As I wrote in my last article, wise saving is an essential part of biblical stewardship (Prov.13:11; Prov.21:20). We save for needs that we are aware of in the near term (such as car repairs, insurance payments, etc.) and anticipated future needs (such as college expenses and retirement).

We also try to be wise regarding how much we save (to avoid hoarding) and how we invest our savings (little or no risk for short-term savings and perhaps a bit more risk for long-term savings based on our tolerance for the inevitable ups and downs of the financial markets).

As a general rule, the younger you are the more stock market volatility risk you can take, simply because you have more time to recover from the inevitable down years. But as you get older, your risk tolerance may decrease, and it probably should.

Investment risk is addressed most appropriately by diversifying and adjusting the asset allocation of your investments. I have discussed this previously here and here, but diversifying with stocks, bonds, and other investments, then deciding which asset classes of each you want to hold and how much of your money you allocate to each, is the best way to mitigate risk and still receive a reasonable return.

An important question

A few months ago, some friends asked me to take a look at their retirement portfolio. They had an important question. Since they were heavily invested in stock mutual funds (approx. 90% of their portfolio at the time), they were wondering at what point they need to pull back and become more conservative, if at all.

Because I am NOT a financial advisor, I don’t give specific advice to anyone about their investments (e.g., whether one mutual fund is better than another, etc.). But I manage my own investments, which I highly recommend you do as well if you are comfortable taking on that responsibility, and I write and occasionally counsel others about how to apply some basic principles and techniques of wise stewardship to their long-term investing strategy.

My first observation was that their overall stock allocation was relatively high, even at their current ages of around 50. I questioned them about that and their risk tolerance. Then, since this couple is about 15 years away from retirement, I suggested that they may want to start reducing their stock allocation at approximately five years away from retirement, if not sooner, given their current fairly aggressive stock allocation.

The basic principle is to shift your asset allocation away from stocks as you age. That way, you have less of your money in higher-risk investments such as stocks, and more in lower-volatility assets like bonds.

Most financial experts say that you shouldn’t move completely out of equities as you age. They suggest that maintaining some diversification and room to grow with stocks is a good idea, even after retiring.

Since I am getting closer to retirement, my total stock fund allocations are down to around 30 percent, which I admit is pretty conservative for someone who isn’t even retired yet. But I have always been conservative regarding stocks; I don’t think I have ever held more than 60 percent. For me, it’s more important to protect what I have worked for and saved rather than getting a lot more by betting on the market. As Warren Buffet said in one of his now-famous homespun quotes on investing: “Rule No. 1: Never Lose Money. Rule No. 2: Never Forget Rule No. 1.”

Of course, all investors lose money from time to time, even if it’s only temporary. From a biblical perspective, risk-taking is not inherently wrong. Scripture does not condemn the principle of shared risk, prudently taken (as with equity in sound businesses), and associated profit-sharing. It seems to encourage putting capital to work and even taking some risks in doing so. This idea shows up prominently in Matt.25:14-30, the Parable of the Talents. As fellow blogger Bob Lotich wrote,

It is interesting to me how upset the master got with the steward who took no risks. The other two stewards did take risks and reaped the rewards. I often wonder why the parable didn’t contain a steward who lost some of the investment. But either way, I think we are led to believe that the primary frustration of the master was that the steward was lazy and didn’t even try.

However, profit is almost always uncertain, and the willingness to take on excessive risk can be based on too much presumption about the future, which can become pure speculation, almost like gambling.

The tendency toward presuming about the future is unusually high in a “bull market” such as we have had over the last few years. We tend to think it will go on forever even when there are danger signs on the horizon. That can be caused by what economic behaviorists call “recency bias.” According to Duke University professor of behavioral economics, Dan Ariely:

It is an interesting effect…We look at the most recent evidence, take it too seriously, and expect things will continue in that way.

