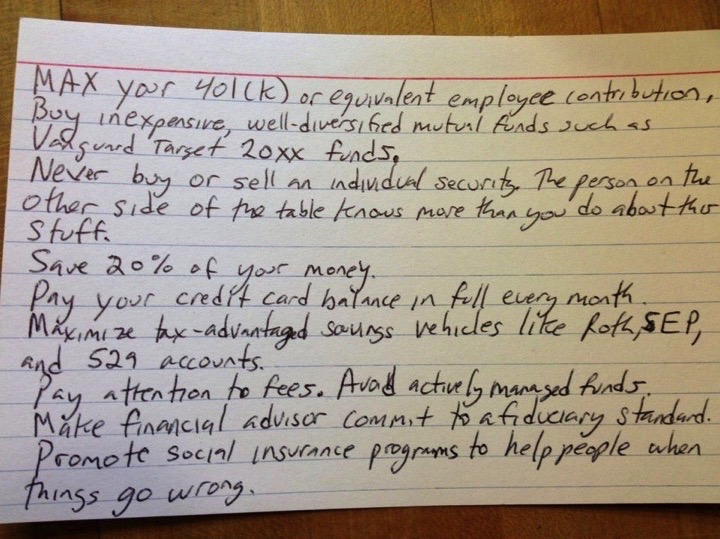

A few years ago, a University of Chicago college professor named Harold Pollack remarked that everything you really needed to know about personal finance could be fit on a single 3×5 inch index card.

Someone asked him to prove it, the result went viral, and Pollack actually ended up co-writing a book about it called The Index Card: Why Personal Finance Doesn’t Have to be Complicated. (It’s a pretty good book, by the way.)

Here is a photo of the original card:

This kind of thing really appeals to me. As I wrote on my personal page of this blog, when it comes to personal finance, “I value simplicity over complexity and pragmatism over sophistication.”

In fact, it intrigued me enough that I purchased the book!

The tips

If you aren’t familiar with “the index card,” I will list the main points and offer some comments on each. And, at the end of this article, I’ll add a few points of my own.

Max your 401(k) or equivalent employee contribution.

I certainly can’t argue with this one. If you are fortunate enough to have a retirement plan at work, take full advantage of it by contributing to it.

The maximum contribution you can make to a 401(k) in 2019 is $19,000. Most people can’t afford to contribute that much. And even if you can, you may not need to save such as large amount, particularly if you are younger.

My advice is to contribute at least enough to get the full employer match (typically between 3 and 6 percent).

If your employer matches dollar for dollar up to 5%, and you save 5% of your salary, you will be putting away 10% total – pretty sweet. If your savings goal is 15%, you might save another 5% in a Roth IRA.

Once you max out your IRA but still want to save more, you can always add to your employer plan, up to the IRS limits, of course.

Buy inexpensive, well-diversified mutual funds, such as Vanguard Target 20xx funds.

He is apparently referring to index funds in general, which many financial professionals are recommending, and “target date funds” as one example. But which funds are available to you will vary from employer to employer unless they offer a “self-directed brokerage account” option in your 401(k) or 403(b) plan.

Target-date funds can be an excellent way to go, but don’t choose one just because it has the right target date – be sure to look at the asset allocation percentages to make sure you are comfortable with the risk profile. (Many soon-to-be retirees were shocked at how much their target-date funds lost during the 2008-2009 crash.)

Never buy or sell an individual security. The person on the other side of the table knows more about their stuff than you do.

This one may seem a little extreme (never buy or sell), and the second part may be a bit confusing.

For the vast majority of us who lack the time, training, and discipline to be good stock pickers, this is good advice. It’s much better to go with good, well-diversified, low-cost index mutual funds. As Albert Einstein famously said, “Everything should be made as simple as possible, but not simpler.”

But if you are up to the task (i.e., willing to learn about financial analysis, doing the detailed research, and regularly monitoring your stock portfolio), you might do better than someone who just takes what the markets give by investing in index funds. If so, you are part of a very small minority of investors.

