In a previous article, I touched on the risk that rising interest rates present to retirees. There are risks—the negative impacts of rising rates—but there are also benefits, especially for savers and retirees.

But to the extent that higher rates are usually associated with inflation, the scale tips toward the negatives and less toward the positives. In this article, we’ll look at both the challenges and benefits of rising interest rates, with a focus on their effects on retirees and those close to retirement.

A long time coming

You don’t need me to tell you that interest rates are higher than they’ve been in a long time. Take a look at this graphic:

Fed Fund Rate: Historical Chart – 2000 to 2023 (Source: macrotrends.net)

The current Fed Funds rate is at 5.33%, higher than it’s been since mid-2000 (over 20 years ago!) when it rose to 6.86%.

The Fed has been raising rates since 2022 to combat inflation, which is at historical highs. (By the way, when you hear a politician say “inflation is down,” you shouldn’t take that to mean that prices are going down across the board. What’s actually happening is that the rate of growth in inflation is slowing down; prices are still high—20 to 30 percent higher in some cases—and getting higher, albeit a little slower than earlier this year.)

When it comes to higher interest rates and retirees, they’re a two-edged sword. Interest rates play a critical role in people’s finances in all life stages, but they can help and hurt retirees in specific ways.

This article will explore the multifaceted relationship between higher interest rates and retiree finances.

The benefits

Increased Income from Fixed Investments

Most retirees have fixed-income investments, ranging from savings or money market accounts to certifications of deposits (CDs) to bonds (or bond funds). We hold these investments to diversify our portfolios, but more important to many, to generate interest that we can use as income in retirement.

This is where the good news is: Higher interest rates usually mean increased returns on these fixed-income investments, such as bonds and certificates of deposit (CDs). As shown below, bond yields for 5-year treasuries are now yielding almost 4.5%:

5-Year Treasuries: Historical Chart – 2000 to 2023 (Source: macrotrends.net)

Corporate bonds are also up. The iShares US Corporate Bond Index ETF (IE), with an average duration of 6.5 years, is yielding over 5.5%.

We were all surprised by these rapidly rising interest rates. Little did we know that we’d be earning 5% on our cash through SPAXX (Fidelity), VMFXX (Vanguard), etc., but here we are. My default cash account in my Fidelity IRA is in Fidelity Government Cash Reserves (FDRXX), and earns 4.95%.

Because of these high rates, I’ve considered building a bond ladder and a TIPS ladder, but I decided against it for now. (You can read the series of articles I wrote about that HERE.)

This is good news for retirees relying heavily on fixed-income investments for income. But as we know, this is not happening independently of other economic factors. Higher interest rates correlate with higher inflation; when the inflation rate exceeds the interest rate, the net result is effectively a negative interest rate.

Still, we retirees generally like earning a higher absolute return on our fixed income as we hope that inflation will eventually turn negative (rather than just slowing down), which will benefit us even more.

Increased income annuity payouts

Obviously, this doesn’t affect all retirees, but the conventional wisdom says that certain annuities may offer higher payouts when interest rates rise.

Insurance companies typically invest the principal they receive from customers in long-term bonds. And as yields rise, they can pass along some (but not all) of it to annuitants and some return of principal (which is why annuity payouts are usually larger than income from bonds).

