If you read much about retirement finance, you’ll see a lot of hyperbolic rhetoric about “Required Minimum Distributions,” or “RMDs.” You’d think RMDs are going to sneak up on you and devastate your financial plans in retirement.

Spoiler alert: they’re probably not.

Yes, RMDs will impact your savings, income, and taxes, but not as much as if you’re already withdrawing from your retirement savings before your RMDs kick in at age 72 (as many retirees are).

And even if you aren’t, if you understand and plan for them, the negative impacts can be minimized.

I’ll turn age 70 this month and will be 70½ next April. That used to mean that I would be less than a year from having to start taking the dreaded RMDs from my Traditional IRA. But due to recent legislation, there’s some good news (and the same old “bad” news).

The good news is that the new age for having to start RMDs is 72 (and may rise to 75 if some currently pending legislation gets approved). The bad news (but not as much for me): We will all have to take RMDs when we turn 72 (which for me is about 2½ years from now) or 75 (based on legislative outcomes) if you have a traditional (i.e., taxable upon distribution) IRA or 401(k) type account.

I wrote, “but not as much for me,” as I’m basically already taking RMDs as an integral part of my retirement income strategy.

Whether RMDs will have a negative impact on you will depend greatly on your overall financial situation—it will mostly have to do with the potential income tax impacts.

RMD basics

If RMDs are something you’re not too familiar with, you should be. This IRS rule will affect a large number of retirees at some point in their retirement, so there are a few things you really need to know:

1) You’re required to take RMDs (and pay federal and state income taxes on them) on all employer-sponsored retirement plans, including:

- 401(k) plans,

- Roth 401(k) plans (Technically, Roth 401(k)s, if they remain with your company after your departure or retirement, are subject to RMDs after age 70½. However, you can roll them into a Roth IRA, which is not subject to RMDs during the owner’s lifetime.),

- 403(b) plans,

- 457(b) plans.

2) RMD rules also apply to traditional IRAs and IRA-based plans, including:

- Traditional Individual Retirement Accounts (IRAs),

- SEPs,

- SIMPLE IRAs.

You can run, but you can’t hide (except in Roth accounts).

The RMD rules don’t apply to Roth IRAs while the owner is alive, but things change for their heirs. Anyone other than a spouse who inherits a Roth IRA from a parent eventually will have to take mandatory distributions.

3) The penalty for missing an RMD due date or withdrawing less than the correct RMD is 50% of the amount not withdrawn by the due date.

Yes, you read that correctly. If you miss the date you’ll have to pay a 50% penalty in addition to the ordinary income taxes on the money, just as you would with any IRA distribution.

4) If you’re not already taking them, your first RMD will be due by April 1st of the year following the calendar year you reach age 72.

After that, RMDs are due on December 31st every year.

I will turn 72 in October 2024. That means I don’t have to start taking RMDs until April 2025. But, as I’ve mentioned, I’m effectively already taking them since I withdraw a small percentage of my retirement savings every year to supplement our Social Security.

If it sounds like I’m not too concerned about them, that’s because I’m not. But that doesn’t mean we all shouldn’t at least be well informed. It’s essential to understand what they are, the IRS rules for them, and how they might impact our overall financial situation.

Why RMDs in the first place?

When Congress created the IRA in 1974 and the 401(k) in 1978 (long before I had enough income to contribute to either), the proposition was very simple: Eligible workers could contribute a portion of their earned income to a qualified retirement saving account up to a specific limit and not pay income taxes on their contributions or their earnings until they withdraw the funds in retirement.

The intent was to defer taxes in the present to incentivize saving and help grow savings faster and then to tax them at a later date. (In other words, taxes are deferred, not avoided.)

It sounded like a good deal to most (including me), so I made tax-deferred contributions to my 401(k) and sometimes to an IRA for much of my working life.

But the story doesn’t end there. Decades later, in 1987, Congress realized that ‘wealthier’ households might not spend down their now taxable retirement accounts fast enough for the government to collect those deferred taxes. So, they came up with RMDs to prevent taxes from being deferred for a lifetime.

The goal of RMDs is to ensure that most retirement account savings are actually withdrawn and taxes paid during retirement, even though the withdrawn funds don’t have to be spent. (They can instead be saved or re-invested in a non-retirement brokerage account.)

