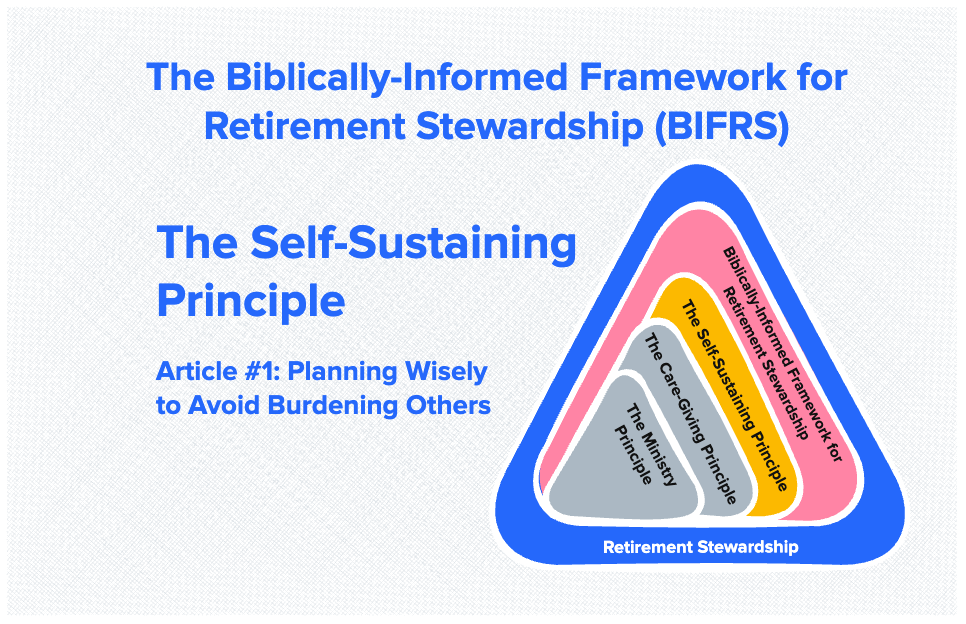

This article is part of the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series.

In the previous article, I introduced a biblical framework for retirement planning based on three principles from John Piper: the Self-Sustaining Principle, the Caregiving Principle, and the Ministry Principle. Together, these three principles provide a simple but theologically well-grounded approach to retirement that integrates faithful financial stewardship with biblical purpose.

Over the coming months, we’ll explore each principle in depth, including links to new and updated articles most relevant to the framework topic. With this article, we begin with the first and most foundational: the Self-Sustaining Principle.

The biblical foundation for this principle

The Self-Sustaining Principle comes from Paul’s letters to the Thessalonians, where he addresses both his own example and his expectations for believers:

For you yourselves know how you ought to imitate us, because we were not idle when we were with you, nor did we eat anyone’s bread without paying for it, but with toil and labor we worked night and day, that we might not be a burden to any of you. (2 Thessalonians 3:7–8, ESV)

Aspire to live quietly, and to mind your own affairs, and to work with your hands… so that you may walk properly before outsiders and be dependent on no one. (1 Thessalonians 4:11–12)

These verses seem intended to convey two key themes: Those outside the church will admire the work ethic of those inside it, and everyone inside the church should provide their own livelihood to the extent they are able.

Paul’s central message is clear: believers should work diligently and live responsibly so they don’t burden others. This isn’t about earning salvation or proving ourselves to God through productivity. It’s about diligence and faithful stewardship that allows us to support ourselves and have resources to help others, rather than constantly needing help ourselves.

As John Piper explains:

The principle is that, insofar as we are able, we should earn our own living, pay our own way. And I think that applies from the day we start earning to the day we die.

Piper believes that the principle applies to all believers, not just those in retirement. However, the dynamics of how that is accomplished change in retirement, which will be our focus.

Notice that key phrase: “insofar as we are able.” This suggests that this isn’t about achieving perfection. It means doing what God has given us the ability to do. It’s about planning wisely within our means so that we can live with dignity, avoid unnecessary dependence on others or the government, and continue serving God’s purposes even when we’re no longer earning a regular paycheck.

What the self-sustaining principle is NOT

Before we go further, let me clarify what I think this principle does NOT mean:

It’s not about achieving complete financial independence. None of us is completely independent. We all depend on God’s provision; we benefit from Social Security (a form of social insurance we paid into); we rely on Medicare; and we may occasionally need help from family or others in our relational community, despite our best planning.