The second part seems to be referring to financial markets or the company itself. Perhaps the idea is that you can’t know something that the markets in general – which includes a lot of professionals and institutional participants – or the companies themselves, haven’t already factored into the price of the stock. Makes sense, I guess.

If he’s referring to hedge fund managers (funds that pool capital and invest in a variety of different assets to maximize risk and return), he is probably right. They are pretty smart people with armies of analysts working for them. You probably don’t, and your wife probably thinks you aren’t as good a stock picker as you think you are.

Save 20% of your money.

I assume this is referring mainly to long-term saving for retirement, but it’s essential to have some short term savings (for emergencies) and medium-term savings (quarterly insurance payment, taxes, next car, vacation, etc.) as well.

Most retirement planners say that saving 15% for retirement – including the employer match – should be enough if you start early enough (by your late 20s or early 30s at the latest). But if you start later – the late 30s to early 40s – you may need to save more.

Saving 15% for retirement, and for other needs you know you will have in the future, could easily get you to 20%, and that would not be unreasonable.

Save what you need, but be careful not be become a hoarder. From a stewardship perspective, there is nothing worse than being a rich fool.

Pay your credit card balance in full every month.

If you use a credit card as a tool to spend money you already have, then you should be paying it off each month. Take the points or cash-back awards and run.

But if you are using to spend money you don’t have, you probably aren’t paying them off; you’re going into debt.

Outstanding credit card debt is the highest it’s been in history. This suggests that most cardholders are NOT paying their balances every month. If that’s you, it may be wise to take Dave Ramsey’s advice: “Were I in your shoes, I would cut it up and get a debit card.”

Maximize tax-advantaged savings vehicles like Roth, SEP, and 529 accounts.

Here he is lumping together several different tax-advantaged savings arrangements as defined by the IRS.

The Roth (IRA) and Simplified Employee Penson (SEP) are retirement savings vehicles. Roth IRAs can be used by anyone as long as they have earned income – the exception is a non-working spouse when the other spouse.

SEPs, however, can only be established by an employer or a self-employed individual. Therefore, you can open a Roth IRA if you have a 401(k), but you can’t have a SEP. In fact, it may make sense to contribute to a Roth IRA after you have maximized your employer’s matching 401(k) or 403(b) contribution.

A 529 account is a tax-advantaged college savings plan, legally known as “qualified tuition plans.” They are sponsored by states or educational institutions. Unlike retirement savings accounts, money in 529 accounts can only be used for education purposes.

This one is a no-brainer. Tax-advantaged retirement savings accounts are the best way to plan for retirement.

Pay attention to fees. Avoid actively managed funds.

“Fees” in this case refers to mutual fund management fees, which are usually expressed as a percentage. With few exceptions, mutual funds have management fees associated with them.

This one is a lot like the second one (investing in low-cost index funds). Fees are actually going down across the board, but costs for actively managed funds can range from .5% to 2 or 3%. In contrast, most index funds range from .05% to 1%.

This matters because fees can really add up over time. According to Vanguard,

Imagine you have $100,000 invested. If the account earned 6% a year for the next 25 years and had no costs or fees, you’d end up with about $430,000. If, on the other hand, you paid 2% a year in costs, after 25 years you’d only have about $260,000.

Clearly, fees can put a real damper on investing returns. Plus, many ordinary investors will not be able to pick actively managed mutual funds that are certain to beat the overall market, even if they have done so at times in the past.

Make financial advisor commit to a fiduciary standard.

Ironically, if you follow Dr. Pollack’s other recommendations, you may not need a financial advisor in the first place. However, many of us should use one, if for no other reason than to validate the decisions we are making and especially to “stay the course” when the going gets tough.

If you decide to hire one, you should definitely ask them about the fiduciary standard. This standard, which is regulated by the SEC or state regulators, states that the advisor is required to put your interests above their own. It is of particular importance when working with advisors who are compensated by commissions, which can introduce a conflict of interest.

