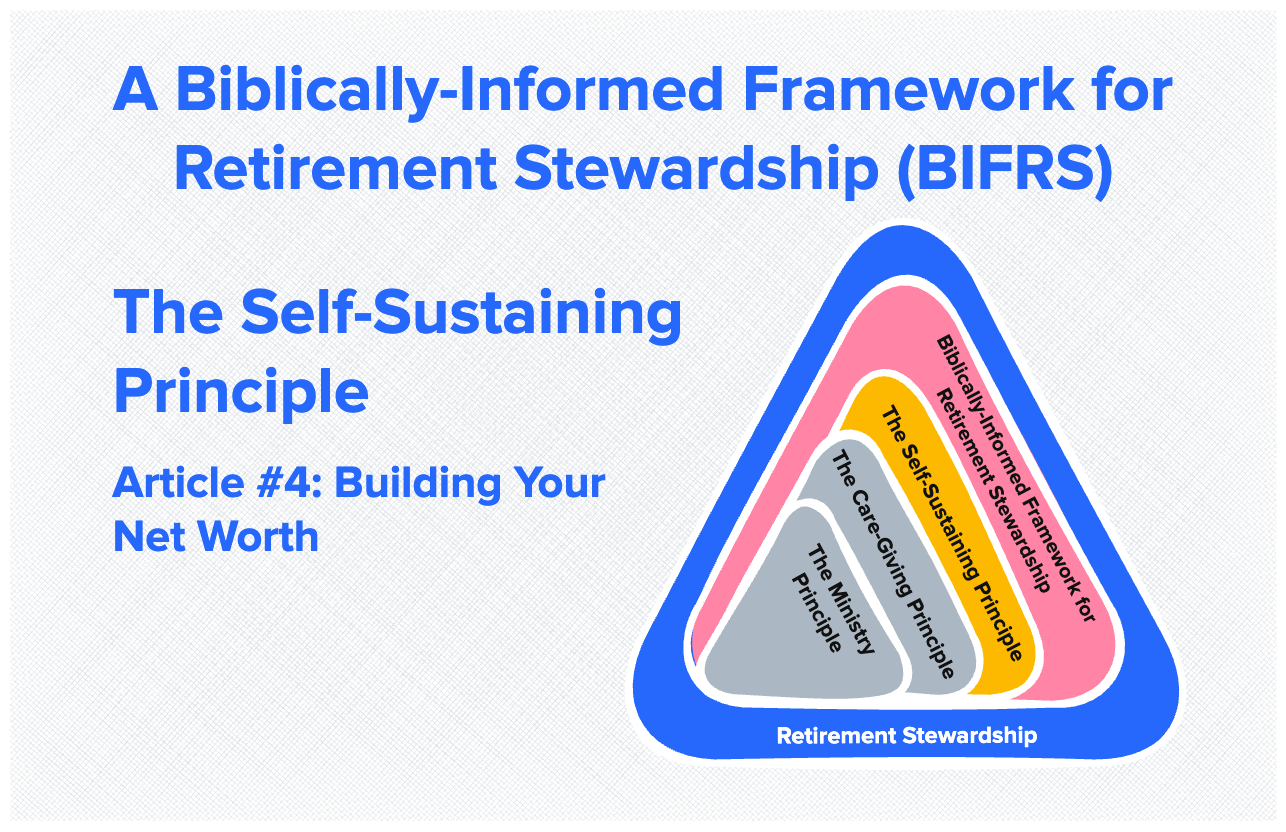

This article is part of the Biblically-Informed Framework for Retirement Stewardship (BIFRS) series.

In the previous article, we explored what net worth means, why it matters for sustainable retirement, and how to calculate and track it. We established that your current wealth forms the foundation for everything else in the Sustainability Principle—you can’t generate sustainable retirement income from wealth you never built.

Now we turn to the practical question: How do you actually build that wealth?

This article examines the mechanics of wealth accumulation, i.e., how wealth grows over time, the power of starting early, key investment decisions you’ll face, and practical strategies for building the foundation you need for sustainable retirement.

The good news: Building adequate wealth for sustainable retirement isn’t mysterious or complicated. It’s the result of consistent, disciplined habits applied over decades:

- Working diligently

- Spending less than you earn

- Saving regularly

- Investing wisely

- Avoiding big mistakes

- Staying patient through market cycles

Let’s explore each dimension.

