In the previous article, I alluded to my “safe withdrawal rate” (SWR) portfolio strategy, which I described as “strategic growth and income.”

I also discussed the impact of inflation on it and two different types of annuities—a nominal (non-inflation-adjusted) annuity and a nominal annuity with a 3% annual cost-of-living increase (COLA) but not indexed to the CPI-U.

My SWR portfolio is structured to earn as much interest and dividends as possible without taking on unwise amounts of risk. If possible, I also want some growth to keep up with inflation, so I have a moderate allocation of about 40 percent to U.S. and international stocks.

I let the monthly and quarterly dividend and interest payments flow into a “cash bucket” within the IRA to generate income. Then I withdraw from it monthly, including tax withholdings, and transfer money to my checking account to use in addition to Social Security to pay our expenses.

Because of the higher interest payments (60% of our assets are in bond funds and cash-like investments), supplemented by stock fund dividends, we have most of the income we need for regular spending without selling any fund shares. But suppose our cash reserves are gradually or suddenly depleted by a large unexpected expense or by our charitable contributions. In that case, I will sell some shares to replenish the cash, probably by rebalancing the portfolio to maintain its target allocation.

I don’t currently own an annuity, but I’m considering adding one to my portfolio. Research by academics and financial professionals suggests that doing so can 1) increase the average remaining portfolio balance at death and 2) provide additional income for lifetime expenses.

In my last article, I examined the impact of inflation on a SWR portfolio and two types of income annuities. In this article, I analyze the potential value of replacing some of the bond allocation in my SWR portfolio with annuities, effectively creating a “hybrid” retirement income strategy. I’m curious to see if the claims I allude to above hold true in my situation.

Adding annuities to the mix

Annuities are very different from an SWR portfolio. If I were to buy one or more, I’d have to give up a fairly large lump sum in exchange for a “guaranteed” lifetime income stream from an insurance company (or companies). The upside is that, besides what’s left in my SWR portfolio, I’d be adding a layer of lifetime income from Social Security, increasing my “guaranteed” income floor.

Here’s a chart describing this concept from my book, Reimagine Retirement:

Source: Reimagine Retirement (by author)

Purchasing an annuity makes the most sense for retirees who are concerned about running out of money. It may also be attractive to those who want to pursue a “safety first” strategy and establish an “income floor” that will cover at least all of their essential living expenses. (TIPS Ladders are another good addition to an income floor.)

Some retirees worry about this when they don’t need to. Their portfolios are large enough, and they have asset allocations that are appropriate for their risk tolerance. They also have a reasonable strategy to generate the income they need that is unlikely to prematurely deplete their savings.

In this case, they may not need an annuity as much as they think. It may still be wise to buy one, if only for the “sleep at night” factor, but they may not need it to avoid running out of money before they run out of time on this earth.

Others who are more likely to outlive their savings are reluctant to buy one. This puzzles advisors and economists who say they need them most. However, if these retirees can live frugally in retirement and reduce expenses when necessary, they may be able to get by without one, risky though that strategy may be.

I’ve done various analyses of my portfolio (without an annuity); in most cases, it outlives our lifetimes. I re-ran the analysis for this article. Of course, I’m dealing with a range of possibilities—there are no guarantees, as anything (including a catastrophic black swan event) could happen. Only God knows the future because He is the one who ultimately controls it: “Many are the plans in the mind of man, but the purpose of the LORD will stand.” (Prov. 19:21, ESV)

For this article, I also analyzed the “hybrid” strategy that many financial professionals recommend to assess how adding income annuities to the mix would affect my retirement income strategy. In my case, I would purchase an income annuity to supplement Social Security to provide the “income floor” to cover my essential expenses while maintaining an SWR portfolio for growth, charitable giving, and additional income.