I might simply call it presumption. And as we know, presumption is not faith, and it certainly isn’t a wise way to make investing decisions. But one thing we know for sure is that stocks go down. We also know that they go up, usually to higher levels than before they went down. But that can take a while.

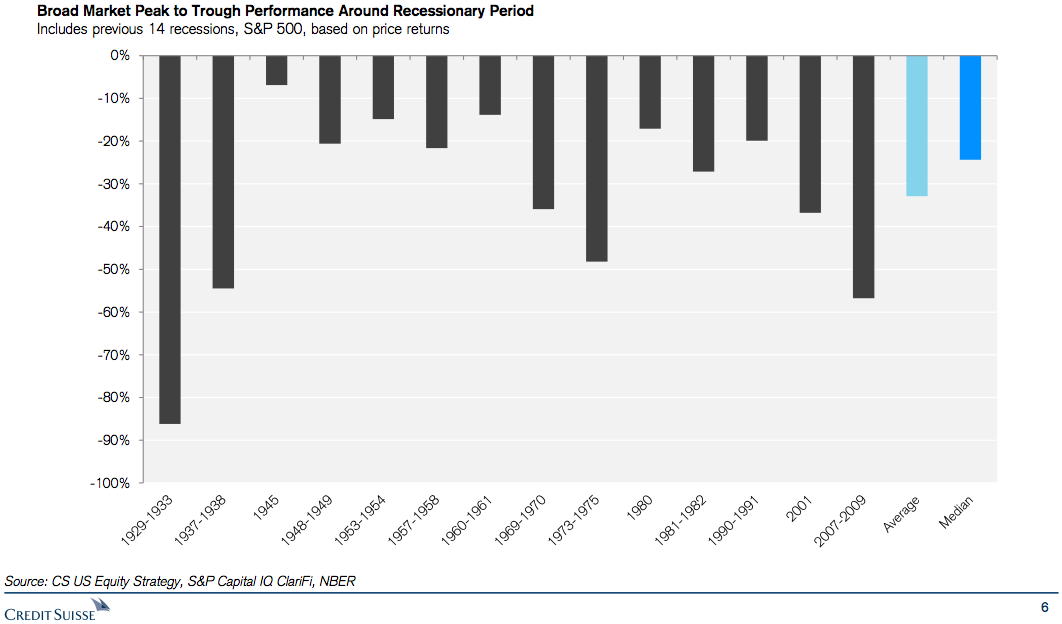

Here’s a chart from Credit Suisse that shows how far the S&P 500 (a major stock market indicator) has tumbled from its high to its low during different recessionary periods. As you can see from the chart, it has averaged a decline of 33% during these recessionary downturns. If you are 64 years old and getting ready to retire with $500,000 and 90% of your investments in an S&P 500 Fund and experience a loss of 33%, you would retire with $351,500 instead of $500,000. If you initially needed to withdraw 4% a year ($20,000), you would now have to withdraw 5.7% (of $351,500) to meet your income goal, further exacerbating the situation.

Of course, given enough time your investments may recover if you hold on to them and don’t panic and sell as many do. Since 1929, the S&P 500 has averaged a gain of 62% during the recovery period, which can take a year or longer, on average (the median is about 300 trading days, or well over a year). That is all well and good, especially if you are 45 years old instead of 65 – you have plenty of time to recover over multiple business cycles. But as we shall see, the impact is different early in retirement.

Historical market cycles are undeniable and inevitable. When they begin and end and how long they are in duration is what we need to be concerned with if we are going to be good stewards, especially as we are getting closer to retirement. Moderation and humility rather than presumption and greed are more important than ever.

What is “sequence of returns risk?”

The topic of stock allocation percentage when one is near or in retirement is a subject of debate in the investment community. But it has less to do with risk tolerance on an emotional level (although that is undoubtedly an important part of it) and more to do with basic math. Some recommend that you stay heavily invested in stocks throughout retirement. On the other extreme, some say that retirees need to be totally out of the stock market and only invest in “safe” things like Treasury securities, I Bonds, and CDs.