How your net worth grows

To build adequate net worth (current wealth) for a sustainable retirement, you need to understand how wealth accumulates over time. The process can be represented by a simple equation:1

Next Year’s Wealth = Current Wealth + Income – Taxes – Giving – Living Expenses + Investment Returns – Interest Paid

Or more simply:

Future Wealth = Starting Wealth + All You Earn – All You Spend – All Interest Paid – All You Give + All Your Investments Earn

But the real insight comes from understanding the power of time and compounding. Consider this classic case study about Susan, Bill, and Chris—three people who made different decisions in their 20s about saving for retirement:

- Susan – invested $5,000/year from age 25 to 35, then stopped (total invested: $50,000)

- Bill – started late and invested $5,000/year from age 35 to 65 (total invested: $150,000)

- Chris – committed to living below his means and invested $5,000/year from age 25 to 65 (total invested: $200,000)

Assuming a 7% annual return, here’s how they finished at age 65:

- Chris: $1,068,048 (invested $200,000)

- Susan: $562,683 (invested only $50,000)

- Bill: $505,365 (invested $150,000)

Susan invested three times less than Bill but ended up with more money. Her 10-year head start meant her money was earning money while Bill was still getting started.

This is the “power of compounding”; your money earns money, and the money your money earns also earns money. It’s a geometric progression that grows exponentially over time. It’s “magical math.”

The key takeaway for sustainable retirement: Most people think investments are glamorous and that “market-beating” returns are the key to wealth. But building the foundation for sustainable retirement is a byproduct of working diligently, spending less than you earn, saving regularly, and investing wisely, thereby minimizing losses, especially in the critical years leading up to retirement.

The earlier you start building your current wealth foundation, the more sustainable your retirement will be. Time is your greatest asset for achieving sustainability.

“A slack hand causes poverty, but the hand of the diligent makes rich. He who gathers in summer is a prudent son, but he who sleeps in harvest is a son who brings shame.” (Proverbs 10:4-5, ESV)

The core message of this verse is clear: When you’re in the summer of your life (the early years), that’s the time to “make hay” (save). But if you slumber at harvest time (procrastinate or fail to save altogether), you could be in for a long, difficult winter during retirement.

A biblical perspective on building wealth

How should Christians think about accumulating wealth for retirement? We’ve already touched on this numerous times, but some things bear repeating.

First, recognize that saving and investing aren’t optional extras—they’re expressions of faithful stewardship:

“But if anyone does not provide for his relatives, and especially for members of his household, he has denied the faith and is worse than an unbeliever.” (1 Timothy 5:8, ESV)

“Precious treasure and oil are in a wise man’s dwelling, but a foolish man devours it.” (Proverbs 21:20, ESV)

Building Current Wealth for sustainable retirement is part of providing for your household—ensuring you don’t become a burden to others in old age.

Second, understand that wealth is a tool, not a god. The purpose of building Current Wealth isn’t to hoard or to achieve financial independence as an end in itself—it’s to create the foundation for a sustainable retirement that enables continued service, generosity, and faithful stewardship:

“Command those who are rich in this present world not to be arrogant nor to put their hope in wealth, which is so uncertain, but to put their hope in God, who richly provides us with everything for our enjoyment.” (1 Timothy 6:17, NIV)

Third, remember that everything belongs to God. You’re not building “your” wealth—you’re stewarding resources God has entrusted to you:

“The earth is the LORD’s and the fullness thereof, the world and those who dwell therein.” (Psalm 24:1, ESV)

Finally, recognize that building sustainable retirement wealth should be balanced with present generosity. You’re not called to maximize accumulation at the expense of current giving:

“One gives freely, yet grows all the richer; another withholds what he should give, and only suffers want.” (Proverbs 11:24, ESV)

The goal is faithful stewardship that meets both present and future needs while maintaining a generous heart—building a foundation for a sustainable retirement while trusting God’s provision. Following a core set of biblical principles may prove helpful in this endeavor.

Biblical Traits of a Successful Investor (Updated 2026) identifies four character traits essential for wise, biblically-grounded investing: Simplicity (using the fewest investments necessary with minimal time required, avoiding needless complexity that leads to harmful over-trading), Patience (staying focused on long-term goals despite market noise and resisting get-rich-quick schemes, with research showing average investors underperform indexes by 3-4% annually due to poor timing decisions), Moderation (maintaining balanced approach avoiding extremes of either hoarding/greed or laziness/passivity, understanding when “enough is enough”), and Humility (recognizing limits of one’s knowledge and abilities, avoiding overconfidence that leads to speculation, and seeking wise counsel from Scripture and experienced advisers).