Here are my assumptions:

- Age: 72 (I’m 71 but will be 72 later this year, and my wife is already 72)

- Life expectancy: 95 years (according to longevityillustrator.org, at age 72, there’s a 3 in 5—60%— chance that one of us will live to age 90, and a one in 3 chance—33%—one of us will make it to 95

- Income and annual inflation: Savings income is adjusted for inflation at 3 percent per year; therefore, withdrawals from the SWR portfolio will increase by that amount annually

- Social Security: Payments are adjusted for inflation at a 2 percent per year historical COLA average

- Nominal SPIA income: Payments will remain constant (and therefore lose purchasing power)

- COLA annuity income: Payments will increase by 3 percent per year, somewhat increasing their purchasing power against inflation

- Effective income tax rate: Set at 15 percent, which is higher than my current effective rate and is based on the pre-2017 Tax Cuts and Jobs Act tax code (I’m assuming higher taxes in the future)

- Charitable distributions: QCDs are included as part of the total expenses but accounted for by reducing the taxable percentage of my IRA portfolio withdrawals

- SWR portfolio allocation: 40% stocks, 60% bonds, annuities, and cash

- Market returns: honestmath.com defaults: Stocks = 8%, bonds = 4.5%, which are lower than their historical averages

- Annual expenses: Actual expenses are adjusted annually for inflation (historical average of 3%)

I used the honestmath.com retirement simulator for the analysis. I like its simplicity and ease of use. I also like that it runs 10,000 random Monte Carlo simulations that are not based on historical market returns, which is more than enough to get a reliable average result over time.

The tool produces a range from the 20th to the 80th percentile for each run, which the developers say is wide enough to cover a range of possible scenarios. It also includes “fat tails.” (You can read more about Monte Carlo analysis on their site here and about fat tails here—and no, it’s not what it sounds like.)

According to the self-proclaimed “dorks” at honestmath.com (they are a nerdy bunch, for sure), I’m in pretty good shape if at least 80% of the trials end with a positive portfolio balance. We’ll see if that’s the case.

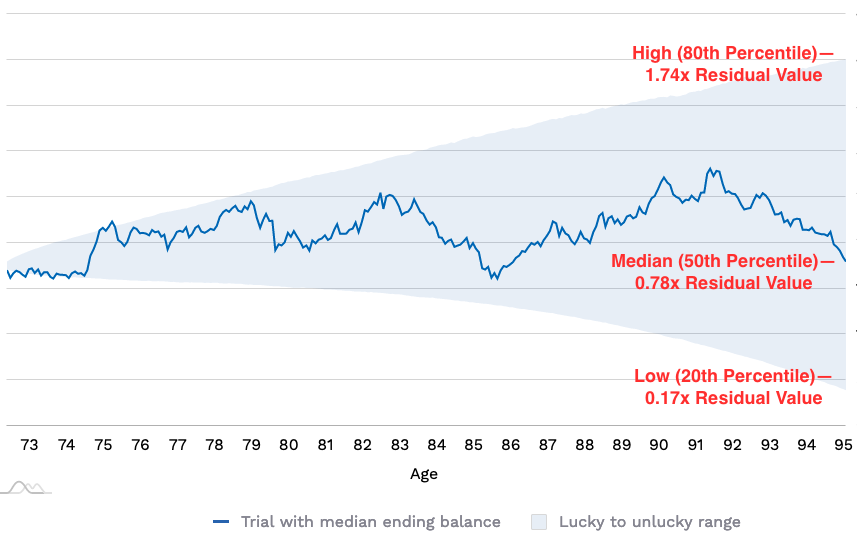

They also say that the blue line (median) on each graph shows the performance of a single portfolio that ended up in the middle (50th percentile) of the 10,000 portfolios in the Monte Carlo analysis at the end of the investment period.

You’ll notice its ups and downs (which change with each simulation run). This underscores an important point: SWR portfolios are volatile, and large changes in portfolio value are normal. The solid blue line represents the portfolio with the average (median) ending balance.

If I run the model several times (you can run it as many times as you like), the portfolio’s ending balance at each percentile should be fairly stable for each run as long as the assumptions remain the same. However, the path of the blue line will look different each time because it shows the unique ups and downs of the single run that ended up as the median portfolio.

In other words, while the final amount remains the same, the path to get there varies due to randomness.

The results

Portfolio #1: My SWR portfolio—no annuities

Here’s the result of a simulation of my actual 40% stocks/60%bonds and cash SWR portfolio plus Social Security using the above assumptions:

As you can see, it does quite well, especially above the 20th percentile. I have annotated the chart with the portfolio’s residual values. (Note: The terminology “0.80x” means that the residual value is 80 percent of the SWR portfolio’s starting balance of “x” before any annuities were purchased from it.)

The portfolio isn’t completely depleted at age 95, but it has a fairly low residual value at the 20th percentile. It’s in pretty good shape at the 50th percentile and almost double at the 80th percentile. I interpret this to mean that our savings are likely to last until age 95 and beyond.