But if your advisor is someone you trust to always act in your best interest, regardless of how they are compensated, then this may be of less importance to you. Just make sure you know how they are being paid and what it is going to cost you.

Promote social insurance programs to help people when things go wrong.

I assume that this refers to what we might call “social safety nets,’ which help people living on the margins who are likely to otherwise fall through the cracks.

Many churches and individual Christians rightly try to help the poor and disadvantaged in our society. And although this is often debated, social insurance programs are also “biblical” to the extent that there is no specific prohibition in Scripture that says civil governments shouldn’t do the same.

Crossway summarized theologian Wayne Grudem’s position on poverty and wealth and the issue of social programs this way:

Immediate short-term efforts to alleviate poverty through work by individuals, Christian organizations, and government welfare programs are all important and must be continued, but short-term help is not enough.

By including this as he did, Dr. Pollard seems to be suggesting that when someone is struggling, we are all affected. I think there is some truth to this.

Sure, we may not be impacted directly, but none of us are immune from the ripple effects, especially as the sheer number of people living on the margins in our society continues to increase.

As Christians, we have to think biblically about this problem. Although there is no doubt that the difficulties that some experience are due to their own bad choices, they still need our help. The dilemma is often deciding what kind of assistance is most helpful without hurting.

If we support the right kinds of social insurance programs, we are not only helping others (which is the honorable and compassionate thing to do), we also help ourselves. First, through the blessings we receive from helping others, and second, by indirectly helping everyone, including ourselves – we are all in the same big boat and subject to the same winds and tides (Matt. 5:45).

Adding a few of my own…

Although Dr. Pollack did a good job of listing some important “to dos” with regard to personal finance, for those who want to honor and obey God with their finances, the list is incomplete.

Coming at this from a Christian stewardship perspective, I wouldn’t change much of what Dr. Pollack wrote. I would, however, add a few things to his list:

Acknowledge that all you have comes from God and steward it accordingly.

This is the most important thing to know about your personal finances. It is the fundamental stewardship principle: all that we have – our time, talents, and treasure – belongs to God.

Therefore, we don’t “own” anything – we are all managers of what God entrusts to us. Although some are given more to steward than others, the responsibility is the same: to manage (“steward”) all that we have been given in ways that honor and glorify God.

Start giving early in life and do it consistently, proportionately, and sacrificially for as long as you live.

There are lots of good things we can do with our money (spend, save, and give), but giving is the best. As Luke the disciple wrote in the book of Acts:

In all things I have shown you that by working hard in this way we must help the weak and remember the words of the Lord Jesus, how he himself said, ‘It is more blessed to give than to receive’ (Acts 20:35).

In some ways giving is a lot like saving (except that the treasure is stored elsewhere – Luke 6:19-20). If we start taking money right off the top, and it consistently before we spend on ourselves, it can become a routine, but it should never be dull.

As Dave Ramsey says, “generous giving really is the most fun you can have with money.”

Avoid debt, and be careful of how much house or car you buy.

The key to creating liquidity and margin in your financial life is to spend less than you earn.

Having too much debt (or the wrong kind of debt), and having fixed expenses that are disproportionately high relative to your income, can keep you underwater for a long time.

Houses and cars tend to be the big fixed expenses that trip people up. If you keep them in check – spend 28% or less of take-home pay on a home mortgage and buy a late model used car for cash – you will be in much better shape.

Finally, I would add…

Pay attention to your health.

This one is important for a lot of quality of life reasons, of course, but it also can have a significant impact on our financial position.

Some chronic health problems can make it difficult or impossible to work. That dramatically impacts income.

High healthcare costs are another problem, and they can be particularly damaging in retirement when our health may become worse at a time when our income is less.

Bodily training provides some benefits (1 Tim. 4:8), as does watching what we eat and getting a physical check-up at least once a year.

We’re going to need a bigger card

I guess we’ll need a 5 x 7-inch card now, but that’s OK, right?