5 Reasons to be Humble in Retirement Stewardship (2019) argues that pride—taking credit for wealth and success—is antithetical to biblical stewardship, while humility (recognizing God as the source of all provision) is foundational to wise retirement planning. Drawing from Augustine (“you must first lay deep foundations of humility”), Tim Keller, and Scripture (1 Cor 4:7, 1 Tim 6:17, Prov 16:18), the article identifies five areas where overconfidence undermines retirement planning.

Invest and Retire Like Dave Ramsey (2023) critically evaluates Dave Ramsey’s retirement investing philosophy, agreeing with foundational principles (Baby Steps, debt elimination, 10-15% savings rate, tax-advantaged accounts like Roth IRAs and 401(k)s with employer match, mutual fund diversification over individual stocks) but diverging on key investment strategies.

Your big investment decisions

Once you’ve decided to save, you need an investment strategy. This requires several important decisions that will affect the sustainability of your eventual retirement.

Decision #1: Hire an adviser or do it yourself (DIY)?

Your first decision is whether to manage your investments yourself or to engage a professional.

If you’re saving in a 401(k) or 403(b), you’re already a DIY investor. Your employer provides investment options, educational materials, and perhaps classes or free counsel. Ultimately, you probably select the funds, monitor performance, and determine when changes are needed.

With an IRA, you make the same decisions but with far more options. Many excellent financial services firms offer self-directed IRA accounts and are typically reliable sources of financial guidance.

If you hire an adviser, most firms charge a percentage of assets under management—typically 0.50% to 1.5% annually. Some charge even higher fees or add sales commissions. (These are in addition to the fees charged by your investments themselves.) Be careful with these types of fees; they can add up quickly.

My perspective: I’m a fan of DIY investing for two reasons: (1) lower costs that enhance long-term wealth accumulation and sustainability, and (2) nobody cares about your (my) money as much as you (I) do. But it requires education: reading blogs, articles, books, and perhaps taking classes. Most people don’t want to invest that time and energy, so hiring a competent, trustworthy adviser at a reasonable fee (which I consider to be less than 1% of assets, preferably closer to 0.50% to 0.75%) is often the wise choice.

Finding an adviser: Look for fee-only advisers at napfa.org, letsmakeaplan.org, or plannersearch.org. Interview multiple candidates before choosing one.

Check each adviser’s background:

- Google their name and firm for lawsuits or disputes

- Search BrokerCheck for regulatory issues

- Review their Form ADV at adviserinfo.sec.gov

- Look for annual fees of 1% or less

- Verify they adhere to the fiduciary standard—putting your interests ahead of their own

Remember: fees compound negatively over time. The SEC’s analysis shows that a 1% ongoing fee on a $100,000 portfolio growing 4% annually costs $40,000 over 20 years. For a $500,000 portfolio over 30 years with 6% growth:

- At 0.25% fees: Ending balance ~$2.5 million

- At 1.00% fees: Ending balance ~$2.0 million

- Lost to fees: $500,000

Lower fees mean greater wealth accumulation, which directly translates into greater retirement sustainability.

Financial Advisors—Part 1: What They Do (Updated 2026) provides a comprehensive overview of the different types of financial advisors, distinguishing between Registered Investment Advisors (RIAs) that operate under fiduciary standards and broker-dealers, which are subject to different requirements under Regulation Best Interest (Reg BI).

Financial Advisors—Part 2: How They’re Paid (Updated 2026) explains the critical importance of understanding total advisory costs, detailing four primary compensation methods and showing how a portfolio charging 2.25% total fees would grow to only $315,000 over 20 years versus $610,000 with 0.15% total fees—nearly double the ending value from fee differences alone.

Financial Advisors – Part 3: How to Choose One (Updated 2026) provides a comprehensive framework for deciding whether you need an advisor, presenting a three-tier decision framework: you probably don’t need ongoing services if your situation is straightforward; you probably need periodic professional guidance for major irrevocable decisions like Social Security claiming; and you probably need ongoing comprehensive services only if your situation is genuinely complex or you’ve demonstrated inability to follow disciplined strategies.