It’s not about accumulating as much wealth as possible. The goal isn’t to die with the largest possible portfolio. It’s to steward resources wisely enough that we can fund our needs without burdening others and maintain margin for generosity and service.

It’s not about eliminating all risk or uncertainty. We can’t predict market crashes, healthcare crises, or how long we’ll live. The Self-Sustaining Principle calls us to plan prudently, not to eliminate all uncertainty, which is impossible.

It’s not a legalistic standard of “enough.” There’s no biblical dollar amount that qualifies as sufficient retirement savings. What’s enough for one person may be inadequate for another, depending on health, family circumstances, and God’s calling. God is sovereign in how He distributes His gifts, including financial resources.

It’s not about self-sufficiency apart from God. Planning wisely doesn’t mean we stop depending on God. Rather, it means we don’t presume on God’s provision by failing to prepare when we can and should. That would violate the “insofar as we are able” aspect of the principle.

What the self-sustaining principle IS

So what exactly is this principle calling us to do? Here are a few thoughts:

It’s about responsible planning. When we know we’ll likely face a season of life when we can no longer work (or work less), wisdom says we should prepare for that reality now. This is biblical stewardship, managing today’s resources with tomorrow’s needs in mind.

It’s about avoiding unnecessary dependence. None of us wants to become a financial burden on our children or others when we could have prevented it through wise planning. The Self-Sustaining Principle honors and serves our families by not forcing them to take on roles they shouldn’t have to carry.

It’s about maintaining dignity and freedom. Financial self-sufficiency in retirement preserves the dignity of making our own choices and the freedom to serve God’s purposes without the constraints of unnecessary financial dependence.

It’s about creating margin for ministry and generosity. When we’re not constantly worried about running out of money or dependent on others for our basic needs, we’re free to focus on what God has called us to do in this season, whether that’s service, generosity, family presence, or continued productive work.

It’s about faithful stewardship. We plan not because we’re anxious or faithless, but because we’re faithful. God has given us resources, time, and the ability to prepare; using those gifts wisely is an act of worship.

An important clarification: We’ll discuss this further in the “Caregiving Principle,” but the Sustainability Principle focuses on financial provision, which does NOT mean complete independence from all help. Receiving personal care, household assistance, and occasional financial support from family or church is appropriate, especially in later life or during health decline. Providing such care is precisely how children honor their parents (1 Timothy 5:4) and how Christians love one another (Galatians 6:2). Financial sustainability creates the context in which care can be received as mutual love rather than imposed as a crisis.

What It Really Means to “Retire With Dignity” (Updated 2026) discusses retiring with dignity from a Christian stewardship perspective, contrasting worldly definitions of dignity (financial independence, luxury, respect) with biblical dignity rooted in being made in God’s image. It emphasizes that true dignity in retirement comes from continuing to serve God and others, maintaining purpose through ministry and relationships, and viewing retirement as stewardship rather than entitlement.

Retirement Planning and the “Wheel of Life” (Updated 2026) adapts the “Wheel of Life” framework to include: Fun, Physical health, Finances/Giving, Work, Relationships, Daily Management, Spiritual life, and Mental activity. Biblical stewardship means faithfully managing time, talents, and treasure across all areas. Success in one dimension (such as accumulating wealth) at the expense of others (such as relationships or health) leads to imbalance and unfulfillment. The spiritual dimension should be the highest priority, but all eight areas need intentional attention. Money is a means to support the other seven areas, not an end in itself.

Communication About Retirement in Marriage (Updated 2026) discusses how many couples avoid detailed retirement conversations, focusing on generalities (when/where to retire) while neglecting financial specifics. Different temperaments compound this—”nerds” focus on numbers while “free spirits” focus on experiences. The Biblical Framework for Retirement Stewardship provides structure through three principles: Self-Sustaining (financial sustainability), Caregiving (planning for giving and receiving care), and Ministry (God’s purpose for this season). Couples should hold separate planning sessions for each principle, set specific goals across all three areas, and schedule regular check-ups.

Why this principle matters for retirement

During your working years, self-sustainability was relatively straightforward. If you had a job (and most of us did), you worked, earned income, and used that income to pay your bills. The system was simple: work produced income, which covered expenses. If your income was greater than your expenses, all the better.

Retirement fundamentally changes this equation. You’re no longer creating income through labor. Instead, you have to draw income from accumulated resources—Social Security, pensions, savings, investments—while ensuring those resources last as long as you do. This transition from earning to drawing (accumulation to decumulation) creates entirely new challenges.