That kind of makes sense, I guess. (I still don’t like it very much—not the RMD itself, but that “have to pay taxes on it” part.)

How are they calculated?

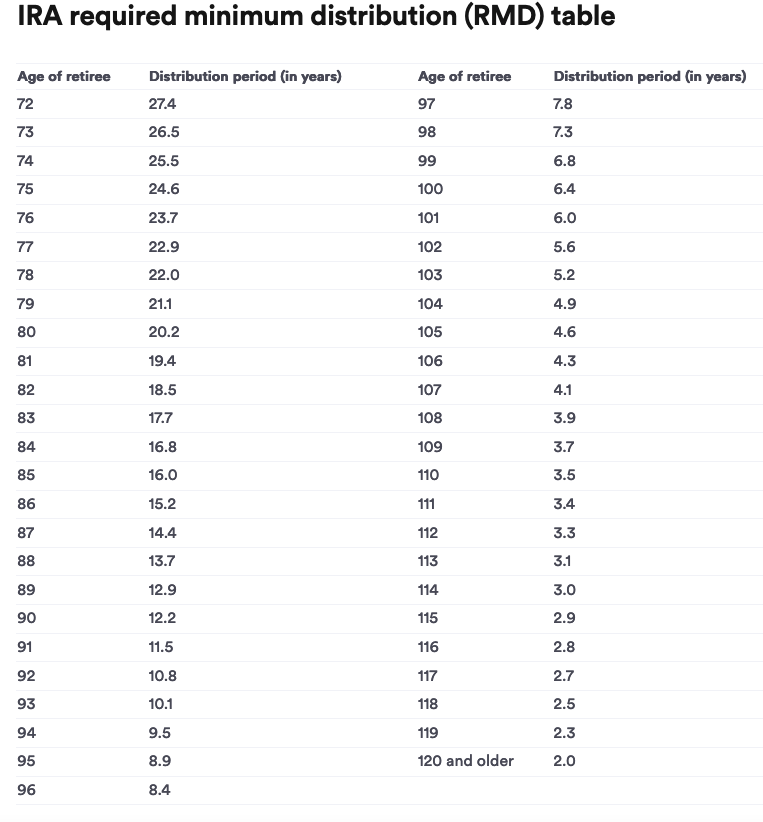

The math is pretty simple. RMDs are calculated by dividing your account balance as of December 31st of the previous year by a factor based on your current age from an IRS actuarial table. The result is your RMD amount (not percentage).

The challenge is that there are different tables, so you need to use the one that fits your situation (marital status, spouse’s age, etc.).

For example, I would use Appendix B. Uniform Lifetime Table III for Married Owners Whose Spouses Aren’t More Than 10 Years Younger:

As you can see, at age 72, the factor for my situation is 27.4, which equates to an RMD of 3.65%. Interestingly, that’s very close to what I’m already withdrawing from my account as I approach age 70.

As you can see, the factors increase each year, so my yearly RMD percentage will also increase, as will the taxes due. If I live to be age 90, my RMD for the next year would be 8.2%—a very high percentage. However, in all likelihood, that higher percentage will be applied to a (much?) lower account balance than I started with at age 72.

You may wonder, “what if I don’t need that much when I reach age (fill in the blank)? Am I being required to withdraw more than I want to?”

The answer is maybe. Yes, you may have to withdraw more than you need and pay the taxes. But just because you withdraw it doesn’t mean you don’t have to spend it—you can save the money, invest it in a taxable brokerage account, or give it away if you want to. (You could even put the money back into an IRA if your earned income is at least equal to the contribution amount.)

An easier way to figure out your RMD is to use any of the many RMD calculators on the web. For example, Fidelity has one that will estimate your RMD at a future date based on your age, marital and account status, prior year balance, and estimated annual growth.

Your retirement account custodian’s website probably has one too. Remember to calculate the RMD for all retirement plans except Roth IRAs held with all custodians and withdraw their sum. (Consolidating accounts makes this easier.)

Even easier when the time comes is to sign up for an automatic RMD withdrawal service with your account custodian. All the major providers, such as Fidelity, Vanguard, and Schwab, provide that service. They will withdraw the exact RMD by the required deadline and prevent you from making a costly mistake.