Should Your Financial Planner/Adviser/Broker be a “Fiduciary”? (Updated 2026) goes more in-depth to answer the question of whether you should select a financial adviser who is held to the “fiduciary standard” (putting clients’ interests first) versus the “suitability standard” (recommending products that merely fit clients’ general profile). The article suggests that you look for an adviser with strong credentials (especially CFP), who works as a fiduciary (fee-only or fee-based RIAs preferred), clearly discloses compensation, and demonstrates commitment to your best interests.

Decision #2: Where to invest?

Whether you handle the process yourself or use an adviser, you need a financial institution to hold your assets and execute transactions.

Outstanding firms with client-focused business models:

Vanguard – The nation’s largest mutual fund company, known for low-cost index funds and ETFs. A client-owned structure means there is no conflict between customers and owners. As of 2025, Vanguard manages over $9 trillion in assets and continues to lead in low-cost investing, maximizing wealth accumulation.

Fidelity – Top-rated discount brokerage, privately owned. Excellent platform, broad fund selection, and competitive pricing. I held my IRA with Fidelity for many years.

Charles Schwab – Major discount brokerage with excellent reputation for value and service. Low costs, an outstanding website, and a broad range of proprietary funds.

TIAA – Over 100-year-old not-for-profit firm with stellar reputation in academic and non-profit communities. Specializes in retirement accounts.

Independent advisors: Registered Investment Advisers (RIAs) typically charge fees only (no commissions) and usually select custodians such as Fidelity, Schwab, or TD Ameritrade (now part of Schwab) for you.

A note on Christian advisors: Many Christians prefer working with Christian advisers, which is fine. But competence, experience, knowledge, wisdom, and integrity matter equally—they’re your financial adviser, not your pastor. You need both. Kingdom Advisors is a good place to start. The Blue Trust is a good firm to consider.

Decision #3: What to invest in?

This is about deciding what you’ll invest in and why. These are decisions that will ultimately determine how much wealth you accumulate for a sustainable retirement.

The temptation to “beat the market”: Some people try to play the markets by buying and selling to time ups and downs. This is a losing strategy in the vast majority of cases and often undermines long-term wealth accumulation.

Here’s reality: The stock market is us—all of us. We are the market. It’s foolish for average investors to believe they can consistently “beat the market.” To beat the market, you must beat someone else at the same game by more than your costs. That someone might be a sophisticated Wall Street hedge fund manager.

My recommendation: Don’t go toe-to-toe with Wall Street professionals with money you need for retirement sustainability. You’re better off owning a cheaply-managed basket of many different stocks—a mutual fund. I favor index funds because they virtually ensure you’ll capture your portion of economic growth in whatever sectors you’re investing in, at relatively low cost.

Fewer than 20% of actively managed funds outperform their index benchmarks over 15+ year periods, according to 2024 SPIVA data.

Beyond stocks—the need for diversification: You need more than just stocks. You need diversification for building sustainable wealth. Most experts recommend adding bonds to your portfolio as the traditional stock diversifier. Bonds tend to hold value when stocks fall, helping you avoid panic-selling during downturns and providing income when needed. Both are critical for sustainable retirement income later.

How much in bonds? That depends on your risk tolerance. But here’s the truth most won’t tell you: It’s not terribly crucial whether your allocation is 60/40, 40/60, or 50/50 stocks/bonds. What is important for building sustainable retirement wealth:

- Starting to save early

- Keeping expenses low

- Not getting greedy or fearful during market swings

- Not putting all eggs in one basket

- Sticking with your strategy

My personal experience: I maintained a balanced 60/40 stock/bond allocation for most of my working life. Sometimes I was a little more aggressive. I experienced several market “crashes,” and it still worked out okay in terms of building the foundation I needed for a sustainable retirement. Regular saving and capital preservation were more important to me than marginal gains, which is why I took a relatively conservative approach.

At the start of 2026, at age 73, my portfolio consists of 35% stocks, 55% bonds, and 10% cash across eight mutual funds and ETFs. I maintain approximately two years of living expenses liquid so I can ride out any stock market storm without selling damaged assets, which I think is essential for sustainable withdrawal strategies.