Consider what happens if you don’t plan wisely for self-sustainability:

You may run out of money before you run out of life. This is perhaps the most terrifying prospect retirees face. Running out of money at age 85 or 90, when you’re least able to fix the problem, creates impossible choices and forces dependence on others.

You become a burden on family. Your children, who are likely in their peak earning years and dealing with their own financial pressures (mortgages, college tuition, their own retirement savings), suddenly must support you financially. This reverses the biblical order, in which parents provide for their children.

You lose freedom and dignity. Financial dependence often means losing the ability to make your own choices. You may need to move in with family, accept help with basic expenses, or limit your activities based on what others can afford to support.

You sacrifice opportunities for service and generosity. When you’re constantly worried about money or dependent on others, you can’t focus on serving God and blessing others. The Ministry Principle becomes nearly impossible to live out when the Self-Sustaining Principle has been neglected.

You create family stress and potential conflict. Money problems don’t just affect you—they ripple through family relationships, creating stress, resentment, and conflict that damages the very relationships you most value.

The “Retire With Dignity” series provides life-stage financial guidance grounded in the Biblical Framework for Retirement Stewardship’s three principles: Self-Sustaining (financial sustainability), Caregiving (preparing to give and receive care), and Ministry (continuing fruitful service).

The Most Important Thing to do in Your 20s and 30s to Retire With Dignity (Updated 2026): In your 20s-30s, the priority is starting to save early to harness compound interest’s power—even small amounts grow exponentially over decades.

The Most Important Thing to do in Your 30s and 40s to Retire With Dignity (Updated 2026): Your 30s-40s demand eliminating debt (especially consumer debt and student loans) to free up income for increased saving while beginning estate planning and maintaining generosity despite financial pressure.

The Most Important Thing to do in Your 40s and 50s to Retire With Dignity (Updated 2026): The 40s-50s are your last opportunity to check retirement readiness and make major course corrections; this is also the critical window for purchasing long-term care insurance and envisioning what purposeful retirement might look like.

The Most Important Thing to do in Your 60s and Beyond to Retire With Dignity (Updated 2026): In your 60s and beyond, you must convert lifetime savings into sustainable income through careful Social Security optimization and withdrawal strategies, finalize all caregiving documents and wishes, and most importantly, deploy accumulated time, talent, and treasure for kingdom purposes. Retirement isn’t the end of productive work but a new chapter for serving God with the freedom and resources you’ve spent decades preparing for.

The tension between faith and planning

Some Christians struggle with the Self-Sustaining Principle because they fear it conflicts with faith in God’s provision. After all, didn’t Jesus tell us not to worry about tomorrow (Matthew 6:34)? Doesn’t Philippians 4:19 promise that God will supply all our needs?

This is a false tension. Biblical faith doesn’t mean failing to plan; it means planning in dependence on God rather than in anxiety or pride.

At the heart of this is one of the Bible’s great mysteries: God’s sovereignty and our responsibility. There’s much we could say about this, but in this context, it’s best to acknowledge that good stewardship is “both/and.”

Consider the Proverbs’ praise of the ant who gathers food in summer for the winter ahead (Proverbs 6:6-8). Consider Joseph storing grain during years of plenty to prepare for years of famine (Genesis 41:53-57). Consider Paul’s instruction to set aside funds in advance for the Jerusalem collection (1 Corinthians 16:2). The Bible consistently commends prudent planning for known future needs.

Jesus’ warning against anxiety isn’t a prohibition on planning; it’s a prohibition on worry and fear-driven living. There’s a huge difference between:

- Anxious hoarding: “I must accumulate as much as possible because I can’t trust God.”

- Faithful stewardship: “I’ll save wisely for needs I know are coming, trusting God to provide and guide.”

The first makes money your god. The second makes God your God while faithfully stewarding the resources He’s provided.

As Proverbs 21:20 says: “Precious treasure and oil are in a wise man’s dwelling, but a foolish man devours it.” Wise planning doesn’t contradict faith—it expresses faith by acknowledging God’s wisdom and following His principles.

The self-sustaining principle encompasses all financial planning

When we discuss the Self-Sustaining Principle, we mean everything related to generating sustainable retirement income. This principle provides the “why” behind all the financial planning topics I write about.

Let me show you how virtually every financial decision in retirement connects to this foundational principle:

Wealth accumulation

Why save consistently during working years? Because retirement income depends on the wealth you’ve built. No accumulation means no portfolio to generate income when paychecks stop.