A pessimistic person might focus on the results at the 20th percentile using the default assumptions. They might also lower the default assumptions, increase the average inflation rate, etc., to model more difficult economic scenarios.

Portfolio #2: My SWR portfolio plus nominal annuity

This is the “hybrid” portfolio (SWR portfolio + Social Security + nominal annuity) that I introduced earlier. The annuity purchase with IRA dollars is large enough to provide the additional income we need to supplement Social Security to cover our basic living expenses.

This scenario is a little more complicated from a modeling standpoint. The challenge is that the simulation tool treats taxes on Social Security benefits (which are taxable up to 85%) and annuity income (which, in my case, is taxable up to 100%) the same.

If I add an income annuity that would still be in an IRA account “wrapper,” I have to estimate the combined taxable percentage for what the simulator calls “retirement income,” distinguishing it from income from the SWR portfolio, which it calls “portfolio” income.

I take QCDs for charitable contributions from my IRA (which are tax-free), so I have to account for that because the annuity payments that would be in an IRA are now included in “retirement income,” and the income from the SWR portfolio is reduced accordingly.

I was surprised that this strategy performed almost as well as Portfolio #1. Although inflation took its toll on the nominal annuity, maintaining a relatively large SWR portfolio balance, with 40% in stocks, seemed to mitigate its effects. Moreover, if the SWR portfolio were to fail at the 20th percentile, the nominal annuity would continue to make payments but with much less purchasing power later in the period.

Portfolio #3: SWR w/ 3% COLA Annuity

To implement this strategy with a COLA annuity, I had to assume a 27% larger annuity to provide the same amount of income at the beginning since the initial payout is reduced to account for the 3% annual COLA increases. This further reduced the size of my SWR portfolio, as it’s a significant percentage of my retirement savings.

The performance of the SWR portfolio with this strategy over the 23-year period is similar to that of the SWR with a nominal annuity. However, there is a BIG difference between this strategy and the others, which I’ll get to shortly.

Here’s a table summarizing the results. I have highlighted the strategy with the highest residual value at each percentile. (Note: The terminology “0.80x” means that the residual value is 80 percent of the starting balance of the SWR portfolio before any annuities were purchased from it. I show it that way because the starting value for each is different).

As you can see, there’s surprisingly little difference in residual value between the three strategies even though large lump sums were used to purchase annuities for the two hybrid strategies, which significantly reduced the SWR portfolio from the start—more so for the COLA annuity than the nominal one.

The SWR portfolio-only strategy has a slight edge at the 50th and 80th percentiles. However, that’s an apples-to-oranges comparison since the others, which did almost as well, included a lifetime ‘guaranteed’ income stream.

I mentioned earlier that there is a critical difference between the COLA strategy and the other two. Notice the third column. It refers to the annuity payments in each strategy.

Although all strategies continue Social Security payments for life, only the hybrid strategies include annuity payments for life. The column shows their nominal value (not adjusted for inflation) at age 95 relative to the starting amount at age 72.

Because the nominal annuity payments aren’t adjusted annually, they remain at 1.00x at age 95. However, the COLA annuity (in red) is adjusted by 3% per year, nearly doubles in 23 years, and continues to pay as long as either of us lives.

This is a significant difference. If the SWR portfolio fails earlier than the simulation suggests, the COLA annuity will continue to pay 1.97 times the initial amount.

Some thoughts

Here are some things that stand out to me:

1—The residual value of the SWR portfolio is positive at the 20th percentile for all three strategies but is particularly strong at the median (50th percentile) and above. This suggests that barring an unforeseen catastrophic event or uncontrolled spending, total depletion of the SWR portfolio is unlikely with any of the three strategies. It also indicates that all three would be reasonable strategies for me to implement.

2—Although the SWR portfolio-only strategy performed the best relative to its residual value, we would be worse off financially if it failed before age 95, with only Social Security to rely on for income. This is perhaps the best argument for an annuity without regard to residual value comparisons. Yes, we’d be out of savings, but we’d presumably still have Social Security and annuity income to meet our basic needs, which is the whole point of an annuity in the first place.

3—The COLA annuity strategy best illustrates the potential benefits of a hybrid approach. The median residual value of this strategy was equal to that of the nominal annuity. And it’s almost as good as the SWR portfolio-only strategy, even though the SWR portfolio in the COLA strategy is 30% smaller than the SWR portfolio-only strategy.

