluctuates, relative to the average price in a given time period. Volatility measures are used to predict the likelihood of a significant price change. The higher the volatility, the riskier the asset.

By any measure, at least in the short-term, Bitcoin is very “risky.”

Intra-day Bitcoin price swings of 5–10% are not uncommon. However, you don’t see that (or “feel” it) when you look at a chart like the one showing Strategy’s holdings above, but you do tend to see the “up 30 billion” part.

Bitcoin’s daily volatility over the last 5 years has been 3% to 5%, and its annual volatility has been 60% to 80% (with occasional spikes). That’s the definition of “high volatility”

For comparison, the S&P 500 (US large-cap equities) typically exhibits daily volatility of around 1% (or somewhat less), with an annualized range of 15% to 20%. That’s a pretty significant difference, considering how the stock market can scare the dickens out of us from time to time.

To further illustrate, here’s another chart that compares Bitcoin’s price (white line) with its 30-day (purple) and 60-day (blue) volatility indexes from 2019 to 2025:

Bitcoin’s price (white line) increased overall from 2015 to 2019, then moved from under $10,000 in 2019 to peaks above $100,000 in 2021, followed by a sharp decline into 2022.

The 30- and 60-day volatility indexes show how price swings intensified during major rallies and crashes, spiking above 5% during big moves, and eased when the market stabilized. Overall, the chart highlights the cyclical relationship between Bitcoin’s rapid price gains/losses and its periods of high volatility.

That kind of volatility can be tough to stomach; those who dared to invest have been rewarded handsomely. Therefore, retirees who rely on a steady income and capital preservation should tread carefully. For this reason, it may be more suitable for younger investors (or younger retirees) with longer planning horizons who can tolerate the asset’s volatility.

One thing is for certain

Significant losses won’t (or shouldn’t) matter to you in the short-term if you believe that the upward trend (the white line in the chart above) will continue to be up. Will it be?

Well, to quote comedian Nate Bargatze in his funny SNL “Washington’s Dream” skits (Parts One and Two), “nobody knows?” (What the videos if you haven’t seen them; they’re hilarious.)

There’s every indication that it will, probably, but it may not. “Nobody knows.”

One thing is for sure: volatility. That means significant gains at times, but also substantial losses at other times. Let’s consider the significant losses first.

Bitcoin losses in a retirement account are meaningless if they occur in the short term. You ride out the storm, hoping, praying, and believing that the price increases in the long term as you remain invested as a “buy-and-hold” investor.

However, losses in a taxable account (i.e., non-retirement account) can actually be helpful (even if they’re not desirable). Capital losses offset capital gains (duh!), and up to $3,000 in net losses can be used to reduce ordinary income.

You may be thinking, “Oh boy, I can lose money to make money.” Listen to yourself (or at least think about what you are thinking)! You’re investing to make money, so don’t get too excited about losing money with Bitcoin—there are easier ways to lose money, LOL!

Seriously, here’s the bottom line: I don’t think super-volatile assets, such as Bitcoin, generally belong in retirement accounts. In taxable accounts, losses can offer tax benefits, and gains—though taxable—can be accessed with much more flexibility.

But in traditional retirement accounts, high-yielding assets, such as taxable bonds, bond funds, or dividend-paying stocks, are a better fit. Roth and taxable accounts are best used for holding low-yield and potentially high-growth equities.

So, if you’re going to hold cryptocurrency, it may be better to do so outside your retirement account in a taxable account.

What others are saying

I thought it might be helpful to see what financial experts in the Christian community have to say about it. They can be divided into three main camps:

- Cautious but suspicious (used to be me)

- Open but careful (I’m getting there)

- Enthusiastic but in the minority (I’m definitely not there yet)

The Christian community remains somewhat divided on Bitcoin and cryptocurrencies, though the conversation is becoming more nuanced as these assets move into the mainstream.

A few years ago, I would have been in the “cautious” category, but now I’d say I’m more “open but careful,” although not entirely enthusiastic yet (if I were, I might consider owning some).

Let’s see who’s in these camps:

1—The cautious but suspicious view

Many in the Christian financial world remain skeptical or outright critical of crypto. They are based on biblical stewardship principles.

They view Bitcoin as more speculative than other “investments,” and financial ministries like Crown Financial and Compass generally advise avoiding highly speculative assets.

They also express concerns about the “get rich quick” appeal, as it can tempt believers toward greed, rather than godly contentment (Luke 12:15).

Finally, there are questions about whether crypto aligns with biblical principles, given that value is based on labor, scarcity, or usefulness (e.g., Prov. 13:11, Gen. 3:19).

Two of the loudest voices in this category have been Ron Blue, a Christian financial author and founder of Kingdom Advisors, who has expressed concern over speculative investing and has focused instead on wise, long-term, biblically based principles.

Additionally, Dave Ramsey has been critical, calling crypto a “get-rich-quick” scheme in disguise and stating it has no place in a retirement portfolio. Chuck Bentley (Crown Financial Ministries) has expressed similar sentiments when he said,

I am against making speculative, reactionary decisions instead of measured investments. FOMO, or ‘fear of missing out,’ is a very real fear…1

He went on to say,

I can find no redemptive purpose for investing in Bitcoin other than wanting to get in on the wild speculation…2

2—The open but careful view

Other Christians take a more balanced or open-minded approach, acknowledging crypto’s potential but urging careful, values-based engagement.