Why start saving early? Because compound growth multiplies early dollars far more than late dollars. Time is your most powerful wealth-building tool.

Why prioritize savings rate over investment returns? Because you control savings but can’t control markets. A higher savings rate provides guaranteed progress toward your goal.

Why live below your means? Because the gap between earning and spending determines both how much you save now and how much you’ll need later. Lifestyle creep undermines both.

Why diversify across tax buckets? Having traditional, Roth, and taxable accounts provides retirement tax flexibility that can significantly extend portfolio longevity.

Why get asset allocation right? Because you need growth to build wealth while avoiding losses that can’t be recovered. Balance changes as you age.

Why eliminate debt before retirement? Because interest payments compete directly with wealth building, and carrying debt into retirement dramatically increases income needs.

Why invest for growth, not just safety? Because inflation erodes purchasing power. “Safe” money that doesn’t keep up with inflation loses real value each year.

Income generation

Why do you need to understand Social Security claiming strategies? Because Social Security likely forms the foundation of your retirement income, and claiming wisely can mean the difference between self-sufficiency and running short in your 80s and 90s.

Why do pensions and annuities matter? Guaranteed income sources reduce the risk of outliving your money and provide stability that allows portfolio assets to last longer.

Why must you master portfolio withdrawals? Because if you withdraw too much too fast, you’ll deplete your resources prematurely. If you withdraw too little out of fear, you may live with unnecessary anxiety and miss opportunities for service and generosity.

Asset management

Why does portfolio allocation matter in retirement? Because you need your investments to continue growing enough to outpace inflation while also avoiding the catastrophic losses that could destroy your plan. The Self-Sustaining Principle requires balancing growth and preservation.

Why worry about sequence of returns risk? Because a market crash early in retirement, combined with withdrawals, can devastate a portfolio beyond recovery—even if you would have been fine had the crash occurred later. Mitigating this risk helps you remain self-sustaining.

Why consider dividend investing or bond ladders? These strategies can provide more reliable income and potentially reduce the need to sell assets during market downturns. They’re tools for maintaining self-sufficiency in varying market conditions.

Tax efficiency

Why spend time on tax planning in retirement? Because every dollar unnecessarily paid in taxes is a dollar that can’t fund your living expenses or support your giving. Tax efficiency directly extends how long your resources last.

Why master Roth conversions? Because converting traditional IRA assets to Roth during strategic windows can dramatically reduce your lifetime tax burden, allowing you to be self-sustaining on less overall wealth.

Why understand Required Minimum Distributions? Because RMDs can push you into higher tax brackets and trigger Medicare IRMAA surcharges if you don’t plan ahead. Managing RMDs well preserves more resources for your needs.

Why use Qualified Charitable Distributions? Because QCDs allow you to give generously while reducing your taxable income, which means you maintain self-sufficiency on less while supporting kingdom work.

Expense management

Why does healthcare planning matter so much? Healthcare costs are among the largest and most unpredictable retirement expenses. Failing to plan for Medicare, supplemental insurance, and out-of-pocket costs can quickly drain resources.

Why worry about Medicare IRMAA? Because if your income crosses certain thresholds, your Medicare premiums can increase by thousands of dollars annually. Understanding IRMAA helps you structure income to avoid these surcharges.

Why consider long-term care? Because LTC costs can devastate even substantial retirement savings. Planning for this possibility—whether through insurance, savings, or hybrid strategies—helps ensure you can remain self-sustaining even if you need care.

Housing decisions

Why think strategically about housing in retirement? Your home likely represents your largest asset and largest expense category. Downsizing or relocating can significantly reduce expenses, free up capital, and extend the life of your resources.

Why consider home equity strategically? While home equity is illiquid, it can serve as a financial stabilizer—a reserve that can be accessed if needed or preserved as a legacy. Understanding its role helps you plan with greater confidence.

Risk management

Why maintain emergency reserves? Because unexpected expenses are certain—you just don’t know when or how much. Having adequate cash reserves means you won’t be forced to sell investments at the worst possible time or suddenly need family help.

Why diversify across tax buckets? Having money in taxable accounts, traditional IRAs, and Roth accounts gives you flexibility to manage taxes and withdrawals in changing circumstances. This flexibility helps maintain self-sufficiency when conditions change.

Why carry appropriate insurance? Catastrophic health events, property losses, or liability claims can destroy financial plans. Insurance protects the resources you’ve accumulated, preserving your ability to remain self-sustaining.