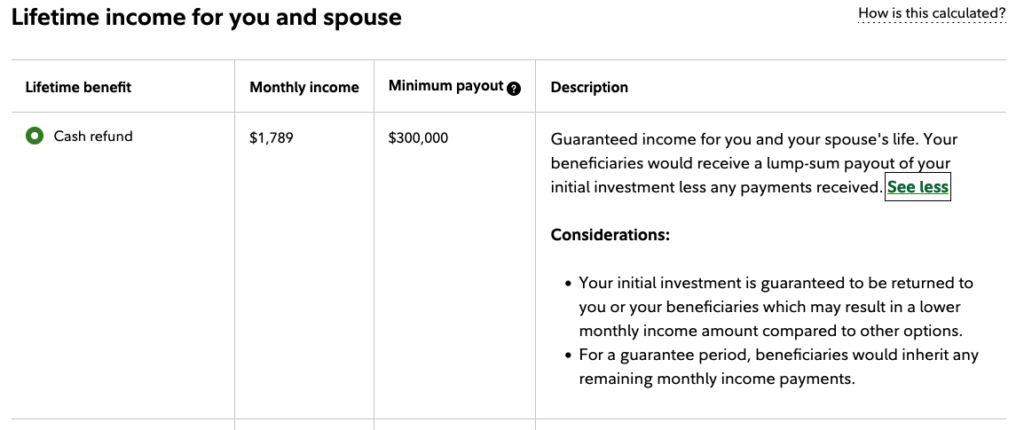

I ran some numbers on fidelity.com for my wife and me for a simple lifetime income annuity with a principal amount of $300,000 with no annual increase and payouts starting on 11/01/2023.

Our monthly income would be $1,789, which is a payout of 7.16%. That’s certainly higher than any high-quality treasury or corporate bond—the 30-year treasury currently yields 4.38%. (Note that we are in an “inverted yield curve” environment where long-term bonds pay less than shorter ones.)

That seems like a better payout than what I saw a couple of years ago, but even without rising rates, the older you get, the higher the annuity payouts.

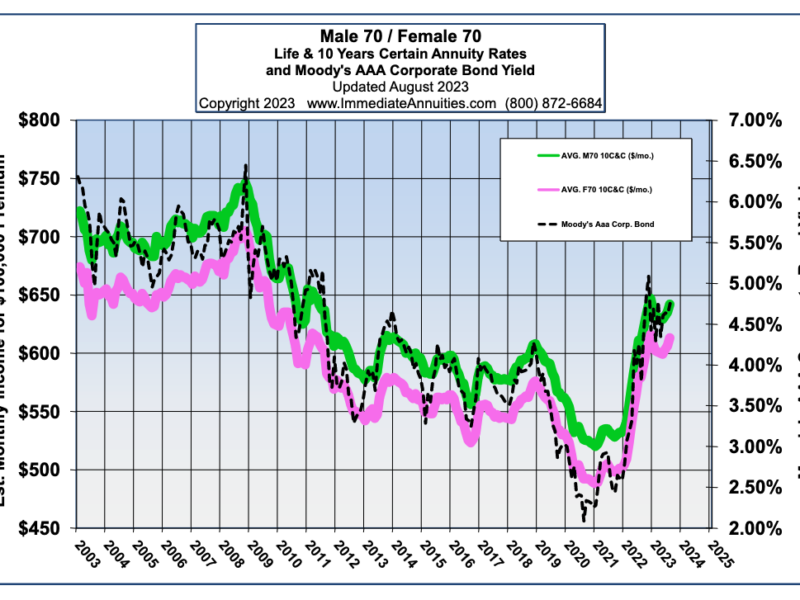

I wanted to see what happened, so I did some research and found this chart on immediateannuities.com:

It’s a little confusing, but suffice it to say that based on 20 years of data, single premium income annuities (SPIAs) are now at their highest levels in a decade.

As the chart shows, a $300,000 premium would have generated an income of 5.40% just two years ago for a male age 70, but today would pay 5.75%, an increase of almost 9% (1.09 x .054 = 5.8%).

Does this mean we should all go purchase a fixed or deferred income annuity with some of our retirement savings? Probably not. But if you’ve been seriously considering it, this may be a good time to pull the trigger.

The challenges

Declining bond values

As I shared previously, it was hard to see losses in our supposedly less risky assets like bonds. But now stock prices have rebounded, and bond prices, while still mostly in negative territory, have begun to stabilize as investors anticipate a slowdown in the rise of interest rates.

The iShares Core US Aggregate Bond ETF (AGG) is still down 1.0% for the last year and 4.4% for the previous three. And we’re not out of the woods yet.

In late August, the Fed Chair left the door open to more rate hikes this year, given that a core CPI of 4.7% is still well above the Fed’s 2% target. As a result, there could be another .25% hike in December, moving the Fed Funds Rate up to 5.5% — 5.75%. This will further reduce bond valuations.

While it seems counterintuitive, bond prices fall when interest rates rise. Therefore, newer bondholders benefit, while long-term bondholders can experience losses when their bond values fall. Of course, that’s only true “on paper.” Only retirees who sell individual bonds before maturity or bond funds before interest rates come back down and values rise will experience actual loss.