I guess I fall somewhere between, but definitely toward the “safer” end of things. It is tough to stay ahead of inflation if only investing in “safe” fixed-income instruments. On the other hand, being too heavily invested in higher-risk assets like stocks can cause problems as we shall see.

You may not be someone who checks what the financial markets do each day. (Most financial planners/advisors recommend that you don’t.) However, if you are getting close to retirement, you may be more tempted to do so. It’s “natural,” because as you get closer to when you will need your retirement savings to live on, the less volatility (fancy word for market ups and downs) you can tolerate, especially the down part.

No one wants to see massive losses in their portfolios, ever. That’s the emotional risk tolerance part. But here’s the math part: A significant loss (which can mean different things to different people) just before or early in retirement can have some pretty severe damaging effects in the long term.

It doesn’t matter if your portfolio is large or small; you are vulnerable during this period, which is typically considered the five years leading up to, and then the five years going into, retirement. Once you retire, you will probably stop contributing to your savings and will begin withdrawing from them instead. If you experience significant losses during that time, it can be very hard to recover.

There’s a fancy word for this – it’s called “sequence risk” or “sequence of returns risk.” It is the risk that you retire during an unfortunate period of poor returns. It has a “double whammy” effect (that’s another technical, financial term) such that your savings go down in value at the same time you start taking money out. Respected retirement researcher, Dr. Wayne Pfau, explains the risk this way:

In the withdrawal phase of retirement, the specific sequence of market returns matters greatly. Individuals drawing off their investments have no way to manage this risk except to spend at a very conservative rate and hope for the best. More often than not this will require being overly conservative and leaving assets on the table at death.

How much can sequence risk hurt?

This risk has the greatest impact over long periods. To illustrate, consider this example from MFS:

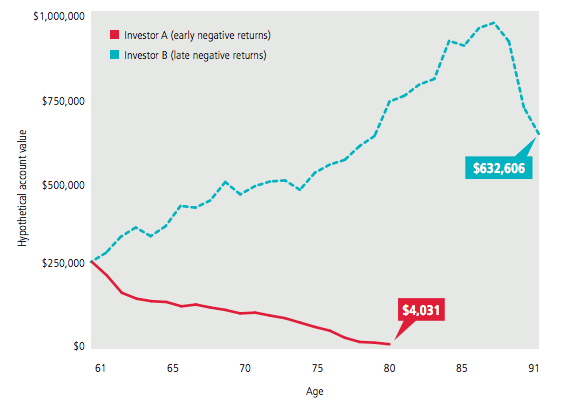

The chart shows two different 30-year scenarios. The solid red line is for Investor A who started off with several years of negative returns. The dotted teal line is for Investor B who had a string of negative years at the end of retirement. Both started with $250,000 and both took out $12,500 per year of income, increasing at 3% a year for inflation. In this example, both investors had a 6.6% average annual rate of return (which may be a little optimistic) on their investments for the 30-year period.

As you can see, the scenario for Investor B with favorable returns during the early years of retirement, even though there were still some ups and downs, ended up at age 91 with a much larger account balance larger than what it started with. Investor A, who experienced poor returns early on, actually ran out of money by age 80.

The main variables are poor returns in the early years – how bad they are, and how many years. The lower returns and/or the longer the duration of a market slump in the early years of retirement, the greater the risk in the long term. In contrast, a few bad years toward the end of your life may be irrelevant since you have probably had enough to live on up to that point, and you will probably still outlive your money.

So, what can you do?

Perhaps like some of you, I am in the “vulnerable” period – the five years or less before retirement. So, I have been thinking about this, even though the stock market has not been unusually volatile lately. The more significant concern may be a major geopolitical or macroeconomic event that causes the markets to fall precipitously, especially as stocks are at such rarified heights right now and then take a long, slow road to recovery. Remember, the risk is not a single bad year (you can usually recover from that rather quickly) but several bad years in a row resulting in major losses early in retirement.