Why I reduced my equity allocation: Early in retirement, I gradually shifted my equity exposure from 60% to 40%, and more recently from 40% to 35%. This wasn’t panic; it was intentional risk reduction aligned with my sustainability goals. I’m seeking more stable, dividend- and interest-focused income rather than lots of growth. With my investments and Social Security income, I don’t need to maximize returns. I need to preserve capital and generate sustainable income. That’s the “enough” principle in action, a key concept within the Sustainability Principle framework. However, holding some stocks is a good hedge against inflation.

Investing for Retirement—Part One: Introduction (Updated 2026) outlines the foundational role of your net worth in sustaining retirement, explaining how decades of disciplined saving and prudent investing during your working years accumulate to create the portfolio balance that must support 25-30 years of retirement. The article grounds investing in biblical stewardship principles, distinguishing between prudent risk-taking for productive purposes (investing, which Scripture sanctions in Proverbs 31 and Ecclesiastes 11) and speculative gambling on future events (which presumes on the future, contrary to James 4:13-17). The article also discusses the different (investable) asset types and how they fit in a portfolio.

Investing for Retirement—Part Two: Your Approach (Updated 2026) explores how to hold retirement assets and different management styles. It explains that while thousands of investment options exist (over 9,500 mutual funds and 2,000 ETFs), most people need only 5-10 funds for a well-balanced portfolio. Assets can be held individually (stocks, bonds, cash) or as pooled investments (mutual funds, ETFs, closed-end funds), with pooled investments offering key advantages of diversification, professional oversight, and affordability. The article contrasts active management (where fund managers actively select investments to outperform the market, typically charging 0.5-1.5% fees) with passive management (index funds that simply track market performance at lower cost, typically 0.05-1.0% fees). Since John Bogle pioneered index investing in the 1970s, passive investing has surged—with about 80% of actively managed funds failing to beat their benchmarks over time—leading to massive flows from active to passive funds.

Investing for Retirement—Part 3: Managing Your Assets (Updated 2026) outlines three primary implementation approaches for retirement investing—managed portfolios (professionally managed with fees typically 0.35-1.50% annually), do-it-yourself investing (now more affordable than ever with zero-commission trading and ultra-low expense ratios below 0.10%), and single-fund approaches using target-date retirement funds (like Vanguard’s charging only 0.08%) that automatically adjust asset allocation as you age.

Decision #4: How Often to Adjust Your Portfolio?

Some people love tinkering with investments. That can be dangerous to your financial health and long-term wealth accumulation. Usually, it’s better to be patient and let financial markets work in your favor.

My approach: Unless your asset allocation deviates significantly from your risk tolerance, say, by more than 10% for more than a year, rebalancing is optional. If you want a precise balance, simply hold balanced funds that automatically rebalance. Target date funds do too.

In 2025, I rebalanced significantly, reducing my equity allocation from 40% to 35% and shifting toward dividend growth-focused investments. I still have some stock index funds; I just tilted more toward dividends. This wasn’t routine rebalancing; it was a strategic decision informed by my age, risk tolerance, asset base, and sustainability goals.

Decision #5: What to do if you’ve fallen behind

This is perhaps the most difficult decision to confront. You’ve calculated your net worth, assessed your trajectory using the five-step framework, and discovered an uncomfortable truth: you’re not on track. The gap between where you are and where you need to be feels overwhelming—maybe even insurmountable.

Perhaps you’re 55 with $150,000 saved when you should have $500,000. Or you’re 62 with $200,000, hoping to retire at 65, but the numbers show you’ll need to work until 70, or longer. Or worst of all, you’re already retired with inadequate savings, watching your portfolio deplete faster than expected while wondering how you’ll make it last.

If this describes your situation, first know this: You’re not alone. According to the Federal Reserve’s 2022 Survey of Consumer Finances, the median retirement account balance for Americans aged 65-74 is only $200,000. Many people discover late in the game that they haven’t saved nearly enough. This isn’t a moral failing; it’s a wake-up call requiring honest assessment and decisive action.

Second, know this: It’s not hopeless. While your options narrow as retirement approaches, strategic steps can still significantly improve your situation. The Self-Sustaining Principle doesn’t demand perfection—it calls for faithfulness with what you have, starting today.

Two paths forward:

The path you take depends entirely on where you are in your retirement journey:

If you have time (10-15 years until retirement), you still have meaningful leverage to change your trajectory. Every year of aggressive saving, compound returns, and strategic decisions can close substantial gaps. Working even 2-3 extra years beyond your original plan can significantly improve retirement security through the compounding benefits of continued contributions, delayed withdrawals, and higher Social Security benefits.