In response, some retirees may be tempted to move a substantial portion of their savings to safer money market accounts. The problem is that their interest may not keep up with inflation, especially if rates start declining, but inflation does not.

Higher mortgage rates

According to one source, a large majority of older households—76.2 percent of households aged 50 and over and 78.7 percent of households aged 65 and over—own their homes.

The survey also found that 44 percent of Americans between the ages of 60 and 70 have a mortgage when they retire, and 17 percent of those surveyed say they may never pay it off.

Rising mortgage rates are of little or no concern to retirees who own their homes outright and probably of little concern if they hold an ultra-low fixed-rate mortgage. (Handling that mortgage payment in retirement is another matter.)

However, rising rates concern retirees who, like many others, would like to sell and purchase another house—perhaps to downsize or buy that long-awaited retirement home. If they need a mortgage in some amount, they will have to pay much more interest and are likely to pay more for the house or settle for less house than they originally planned.

The table below shows that a home buyer who could afford a $2,000 monthly mortgage payment when rates were at 3.5% could borrow $445k. But with rates at 6.5%, they can only afford to borrow $316K, almost 30% less.

Mortgage rates are much higher because the 10-year treasury bond yields above 4%. In other words, the financial markets anticipate that inflation will stay high for longer. We’ll have to see how that plays out.

Higher housing costs

A variety of factors have driven house valuations higher. Conventional wisdom says that higher interest rates should result in lower prices, but higher rates can indirectly impact housing prices, and other dynamics are at play as well.

Higher rates make housing less affordable, which means fewer people are willing to sell their current home and give up their super-low-interest mortgage, which translates into less inventory and, therefore, higher costs in areas where demand has remained relatively high.

Still, you might assume that the current housing market presents an ideal opportunity for cash buyers (which many retirees are) who don’t require a mortgage. However, this assumption doesn’t always hold.

Many homeowners must sell their current home to purchase a new property. If they currently hold a 30-year mortgage locked in at a low 3.2 percent interest rate, they’re unlikely to want to swap that for a potentially larger mortgage with rates over 7 percent.

As a result, housing prices have experienced a decline, and the inventory of available homes for purchase has dwindled. This scarcity in supply, coupled with surprisingly stable demand, has driven an upswing in housing prices that started in the summer.

These dynamics have caused more and more people to take a wait-and-see approach, and as pent-up demand builds, the result is higher home prices than initially forecast.

Higher revolving credit interest rates

Any retirees with revolving credit accounts (credit cards) or adjustable-rate loans are getting walloped. This can make debt management much more challenging.

According to bankrate.com, current average interest rates are over 20 percent! If you have a credit card balance of $5,000, that’s $83 per month or $1,000 in interest a year!

Other adjustable-rate loans, such as home equity lines of credit, a popular “credit line” with some, are also up. Average rates are now in the 7 to 9 percent range as opposed to 4% just a couple of years ago. (They may still be a good option for paying off much higher revolving credit accounts.)

If your revolving credit accounts are causing you problems (they do for many retirees), see if there’s a way to pay them off without using your retirement savings. In lieu of that, refinancing with a lower-interest vehicle may be the way to go.

Take the good, deal with the bad

Higher interest rates are a double-edged sword for retirees, offering benefits and challenges. While they can provide retirees with enhanced income from fixed investments and protect against inflation, they also bring the risk of declining bond values, reduced returns on cash, and potential impacts on stock market investments and debt management.

An excellent way to navigate the complex relationship between interest rates and retirement—both the benefits and challenges—is to maintain a diversified portfolio, regularly review your financial plans, watch your spending, and consult with your financial advisor if you have one, who can help you come us with a personal strategy to deal with these changing economic conditions.

Navigating these chopping economic waters requires wisdom and faith. If you’re tempted toward anxiety or fear of what the future holds, remember this: The Bible describes faith as the assurance of something we hope for that we do not presently have (Heb. 11:1). God is sovereign over all, including the U.S. economy, and these challenges can help us cultivate wisdom and develop our faith in him.

So, putting your faith and trust in God, and being flexible and adaptable with your financial plans, can help you find peace as you stay the course regardless of the interest rate environment.