4—The main problem with the nominal annuity hybrid strategy is that inflation will significantly reduce its purchasing power. If the SWR portfolio fails or is significantly depleted, it would be better to have the COLA income annuity because, as noted above, it will almost double over 23 years.

5—If inflation averages significantly higher than 3% per year, the benefit of the COLA strategy would be diminished, but it could still be higher than the nominal annuity. In my last article, I illustrated the devastating effect of high inflation on a nominal annuity and a COLA annuity if it’s higher than the annual adjustment for a long time. At a high average inflation rate of 4.5% per year, the SWR portfolio would be nearly depleted by age 91. Although the COLA annuity would continue to make payments, its purchasing power would be reduced.

Why did the SWR portfolio perform better regarding residual portfolio value at the 50th and 80th percentiles?

My initial assumption was that at least one of the hybrid strategies would outperform the pure SWR portfolio strategy. Many researchers have claimed that hybrid strategies improve portfolio longevity and increase residual wealth.

The results partially supported this hypothesis. Residual wealth for the hybrid strategies was very similar to the SWR portfolio, and it also paid out a guaranteed lifetime income stream. The lifetime income effectively insures against increased longevity, should that be the case.

Note also that I did not do a 100% annuities-for-bonds swap; I bought only enough annuities to provide an “income floor” and left a relatively large balance in my SWR portfolio. (However, I had to buy a larger annuity contract to get the same income from the COLA annuity.) This may have improved the portfolio’s performance over a long period of time, resulting in slightly better residuals above the 20th percentile.

It’s decision time—again

I have more data, but I’m not sure it’s enough to give me a clear direction on buying an annuity. The simulation of the SWR portfolio-only strategy shows a positive outcome at age 95 between the 20th and 100th percentiles, and as the developers at honestmath.com wrote, “If at least 80% of your trials end with a positive portfolio balance, we’d consider you in good shape.”

So, the results suggest that I might be okay without an annuity, barring some catastrophic event (which isn’t impossible). But even then, regarding the most extreme risks, honest math says,

“Of course it’s possible that markets suffer unprecedented shocks, or that the financial system collapses entirely. In the case of the latter, however, we’d argue that you’re likely to be less concerned with the value of your portfolio than you are with the [number] of your close friends.”

honestmath.com

The thing I like best about the SWR portfolio-only strategy versus one with an annuity is that while annuities provide stable and predictable income, a stock and bond portfolio can provide higher returns, flexibility, and liquidity (one of the things that’s important to me and other retirees).

The main drawback is that it’s volatile, so future returns are uncertain, certainly less so than a guaranteed income annuity. Even with a moderately conservative asset allocation of 40% stocks / 60% bonds, it could fail prematurely for any number of reasons, however unlikely.

The possibility of a significant market collapse leading to premature portfolio exhaustion gives me pause. However, the COLA annuity strategy—with 1.97x the annuity payout value at age 95—is fairly attractive regardless of what happens to the SWR portfolio.

Would the insurance companies remain solvent and able to make payments indefinitely? Would the state guaranty associations be able to cover the liabilities? Probably, but who knows? There is no such thing as an absolute guarantee.

If I choose a COLA annuity, I would have to surrender a large lump sum—larger than with a nominal annuity—and I calculated that it would take fifteen (15) years, to age 87, before the nominal annuity and the COLA annuity would break even in terms of the premium I had to pay for the 3% annual adjustments.

There’s about an 80% chance that one of us will make it to age 87, but only a 30% chance that one of us will make it to age 95. (The chart below assumes that “retirement age” is our current age of 72 since we’re retired).

Although I’m not ready to pull the trigger on it yet, I don’t have much conviction in my decision not to buy one. I certainly can’t rule it out, so I’ll have to think and pray about it for a while.

Enough about me; what about you? Would adding an income annuity to your portfolio benefit you in retirement?

If you’re looking at a longer horizon (25, 30, or 40 years) and are concerned about running out of money (or running a retirement planning model that shows it’s likely you could) or are receiving relatively small Social Security benefits, I would strongly urge you to consider incorporating an income annuity into your strategy. Run the numbers on honestmath.com (or the planner/simulator of your choice) and see what you come up with.

Get professional help if you need it, but make sure you work with a fiduciary, not someone selling annuities on commission. Because of higher interest rates, this may be the best time in a long time to buy an annuity if it seems appropriate to you.