If you’re already in or near retirement (within 5 years or already retired), your options are more limited but not nonexistent. You’re no longer reducing expenses to save more—you’re reducing to make what you have last longer. Part-time work, strategic Social Security claiming, downsizing, and careful withdrawal management become your primary tools.

Because the strategies differ so dramatically depending on your situation, I’ve written two comprehensive articles that walk through specific, actionable steps:

Behind in Retirement Savings? There’s Hope and a Path Forward (Updated 2026) addresses those who still have time to catch up. It walks through the specific steps Mike and Debbie (age 60, retiring at 62 for mission work) can take to close their $120,000 savings gap: increasing savings immediately to 20-30% of income, making catch-up contributions, reducing expenses dramatically, paying off their mortgage before retirement, considering working longer, and maintaining faithful giving through it all.

When Time Is Running Short: Practical Steps for Catching Up on Retirement Savings (Updated 2026) follows some example couples: Mike and Debbie (pre-retirement) and Tom and Susan (already retired with only $180,000 saved and withdrawing at a risky 6.7% rate. It walks through the emotional and practical realities of catching up when options are limited.

Making DIY investing simple

If you choose the do-it-yourself path, here are several approaches that work well:

1. Target date retirement funds

These “one-stop-shop” funds do everything for you: asset allocation, fund selection, rebalancing, etc. They automatically become more conservative as your target retirement date approaches. Vanguard, Fidelity, Schwab, T. Rowe Price, and TIAA all offer quality target-date funds with expense ratios under 0.15%.

2. Model portfolio approach

You can choose to follow an established strategy. Here are some suggested resources:

- Sound Mind Investing – Christian investing service offering multiple strategies and model portfolios (subscription required)

- Bogleheads Lazy Portfolios – Simple asset allocation plans

- Paul Merriman’s Ultimate Buy-and-Hold Portfolio

- Rick Ferri’s Core-4 Portfolios

- 8 Simple Portfolios – from Oblivious Investor (Mike Piper, CPA)

- 55 Lazy Portfolios – from Optimized Portfolio

3. Robo-advisers

Technology-driven investment services at 0.25%-0.50%:

4. Educational resources (books)

For beginners:

- The Bogleheads’ Guide to Investing – Multiple Bogleheads

- The Little Book of Common Sense Investing – John C. Bogle

- Investing Made Simple – Mike Piper, CPA

For deeper understanding:

- A Wealth of Common Sense – Ben Carlson

- The Intelligent Asset Allocator – William Bernstein

- A Random Walk Down Wall Street – Burton G. Malkiel

The most important things

The most important recommendation I can make for building sustainable retirement wealth: Eschew complexity and embrace simplicity and low costs. RUN toward both.

Excellent examples of simple, low-cost investing are Target Date Retirement Funds. You can obtain broad diversification at low cost from providers like Vanguard (0.08% expense ratio), Fidelity (0.12%), or Schwab (0.08%). These low costs compound positively over decades, maximizing your wealth accumulation.

Diversification versus complication: Diversification is beneficial for building sustainable wealth. Scattering money across multiple accounts and products is not. My retirement investments are held in eight funds within two IRA accounts (one Traditional, one Roth). They’re highly visible, transparent, and very manageable.

In my experience, the most complex financial products are also the most expensive, characterized by high commissions and fees that undermine wealth accumulation. Keep things simple and understandable.

Remember this truth: There is no such thing as a perfect portfolio. There is no single best investment. You can only make good, well-informed choices that align with your values and goals—choices that are good enough to build adequate Current Wealth for sustainable retirement.

Avoid the big mistakes: Risky, expensive investments you don’t understand. Buying and selling at the wrong times based on emotion. Panic-selling during downturns. Chasing performance. Over-trading. All of these undermine the steady wealth accumulation needed for sustainable retirement.

You only need to meet your personal investment objectives to achieve a sustainable retirement. Avoid comparisons and “if only” thinking. Do your homework and make a good-enough decision. Then patiently leave your money alone and get on with life.

That’s what you save and invest for in the first place, and that’s the essence of wise retirement stewardship and the foundation of sustainable retirement.

- I “borrowed” this equation from my book NextGen Steward. In it, I use the “Financial Life Equation” (FLE) extensively to cover a range of topics for young readers. ↩︎