As previously noted, I reduced my overall stock allocation in the last year and I am currently under 30%. I am not necessarily suggesting you do the same – I did what I think is right for me as I am currently almost 65 years old. But if you are heavy in stocks, you may want to consider reducing your allocation, especially if you are in the “high vulnerability zone,” i.e., one to three years from retirement.

Understandably, many investors are reluctant to reduce their stock allocation, especially given the great returns from stocks over the last 5 to 7 years or so. Plus, they are also concerned that bond interest rates are historically low and prices are high. As I write this, the yield on a ten-year Treasury Bill is just over 2%. As interest rates rise, bonds and bond funds will drop in price (that’s what they do), resulting in possible losses, which is exactly what a near-retiree needs to avoid. Wow, talk about a stock and a hard place!

Due to the unpredictability of the financial markets and economy in general, there is no silver bullet. If you are too conservative (little or no risk), your savings may not grow enough to offset inflation. If you take too much risk, you may experience significant losses at a time when you can least afford them. Retirement planning experts in recent years have begun to suggest that the optimal approach is to reduce your exposure to stocks early in retirement, but then increase your stock allocation as you age. Remember the chart above? Losses later in retirement have a much less negative impact.

If you are concerned about sequence risk (and I think you should be aware and plan accordingly), here are a few ways to reduce it:

- Create a cash reserve of at least two to three years of living expenses. Think of this as your “sequence of returns risk emergency fund.” The idea is to have a source of income that you can tap into without having to sell assets that have significantly declined in value and give your portfolio time to recover from a large loss. Once you sell assets that have gone down in value, you are “locking-in” that loss. But if you can let them ride, the probability is high that they will eventually recover. Keep those savings in an FDIC-insured savings account.

- Consider using bonds (or bond funds) as a way to reduce risk instead just a source of retirement income. High-quality, short- to intermediate-term bonds (especially U.S. Treasuries) can help reduce the risk to the bond portion of your portfolio by providing some stability during stock market declines. Although they can boost retirement income, higher yield bonds are riskier and tend to be highly correlated with stocks. Therefore, they can experience more severe losses than lower-yield bonds during major stock market corrections. (Check out this excellent article from Mike Piper on this subject titled, “What Happens to Bond in a Stock Market Crash.” He describes how different assets types behaved during the ‘crash” of 2008-2010. I also highly recommend his book, Investing Made Simple: Investing in Index Funds Explained in 100 Pages or Less,” especially for those of you who want to take more control over your investments.)

- Consider reducing your allocation to stocks as you get closer to retirement. The general consensus seems to be that a 30 to 40% allocation, and perhaps no more than 50%, to stocks may be wise in those first years of retirement. If the market experiences a major downturn, a relatively small portion of your portfolio will be directly impacted. Many financial planners then recommend that you then gradually increase your equity exposure over time. If your risk tolerance is very low, or if you have guaranteed income sources such as a pension or annuity, you could reduce your exposure to stocks even lower, but don’t bail out of them all together – you need growth and some protection against inflation.

- If you are invested in a target date fund, verify that the stock allocation is consistent with your risk tolerance.Target date funds are a great way to invest your retirement savings, but they are not all created or managed the same. As you get close to retirement, take a look at the stock versus bond allocation. If it’s not to your liking, seek out a more conservative fund, or sell some shares and add some bond funds to lower the overall risk of your portfolio. (Of course, that kind of negates the purpose of a Target Date Fund in the first place, so do that only if you REALLY like your current fund and want to stay with it for the long haul.)

- Get some advice. Although this is not an extremely complex issue, many people would do well to seek out some professional advice. Consider talking with a fee-based financial planner that you trust who can assess your individual situation, risk tolerance, and recommend the stock-to-bond ratio and amount of cash reserves that is right for you. He/she can also help you with asset allocation as you age.