If you mess up (it happens), there are ways you can correct the error, and have the penalty fee waived under certain circumstances.

So how big a deal is it?

RMDs are a fact for most retirees with retirement savings unless they’re all held in Roth accounts. (Even then, RMDs will be required for heirs under certain circumstances—more on that later.)

Because RMDs are taxable as ordinary income, they can impact your financial situation in a couple of ways:

1) RMDs may push you into a higher marginal tax bracket.

Let’s say you have Social Security and a pension, occasionally withdraw from your retirement savings, and take the standard deduction. Then, the year after you reach age 72, you have to start withdrawing your RMD. That additional taxable income or may not push you into a higher marginal tax bracket.

For example, if you’re Modified Adjusted Gross Income (MAGI) put you in the 12% marginal bracket (meaning your MAGI is less than $83,550), and your RMD is large enough to immediately bump you into the 22% bracket (a 10% increase), you’ll have to pay 22% of your RMD above $83,550 to the IRS. If you didn’t really need all the RMD in the first place, that might not be too big a deal. You can pay the taxes and save the rest.

Some (most?) retirees will not be forced into a higher tax bracket due to RMDs, though they will pay more tax because they have more taxable income. To illustrate:

- 72 year old couple receives $40,000 in Social Security (49% taxable) and pension benefits of $40,000 (100% taxable)

- AGI is 59,600 (marginal tax rate of 12%)

- Tax-deferred retirement savings of $800,000

- RMD of $28,000; increases AGI to $87,600 (triggers marginal tax rate of 22%, but only on income above $83,550, which is $4,050)

- Standard deduction of $28,800 reduces taxable income (MAGI) to $58,800 (marginal tax rate is back to 12%)

- Taxes are $6,658, which is an effective tax rate of 7.6% of AGI and 11.3% of final taxable income (MAGI)

In this example, the couple started taking RMDs but remained in a 12% marginal tax bracket. And although they will pay more in taxes (because their income is higher), their effective tax rate (the percentage they pay on their taxable income after deductions) will remain relatively low under the current tax code (less than 10% of AGI).

What if the same couple is making annual withdrawals of 4% ($32,000) from their retirement savings instead of receiving a pension of $40,000 (AGI of $51,600)? At age 72, their RMD is 3.6%, so they will not see any change to their income or their tax obligation. They’re already withdrawing more than their RMD amount.

2) More of your Social Security benefits may be taxed, possibly much more (sometimes called the ”tax torpedo”).

In the example above, 49% of our couple’s Social Security benefits were taxable. But Social Security benefits are taxable at one of three levels based on your “combined income.” (”Combined income” is essentially half of your Social Security benefit plus your other gross income and any tax-exempt interest.)

Based on that formula, either 0%, 50%, or 85% of your benefits will be taxable based on how high your combined income is. Depending on your total income before taking RMDs, and the percentage of that income that comes from Social Security, you could end up with a much higher actual marginal tax rate, especially if you have above-average Social Security benefits (many higher wage earners will).

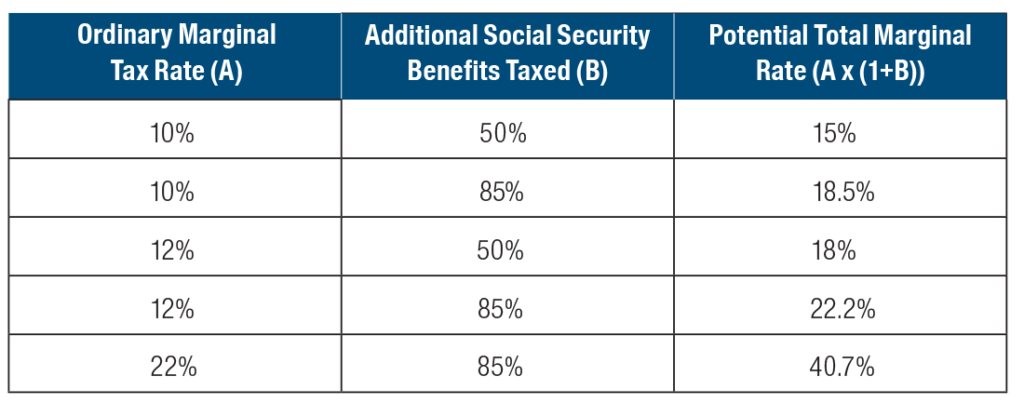

If your RMDs cause more of your Social Security to be taxable, those in the 22% marginal tax rate, for example, could end up with a marginal tax rate as high as 40.7%. ”How so?” you might ask. Take a look at this chart from T. Rowe Price:

The chart shows how RMDs might increase your income enough to make more of your Social Security benefits taxable. For example, as shown in the chart, if your ordinary marginal tax rate is 12% but your new combined income due to RMDs increases the percentage of taxable Social Security benefits from 50% to 85%, your ”total marginal rate” is (12% x (1 + 85%)) = (.12 x 185) = .222, or 22.2%.

The big “torpedo blast” comes when your RMDs are large, your ordinary marginal rate increases to 22%, and 85% of your SS benefits are taxable—all at the same time. The total marginal rate goes to 40.7% (.22 x 185 = 40.7).

Remember, this doesn’t mean you will pay 40.7% of your total income in taxes. It simply means that your total marginal tax rate increased because it resulted in more of your Social Security benefits being taxable. And, at higher income levels, it eventually returns to 22%.

If you’re in this group (or think you might be), you should probably talk with a financial planner or tax professional and get help managing your retirement expenses, income, and tax projections.

Can RMDs be avoided or reduced?

If you have retirement savings in traditional (tax-deferred) accounts, the simple answer is ”no, there is no way to avoid RMDs.” That said, there are a couple of other ways to reduce the taxes on RMDs:

1) Do a Roth conversion.

If you move money from “tax-deferred” (traditional) to “tax-fee” (Roth) accounts, you may be able to reduce your RMDs (and your taxes) in the long run. (Remember, Roth accounts grow tax-free, and there are no RMDs.)

This requires you to execute a Roth conversion, but the converted amount is taxable in the year you do the conversion. However, the taxes owed at the time you convert may be lower than taxes on your tax-deferred (non-Roth) accounts in the future.

I’ve considered this multiple times and run the numbers, but I haven’t gotten comfortable doing a Roth conversion. That’s because I didn’t have enough non-retirement savings to pay the taxes in the year I wanted to do the conversion. (If you use retirement savings to pay the taxes, the net benefit of doing the conversion is significantly reduced.)

2) Charity-minded retirees can use Qualified Charitable Distributions (QCD) to reduce taxable income.

I plan to write more about this in the future (as I will be eligible to make QCDs next year), but the simple explanation of QCD charitable giving allows us, starting at age 70½, to instruct our retirement savings account administrator to directly send IRA distributions—up to $100,000 per year—to a qualified 501(c)(3) charity.

This IRA distribution counts toward the RMD requirement but must not be reported as taxable income. This effectively reduces the taxes due on your RMDs.

Many readers of this blog are probably already giving to their church and other ministries and charities. If so, you may find that using the QCD for giving provides you with a greater tax benefit.

That’s because it reduces your AGI, which is used in various tax calculations, such as the taxable portion of your Social Security benefits. It also allows you to receive a tax benefit from your charitable contributions even if you don’t itemize and are taking the standard deduction (which is the case for many since the tax law changes enacted in 2017).

3) Consider a Qualified Longetivty Annuity (QLAC) contract.

A QLAC is basically a deferred annuity that meets specific IRS requirements. You can use money in an IRA to purchase a QLAC, which effectively reduces the amount of your tax-deferred savings and, thus, your RMD amount. (The assets in a QLAC are excluded from your RMD calculation.)

Because a QLAC is a deferred annuity, you would typically wait many years before withdrawing from them, perhaps by “annuitizing” them into a stream of regular payments that last for the rest of your life (which is why they’re called “longevity annuities.”)

Some see QLACs as a replacement for Long Term Care Insurance. However, keep in mind that such distributions will be taxable at the time they are made.

Get help

RMDs will not be that big a deal for most retirees because many people with retirement savings will need to withdraw from them for income in retirement. However, as we have seen, there could be significant tax implications in some cases.

Therefore, these decisions probably need to be made in consultation with a financial planner or tax professional. But keep in mind that the closer you get to age 72, the less likely you’ll be able to reduce your RMDs.