They believe that innovation isn’t inherently unbiblical, and some argue that Christians should not fear new technologies if used wisely.

They also view Bitcoin as a “neutral tool.” Like money itself, crypto is morally neutral; it can be used for good or evil (1 Tim. 6:10).

A small crypto allocation may be a prudent part of a broader portfolio if approached with humility and wisdom.

Some notable voices in this category are Kingdom Advisors (the Christian financial planning network), which has hosted webinars and discussions about crypto, acknowledging its growing role in portfolios while cautioning advisors to align client decisions with biblical stewardship.

One of my favorite bloggers, Tim Challies, acknowledges blockchain’s potential to protect the poor, secure property rights, and counteract inflation, while also warning of scams and the dangers of greed:

Faith is a necessary part of everything the Christian undertakes … the wise steward evaluates risk and reward with clear eyes.

Additionally, many faith-driven investors are exploring the potential of blockchain for enhancing transparency and financial inclusion, particularly in underbanked or persecuted regions.

3—The enthusiastic minority

This is a smaller but growing number of Christians who view Bitcoin as potentially redemptive or even aligned with biblical values.

They tend to view Bitcoin’s decentralized structure as a check against unjust, controlling, and authoritarian governments and their tendency toward unethical financial manipulation.

They may also view Bitcoin’s limited supply as aligning with biblical economic principles that emphasize scarcity, thrift, and honest scales (Proverbs 11:1).

Some even note that missionaries and ministries are experimenting with blockchain for fundraising or reaching closed countries.

Some tech-savvy Christian entrepreneurs and crypto advocates, such as Jimmy Song (a Christian and Bitcoin supporter who wrote Thank God for Bitcoin), argue that Bitcoin represents “honest money” consistent with a biblical worldview that advantages the poor and marginalized. In an article responding to one published by The Gospel Coalition, he wrote,

Bitcoin allows Christians to opt out of the corrupt system of central banking… People all over the world suffer from this system. Bitcoin is a way to opt out.”3

Because Bitcoin is decentralized, it is an apolitical money, meaning that it serves no one’s agenda. Because Bitcoin is digital, it’s convenient and individuals can obtain banking services without the need of a bank.4

What the Bible says

This is another case of a modern technological innovation that isn’t mentioned in the Bible—there’s no biblical command for or against investing in Bitcoin. But, as always, some principles should shape our view and practical implementation, should we choose to do so:

The prudent sees danger and hides himself, but the simple go on and suffer for it.” (Prov. 27:12, ESV)

Moreover, it is required of stewards that they be found trustworthy. (1 Cor. 4:2, ESV)

As Christians and stewards of retirement, we are called to be wise and faithful managers of God’s resources. That doesn’t mean avoiding all risk, but it does mean understanding what we invest in, aligning our investments with our values, and avoiding speculation for the sake of greed.

Bitcoin may be maturing, but it’s still an evolving asset. Retirees and near-retirees should approach it like they would any new financial innovation: with discernment and information, so that they have a good understanding of both its risks and opportunities.

Should we invest?

I can’t answer that question for you, of course. Bitcoin is clearly no longer just for early adopters or risk-takers/thrill-seekers. It’s showing up in the portfolios of cautious investors, pensions, and even retirement accounts.

That doesn’t mean it’s right for everyone, but if it’s something you’ve been considering, a small, intentional allocation may be worth making. I wouldn’t replace all my bonds or cash with it, or even a significant percentage, but it could complement your portfolio to help address future economic uncertainty (more on that in the following article).

So, while many in the Christian community remain understandably skeptical—especially those in financial and stewardship ministries —others are cautiously exploring how Bitcoin might play a small role in a well-diversified portfolio.

If I decide to add a small position to my IRA, I’ll probably do so by purchasing either Fidelity’s Spot Bitcoin Fund (FBTC) or iShares Bitcoin Trust ETF (IBIT).5 If you choose to invest in Bitcoin or some other cryptocurrency, do so prayerfully, humbly, and only after studying it carefully and with wise counsel. Please don’t do it as a path to riches, but as part of a broader strategy of faithful and thoughtful stewardship.

- https://www.crown.org/all-resources/ask-chuck-will-bitcoin-fever-pan-out/ ↩︎

- https://www.crown.org/all-resources/ask-chuck-should-bitcoin-be-in-my-retirement-portfolio ↩︎

- https://jimmysong.medium.com/on-christians-investing-in-bitcoin-6688c58434b6 ↩︎

- https://jimmysong.medium.com/on-christians-investing-in-bitcoin-6688c58434b6 ↩︎

- “A spot bitcoin ETF is an investment vehicle that tracks the price of bitcoin by holding actual bitcoin in reserve. Unlike futures-based bitcoin ETFs, which derive their value from contracts predicting the future price of bitcoin, spot bitcoin ETFs aim to reflect the real-time price of bitcoin. Investors in a spot ETF gain exposure to bitcoin’s market performance, but without the complexities of wallet management, private key security or direct custody.” (Forbes) ↩︎