Debt management

Why avoid or minimize debt in retirement? Because debt is a claim on future income—income you may not have or may need for other purposes. Entering retirement debt-free dramatically reduces how much you need to be self-sustaining.

Why pay off mortgages before retirement if possible? Eliminating your largest monthly expense substantially reduces the income you need to generate, extending how long your resources will last.

Do you see the pattern? Every financial topic, every planning strategy, every decision about money in retirement ultimately comes back to this fundamental principle: plan wisely so you can remain self-sustaining and avoid burdening others.

The self-sustaining principle in action

Let me show you how this principle works in real situations:

John and Mary are both 62 and considering when to claim Social Security. John could claim now and receive $2,000/month, or wait until age 70 and receive $2,480/month. Mary would get $1,200 now or $1,488 at 70.

Based on the Self-Sustaining Principle, they should delay if possible. Here’s why: By waiting, they maximize their lifetime guaranteed income—income that adjusts for inflation and can never run out. This provides the strongest foundation for remaining self-sustaining into their 80s and 90s. Plus, if John dies first, Mary will receive 100% of his higher benefit as a survivor, protecting her ability to remain self-sustaining as a widow.

They could use taxable account or retirement portfolio withdrawals to bridge the gap from 62 to 70, effectively “buying” higher lifetime income.

Robert is 68 and has $800,000 in traditional IRAs. His RMDs will begin at age 73, and based on his current tax bracket, he’ll pay roughly 22% federal tax on those distributions. He’s considering Roth conversions now while he’s in the 12% bracket.

The Self-Sustaining Principle suggests that he should seriously consider strategic Roth conversions. Here’s why: By converting some IRA money to Roth now at lower tax rates, he’ll pay less in lifetime taxes. That means more money available for his needs throughout retirement. Additionally, Roth accounts don’t have RMDs, giving him more control over taxable income in his 80s, which helps him avoid IRMAA surcharges and manage Social Security taxation.

Susan is 65, recently retired, and owns a paid-off house valued at $400,000, with property taxes and maintenance costs totaling $12,000 annually. She’s considering downsizing to a smaller home or condo that would cost $6,000 annually to maintain, freeing up $200,000 in equity.

The Self-Sustaining Principle suggests that she should seriously consider the move. Here’s why: Reducing housing costs by $6,000/year means her portfolio needs to generate $6,000 less in annual income, which at a 4% withdrawal rate is equivalent to having $150,000 more in savings. Plus, the freed-up equity could either supplement her portfolio or create a long-term care reserve.

The heart behind the principle

At its core, the Self-Sustaining Principle isn’t about money; it’s about faithfulness and love.

When Paul worked “night and day” to avoid burdening the Thessalonians, he wasn’t being legalistic or self-sufficient in an arrogant way. He was being faithful and loving. He recognized that maintaining his own support freed the church’s resources to serve those with genuine needs, the widows, orphans, the sick, and the genuinely poor.

The same principle applies in retirement. When you plan wisely and remain self-sustaining, you free your family to focus on their own responsibilities and callings. You free the church to support those with true needs rather than those who simply failed to plan. You maintain the freedom to serve and give rather than constantly receiving.

This is faithful stewardship, and it’s an expression of love and concern for others.

Looking ahead

In the coming weeks, we’ll explore the practical side of the Self-Sustaining Principle in detail. Here’s what’s coming:

Social Security: Understanding the foundation of most retirement income plans, claiming strategies, taxation, survivor benefits, and working while collecting.

Retirement Income Sources: Exploring pensions, annuities, portfolio withdrawals, part-time work, and how to build a reliable income system that lasts.

Withdrawal Strategies: Examining the 4% rule and alternatives, variable withdrawal strategies, sequence of returns risk, and how to draw from your portfolio sustainably.

Tax Planning: Mastering retirement taxation, Social Security taxation, RMD strategies, Roth conversions, and maximizing after-tax income.

Portfolio Management: Understanding asset allocation in retirement, managing risk, dividend investing, rebalancing, and investing for both growth and stability.

Healthcare Costs: Planning for Medicare, choosing supplements, managing IRMAA, budgeting for healthcare inflation, and preparing for the unexpected.

Housing Decisions: Evaluating whether to downsize, relocate, or age in place; understanding home equity as an asset; reducing housing costs strategically.

Long-Term Care: Assessing LTC risk, exploring insurance options, considering self-funding approaches, and planning to protect resources.

Each article will ground the topic in the Self-Sustaining Principle—showing not only how to make wise financial decisions but also why those decisions matter for faithful stewardship.